(TheNewswire)

Vancouver, British Columbia – TheNewswire - November 29, 2022– Norseman Silver Inc. (TSXV:NOC) (OTC:NOCSF) (“Norseman” or the “Company”) is pleased to provide an update on the Company’s Q2 2022 drill program at Silver Switchback, located in British Columbia, Canada.

The complete assay results of all drill core samples which were collected during the 2022 drilling campaign at the Silver Switchback project in the Omineca Mining Division, British Columbia have been received. The four-hole drill program which was concluded in mid-September of 2022 followed the encouraging results that were obtained from the ground IP-Resistivity survey conducted in July 2022. Four drill holes completed with a total length of 804 meters served to probe into an approximately 1-km. long and N-S trending high chargeability anomaly.

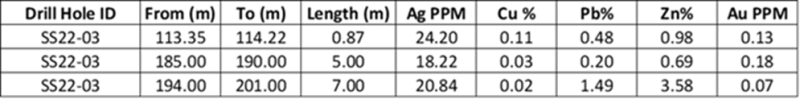

The most interesting drill intercepts were encountered in drill hole SS22-03 which is located along the central section of the target high chargeability anomaly. Three significantly mineralized intervals were intersected in this hole, the best of which is a 7-meter zone at 194m. down to the hole bottom at 201m. depth which picked up 3.58% Zn, 1.49% Pb and 20.84 ppm Ag including 7.81% Zn, 2.94% Pb and 37.65 ppm Ag from 199m. to 201m. All mineralized intervals are characterized by quartz/sericite/calcite veins with associated pyrite, sphalerite, galena and chalcopyrite in decreasing concentrations. The three mineralized intercepts with their weighted average assays are in the table below:

Click Image To View Full Size

SS22-04, about 200 meters immediately to the north of SS22-03, also intersected significantly mineralized intervals albeit with relatively lower concentrations. More importantly, the mineralized intervals at SS22-04 occur at shallower depths compared to SS22-03. The mineralized zones range from 0.50 to 5 meters in length with the best intercept occurring at 101 to 103m. depth which picked up 1.57% Zinc, 0.57% Lead and 13.68ppm Silver, including 3.11% Zinc, 2.25% Lead and 50.70ppm Silver from 101.50 to 102.00m. depth. Two (2) other more significant intervals showed elevated Zn, Pb and Ag values as follows:

-

2.50 m. from 55.03m to 57.53m @ 0.22% Zn, 0.20% Pb and 4.38ppm Ag

-

4.93 m. from 62.07m. to 70.15m @0.60% Zn, 0.25% Pb and 6.43 ppm Ag including 1.75m. (68.40m-70.15m.) @ 1.24% Zn, 0.57% Pb and 13.68ppm Ag

Drill holes SS22-01 and SS 22-02 were drilled along the southern and northern sections of the high chargeability body, respectively. Both holes intersected relatively narrower and more subdued albeit still anomalous metal values. These appear to have intersected the margins of the mineralized body. Hole intervals of interest consisted of the same type of veins in holes SS22-03 and 04 but these are widely spaced and significantly thinner structures. Mineralization appears to be erratic and confined only to 0.50 to 1.0 -meter intervals along the holes’ length. The best mineralized interval is a 1.08 meter-long zone from 123.52 to 123.60m. depth at SS 22-001, which picked up 0.81% Zn, 0.22% Pb. In the same drill hole, the highest Ag assay was intersected at 159.22 to 160.22 m. depth, with values of 14.60ppm Ag, 0.45% Zn and 0.39% Pb.

Although quite narrow intervals, all mineralized intervals intersected more specifically at SS22-03 remain open at depths. Interestingly, Ag and the base metals as well as the anomalous Au contents, appear to be increasing in intensity at deeper levels. Indeed, the zones of significant Ag and base metal mineralization notably along the central sections of the high chargeability anomaly as indicated in the encouraging intercepts along holes SS22-03 and SS22-04 deserve further evaluation. The complete geochemistry data shall be correlated with the hole geology information to come up with possible projections on likely trends towards the core of mineralization. Considering the mineralization indications obtained so far, a follow-up drill program to probe the zones of continuity, both lateral to and vertical from the discovery holes appears warranted.

Quality Assurance and Quality Control

All drill cores were transported securely every day by the company-assigned truck from the drill site to the logging, sampling and storage facility in Smithers, BC. The drill site is located about 64 kms. west of Smithers. As part of the QA/QC process, laboratory-certified standards, blanks and duplicate samples were inserted into the sample chain at the facility in Smithers. From Smithers, all drill core samples are transported securely by land through a cargo-courier duly licensed and certified in BC. The samples are directly delivered and duly received at the ALS Canada Ltd. Laboratory located in North Vancouver, BC. Samples are dried, weighed, crushed to 70% passing -2mm, split to 250g pulps then crushed to 85% passing minus 75 microns. Samples are dissolved with four-acid digestion and analyzed by 33-element ICP-AES, with gold by Fire Assay (AES Finish). Laboratory internal QA/QC sample standards by ALS Labs are also inserted in the sample stream during the laboratory analytical process.

Qualified Person

The technical information in this news release was reviewed by Rene Victorino, P. Geo., Vice President for Exploration of Norseman Silver Inc., a qualified person as defined under National Instrument 43-101 (NI 43-101).

About Norseman Silver

Norseman Silver is focused on acquiring, exploring and developing silver assets with upside potential in the Americas. The Company’s current property portfolio includes the Cariboo, Silver Vista, Silver Switchback and projects, located in a prolific region in central British Columbia, Canada, and the Taquetren silver project, located in Rio Negro, Argentina. Norseman Silver’s shares are listed on the TSX Venture Exchange under the symbol NOC and on the OTCQB under the symbol NOCSF. Learn more about Norseman Silver atwww.norsemansilver.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the United States Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

On behalf of Norseman Silver Inc.

Sean Hurd

President and CEO

For further information, please contact:

Sean Hurd

President and CEO

Info@norsemansilver.com

604-505-4554

Copyright (c) 2022 TheNewswire - All rights reserved.