3-Pit Mine Delivers 31% increase in Mineral Reserves and 195,000 oz Annual Average Gold Production First 12 Years

TORONTO, Dec. 07, 2022 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”; TSX: MOZ) is pleased to report the results of an Updated Feasibility Study (“Updated FS”) for the Valentine Gold Project located in the central region of Newfoundland and Labrador (“Valentine” or the “Project”).

This Updated FS presents for the first time a 3-pit mine plan for the Project based on the Marathon, Leprechaun and Berry Deposits, with increased Mineral Reserves, an extended mine life, and a higher gold production profile. The Updated FS incorporates the same conventional open pit mining and milling strategy previously presented in the April 2021 Feasibility Study (the “April 2021 FS”), with updated capital and operating cost estimates based on current-market pricing, and updated metal price assumptions. The Valentine Gold Project was released from provincial and federal environmental assessment earlier in 2022 based on mining at the Leprechaun and Marathon Deposits, and early works construction commenced in October of this year. The Updated FS incorporates an amended permitting strategy to allow for the Berry Deposit to be included in the mining schedule by the first year of mine operations.

Highlights of the Updated FS are as follows (all figures are in Canadian dollars, troy ounces, and estimated at US$1,700/oz gold on an unlevered basis unless otherwise noted):

- Proven and Probable Mineral Reserves of 2.7 Moz Au (51.6 Mt at 1.62 g/t Au), increases of +31% in ounces, +10% in tonnes and +20% in grade compared to the previous estimate.

- “High Grade” Proven and Probable Mineral Reserves (greater than 0.7 g/t Au and designated as direct mill-feed in the Project’s mine plan) of 2.4 Moz Au (35.3 Mt at 2.12 g/t Au), increases of +38% in ounces, +29% in tonnes and +7% in grade compared to the previous estimate.

- 14.3-year mine life with first gold scheduled for January 2025.

- Average gold production of 195,000 oz/year at an annual average All-In Sustaining Cost (“AISC”)1 of US$1,007/oz for $121M of annual average free cash flow (“FCF”) for 12 years from 2025 to 2036.

- Open pits optimized at gold price cases of US$950/oz (Leprechaun), US$1200/oz (Marathon) and US$1350/oz (Berry).

- Remaining capital cost (“Capex”) of $463M (US$347M), representing the Project’s cost-to-complete effective October 31, 2022.

- After-tax Net Present Value at a 5% discount rate (“NPV5%”) of $648M (US$486M), Internal Rate of Return (“IRR”) of 22%, and payback of 2.8 years.

- Peak full time direct employment of 405 persons during construction and 522 during operations, with $598M payable in federal and provincial income taxes and mining duties, at US$1700/oz gold.

The Company will be hosting a virtual Technical Session on Thursday, December 8th at 10:00 am EDT to discuss the results of the updated FS. Details of the session, which will include an investor Q&A, are as follows: Participants may listen to the webcast by registering via the following link: https://app.webinar.net/Yo9384MB4lK. An archived webcast will be available at www.marathon-gold.com. The presentation for the technical session will be found on the Company’s website at www.marathon-gold.com.

Matt Manson, President and CEO, commented: “This Updated Feasibility Study confirms Valentine as a robust open pit gold mining project with solid operating credentials and high cash margins. Notwithstanding the increase in costs experienced across the mining industry since the publication of the April 2021 Feasibility Study, the Project has benefited from the addition of the Berry Deposit to our mine plan, allowing us to present a project with a longer operating life and a significantly improved gold production profile. In terms of direct, high grade ‘mill feed’ (ore with a cut-off grade of 0.7 g/t Au), we are now reflecting 195,000 Au ounces per annum for 12 years compared to 179,000 Au ounces over 9 years previously, with an annual average AISC2 during this period of US$1,007/oz. Our first three years of production will average 200,000 Au ounces per annum at an annual average AISC of US$890/oz, at an expected head grade of 2.75 g/t Au. This is expected to generate substantial cash flow in the early years of mining.

“Our approach to mining Valentine is to present a large project with a high strip, supported by a high-grade mineral resource that we have focused on de-risking, open pits optimized on cautious gold price cases of between US$950/oz and US$1350/oz, and a real-market operating cost build-up. Other aspects of the mine design, such as the site layout, basic mill flow-sheet, mill expansion strategy, thickened tailings deposition strategy, 400-person camp, and low-cost site power via the NL Hydro power grid, remain as previously conceived. Since early works at the Project have already commenced, our updated capital and operating cost estimates benefit from a level of procurement, labour force development and engineering design that is at a higher level than typical for a feasibility-level study. Our cost-to-complete estimate of $463M, effective as of October 31, 2022, compares well with our guidance of $470-$490M issued in September. Finally, we will have more than 24 months during construction to bring Berry into the permitted mine plan in time for it to contribute to the first year of operations, in a regulatory process that we assess will be primarily at the provincial level. The Valentine Gold Project is well on its way to being the largest gold mine in Atlantic Canada. It will be the most important new mining project in Newfoundland and Labrador since Voisey’s Bay, and a major contributor to the socio-economic well being of Newfoundland’s Central Region.”

Valentine Gold Project Updated Feasibility Study

The Updated FS was completed by Ausenco Engineering Canada Inc. as Lead Consultant. Moose Mountain Technical Services as Mining Consultant, JR Goode and Associates as Metallurgical Consultant, SNC-Lavalin as Process Engineering and Costing provider, APEX Geoscience Ltd. as Geological Consultant, Golder Associates Ltd. as Tailings Consultant, Stantec Consulting Ltd. as Site Water Management and Environmental Consultant, Terrane Geoscience Inc. as Geotechnical Consultant, and GEMTEC Consulting Engineers and Scientists Limited as Geotechnical and Hydrogeological Consultant. The Valentine Gold Project Mineral Resource Estimate was prepared by John T. Boyd Company. Roy Eccles P. Geol. of APEX Geoscience Ltd. and a member of PEGNL has reviewed and takes responsibility for the Mineral Resource Estimate. The Mineral Reserve Estimate was prepared by Moose Mountain Technical Services.

Table 1: Summary of Key Results and Assumptions in the Updated Feasibility Study

| Production Datanote 1 |

|

Values |

Units |

|

Life of Mine |

14.3 |

Years |

|

Processing Rate (2025-2028) |

6,850 (2.50) |

tpd (Mtpa) |

|

Processing Rate (2029-2039) |

10,960 (4.00) |

tpd (Mtpa) |

|

Contained Gold |

2.68 |

Moz |

|

Recovered Gold |

2.55 |

Moz |

|

Average Gold Recovery |

95.0% |

|

|

Total Resource Mined |

51.6 |

Mt |

|

Total Waste Mined |

545.4 |

Mt |

|

Overall Strip Ratio |

10.6:1 |

waste:ore |

2025-2027: First Three

Years of Productionnote 2

|

Years |

3 |

Years |

| Average Annual Gold Production |

200 |

koz |

| Average Mill Feed Grade |

2.75 |

g/t |

| Annual Average AISC |

$890 |

US$/oz |

| Annual Average After-Tax Free Cash Flow |

$157 |

C$M |

2025-2036: High Grade

Feed Run Ratenote 2

|

Years |

12 |

Years |

| Average Annual Gold Production |

195 |

koz |

| Average Mill Feed Grade |

1.80 |

g/t |

| Annual Average AISC |

$1,007 |

US$/oz |

| Annual Average After-Tax Free Cash Flow |

$121 |

C$M |

2037-2039: Low Grade

Stockpile Run Ratenote 2

|

Years |

2.3 |

Years |

| Average Annual Gold Production |

97 |

koz |

| Average Mill Feed Grade |

0.79 |

g/t |

| Annual Average AISC |

$1,510 |

US$/oz |

| Annual Average After-Tax Free Cash Flow |

$74 |

C$M |

| Capital Costsnote 1 |

|

Values |

Units |

|

Sunk Capital (Project Costs 2021 - Oct 31, 2022) |

$71 |

C$M |

|

Remaining Initial Capital (at October 31, 2022) |

$463 |

C$M |

|

Sustaining Capital |

$377 |

C$M |

|

Expansion Capital |

$66 |

C$M |

|

Closure Costs |

$79 |

C$M |

|

Salvage Costs |

($30) |

C$M |

|

Capital Intensity (Initial Capital/oz) |

$136 |

US$/oz |

| Life of Mine (LOM) Operating Costsnotes 1,3 |

Values |

Units |

|

Mining (/t mined) |

$3.03 |

C$/t |

|

Mining (/t milled) |

$34.48 |

C$/t |

|

Processing and Water Treatment (/t milled) |

$16.62 |

C$/t |

|

G&A (/t milled) |

$6.99 |

C$/t |

|

Total Operating Cost (/t milled) |

$58.09 |

C$/t |

|

Refining & Transport |

$3.93 |

C$/oz |

|

Silver Credit |

($9.61) |

C$/oz |

|

Total Cash Cost |

$902 |

US$/oz |

|

All-In Sustaining Costnote 4 |

$1,046 |

US$/oz |

| Financial Analysisnote 1 |

|

Values |

Units |

|

Gold Price Assumption for Financial Analysis |

$1,700 |

US$ |

|

US$:C$ Exchange |

0.75 |

|

|

Pre-Tax NPV5% |

$1,000 |

C$M |

|

Pre-Tax IRR |

27% |

|

|

Pre-Tax Payback |

2.7 |

years |

|

After-Tax NPV5% |

$648 |

C$M |

|

After-Tax IRR |

22% |

|

|

After-Tax Payback |

2.8 |

years |

|

Royaltiesnote 5 |

1.5% NSR |

|

|

Mine Revenue |

$5,785 |

C$M |

|

EBITDA |

$2,716 |

C$M |

|

EBITDA Margin |

47% |

|

|

Pre-Tax Unlevered Free Cash Flow |

$1,778 |

C$M |

|

After-Tax Unlevered Free Cash Flow |

$1,181 |

C$M |

|

LOM Direct Income Taxes and NL Mining Taxes |

$598 |

C$M |

Notes:

- Denotes a “specified financial measure” within the meaning of NI 52-112. See note on “Non-IFRS Financial Measures”.

- Represents full calendar years.

- LOM operating costs exclude capitalized operating costs prior to January 2025 and pre-strip mining tonnes.

- AISC includes Royalties, Total Cash Costs and Sustaining Capital, including expansion and closure costs. Excludes corporate G&A.

- Assumes the exercise of a right to repurchase 0.5% of the Franco Nevada NSR for US$7M prior to December 31, 2022.

Mining

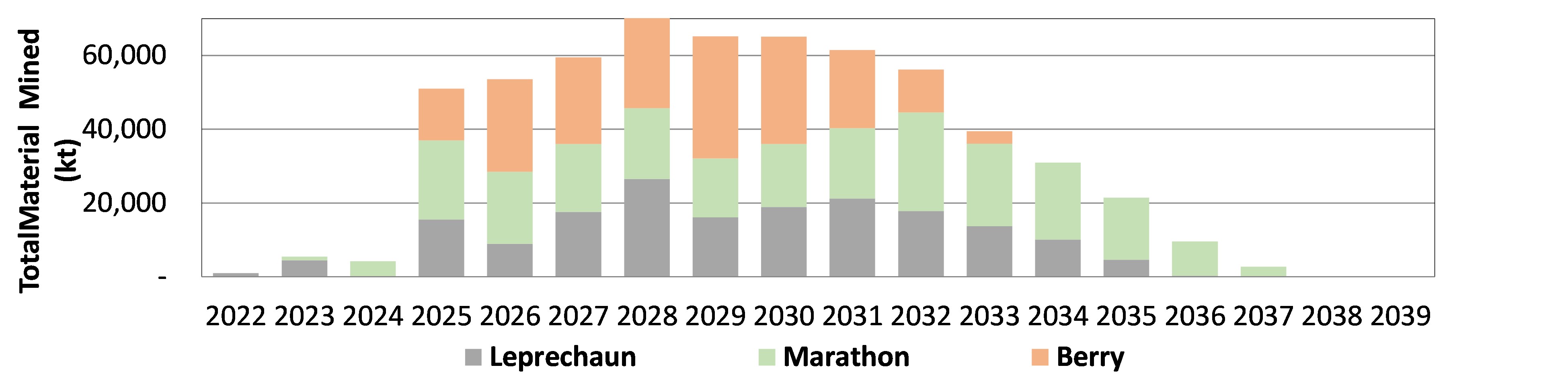

The Updated FS contemplates open pit mining from each of the Leprechaun, Marathon and Berry Deposits concurrently. Pre-stripping of waste material at the Leprechaun Deposit commenced in October 2022 and mining will extend to 2036. Marathon will be mined between 2023 and 2037. Mining at Berry is scheduled to commence in the second quarter of 2025, subject to the receipt of all regulatory approvals, and be completed in 2033 (Figure 1). The Berry pit will be utilized for waste rock and tailings disposal starting in 2034.

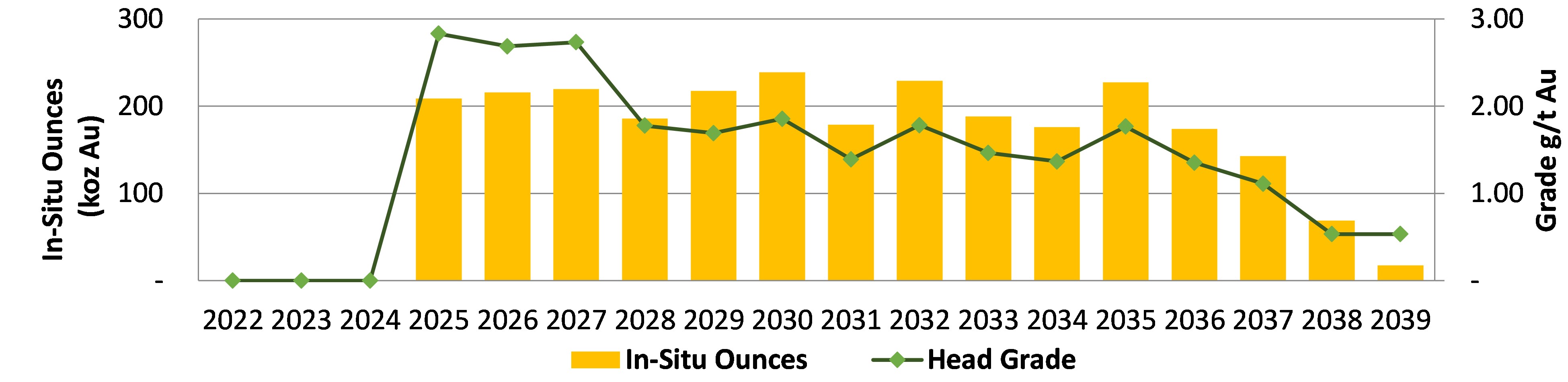

Ore with a cut-off grade of 0.70 g/t Au (“high-grade”) will be prioritized for mill processing, initially at 6,850 tonnes per day (“tpd”), or 2.5 Million tonnes per annum (“Mtpa”), and then at 10,960 tpd, or 4.0 Mtpa, following a mill expansion in Year 4. Ore between 0.38 and 0.70 g/t Au (“low-grade”) will be stockpiled for processing at the end of the mine life. The Updated FS mine schedule benefits from considerably more high-grade mill-feed material than in the April 2021 FS. Total high-grade mill feed available in the updated Mineral Reserve now comprises 2.4 Moz Au (35.3 Mt at 2.12 g/t Au), increases of +38% in ounces, +29% in tonnes and +7% in grade compared to the previous estimate. This supports a 12-year high-grade mine life of 195,000 oz of annual average gold production between 2025 and 2036 (Table 2 and Figure 2).

Table 2: Mining Phases and Production Schedule

|

Phase 1 |

Phase 2 |

Phase 1 & 2 |

Phase 3 |

LOM |

| Annual Averagesnote1,2 |

First 3 Years

2025-27 |

Mid 9 Years

2028-36 |

First 12 Years

2025-36 |

Stockpile

Last 3 Years

2037-39 |

14.3 Year

Mine Life

2025-39 |

| Recovered Gold (koz Au) |

200 |

193 |

195 |

97 |

179 |

| Head Grade (g/t Au) |

2.75 |

1.60 |

1.80 |

0.79 |

1.62 |

| Processing Rate (Mtpa) |

2.5 |

4.0 |

2.5 to 4.0 |

4.00 |

2.5 to 4.0 |

| AISC (US$/oz) note3 |

$890 |

$1,048 |

$1,007 |

$1,510 |

$1,046 |

| FCF (C$M) |

$157 |

$109 |

$121 |

$74 |

$113 |

Notes:

- Denotes a “specified financial measure” within the meaning of NI 52-112. See note on “Non-IFRS Financial Measures”.

- Represents full calendar years.

- AISC includes Royalties, Total Cash Costs and Sustaining Capital, including expansion and closure costs. Excludes corporate G&A.

Each deposit will be developed in three phases, with the Marathon pit reaching a maximum dimension of 1,250 m x 650 m x 300 m deep, the Leprechaun pit achieving 1,000 m x 700 m x 300 m deep and the Berry pit achieving 1,900 m x 600 m x 300 m deep. Life of Mine (“LOM”) strip ratios will be 10.0 at Marathon, 10.7 at Leprechaun, 11.3 at Berry and 10.6 overall.

Figure 1: Annual Average Tonnes Mined (Ore and Waste) by Mineral Deposit

Figure 2: Annual Average Mill Feed Contained Metal and Head-Grade

Mining will be by conventional drill/blast/load/haul methods, with 12 metre benches for waste and selective mining practices on 6 metre benches for ore. Drills will be sized and selected separately for bulk production drilling in waste and selective drilling in ore, with RC drills for bench-scale grade control drilling. Bulk production loading will be by 15.5m3 bucket sized hydraulic excavators and 13m3 bucket-sized wheel loaders, with 12m3 bucket-sized hydraulic excavators for selective ore loading. The haulage fleet will comprise 140 and 90 tonne payload rigid-frame haul trucks and 40 tonne articulated trucks. Mining equipment will be purchased under the terms of equipment leasing agreements with Caterpillar Financial Services Limited and Epiroc Canada Inc., already concluded.

Mineral Resources

The Valentine Gold Project Mineral Resource Estimate (“MRE” or “MREs”) upon which the Updated FS was based, was originally disclosed in July 2022 (Marathon news release dated July 6, 2022). Compared to the previous MRE upon which the April 2021 FS was based, the current MRE incorporated new exploration information including approximately 100,000 metres of drilling completed at the Berry Deposit. The MRE also benefited from new geological models, updated gold price and exchange rate assumptions, updated estimates for mining and processing costs, new Whittle pit shells, and the results of a 2021 Reverse Circulation drill program completed at the Marathon and Leprechaun deposits.

The updated MREs for the Marathon, Leprechaun and Berry deposits are effective as of June 15, 2022. The MREs for the Sprite and Victory deposits are effective as of November 20, 2020 and remain unchanged. The MREs were prepared by John T. Boyd Company. Roy Eccles P. Geol. (PEGNL) of APEX Geoscience Ltd. has reviewed and takes responsibility for the Updated FS MREs, which supercede and replace all previous Valentine Gold Project MREs. The updated MREs were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards and Best Practice Guidelines of Mineral Resources and Reserves (2014, 2019).

Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 3: Total Measured and Indicated Mineral Resources, by Deposit

|

Category |

Tonnes (Mt) |

Grade (g/t Au) |

Oz (Moz Au) |

|

|

|

|

|

| Marathon |

Measured |

15.10 |

1.90 |

0.92 |

|

Indicated |

14.99 |

1.61 |

0.78 |

|

Total M&I |

30.09 |

1.76 |

1.70 |

|

|

|

|

|

| Leprechaun |

Measured |

7.37 |

2.56 |

0.61 |

|

Indicated |

8.22 |

1.78 |

0.47 |

|

Total M&I |

15.59 |

2.15 |

1.08 |

|

|

|

|

|

| Berry |

Measured |

6.75 |

2.42 |

0.53 |

|

Indicated |

10.41 |

1.67 |

0.56 |

|

Total M&I |

17.16 |

1.97 |

1.09 |

|

|

|

|

|

| Victory |

Measured |

- |

- |

- |

|

Indicated |

1.09 |

1.46 |

0.05 |

|

Total M&I |

1.09 |

1.46 |

0.05 |

|

|

|

|

|

| Sprite |

Measured |

- |

- |

- |

|

Indicated |

0.70 |

1.74 |

0.04 |

|

Total M&I |

0.70 |

1.74 |

0.04 |

|

|

|

|

|

| All Deposits |

Measured |

29.23 |

2.19 |

2.06 |

|

Indicated |

35.40 |

1.67 |

1.90 |

|

Total M&I |

64.62 |

1.90 |

3.96 |

Notes:

- Totals may not add due to rounding.

- See “Notes to the Mineral Resources”

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Notes to the Mineral Resources

The Valentine Gold Project Mineral Resource estimate is based on a total database of over 380,840 metres drilled and 263,646 fire assays, approximately 21% of which have been processed by metallic screen fire assay. Bulk densities assigned to the Quartz-Tourmaline-Pyrite-Vein domain (“QTPV”) range from 2,59 t/m3 and 2.69 t/m3, dependant on the deposit. Open-pit Mineral Resources have been determined by the Whittle method based on an estimate of their reasonable prospects for eventual economic extraction, using certain assumptions for gold recovery, costs for mining, processing and sale, a US$1,800/oz gold price, and a USD$:CAD$ exchange of 0.78. All in-pit Mineral Resources apply a pit discard cut-off grade of 0.30 g/t Au. Additional underground Mineral Resources are defined as material outside of the Whittle pit shell at a cut-off of 1.4 g/t Au. The reader is reminded that Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The quantity and grade of reported Inferred Mineral Resources in this estimation are conceptual in nature and there has been insufficient exploration to define these Inferred Mineral resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant issues including risks set forth in in Marathon’s Annual Information Form for the year ended December 31, 2021 and other filings made with Canadian securities regulatory authorities and available at www.sedar.com.

Table 4: Total Inferred Mineral Resources, by Deposit

|

Category |

Tonnes (Mt) |

Grade (g/t Au) |

Oz (Moz Au) |

|

|

|

|

|

| Marathon |

Inferred |

6.98 |

2.02 |

0.45 |

|

|

|

|

|

| Leprechaun |

Inferred |

4.86 |

1.58 |

0.25 |

|

|

|

|

|

| Berry |

Inferred |

5.33 |

1.49 |

0.25 |

|

|

|

|

|

| Victory |

Inferred |

2.33 |

1.26 |

0.09 |

|

|

|

|

|

| Sprite |

Inferred |

1.25 |

1.26 |

0.05 |

|

|

|

|

|

| All Deposits |

Inferred |

20.75 |

1.65 |

1.10 |

Notes:

- Totals may not add due to rounding.

- See “Notes to the Mineral Resources”

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Mineral Reserves

An updated Mineral Reserve estimate was prepared by Moose Mountain Technical Services, with an effective date of November 30, 2022 (Table 5). Proven and Probable Mineral Reserves are derived from the Measured and Indicated Mineral Resources utilizing Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards on Mineral Resources and Reserves (2014).

Table 5: Total Proven and Probable Mineral Reserves (Changes to the April 2021 Mineral Reserve estimate are shown in italics)

|

Category |

Tonnes (Mt) |

Grade (g/t Au) |

Oz (Moz Au) |

|

|

|

|

|

|

|

|

| Marathon |

Proven |

11.47 |

-44% |

1.70 |

+25% |

0.63 |

-30% |

|

Probable |

9.86 |

+8% |

1.40 |

+22% |

0.44 |

+31% |

|

Total P&P |

21.33 |

-28% |

1.56 |

+20% |

1.07 |

-14% |

|

|

|

|

|

|

|

|

| Leprechaun |

Proven |

6.57 |

-28% |

2.11 |

+25% |

0.45 |

-9% |

|

Probable |

8.58 |

+4% |

1.44 |

+21% |

0.40 |

+26% |

|

Total P&P |

15.15 |

-13% |

1.73 |

+19% |

0.84 |

+3% |

|

|

|

|

|

|

|

|

| Berry |

Proven |

5.32 |

n/a |

2.03 |

n/a |

0.35 |

n/a |

|

Probable |

9.78 |

n/a |

1.36 |

n/a |

0.43 |

n/a |

|

Total P&P |

15.10 |

n/a |

1.60 |

n/a |

0.77 |

n/a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All Deposits |

Proven |

23.36 |

-21% |

1.89 |

+29% |

1.43 |

+2% |

|

Probable |

28.22 |

+62% |

1.40 |

+20% |

1.27 |

+94% |

|

Total P&P |

51.58 |

+10% |

1.62 |

+20% |

2.69 |

+31% |

Notes:

- Totals may not add due to rounding.

- See “Notes to the Mineral Reserves”

Notes to the Mineral Reserves

The Mineral Reserve estimate was prepared by Marc Schulte, P.Eng. (who is also an independent Qualified Person), reported using the 2014 CIM Definition Standards, and having an effective date of November 30, 2022. Mineral Reserves are mined tonnes and grade; the reference point is the mill feed at the primary crusher. Mineral Reserves are reported at a cut-off grade of 0.38 g/t Au. The cut-off grade assumes US$1,600/oz Au at a currency exchange rate of US$0.78 per C$1.00; 99.8% payable gold; US$5.00/oz off-site costs (refining and transport); and uses an 87% metallurgical recovery. The cut-off grade covers processing costs of $15.20/t, administrative (G&A) costs of $5.30/t, and a stockpile rehandle cost of $1.85/t. Mined tonnes and grade are based on an SMU of 6 m x 6 m x 6 m, including additional mining losses estimated for the removal of isolated blocks (surrounded by waste) and low-grade (<0.5 g/t Au) blocks bounded by waste on three sides. Numbers have been rounded as required by reporting guidelines. The estimate of Mineral Reserves may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant issues including risks set forth in in Marathon’s Annual Information Form for the year ended December 31, 2021 and other filings made with Canadian securities regulatory authorities and available at www.sedar.com.

Mine planning and Mineral Reserves use block dimensions of 6x6x6 metres. Ore losses and dilution are introduced to the Mineral Reserve through the re-blocking of the 2x2x2 metre Mineral Resource block model, and the characterisation of isolated blocks as waste. This process yields estimates of mining dilution and ore loss of 24% and 3% respectively at Marathon, 34% and 5% at Leprechaun, and 39% and 7% at Berry.

Mineral Reserves are pit-constrained based on the results of an ultimate pit limit sensitivity analysis. Cash flows are assessed for multiple, nested pit shells using updated mining costs, a $0.78 US$:C$ exchange rate, and a US$1,600/oz gold price progressively discounted with revenue factors. The final pit shells selected represent optimizations based on gold price inputs of US$950/oz at Leprechaun, US$1,200/oz at Marathon and US$1,350/oz at Berry.

Total Proven Mineral Reserves (Table 6), estimated with a bottom-cut-off of 0.38 g/t Au, are 1.43 Moz (23.36 Mt at 1.89 g/t Au). Total Probable Mineral Reserves are 1.27 Moz (28.22 Mt at 1.40 g/t Au).

Proven Mineral Reserves estimated with a 0.70 g/t Au cut-off and scheduled for priority processing as high-grade mill feed (Table 6), are 1.32 Moz (17.21 Mt at 2.38 g/t Au). Probable Mineral Reserves with a 0.70 g/t Au cut-off are 1.09 Moz (18.10 Mt at 1.88 g/t Au).

Table 6: Total Proven and Probable Mineral Reserves, by Milling Category (Changes to the April 2021 Mineral Reserve estimate are shown in italics)

|

Category |

Tonnes (Mt) |

Grade (g/t Au) |

Oz (Moz Au) |

|

|

|

|

|

|

|

|

High Grade Mill Feed

|

Proven |

17.21 |

-4% |

2.38 |

+13% |

1.32 |

+9% |

| (+0.70 g/t Au) |

Probable |

18.10 |

+91% |

1.88 |

+8% |

1.09 |

+106% |

|

Total P&P |

35.32 |

+29% |

2.12 |

+7% |

2.41 |

+38% |

|

|

|

|

|

|

|

|

Low Grade Stockpile

|

Proven |

6.14 |

-48% |

0.54 |

+13% |

0.11 |

-39% |

| (0.38-0.70 g/t Au) |

Probable |

10.12 |

+28% |

0.53 |

+10% |

0.17 |

+42% |

|

Total P&P |

16.26 |

-17% |

0.53 |

+10% |

0.28 |

-8% |

|

|

|

|

|

|

|

|

| Total |

Proven |

23.36 |

-21% |

1.89 |

+29% |

1.43 |

+2% |

|

Probable |

28.22 |

+62% |

1.40 |

+20% |

1.27 |

+94% |

|

Total P&P |

51.58 |

+10% |

1.62 |

+20% |

2.69 |

+31% |

Notes:

- Totals may not add due to rounding.

- See “Notes to the Mineral Reserves”

Processing, Recovery and Tailings Management

The Updated FS presents a two-phase processing and recovery design consistent with the design presented in the April 2021 FS. Metallurgy and comminution test-work on Berry ore samples has indicated that Leprechaun, Marathon and Berry ore can be expected to exhibit similar grinding and recovery characteristics.

- Phase 1 processing (2.5 Mt/a) comprises grinding to 80% passing 75 µm, a semi-autogenous (SAG) mill, ball mill, gravity concentration, and gravity tails leaching, carbon elution, and gold recovery. Leach-adsorption tails will be treated for cyanide destruction, thickened, and deposited in the Tailings Management Facility (“TMF”).

- Phase 2 processing (expansion to 4.0 Mt/a) includes Phase 1 equipment with a coarsening of the primary grind to 80% passing 150 µm, and the addition of pebble crushing, gravity tails flotation, flotation concentrate regrinding (to 15 µm), flotation concentrate leaching, and thickening of both the flotation concentrate and flotation tailings streams.

Expansion to Phase 2 in the mill is scheduled for 2028 (Year 4 of the production schedule). Overall LOM gold recovery is estimated at 95%. Plant availabilities of 75% for crushing and 92% for grinding and recovery are assumed.

The TMF will store 31.6 Mt of thickened tailings slurry to be generated over the initial ten years of the mine life. For the remaining mine life, 20 Mt of tailings will be deposited in the mined-out Berry open pit. The TMF dams are stage-raised rockfill embankments with lined upstream slopes. A seepage mitigation measure in the form of an upstream extension of the liner on the foundation is incorporated in the design. The dams will be raised by the downstream method.

The accumulation of water in the TMF has been modelled for the mean and 25-year wet and dry annual precipitation conditions. Reclaim water is pumped from the TMF to the process plant. A water treatment plant and polishing pond allow for the treatment and discharge of excess site water.

Capital and Operating Costs

Capital costs (Table 7) have a basis of estimate at Class 3 (FEL3) with a stated +/-15% accuracy (after the Association for the Advancement of Cost Engineering International).

Remaining Initial Capital, expressed as the cost to complete as of October 31, 2022, is estimated at $463M. The Updated FS recognises $71M of sunk costs representing capitalized costs related to the Project’s current scope, and incurred from 2021 through October 31, 2022. Contingencies of $39M, or 8%, are determined on the basis of deterministic criteria, ranging from 0% on costs already contracted with firm bids or filled purchase orders up to 15% on costs based on informal quotes. Growth factors of up to 5% have been applied on an item-by-item basis. Overall detailed engineering completed to the end of October stood at 50%. Detailed engineering on civils-related site activities, which characterise the early construction period, are most advanced at between 90% and 100%. Procurement completion at October 31, 2022 was 26%.

Sustaining Capital, comprising mining related capital and site infrastructure capital, is estimated at $377M. Capital associated with the Phase 2 mill expansion is estimated at $66M, with closure and reclamation costs estimates at $79M, before salvage.

Capital costs on leased mining equipment are represented as Initial Capital, to the extent that a lease payment or deposit occurs within the project construction period, and as Sustaining Capital to the extent they occur during the operating phase.

Table 7: LOM Capital Costs

| Itemnote 1,2 |

Cost (C$M) |

| Mining Capex |

$67 |

| Process Plant |

$162 |

| Infrastructure |

$120 |

| Offsite Infrastructure |

$22 |

| Contractor Indirects |

$34 |

| Project Delivery |

$21 |

| Owners Cost |

$71 |

| Contingency |

$39 |

| Sunk Capitalnote 3 |

$71 |

| Remaining Initial Capitalnote4 |

$463 |

|

|

| Sustaining Capital, Mining |

$263 |

| Sustaining Capital, Infrastructure |

$115 |

| Total Sustaining Capital |

$377 |

|

|

| Mill Expansion Capital |

$66 |

| Closure |

$79 |

| Salvage |

$(30) |

|

|

| Total |

$ 1,026 |

Notes:

1. Denotes a “specified financial measure” within the meaning of NI 52-112. See note on “Non-IFRS Financial Measures”.

2. Columns may not sum exactly due to rounding.

3. Capitalized Project Costs from 2021 to Oct 31, 2022.

4. Cost to Complete Effective October 31, 2022.

Mine operating costs (Table 8) are estimated at $3.03/t mined or $34.48/t milled (LOM). Mining costs reflect the high strip ratios in the three mining pits and the relatively short haul distances for waste. Mining costs are estimated at $3.80/t for ore, which will be selectively mined on 6 metre benches with smaller equipment and more detailed grade control practices, and $2.75/t for waste, which will be bulk mined on 12 metre benches.

Processing & Water Treatment costs (LOM) are estimated at $16.62/t milled, and G&A at $6.99/t milled. Within these totals, Phase 1 (2.5 Mtpa) Processing & Water Treatment and G&A costs are estimated at $20.5/t milled and $10.4/t milled respectively, with Phase 2 (4.0 Mtpa) at $15.9/t and $6.2/t respectively.

Fuel costs and associated taxes were established using the forward-looking contract pricing as of 2025 and onwards. Estimated costs are C$1.3858/L for diesel and C$1.45/L for gasoline. Annual power costs were calculated using an energy price of C$0.044/kWh and a demand price of C$10.73/kW based on Newfoundland Industrial Firm Rates, July 1, 2022. Labour costs have been estimated on the basis of a detailed labour force work plan that has been developed for the Project, and direct experience within the NL labour market as Marathon builds out its operating team.

Total Cash Costs are US$902/oz with AISC of US$1,046/oz (LOM). AISC³ during the first 12 years of high-grade mill feed is estimated at US$1,007M, rising to US$1,510M when processing of the low-grade stockpile commences in 2037.

Table 8: Life of Mine Operating Costs and AISC

| Itemnote1,2 |

Value |

Units |

| Tonnes Mined, excluding pre-strip |

586 |

Mt |

| Tonnes Milled, LOM |

52 |

Mt |

| Payable Ounces |

2.55 |

Moz |

|

|

|

| Mining Costs |

$1,779 |

C$M |

|

$3.03 |

C$/tonne mined |

|

$34.48 |

C$/tonne milled |

|

|

|

| Processing & Water Treatment |

$857 |

C$M |

|

$16.62 |

C$/tonne milled |

|

|

|

| G&A |

$361 |

C$M |

|

$6.99 |

C$/tonne milled |

|

|

|

| Total |

$2,996 |

C$M |

|

$58.09 |

C$/tonne milled |

|

|

|

| Off-Site Costs, Refining and Transport |

$10 |

C$M |

| Silver Credit |

$(25) |

C$M |

| Royalties |

$87 |

C$M |

|

|

|

| Total Cash Costs |

$902 |

US$/oz |

|

|

|

| Sustaining, Expansion, Closure Capital |

$492 |

C$M |

|

|

|

| Total AISCnote3 |

$1,046 |

US$/oz |

Notes:

1. Denotes a “specified financial measure” within the meaning of NI 52-112. See note on “Non-IFRS Financial Measures”.

2. Columns may not sum exactly due to rounding.

3. AISC includes Royalties, Total Cash Costs and Sustaining Capital, including expansion and closure costs. Excludes Corporate G&A.

Financial Analysis

At a US$1,700 gold price and a US$:C$ exchange of 0.75 the Project generates an after-tax NPV5% of $648M, at a 5% discount rate, and IRR of 22% (unlevered; Table 9). Payback on initial capital is 2.8 years. Before taxes, NPV5% is $1.0B, IRR is 27%, and payback is 2.7 years. The Project’s valuation is discounted to December 31, 2022.

LOM EBITDA is estimated at $2.7B, with an effective EBITDA margin of 47%. LOM after-tax FCF is estimated at $1.2B on an unlevered basis. Annual average after-tax FCF during the 12-year high-grade production period between 2025 and 2036 is estimated at $121M. The Project is forecast to generate federal and provincial income taxes and mining duties of $598M.

At a US$1,900/oz gold upside case, the Project generates an after-tax NPV5% of $919M and IRR of 29%. The Project generates a 15% after-tax IRR at a gold price of US$1,500/oz and is cash positive after-tax at gold prices above US$1,180/oz, approximately US$600/oz below the current spot price. At the base case gold price of US$1,700/oz, the Project’s after-tax NPV5% increases to $1.2B on December 31, 2024, the end of the Initial Capital period and immediately prior to the scheduled production ramp-up.

The Project is most sensitive to revenue attributes such as gold price, head grade and exchange rate, followed by operating cost and capital cost (Table 10).

A 1.5% Net Smelter Royalty (“NSR”) is applied to all gold production. In February 2019 the Company sold a 2% net smelter returns royalty on the Valentine Gold Project to Franco-Nevada Corp. The FS assumes the exercise of a right in favour of the Company to repurchase 0.5% of the NSR for US$7M prior to December 31, 2022, the cost of which is excluded from the Project-level economic analysis.

Table 9: Valuation Sensitivities to the Gold Price (after-tax, unlevered)

Gold Price (US$/oz)

Price Case |

|

$1,500

Downside |

$1,600 |

$1,700

Base Case |

$1,800 |

$1,900

Upside |

$2,000 |

After Tax NPV (C$M)

|

0% |

$764 |

$976 |

$1,181 |

$1,382 |

$1,583 |

$1,784 |

| 3% |

$494 |

$663 |

$825 |

$983 |

$1,140 |

$1,298 |

| 5% |

$361 |

$507 |

$648 |

$783 |

$919 |

$1,054 |

| 8% |

$209 |

$330 |

$445 |

$555 |

$664 |

$774 |

| 10% |

$133 |

$240 |

$341 |

$437 |

$533 |

$629 |

|

|

|

|

|

|

|

|

| IRR |

|

15% |

19% |

22% |

26% |

29% |

32% |

|

|

|

|

|

|

|

|

| NPV5%/Capex |

|

0.8 |

1.1 |

1.4 |

1.7 |

2.0 |

2.3 |

|

|

|

|

|

|

|

|

| Paybacknote 2 |

Years |

5.6 |

4.8 |

2.8 |

2.6 |

2.3 |

2.0 |

|

|

|

|

|

|

|

|

| Total FCFnote1, 3 |

C$M |

$764 |

$976 |

$1,181 |

$1,382 |

$1,583 |

$1,784 |

|

|

|

|

|

|

|

|

| Average Annual FCFnote1, 4 |

C$M |

$89 |

$105 |

$121 |

$136 |

$151 |

$166 |

Notes:

- Denotes a “specified financial measure” within the meaning of NI 52-112. See note on “Non-IFRS Financial Measures”.

- Payback is defined as achieving cumulative positive free cashflow after all cash costs and capital costs, including sustaining and expansion.

- Calculated LOM, unlevered.

- Calculated for the period 2025-2036 of sustained high grade mill feed, unlevered.

Table 10: Valuation Sensitivities to Certain Operating Parameters (after-tax, unlevered)

| Factor |

|

-20% |

-10% |

0% |

10% |

20% |

Operating Cost

|

IRR |

28% |

25% |

22% |

19 % |

16 % |

| NPV |

$894 |

$771 |

$ 648 |

$520 |

$388 |

Initial Capital Cost

|

IRR |

27% |

25% |

22% |

20% |

19% |

| NPV |

$704 |

$676 |

$648 |

$618 |

$588 |

|

|

0.65 |

0.70 |

0.75 |

0.80 |

0.85 |

$C:$US F/X

|

IRR |

31 % |

26 % |

22% |

19 % |

15 % |

| NPV |

$1,003 |

$813 |

$ 648 |

$498 |

$360 |

|

|

|

|

|

|

|

Project Schedule

Early works at the Project commenced in October 2022. These comprise the installation of a temporary camp, pre-strip mining at the Leprechaun Deposit for construction materials, grubbing and tree-removal, and the construction of roads and facilities pads. Mobilization for principal civil works will commence in January 2023, with first ore expected to be delivered to the mill at the end of 2024. First gold is expected in January 2025, with production ramp-up during the first quarter of 2025.

Environmental Assessment

The Valentine Gold Project was subject to the Newfoundland and Labrador Environmental Protection Act (“NL EPA”), associated Environmental Assessment Regulations, and the Canadian Environmental Assessment Act (“CEAA, 2012”). In September 2020, Marathon submitted an Environmental Impact Statement (“EIS”) to the Impact Assessment Agency of Canada (“IAAC”) and the NL Environment and Climate Change (EA Division) to meet the requirements of CEAA (2012) and the NL EPA respectively, in accordance with the project-specific guidelines issued by the federal and provincial governments. The scope of assessment for the EIS included the mine access road, Marathon Complex (pit, waste rock facility and associated infrastructure), Leprechaun Complex, Processing Plant/TMF Complex, and associated site infrastructure. The Valentine Gold Project was released from the provincial Environmental Assessment (“EA”) process on March 17, 2022, and the federal EA process on August 24, 2022.

Upon release from the provincial and federal EA processes, numerous approval, authorization, and permit applications were prepared and submitted for approval prior to initiating project construction. Permits could only be issued following release from the EA processes, however, some long-lead items, such as the Fisheries Act application, were initiated prior to EA release.

Major permits and authorizations issued to date by the NL Department of Industry, Energy and Technology include the Mining Lease, the Surface Lease, the Approval of the Early Works Development and Rehabilitation & Closure Plan, the Approval of the Construction Environmental Protection Plan, and the Early Works Certificate and Approval for Construction, issued by the NL Department of Environment and Climate Change. Important authorisations issued at the federal level include the Federal Fisheries Act Authorization from Fisheries and Oceans Canada

The Berry Complex (pit, waste rock facility and associated infrastructure) is expected to be subject to further EA requirements to identify, assess and mitigate potential environmental effects during all project phases, including construction, operation, decommissioning, rehabilitation and closure and post-closure. From the provincial EA perspective, the addition of the Berry Complex would be considered a new undertaking requiring EA registration, whereas federally the Berry Complex addition would be considered a change to the Designated Project, requiring a similar submission, as described in the Decision Statement conditions. The federal designated project list (Physical Activities Regulations-SOR 2019-285) sets out specific triggers related to project changes such as mine expansions and refers to metal mine expansion of mining area and/or mill capacity after expansion. The proposed Berry Complex does not meet the thresholds identified in the Regulations such that a federal EA would be triggered under the Impact Assessment Act. Further consultation with provincial and federal regulators will confirm the EA requirements.

Once EA requirements are complete, existing approvals, authorizations and permits will be updated, as required. In the Updated FS, mining at the Berry Deposit has been scheduled for the second quarter of 2025, allowing more than 24 months to conclude any regulatory assessment required.

NI 43-101 Technical Report

Marathon expects to shortly file a Technical Report prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) for the Valentine Gold Project Updated FS, including a description of the updated Mineral Resource Estimate and the updated Mineral Reserve Estimate.

Qualified Persons

Disclosure of a scientific or technical nature in this news release has been approved by Mr. Tim Williams, FAusIMM, Chief Operating Officer of Marathon, Mr. Paolo Toscano, P.Eng. (Ont.), Vice President, Projects for Marathon, Mr. James Powell, P.Eng. (NL), Vice President, Regulatory and Government Affairs for Marathon and Mr. David Ross, P.Geo. (NL), Vice President of Geology and Exploration for Marathon. Ms. Jessica Borysenko, P.Geo. (NL), Manager, GIS, is responsible for data quality assurance and control for Marathon. Mr. Williams, Mr. Toscano, Mr. Powell and Mr. Ross and Ms. Borysenko have verified the data disclosed in this news release, including sampling, analytical and test data underlying the information it contains. This included a site inspection, drill database verification, and independent analytical testwork.

Mr. Robert Raponi, P.Eng. (NL, ON) of Ausenco Engineering Canada, is the Qualified Person responsible for the preparation of the Updated FS NI 43-101 Technical Report, and the Updated FS financial model using capital costs, operating costs, and the mining cost provided by other parties.

Mr. Roy Eccles, P. Geol. (PEGNL, AB), of APEX Geoscience Ltd., is the Qualified Person responsible for the review and acceptance of responsibility of the MRE prepared by John T. Boyd Company. Mr. Eccles is also the Qualified Person responsible for geological technical information including a QA/QC review of drilling and sampling data used in the MRE.

Mr. Marc Schulte, P.Eng. (NL), of Moose Mountain Technical Services, is the Qualified Person responsible for the preparation of the Mineral Reserves and mine planning.

John Goode, P.Eng. (NL, ON), of J.R. Goode & Associates is the Qualified Person responsible for the metallurgical testwork program and its interpretation.

Peter Merry, P.Eng. (NL, ON, NT, NU), of Golder Associates Ltd., is the Qualified Person responsible for design of the TMF and its water management infrastructure.

Sheldon Smith, P.Geo. (NL, ON), of Stantec Consulting Ltd. is the Qualified Person responsible for site water balance and surface water management.

Shawn Russell, P.Eng. (NL) and Carolyn Anstey-Moore, P.Geo (NL, NB) of GEMTEC Consulting Engineers and Scientists Limited are the Qualified Persons responsible for site wide geotechnical and hydrogeological considerations.

Mr. Tony Lipiec, P.Eng (ON, BC), of SNC-Lavalin, is the Qualified Person responsible for mill and process design.

Each of Mr. Raponi, Mr. Eccles, Mr. Schulte, Mr. Goode, Mr. Merry, Mr. Smith, Mr. Russell, Ms. Anstey-Moore and Mr. Lipiec has reviewed the technical information contained in the Updated FS and in this press release in their area of expertise and are considered to be “independent” of Marathon and the Valentine Gold Project for purposes of NI 43-101.

Non-IFRS Financial Measures

The Company has included various references in this document that constitute “specified financial measures” within the meaning of National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators, such as, for example, Free Cash Flow, EBITDA, Total Cash Cost and All-In Sustaining Cost. None of these specified measures is a standardized financial measure under International Financial Reporting Standards (“IFRS”) and these measures might not be comparable to similar financial measures disclosed by other issuers. Each of these measures are intended to provide additional information to the reader and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Certain non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Total Cash Cost and Total Cash Cost per Ounce

Total Cash Cost is reflective of the cost of production. Total Cash Cost reported in the FS include mining costs, processing & water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total Cash Cost per Ounce is calculated as Total Cash Cost divided by payable gold ounces.

All-in Sustaining Cost (AISC) and AISC per Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the FS includes total cash costs, sustaining capital, expansion capital and closure costs, but excludes corporate general and administrative costs and salvage. AISC per Ounce is calculated as AISC divided by payable gold ounces.

Free Cash Flow (FCF)

FCF deducts capital expenditures from net cash provided by operating activities. Management believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Free cash flow is intended to provide additional information only and does not have any standardized definition under IFRS, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate this measure differently.

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)

EBITDA excludes from net earnings income tax expense, finance costs, finance income and depreciation. Management believes that EBITDA is a valuable indicator of our ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose.

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold company advancing its 100%-owned Valentine Gold Project located in the central region of Newfoundland and Labrador, one of the top mining jurisdictions in the world. The Project comprises a series of five mineralized deposits along a 32-kilometre system. A December 2022 Updated Feasibility Study outlined an open pit mining and conventional milling operation producing 195,000 ounces of gold a year for 12 years within a 14.3-year mine life. The Project was released from federal and provincial environmental assessment in 2022 and construction commenced in October 2022. The Project has estimated Proven Mineral Reserves of 1.43 Moz (23.36 Mt at 1.89 g/t) and Probable Mineral Reserves of 1.27 Moz (28.22 Mt at 1.40 g/t). Total Measured Mineral Resources (inclusive of the Mineral Reserves) comprise 2.06 Moz (29.23 Mt at 2.19 g/t) with Indicated Mineral Resources (inclusive of the Mineral Reserves) of 1.90 Moz (35.40 Mt at 1.67 g/t). Additional Inferred Mineral Resources are 1.10 Moz (20.75 Mt at 1.65 g/t Au). Please see Marathon’s Annual Information Form for the year ended December 31, 2021 and other filings made with Canadian securities regulatory authorities and available at www.sedar.com for further details and assumptions relating to the Valentine Gold Project.

For more information, please contact:

Amanda Mallough

Manager, Investor Relations

Tel: 416 855-8202

amallough@marathon-gold.com |

Matt Manson

President & CEO

mmanson@marathon-gold.com |

Julie Robertson

CFO

jrobertson@marathon-gold.com |

To find out more information on Marathon Gold Corporation and the Valentine Gold Project, please visit www.marathon-gold.com.

Cautionary Statement Regarding Forward-Looking Information

Certain information contained in this news release, constitutes forward-looking information within the meaning of Canadian securities laws (“forward-looking statements”). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Marathon expects to occur are forward-looking statements. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “considers”, “intends”, “targets”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”. We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. More particularly and without restriction, this news release contains forward-looking statements and information about the FS and the results therefrom (including IRR, NPV5%, Capex, FCF, AISC and other financial metrics and economic analysis), the realization of mineral reserve and mineral resource estimates, the future financial or operating performance of the Company and the Project, capital and operating costs, the ability of the Company to obtain all government approvals, permits and third-party consents in connection with the Company’s exploration, development and operating activities, the potential impact of COVID-19 on the Company, the Company’s ability to successfully advance the Project and anticipated benefits thereof, economic analyses for the Valentine Gold Project, processing and recovery estimates and strategies, future exploration and mine plans, objectives and expectations and corporate planning of Marathon, future environmental impact statements and the timetable for completion and content thereof and statements as to management's expectations with respect to, among other things, the matters and activities contemplated in this news release.

Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. In respect of the forward-looking statements concerning the interpretation of exploration results and the impact on the Project’s mineral resource estimate, the Company has provided such statements in reliance on certain assumptions it believes are reasonable at this time, including assumptions as to the continuity of mineralization between drill holes. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “inferred mineral resource” or an “indicated mineral resource” will ever be upgraded to a higher category of mineral resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable mineral reserves.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations; uncertainty as to estimation of mineral resources; inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral resources); the potential for delays or changes in plans in exploration or development projects or capital expenditures, or the completion of feasibility studies due to changes in logistical, technical or other factors; the possibility that future exploration, development, construction or mining results will not be consistent with the Company’s expectations; risks related to the ability of the current exploration program to identify and expand mineral resources; risks relating to possible variations in grade, planned mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined; operational mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages and strikes) or other unanticipated difficulties with or interruptions in exploration and development; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; risks related to commodity and power prices, foreign exchange rate fluctuations and changes in interest rates; the uncertainty of profitability based upon the cyclical nature of the mining industry; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental or other stakeholder approvals or in the completion of development or construction activities; risks related to environmental regulation and liability, government regulation and permitting; risks relating to the Company’s ability to attract and retain skilled staff; risks relating to the timing of the receipt of regulatory and governmental approvals for continued operations and future development projects; political and regulatory risks associated with mining and exploration; risks relating to the potential impacts of the COVID-19 pandemic on the Company and the mining industry; changes in general economic conditions or conditions in the financial markets; and other risks described in Marathon’s documents filed with Canadian securities regulatory authorities, including the Annual Information Form for the year ended December 31, 2021.

You can find further information with respect to these and other risks in Marathon’s Annual Information Form for the year ended December 31, 2021 and other filings made with Canadian securities regulatory authorities available at www.sedar.com. Other than as specifically required by law, Marathon undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results otherwise.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c69e6b9b-c7dc-4a18-b576-d8059cbfa79e

https://www.globenewswire.com/NewsRoom/AttachmentNg/18602d9d-4805-4111-a2e7-579be5135eed

1 Denotes a “specified financial measure” within the meaning of National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators (“NI 52-112”). See note on “Non-IFRS Financial Measures”.

2 Denotes a “specified financial measure” within the meaning of NI 52-112. See note on “Non-IFRS Financial Measures”.