(TheNewswire)

|

|

|

|

Jervois Global Limited

ACN: 007 626 575

ASX/TSXV: JRV

OTCQX: JRVMF

Corporate Information

2,079M Ordinary Shares

77.2M Options

4.4M Performance Rights

3.2M Warrants

Non-Executive Chairman

Peter Johnston

CEO and Executive Director

Bryce Crocker

Non-Executive Directors

Brian Kennedy

Michael Callahan

David Issroff

Daniela Chimisso dos Santos

Company Secretary

Alwyn Davey

Contact Details

Suite 2.03,

1-11 Gordon Street

Cremorne

Victoria 3121

Australia

P: +61 (3) 9583 0498

E: admin@jervoisglobal.com

W: www.jervoisglobal.com

|

Highlights

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil:

Idaho Cobalt Operations (“ICO”), United States:

-

Initial mine development and infrastructure near complete

-

Unprecedented labour shortages and severe winter weather underpins revision to project schedule and cost – commercial concentrate production now expected end of Q1 2023

-

Promising results from recent resource expansion drilling, confirming potential for mine life extension

Jervois Finland:

-

Q4 2022 cobalt sales of 1,355 metric tonnes

-

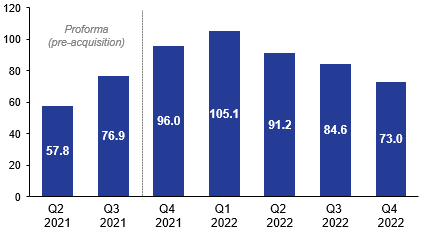

Q4 2022 revenue US$73.0 million (FY22: US$353.9 million)

-

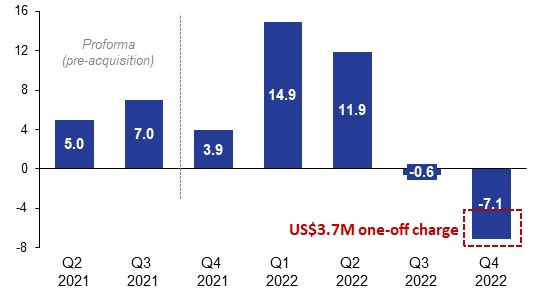

Q4 2022 Adjusted EBITDA of -US$7.1 million (FY22: US$19.1 million), impacted by higher cost inventory unwind and a backdated assay adjustment from refinery operator Umicore

-

Jervois appoints AFRY to lead Kokkola refinery expansion Bankable Feasibility Study

Corporate:

-

Financial strength and flexibility enhanced by US$150 million equity raise

-

Dr. Daniela Chimisso dos Santos appointed Non-Executive Director

-

Jervois ended December 2022 quarter with US$152.6 million in cash, US$112.8 million physical cobalt inventories in Jervois Finland, and total drawn debt of US$215.0 million1

|

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil

In November 2022, Jervois Global Limited (“Jervois” or the “Company”) announced Final Investment Decision (“FID”) approval for restart of the SMP nickel and cobalt refinery in São Paulo, Brazil. First production at SMP is expected at the end of Q1 2024.

SMP is located within the São Paulo city limits with ready access to labour, utilities and services and is 120km via highway from the largest container port in Brazil (Santos), ensuring it is well placed to serve export markets.

During the quarter, Ausenco commenced early works activities associated with an EPCM role. This start and activities accomplished to date continue to reconcile with the R$345 million (~US$65 million) project budget and associated schedule. Detailed 3D scanning of the existing plant to facilitate full reconstruction activities are approximately 75% complete. Key tenders are underway, including for dual media filters, larix filter refurbishment and the general restart and construction work package (appointment expected in February 2023).

Operational readiness is also advancing, including organisational and systems development. During the quarter, Jervois appointed experienced resources executive Mr. Carlos Braga as President and Executive General Manager – Jervois Brasil. Mr. Braga continues to build an experienced leadership team that will drive delivery of the SMP restart and re-establish the refinery again as a key strategic installation in both Brazil and the Americas.

SMP previously produced ‘Tocantins’ nickel and cobalt products, which are well established domestically in Brazil and in key Western export markets such as Europe and Japan. The Company’s commercial team are re-establishing nickel and cobalt customer relationships ahead of first production next year. Nickel pricing and expected Tocantins premia across both Brazil and key export markets in the United States (“U.S.") and Europe, continue to be significantly stronger than those contained in the SMP restart Bankable Feasibility Study (“BFS”) underpinning the Jervois Board’s FID.

Mixed hydroxide precipitate (“MHP”) supply contracts remain under negotiation and are expected to be progressively finalised across 2023. Jervois continues to have confidence in its ability to competitively procure to underpin the initial years of capacity utilisation at SMP. Current market conditions for MHP and cobalt hydroxide indicate CIF Asia pricing quoted at 61%-68% for MHP and 55%-58% for cobalt hydroxide, respectively, (based on the Fastmarkets Metal Bulletin (“MB”), at 26 January 2023); both significantly below the 75% assumption applied in the SMP restart BFS.

Idaho Cobalt Operations (“ICO”), United States

As reported last quarter, in October 2022 and prior to the onset of winter, Jervois celebrated the official opening of ICO with an event attended by representatives from Jervois and the Australian and U.S. Governments, including Idaho Governor Mr. Brad Little and the Australian Ambassador to the U.S., the Hon. Arthur Sinodinos AO.

ICO is the only primary cobalt mine in the U.S. and will produce a cobalt concentrate, which will be refined into the critical mineral necessary for electric vehicles, energy generation and distribution, defence, and other industries. Cobalt will play a key role in the transition to a low carbon economy.

ICO Construction and Mine Development Progress

During the quarter, underground mine development and construction of infrastructure advanced and is now largely complete, including triple clarifying sumps, main shop and associated fuel services. Access to the RAM orebody has now been established in six headings across 11 faces, and developmental ore is being stored ready for delivery to the processing plant.

Site construction above ground was significantly impacted from December 2022 until mid-January 2023 due to exceptionally severe winter weather affecting North America. The weather compounded acute skilled trade shortages, with significant productivity loss in mechanical, piping, electrical and instrumentation over a key period up to plant commissioning. Whilst the accommodation camp commenced operations at the end of the prior quarter, its utilisation of approximately 100 beds represented much less than half of the daily construction workforce at site over winter. Bed capacity was prioritised toward miners, meaning the majority of the surface construction workforce was commuting across winter, compounding falls in productivity and staff retention.

These delays have negatively impacted the US$107.5 million construction budget, with a capital expenditure overrun of between 15% to 25% projected. First commercial concentrate production is now expected at the end of Q1 2023 and Jervois expects to ramp-up to full nameplate capacity across Q2 2023.

At the end of December 2022, cumulative project expenditure was US$103.9 million of the prior construction budget.

With final plant commissioning on RAM ore scheduled to begin at the end of Q1 2023, and ramp up across Q2 2023, ICO now expects to produce approximately 1,100 to 1,300 metric tonnes of cobalt contained in concentrate and 3,000 to 3,200 metric tonnes of copper contained in concentrate this calendar year.

Drilling at ICO

In-fill and expansion drilling campaigns conducted throughout 2022 have returned promising results. Jervois’ 2022 drilling program at ICO totalled 10,300 metres (“m”) in 69 completed diamond drillholes. With the exception of a single (230m) geotechnical drillhole, the 2022 drilling was focused on the RAM deposit underpinning current mine development at ICO, and its down-dip extents, and comprised 62 infill drillholes (totalling 7,730m) and 6 targeted RAM resource expansion drillholes (totalling 2,300m).

In-fill drilling has confirmed the current RAM deposit resource model and continues to de-risk mining. In conjunction with other technologies being utilised at ICO, including Exyn autonomous drone lidar survey systems, in-fill drilling is a key component that will better enable the ICO team to forecast and manage grade control and dilution.

In-fill drilling is ongoing and will continue throughout 2023 as vertical mine development progresses, focused on production areas within the upper levels of the Mid Zone and the South Zone of the deposit.

The six expansion drill holes all intersected the main mineralised horizon (“MMH”) with portable x-ray fluorescence (“pXRF”) indication of cobalt-copper. Analytical results have been received for the first two drill holes, and include:

-

Hole JS22-001B collared from surface intersected 0.58% Co, 0.66% Cu, 0.31 g/t Au over a calculated true width (CTW) of 6.0m, including 1.06m CTW at 1.71% Co, 0.70% Cu, 0.75 g/t Au.

-

Hole JU22-064 collared from an underground platform intersected 0.27% Co, 0.67% Cu, 0.14 g/t Au, over a calculated true width of 2.4m.

Since acquiring 100% ownership of ICO in mid 2019, Jervois has now drilled eight targeted exploration or expansion holes outside of the previously defined Mineral Reserve and Resource Estimate (“MRRE”), which was calculated in accordance with standards set forth in both the Australasian JORC Code 2012 (“JORC”) and by the Canadian Institute of Mining (“CIM”). These drill holes included two holes drilled in 2019 that tested footwall targets underlying the RAM deposit (see ASX announcement “Jervois update on drilling at Idaho Cobalt Operations, United States, dated 15 October 2019) and six 2022 expansion holes that tested down-dip extensions of the RAM deposit. All of the 2019 and 2022 exploration / expansion drill holes intersected mineralisation.

Drilling results continue to provide confidence that the RAM resource will ultimately support extended mine life at ICO beyond the initial seven years included in the BFS released in 2020 (see ASX announcement “Jervois releases BFS for Idaho Cobalt Operations” dated 29 September 2020) and introduces the potential for higher annual production rates. The RAM deposit remains open at depth and along strike and Jervois is confident there is strong potential of both resource and reserve expansion.

Jervois expects to complete an updated JORC and CIM National Instrument (“NI”) 43-101 compliant MRRE in Q2 2023 and has an extensive exploration plan across 2023 to capitalise on the benefit of establishment of a central processing hub at ICO, located amongst potential satellite deposits. For further information see ASX announcement “Jervois drilling confirms RAM deposit expansion at ICO” dated 30 January 2023.

Offtake

As there are no cobalt refineries in the U.S., the cobalt concentrate produced at ICO must be sent outside the country for refining. Jervois has a future option to refine ICO cobalt concentrate at its 100%-owned SMP refinery in São Paulo, Brazil, and is continuing its negotiations with third-party processors in U.S. allied countries.

Jervois will sell copper concentrate from ICO into North American markets.

Jervois Finland

-

Quarterly revenue: US$73.0 million (Q3 2022: US$84.6 million)

-

Adjusted EBITDA -US$7.1 million (Q3 2022: -US$0.6 million)

-

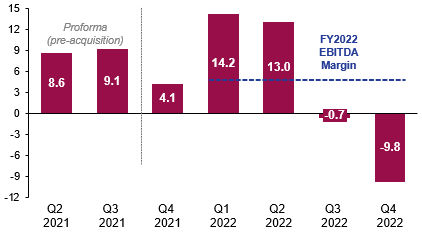

Adjusted EBITDA margin: -9.8% (Q3 2022: -0.7%)

-

Sales volume: 1,355 metric tonnes (Q3 2022: 1,407 metric tonnes)

-

Production volume: 1,258 metric tonnes (Q3 2022: 1,586 metric tonnes)

Sales and Marketing

Both demand and pricing for advanced manufactured cobalt products and battery grade sulphate remained weak across Q4 2022. Chinese cobalt producers continuing to export refined cobalt due to the downturn in their own economy and domestic demand due largely to Covid-19, reducing prices and increasing competition against Jervois’ products from Finland.

The outlook across 2023 is increasingly positive, with the cobalt tonnage requested from the battery sector including automakers across the back end of 2023 and particularly from 2024 and beyond, rising sharply. Should the global economy continue to improve, demand in China recover (to absorb supply from its domestic producers), and consumer electronics and traditional cobalt consuming industries match rises in GDP, Jervois expects to end this calendar year in a far stronger market environment than prevailed during much of 2022.

Jervois’ outlook for key market segments is summarised below.

Batteries:

-

Current demand from battery customers overall is stabilising, as the impact of semiconductor shortages (largely on the automotive sector) and Covid-19 subsides, and inventory overhang as a result of the market correction in China is worked through.

-

Electric Vehicle (EV”) demand growth continues at pace, and Jervois is receiving significant forward cobalt inquiries from OEMs (automakers) for 2024 onwards in the U.S. and Europe. The commissioning and upcoming ramp up of European battery gigafactories supporting these OEMs have commenced purchases of Jervois cobalt products.

-

Consumer electronics, an important driver for cobalt today in lithium cobalt oxide (LCO”) chemistry, and a key reason for recent demand and price weakness, are poised to recover. The global economy continues to improve and the full impact of Asian Covid-19 lockdowns lifting is expected to flow through retail consumption over the course of this year.

Chemicals, Catalysts and Ceramics:

-

Catalysts: cobalt carbonate sales into the oil and gas sector remains steady, and in line with expectations of modest growth year on year.

-

Chemicals: demand in this sector is stable, with impact from the global economic malaise, the Russian invasion of Ukraine, and concern around energy supply and price issues (especially in Europe).

-

Ceramics: demand remains softer in this sector, as high energy costs (especially in Europe) continue to reduce gas fired furnace usage, and each of pigment, digital ink and ceramic production. Chinese cobalt oxide producers continue to discount heavily into Western markets where they are not prevented from doing so by trade or ESG standard hurdles.

Powder Metallurgy:

-

Hard metal and diamond tool sectors have largely improved their 2023 forecasts since Jervois’ last quarterly update, as demand in certain sectors is increasingly positive (aerospace including defence, oil and gas, mining).

-

The energy shortage and high prices in Europe remain concerning for the Company’s customers, with many continuing to work through excess inventories from 2022.

Jervois Finland produced 1,258 metric tonnes and sold 1,355 metric tonnes of cobalt in the quarter, with production deliberately reduced to take account of finished goods inventory levels and underlying market demand. Sales into the battery sector rose, a trend which Jervois expects to continue in the coming years as new market development initiatives with OEMs are pursued and commercial relationships established. The expansion of Jervois’ business into the high growth battery segment is expected to underpin future growth and is fundamental to the Kokkola refinery expansion BFS currently underway.

The Company’s disciplined approach to managing cobalt inventories down continues and is discussed further below in the Working Capital section.

Financial Performance2

Jervois Finland achieved Q4 2022 revenue of US$73.0 million (Figure 1), 14% lower than the prior quarter as the cobalt price continued to fall quarter on quarter, decreasing by 27% between 30 September 2022 and 31 December 2022 (from US$25.8/lb to US$18.8/lb). Sales volumes were substantially in line with the prior quarter (4% lower) and historical trends.

Figure 1: Jervois Finland Revenue (US$M, unaudited)

Q4 2022 Adjusted EBITDA of -US$7.1 million was impacted by lower cobalt prices, the unwind of higher cost feed purchased in prior periods, and a one-off assay adjustment from Umicore, the refinery operator at the Kokkola Industrial Park.

Feed costs are realised in the profit and loss account based on the average cost of inventory at the time when finished goods are sold. For the current period, costs realised in the profit and loss account included raw materials costs linked to purchases settled in prior periods at higher cobalt prices. Jervois expects feed costs realised in the profit and loss account and margins to start to normalise if prices stabilise or rise in the first half of 2023.

The assay adjustment resulted in a reduction to Jervois Finland’s inventory at 31 December 2022. The resulting pre-tax charge recorded in the fourth quarter was US$2.8 million, comprising a US$3.7 million impact to Adjusted EBITDA and partially offset by a US$0.9 million benefit to the Net Realisable Value (“NRV”) adjustment (which is excluded from Adjusted EBITDA). Umicore is conducting a review of assaying procedures, and Jervois Finland is continuing to engage Umicore as the audit progresses.

Higher consumable costs also adversely impacted the result, with caustic soda prices reaching multi-year highs in Q4 2022. Caustic soda is the largest consumable cost in the Umicore-operated refinery process. Jervois Finland’s share of refining consumable costs are incurred as part of the tolling charge under the Refining Capacity Agreement with Umicore.

Full year 2022 Adjusted EBITDA was US$19.1 million, with a weak second half following a strong start to the year. Cobalt price declines from highs of US$39.8/lb in May 2022 to US$18.8/lb at end of the December 2022 were a key driver of margin compression in the second half of the year.

Figure 2: Jervois Finland Adjusted EBITDA (US$M, unaudited)

EBITDA margins were compressed during 2022 as a result of the weak finish to the year, averaging 5% across the 12 months.

Figure 3: Jervois Finland Adjusted EBITDA Margin (%, unaudited)

Full-year 2023 cobalt sales volume guidance for Jervois Finland is 5,300 to 5,600 metric tonnes. The outlook for 2023 will be influenced by the pace of the expected demand recovery, linked to the post-Covid-19 restart in China and demand from the growing battery segment. A return to positive EBITDA is expected as higher cost inventory is adjusted to prevailing market prices, which will be reinforced if cobalt prices stabilise or rise.

Working Capital

Net working capital was US$136.0 million at 31 December 2022, with physical cobalt inventories representing US$112.8 million. Cobalt inventories were 2,540 metric tonnes at 31 December 2022, compared to 2,687 metric tonnes at 30 September 2022. Total inventory volumes at ~155 days at 31 December 2022 represented a 5% reduction relative to the prior quarter, but remain above target levels (90 to 110 days). Cobalt market conditions during Q4 2022 were not supportive of an aggressive unwind, and the strategy remains to pursue a disciplined, but balanced approach. The Jervois Finland 2023 plan aims to reduce inventory to target levels, with delivery underpinned by commercial and operational initiatives. Jervois anticipates that cash progressively released from working capital reductions will be used to meet partial repayment of the Mercuria working capital facility.

The NRV of cobalt inventories as at 31 December 2022 was lower than historic cost and, therefore, a US$23.2 million non-cash accounting adjustment has been recorded in the fourth quarter. The NRV write-down is a non-cash adjustment to the book value of inventory and does not impact the economic gain or loss associated with the inventory position. The economic gain or loss is expected to be realised in future cash flows according to market conditions and other circumstances in the future period when the inventory is sold. The cost has been excluded from Adjusted EBITDA.

Enhancing the Jervois Finland Business Model

Key initiatives are underway with a focus on enhancing the flexibility of raw materials supply, adapting the sale strategy to increase earnings stability, enhancing price risk management, and delivering operational efficiency. Initiatives aim to maximise the flexibility and profitability of the Kokkola operations across the business cycle.

Bankable Feasibility Study

In November 2022, Jervois appointed AFRY to complete basic engineering, environmental permitting including a public Environmental Impact Statement (“EIS”) and lead the BFS to expand the cobalt refinery capacity at the Kokkola Industrial Park. AFRY is a Swedish-Finnish industry leader in engineering, design, and advisory services, with a global reach.

Basic engineering work and the associated BFS study is expected to be complete in Q3 2023 and will be undertaken in accordance with Jervois Finland’s exceptional sustainability record and recently announced net zero targets. As part of the appointment, AFRY will also consult and provide support on Jervois’ EIS and preparation of an Environmental Permit application, which is underway.

The BFS will assess the potential expansion of Jervois Finland’s production capacity via construction of refinery capacity proximate to the current facilities at the Kokkola Industrial Park. Expansion is expected to add a minimum of 6,000 metric tonnes, and potentially up to 10,000 metric tonnes, of annual cobalt refining capacity and would be separate to Jervois Finland’s existing commercial relationships. Higher refined production capacity would provide Jervois with greater flexibility to continuously optimise its product mix and to adapt to end-user demands, specifically rising customer demand in the battery sector particularly in electric vehicles.

As such, expansion of refining capacity will only be implemented in conjunction with growth in customer demand requirements, which based on escalating inbound OEM inquiries and forward sales contract negotiations to date, is expected during the second half of this decade.

The proposed expansion will increase Jervois Finland’s participation in circular “closed loop” recycling, where cobalt material is used by customers and returned to Jervois Finland for regeneration. About 10%-15% of the current cobalt inputs of Jervois Finland’s current operations are received as recycled units. This percentage is anticipated to rise associated with the expansion.

The Company’s potential expansion of Jervois Finland consolidates its important and expanding role in the security of critical mineral supply chains underpinning energy transition and climate goals.

Nico Young Nickel-Cobalt Project, New South Wales (“NSW”), Australia

The Company’s 100%-owned Nico Young nickel and cobalt project envisages heap leaching nickel and cobalt laterite ore to produce either an intermediate MHP or refining through to battery grade nickel sulphate and cobalt in refined sulphide.

As previous announced, the Board of Jervois has approved a drilling campaign at Nico Young, which is planned for Q1 2023, with timing for commencement of the campaign being finalised due to ground conditions following record heavy rains across eastern Australia.

In November 2022, Jervois announced it would receive A$0.5 million funding from the NSW Government to advance testwork associated with underpinning a BFS for Nico Young under the NSW Critical Minerals and High-Tech Metals Activation Fund, Stream 1.

Funding will support Jervois to undertake further studies, which will feed into a BFS. It will also underpin environmental and infrastructure permitting required to advance the project’s development.

Successful completion of these studies will build on the Prefeasibility Study (publicly released as a NI 43-101 PEA in May 2019), which confirmed the technical and commercial viability of an open cut mine operation.

Corporate Activities

Liquidity

Jervois ended December 2022 quarter with US$152.6 million in cash, US$112.8 million physical cobalt inventories in Jervois Finland, and total drawn debt of US$215.0 million.

Equity Raising

During the quarter, Jervois completed a A$231.0 million (US$150.0 million3) equity raising (the “Equity Raising”) to fully fund the SMP refinery restart, ICO ramp up and mine sustaining capital, and the Jervois Finland expansion BFS.

The Equity Raising consisted of a A$113.0 million (US$73.5 million3) institutional placement of new Jervois ordinary shares (the "Placement") and a A$118 million (US$76.7 million3) 1 for 5.42 accelerated pro-rata non-renounceable entitlement offer (the “Entitlement Offer”), which had both Institutional and Retail components.

Entities controlled by AustralianSuper, the Company’s largest shareholder, invested A$55.6 million (US$36.1 million3) – including its full Institutional Offer entitlement, Placement pro-rata and additional Retail Entitlement Offer sub-underwriting.

As a part of the Equity Raising, Mercuria, Jervois’ third largest shareholder, and one of the

world’s largest integrated energy and commodity traders, invested US$10.5 million

(A$16.2 million3).

Jervois Directors and Senior Management participated for approximately A$2.0 million (US$1.3 million3) in the Equity Raising.

The Placement and Institutional Entitlement Offer was strongly supported by new and existing domestic and offshore institutional investors.

Environmental, Social, Governance and Compliance

Climate Action

Jervois is proud to have recently approved a Carbon Reduction Roadmap and net zero target of 2035 for its operations in Finland. Jervois Finland targets emission reductions of 40% by 2025, 60% by 2030, and 100% by 2035 from its 2020 baseline.

This step is the culmination of Jervois Finland’s impressive track record in climate responsive action and the circular economy. Among these, in Q4 2022, Jervois Finland signed a purchase power agreement for long-term wind energy that represents approximately two thirds (or 17.5 GWh) of Jervois Finland’s total annual power consumption.

Responsible Supply Chains

Jervois’ Responsible Supply Chain Working Group advanced progress in the quarter to harmonise and expand standards and procedures for mineral and non-mineral supply chain due diligence in accordance with requirements of the OECD, the Responsible Minerals Initiative and emerging legislation in the U.S., EU, and elsewhere.

In conjunction with this, key Jervois personnel have continued engagement with the Cobalt Institute (“CI”) Learning Group that aims to strengthen capacity of members to implement environmental and human rights due diligence. This included participation in a virtual session with the U.S. Department of Labour and an intensive, in-person training workshop in London on 7-8 December 2022.

Community Engagement

Throughout the quarter, Jervois and local stakeholders made progress towards finalisation of a Community Benefits Agreement at ICO. Over the past year, a series of public meetings, town halls and consultations with a wide range of groups within project affected communities has served to increase understanding of local priorities and strengthen relationships.

Engaging the Global Community

Within the quarter, Jervois continued to engage in the CI Responsible Sourcing and Sustainability Committee and Government Affairs Committee, including through participation in training, committee meetings and contribution to ESG related submissions.

In the quarter, Jervois increased its engagement with the National Mining Association through participation in a resource session on ESG data, reporting and costs of compliance. Jervois continued to engage with U.S.’s Critical Materials Initiative, which aims to advance greener technology via cutting edge research.

In an effort to build understanding of linkages between Jervois’ business strategy and approach to ESG, Jervois Chief Executive Officer, Mr. Bryce Crocker, gave a presentation on 15 November 2022 at the opening session of Kokkola Materials Week: “Towards a Sustainable Future.”

Finally, during the quarter, Jervois Group Manager – ESG, Dr. Jennifer Hinton, was selected as one of the “100 Global Inspirational Women in Mining”.

Board Appointment

During the quarter, Dr. Daniela Chimisso dos Santos joined the Jervois Board as a Non-Executive Director, effective 1 December 2022.

Dr. Chimisso dos Santos is a leading global mining and sustainability expert with significant international experience, including in Brazil, where she is based part-time, and has extensive experience encompassing industry, government, and non-governmental organisations.

Dr. Chimisso dos Santos is a global authority, academic author, lecturer, and presenter on environmental sentencing, ESG, anti-corruption, business and human rights, extractive industries, responsible investment, sovereign debt, and mine closures. She is fluent in five languages and admitted to the Ontario and Alberta Bars in Canada.

Dr. Chimisso dos Santos’ corporate experience includes more than six years with Brazilian- based multinational mining company, Vale S.A., including as Deputy General Counsel; as well as legal roles with Hatch Group, and Shell Group.

Dr. Chimisso dos Santos has recently joined Cescon Barrieu, a full-service premier Brazilian law firm, as Of Counsel. Her previous roles have focused on ESG, primarily for the Canadian government. She is on the Board of Directors of Transparency International – Canada and is on the United Nations’ Development Programme – Extractive Resource Expert Roster, as well as an appointed member to ICC Commission on Arbitration and ADR Task Force on Addressing Issues of International Corruption in International Arbitration, representing ICC Canada.

Previously, Dr. Chimisso dos Santos was a national researcher for Mining for Sustainable Development in Canada and is a former appointed Member, Administrative Tribunals of British Columbia — Environmental Appeal Board, Forest Appeals Commission, and the Oil and Gas Appeal Tribunal.

Exploration and Development Expenditure

Jervois spent US$2.0 million on exploration at ICO during the quarter and US$3.9 million in 2022.

Insider Compensation Reporting

During the quarter, US$0.0 million was paid to Non-Executive Directors and US$0.1 million was paid to the CEO (Executive Director).

Non-Core Assets

The non-core assets are summarised on the Company’s website.

ASX Waiver Information

On 6 June 2019, the ASX granted a waiver to Jervois in respect of extending the period to 8 November 2023 in which it may issue new Jervois shares to the eCobalt option holders as part of the eCobalt transaction. As at 31 December 2022, the following Jervois shares were issued in the quarter on exercise of eCobalt options and the following eCobalt options remain outstanding:

|

Jervois shares issued in the quarter on exercise of eCobalt options:

|

Nil

|

|

eCobalt options remaining4

|

|

1,179,750

1,980,000

|

eCobalt options exercisable until 28 June 2023 at C$0.61 each

eCobalt options exercisable until 1 October 2023 at C$0.53 each

|

|

3,159,750

|

|

By Order of the Board

Bryce Crocker

Chief Executive Officer

For further information, please contact:

Forward-Looking Statements

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to sales, production and operations at Jervois Finland, preparation of expansion studies at Jervois Finland, construction work undertaken at ICO, timing and outcome of drill programmes at ICO, timing of production at ICO, preparation of studies on the SMP refinery, timing of restart of SMP refinery, third party feed to SMP, sales from SMP and the reliability of third party information, and certain other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules, and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Basis of Preparation of Financial Information

Historical and forecast financial information

Historical financial information for Jervois Finland prior to acquisition by Jervois on 1 September 2021 is based on unaudited financial statements that have been prepared in accordance with US GAAP and accounting principles applied under its ownership by Freeport McMoRan Inc. Financial information presented for the period prior to acquisition by Jervois on 1 September 2021 is presented on a proforma basis for illustrative purposes only.

Financial information presented for periods after the acquisition on 1 September 2021 is prepared under the Company’s accounting policies, which conform with Australian Accounting Standards and International Financial Reporting Standards (“IFRS”). The Jervois Finland financial results for the period post-acquisition are consolidated into the Jervois consolidated financial statements. All information presented is unaudited.

EBITDA for historical periods is presented as net income after adding back tax, interest, depreciation, and extraordinary items and is a non-IFRS measure.

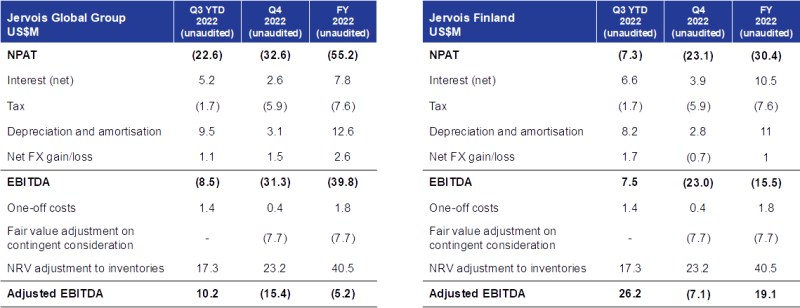

Reconciliation of NPAT to EBITDA and Adjusted EBITDA

EBITDA is a non-IFRS financial measure. EBITDA is presented as net income after adding back interest, tax, depreciation and amortisation, and extraordinary items. Adjusted EBITDA represents EBITDA adjusted to exclude items which do not reflect the underlying performance of the company’s operations. Exclusions from adjusted EBITDA are items that require exclusion in order to maximise insight and consistency on the financial performance of the company’s operations.

Exclusions include gains/losses on disposals, impairment charges (or reversals), certain derivative items, NRV adjustments to inventories, fair value adjustments on financial instruments, and one-off costs related to post-acquisition integration.

Click Image To View Full Size

Tenements

Australian Tenements

|

Description

|

|

Tenement number

|

Interest owned %

|

|

Ardnaree (NSW)

|

|

EL 5527

|

100.0

|

|

Thuddungra (NSW)

|

|

EL 5571

|

100.0

|

|

Nico Young (NSW)

|

|

EL 8698

|

100.0

|

|

West Arunta (WA)

|

|

E80 4820

|

17.9

|

|

West Arunta (WA)

|

|

E80 4986

|

17.9

|

|

West Arunta (WA)

|

|

E80 4987

|

17.9

|

|

Uganda Exploration Licences

|

|

Description

|

|

Exploration Licence number

|

Interest owned %

|

|

Kilembe Area

|

|

EL0292

|

100.0

|

|

Kilembe Area

|

|

EL0012

|

100.0

|

|

Idaho Cobalt Operations – 100% Interest owned

|

|

Claim Name

|

County #

|

IMC #

|

|

SUN 1

|

222991

|

174156

|

|

SUN 2

|

222992

|

174157

|

|

SUN 3 Amended

|

245690

|

174158

|

|

SUN 4

|

222994

|

174159

|

|

SUN 5

|

222995

|

174160

|

|

SUN 6

|

222996

|

174161

|

|

SUN 7

|

224162

|

174628

|

|

SUN 8

|

224163

|

174629

|

|

SUN 9

|

224164

|

174630

|

|

SUN 16 Amended

|

245691

|

177247

|

|

SUN 18 Amended

|

245692

|

177249

|

|

Sun 19

|

277457

|

196394

|

|

SUN FRAC 1

|

228059

|

176755

|

|

SUN FRAC 2

|

228060

|

176756

|

|

TOGO 1

|

228049

|

176769

|

|

TOGO 2

|

228050

|

176770

|

|

TOGO 3

|

228051

|

176771

|

|

DEWEY FRAC Amended

|

248739

|

177253

|

|

Powder 1

|

269506

|

190491

|

|

Powder 2

|

269505

|

190492

|

|

LDC-1

|

224140

|

174579

|

|

LDC-2

|

224141

|

174580

|

|

LDC-3

|

224142

|

174581

|

|

LDC-5

|

224144

|

174583

|

|

LDC-6

|

224145

|

174584

|

|

LDC-7

|

224146

|

174585

|

|

LDC-8

|

224147

|

174586

|

|

LDC-9

|

224148

|

174587

|

|

LDC-10

|

224149

|

174588

|

|

LDC-11

|

224150

|

174589

|

|

LDC-12

|

224151

|

174590

|

|

LDC-13 Amended

|

248718

|

174591

|

|

LDC-14 Amended

|

248719

|

174592

|

|

LDC-16

|

224155

|

174594

|

|

LDC-18

|

224157

|

174596

|

|

LDC-20

|

224159

|

174598

|

|

LDC-22

|

224161

|

174600

|

|

LDC FRAC 1 Amended

|

248720

|

175880

|

|

LDC FRAC 2 Amended

|

248721

|

175881

|

|

LDC FRAC 3 Amended

|

248722

|

175882

|

|

LDC FRAC 4 Amended

|

248723

|

175883

|

|

LDC FRAC 5 Amended

|

248724

|

175884

|

|

RAM 1

|

228501

|

176757

|

|

RAM 2

|

228502

|

176758

|

|

RAM 3

|

228503

|

176759

|

|

RAM 4

|

228504

|

176760

|

|

RAM 5

|

228505

|

176761

|

|

RAM 6

|

228506

|

176762

|

|

RAM 7

|

228507

|

176763

|

|

RAM 8

|

228508

|

176764

|

|

RAM 9

|

228509

|

176765

|

|

RAM 10

|

228510

|

176766

|

|

RAM 11

|

228511

|

176767

|

|

RAM 12

|

228512

|

176768

|

|

RAM 13 Amended

|

245700

|

181276

|

|

RAM 14 Amended

|

245699

|

181277

|

|

RAM 15 Amended

|

245698

|

181278

|

|

RAM 16 Amended

|

245697

|

181279

|

|

Ram Frac 1 Amended

|

245696

|

178081

|

|

Ram Frac 2 Amended

|

245695

|

178082

|

|

Ram Frac 3 Amended

|

245694

|

178083

|

|

Ram Frac 4 Amended

|

245693

|

178084

|

|

HZ 1

|

224173

|

174639

|

|

HZ 2

|

224174

|

174640

|

|

HZ 3

|

224175

|

174641

|

|

HZ 4

|

224176

|

174642

|

|

HZ 5

|

224413

|

174643

|

|

HZ 6

|

224414

|

174644

|

|

HZ 7

|

224415

|

174645

|

|

HZ 8

|

224416

|

174646

|

|

HZ 9

|

224417

|

174647

|

|

HZ 10

|

224418

|

174648

|

|

HZ 11

|

224419

|

174649

|

|

HZ 12

|

224420

|

174650

|

|

HZ 13

|

224421

|

174651

|

|

HZ 14

|

224422

|

174652

|

|

HZ 15

|

231338

|

178085

|

|

HZ 16

|

231339

|

178086

|

|

HZ 18

|

231340

|

178087

|

|

HZ 19

|

224427

|

174657

|

|

Z 20

|

224428

|

174658

|

|

HZ 21

|

224193

|

174659

|

|

HZ 22

|

224194

|

174660

|

|

HZ 23

|

224195

|

174661

|

|

HZ 24

|

224196

|

174662

|

|

HZ 25

|

224197

|

174663

|

|

HZ 26

|

224198

|

174664

|

|

HZ 27

|

224199

|

174665

|

|

HZ 28

|

224200

|

174666

|

|

HZ 29

|

224201

|

174667

|

|

HZ 30

|

224202

|

174668

|

|

HZ 31

|

224203

|

174669

|

|

HZ 32

|

224204

|

174670

|

|

HZ FRAC

|

228967

|

177254

|

|

JC 1

|

224165

|

174631

|

|

JC 2

|

224166

|

174632

|

|

JC 3

|

224167

|

174633

|

|

JC 4

|

224168

|

174634

|

|

JC 5 Amended

|

245689

|

174635

|

|

JC 6

|

224170

|

174636

|

|

JC FR 7

|

224171

|

174637

|

|

JC FR 8

|

224172

|

174638

|

|

JC 9

|

228054

|

176750

|

|

JC 10

|

228055

|

176751

|

|

JC 11

|

228056

|

176752

|

|

JC-12

|

228057

|

176753

|

|

JC-13

|

228058

|

176754

|

|

JC 14

|

228971

|

177250

|

|

JC 15

|

228970

|

177251

|

|

JC 16

|

228969

|

177252

|

|

JC 17

|

259006

|

187091

|

|

JC 18

|

259007

|

187092

|

|

JC 19

|

259008

|

187093

|

|

JC 20

|

259009

|

187094

|

|

JC 21

|

259010

|

187095

|

|

JC 22

|

259011

|

187096

|

|

CHELAN NO. 1 Amended

|

248345

|

175861

|

|

GOOSE 2 Amended

|

259554

|

175863

|

|

GOOSE 3

|

227285

|

175864

|

|

GOOSE 4 Amended

|

259553

|

175865

|

|

GOOSE 6

|

227282

|

175867

|

|

GOOSE 7 Amended

|

259552

|

175868

|

|

GOOSE 8 Amended

|

259551

|

175869

|

|

GOOSE 10 Amended

|

259550

|

175871

|

|

GOOSE 11 Amended

|

259549

|

175872

|

|

GOOSE 12 Amended

|

259548

|

175873

|

|

GOOSE 13

|

228028

|

176729

|

|

GOOSE 14 Amended

|

259547

|

176730

|

|

GOOSE 15

|

228030

|

176731

|

|

GOOSE 16

|

228031

|

176732

|

|

GOOSE 17

|

228032

|

176733

|

|

GOOSE 18 Amended

|

259546

|

176734

|

|

GOOSE 19 Amended

|

259545

|

176735

|

|

GOOSE 20

|

228035

|

176736

|

|

GOOSE 21

|

228036

|

176737

|

|

GOOSE 22

|

228037

|

176738

|

|

GOOSE 23

|

228038

|

176739

|

|

GOOSE 24

|

228039

|

176740

|

|

GOOSE 25

|

228040

|

176741

|

|

SOUTH ID 1 Amended

|

248725

|

175874

|

|

SOUTH ID 2 Amended

|

248726

|

175875

|

|

SOUTH ID 3 Amended

|

248727

|

175876

|

|

SOUTH ID 4 Amended

|

248717

|

175877

|

|

SOUTH ID 5 Amended

|

248715

|

176743

|

|

SOUTH ID 6 Amended

|

248716

|

176744

|

|

South ID 7

|

306433

|

218216

|

|

South ID 8

|

306434

|

218217

|

|

South ID 9

|

306435

|

218218

|

|

South ID 10

|

306436

|

218219

|

|

South ID 11

|

306437

|

218220

|

|

South ID 12

|

306438

|

218221

|

|

South ID 13

|

306439

|

218222

|

|

South ID 14

|

306440

|

218223

|

|

OMS-1

|

307477

|

218904

|

|

Chip 1

|

248956

|

184883

|

|

Chip 2

|

248957

|

184884

|

|

Chip 3 Amended

|

277465

|

196402

|

|

Chip 4 Amended

|

277466

|

196403

|

|

Chip 5 Amended

|

277467

|

196404

|

|

Chip 6 Amended

|

277468

|

196405

|

|

Chip 7 Amended

|

277469

|

196406

|

|

Chip 8 Amended

|

277470

|

196407

|

|

Chip 9 Amended

|

277471

|

196408

|

|

Chip 10 Amended

|

277472

|

196409

|

|

Chip 11 Amended

|

277473

|

196410

|

|

Chip 12 Amended

|

277474

|

196411

|

|

Chip 13 Amended

|

277475

|

196412

|

|

Chip 14 Amended

|

277476

|

196413

|

|

Chip 15 Amended

|

277477

|

196414

|

|

Chip 16 Amended

|

277478

|

196415

|

|

Chip 17 Amended

|

277479

|

196416

|

|

Chip 18 Amended

|

277480

|

196417

|

|

Sun 20

|

306042

|

218133

|

|

Sun 21

|

306043

|

218134

|

|

Sun 22

|

306044

|

218135

|

|

Sun 23

|

306045

|

218136

|

|

Sun 24

|

306046

|

218137

|

|

Sun 25

|

306047

|

218138

|

|

Sun 26

|

306048

|

218139

|

|

Sun 27

|

306049

|

218140

|

|

Sun 28

|

306050

|

218141

|

|

Sun 29

|

306051

|

218142

|

|

Sun 30

|

306052

|

218143

|

|

Sun 31

|

306053

|

218144

|

|

Sun 32

|

306054

|

218145

|

|

Sun 33

|

306055

|

218146

|

|

Sun 34

|

306056

|

218147

|

|

Sun 35

|

306057

|

218148

|

|

Sun 36

|

306058

|

218149

|

|

Chip 21 Fraction

|

306059

|

218113

|

|

Chip 22 Fraction

|

306060

|

218114

|

|

Chip 23

|

306025

|

218115

|

|

Chip 24

|

306026

|

218116

|

|

Chip 25

|

306027

|

218117

|

|

Chip 26

|

306028

|

218118

|

|

Chip 27

|

306029

|

218119

|

|

Chip 28

|

306030

|

218120

|

|

Chip 29

|

306031

|

218121

|

|

Chip 30

|

306032

|

218122

|

|

Chip 31

|

306033

|

218123

|

|

Chip 32

|

306034

|

218124

|

|

Chip 33

|

306035

|

218125

|

|

Chip 34

|

306036

|

218126

|

|

Chip 35

|

306037

|

218127

|

|

Chip 36

|

306038

|

218128

|

|

Chip 37

|

306039

|

218129

|

|

Chip 38

|

306040

|

218130

|

|

Chip 39

|

306041

|

218131

|

|

Chip 40

|

307491

|

218895

|

|

DRC NW 1

|

307492

|

218847

|

|

DRC NW 2

|

307493

|

218848

|

|

DRC NW 3

|

307494

|

218849

|

|

DRC NW 4

|

307495

|

218850

|

|

DRC NW 5

|

307496

|

218851

|

|

DRC NW 6

|

307497

|

218852

|

|

DRC NW 7

|

307498

|

218853

|

|

DRC NW 8

|

307499

|

218854

|

|

DRC NW 9

|

307500

|

218855

|

|

DRC NW 10

|

307501

|

218856

|

|

DRC NW 11

|

307502

|

218857

|

|

DRC NW 12

|

307503

|

218858

|

|

DRC NW 13

|

307504

|

218859

|

|

DRC NW 14

|

307505

|

218860

|

|

DRC NW 15

|

307506

|

218861

|

|

DRC NW 16

|

307507

|

218862

|

|

DRC NW 17

|

307508

|

218863

|

|

DRC NW 18

|

307509

|

218864

|

|

DRC NW 19

|

307510

|

218865

|

|

DRC NW 20

|

307511

|

218866

|

|

DRC NW 21

|

307512

|

218867

|

|

DRC NW 22

|

307513

|

218868

|

|

DRC NW 23

|

307514

|

218869

|

|

DRC NW 24

|

307515

|

218870

|

|

DRC NW 25

|

307516

|

218871

|

|

DRC NW 26

|

307517

|

218872

|

|

DRC NW 27

|

307518

|

218873

|

|

DRC NW 28

|

307519

|

218874

|

|

DRC NW 29

|

307520

|

218875

|

|

DRC NW 30

|

307521

|

218876

|

|

DRC NW 31

|

307522

|

218877

|

|

DRC NW 32

|

307523

|

218878

|

|

DRC NW 33

|

307524

|

218879

|

|

DRC NW 34

|

307525

|

218880

|

|

DRC NW 35

|

307526

|

218881

|

|

DRC NW 36

|

307527

|

218882

|

|

DRC NW 37

|

307528

|

218883

|

|

DRC NW 38

|

307529

|

218884

|

|

DRC NW 39

|

307530

|

218885

|

|

DRC NW 40

|

307531

|

218886

|

|

DRC NW 41

|

307532

|

218887

|

|

DRC NW 42

|

307533

|

218888

|

|

DRC NW 43

|

307534

|

218889

|

|

DRC NW 44

|

307535

|

218890

|

|

DRC NW 45

|

307536

|

218891

|

|

DRC NW 46

|

307537

|

218892

|

|

DRC NW 47

|

307538

|

218893

|

|

DRC NW 48

|

307539

|

218894

|

|

EBatt 1

|

307483

|

218896

|

|

EBatt 2

|

307484

|

218897

|

|

EBatt 3

|

307485

|

218898

|

|

EBatt 4

|

307486

|

218899

|

|

EBatt 5

|

307487

|

218900

|

|

EBatt 6

|

307488

|

218901

|

|

EBatt 7

|

307489

|

218902

|

|

EBatt 8

|

307490

|

218903

|

|

OMM-1

|

307478

|

218905

|

|

OMM-2

|

307479

|

218906

|

|

OMN-2

|

307481

|

218908

|

|

OMN-3

|

307482

|

218909

|

|

BTG-1

|

307471

|

218910

|

|

BTG-2

|

307472

|

218911

|

|

BTG-3

|

307473

|

218912

|

|

BTG-4

|

307474

|

218913

|

|

BTG-5

|

307475

|

218914

|

|

BTG-6

|

307476

|

218915

|

|

NFX 17

|

307230

|

218685

|

|

NFX 18

|

307231

|

218686

|

|

NFX 19

|

307232

|

218687

|

|

NFX 20

|

307233

|

218688

|

|

NFX 21

|

307234

|

218689

|

|

NFX 22

|

307235

|

218690

|

|

NFX 23

|

307236

|

218691

|

|

NFX 24

|

307237

|

218692

|

|

NFX 25

|

307238

|

218693

|

|

NFX 30

|

307243

|

218698

|

|

NFX 31

|

307244

|

218699

|

|

NFX 32

|

307245

|

218700

|

|

NFX 33

|

307246

|

218701

|

|

NFX 34

|

307247

|

218702

|

|

NFX 35

|

307248

|

218703

|

|

NFX 36

|

307249

|

218704

|

|

NFX 37

|

307250

|

218705

|

|

NFX 38

|

307251

|

218706

|

|

NFX 42

|

307255

|

218710

|

|

NFX 43

|

307256

|

218711

|

|

NFX 44

|

307257

|

218712

|

|

NFX 45

|

307258

|

218713

|

|

NFX 46

|

307259

|

218714

|

|

NFX 47

|

307260

|

218715

|

|

NFX 48

|

307261

|

218716

|

|

NFX 49

|

307262

|

218717

|

|

NFX 50

|

307263

|

218718

|

|

NFX 56

|

307269

|

218724

|

|

NFX 57

|

307270

|

218725

|

|

NFX 58

|

307271

|

218726

|

|

NFX 59

|

307272

|

218727

|

|

NFX 60 Amended

|

307558

|

218728

|

|

NFX 61

|

307274

|

218729

|

|

NFX 62

|

307275

|

218730

|

|

NFX 63

|

307276

|

218731

|

|

NFX 64

|

307277

|

218732

|

|

|

|

|

OMN-1 revised

|

315879

|

228322

|

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

|

Name of entity

|

|

Jervois Global Limited

|

|

ABN

|

|

Quarter ended (“current quarter”)

|

|

52 007 626 575

|

|

31 December 2022

|

|

Consolidated statement of cash flows

|

Current quarter

$US’000

|

Year to date

(12 months)

$US’000

|

|

1.

|

Cash flows from operating activities

|

86,960

|

364,844

|

|

1.1

|

Receipts from customers

|

|

1.2

|

Payments for

|

-

|

-

|

|

-

(a)exploration evaluation

|

|

-

(b)development

|

-

|

-

|

|

-

(c)production

|

(93,076)

|

(403,216)

|

|

-

(d)staff costs

|

(3,634)

|

(8,622)

|

|

-

(e)administration and corporate costs

|

(5,265)

|

(9,596)

|

|

1.3

|

Dividends received (see note 3)

|

-

|

-

|

|

1.4

|

Interest received

|

500

|

594

|

|

1.5

|

Interest and other costs of finance paid

|

(3,094)

|

(19,883)

|

|

1.6

|

Income taxes paid

|

1,075

|

(4,696)

|

|

1.7

|

Government grants and tax incentives

|

-

|

-

|

|

1.8

|

Other – incl. business development costs and SMP BFS costs

|

(553)

|

(4,367)

|

|

1.9

|

Net cash from / (used in) operating activities

|

(17,087)

|

(84,942)

|

|

|

2.

|

Cash flows from investing activities

|

-

|

-

|

|

2.1

|

Payments to acquire or for:

|

|

-

(a)entities

|

|

-

(b)tenements

|

-

|

-

|

|

-

(c)property, plant and equipment – incl. assets under construction

|

(41,161)

|

(125,271)

|

|

-

(d)exploration evaluation

|

(9)

|

(94)

|

|

-

(e)acquisition of subsidiaries

|

-

|

-

|

|

-

(f)transfer tax on acquisition

|

-

|

-

|

|

-

(g)other non-current assets

|

-

|

-

|

|

2.2

|

Proceeds from the disposal of:

|

-

|

-

|

|

-

(a)entities

|

|

-

(b)tenements

|

-

|

-

|

|

-

(c)property, plant and equipment

|

301

|

1,551

|

|

-

(d)investments

|

-

|

-

|

|

-

(e)other non-current assets

|

-

|

-

|

|

2.3

|

Cash flows from loans to other entities

|

-

|

-

|

|

2.4

|

Dividends received (see note 3)

|

-

|

-

|

|

2.5

|

Other – SMP Refinery Purchase: lease payment

|

-

|

-

|

|

2.6

|

Net cash from / (used in) investing activities

|

(40,869)

|

(123,814)

|

|

|

3.

|

Cash flows from financing activities

|

154,719

|

154,719

|

|

3.1

|

Proceeds from issues of equity securities (excluding convertible debt securities)

|

|

3.2

|

Proceeds from issue of convertible debt securities

|

-

|

-

|

|

3.3

|

Proceeds from exercise of options

|

222

|

443

|

|

3.4

|

Transaction costs related to issues of equity securities or convertible debt securities

|

(5,514)

|

(6,361)

|

|

3.5

|

Proceeds from borrowings

|

15,000

|

171,000

|

|

3.6

|

Repayment of borrowings

|

-

|

-

|

|

3.7

|

Transaction costs related to loans and borrowings

|

-

|

-

|

|

3.8

|

Dividends paid

|

-

|

-

|

|

3.9

|

Other – incl. lease liabilities

|

(304)

|

(1,622)

|

|

Other – incl. US bonding

|

(6,253)

|

(6,066)

|

|

3.10

|

Net cash from / (used in) financing activities

|

157,870

|

312,113

|

|

|

4.

|

Net increase / (decrease) in cash and cash equivalents for the period

|

|

|

|

4.1

|

Cash and cash equivalents at beginning of period

|

52,319

|

49,181

|

|

4.2

|

Net cash from / (used in) operating activities (item 1.9 above)

|

(17,087)

|

(84,942)

|

|

4.3

|

Net cash from / (used in) investing activities (item 2.6 above)

|

(40,869)

|

(123,814)

|

|

4.4

|

Net cash from / (used in) financing activities (item 3.10 above)

|

157,870

|

312,113

|

|

4.5

|

Effect of movement in exchange rates on cash held

|

414

|

109

|

|

4.6

|

Cash and cash equivalents at end of period

|

152,647

|

152,647

|

|

5.

|

Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts

|

Current quarter

$US’000

|

Previous quarter

$US’000

|

|

5.1

|

Bank balances

|

152,647

|

52,319

|

|

5.2

|

Call deposits

|

-

|

-

|

|

5.3

|

Bank overdrafts

|

-

|

-

|

|

5.4

|

Other (provide details)

|

-

|

-

|

|

5.5

|

Cash and cash equivalents at end of quarter (should equal item 4.6 above)

|

152,647

|

52,319

|

|

6.

|

Payments to related parties of the entity and their associates

|

Current quarter

$US’000

|

|

6.1

|

Aggregate amount of payments to related parties and their associates included in item 1

|

104

|

|

6.2

|

Aggregate amount of payments to related parties and their associates included in item 2

|

-

|

|

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments.

|

|

7.

|

Financing facilities

Note: the term “facility’ includes all forms of financing arrangements available to the entity.

Add notes as necessary for an understanding of the sources of finance available to the entity.

|

Total facility amount at quarter end

$US’000

|

Amount drawn at quarter end

$US’000

|

|

7.1

|

Bond Facility1

|

100,000

|

100,000

|

|

7.2

|

Secured Revolving Credit Facility2

|

150,000

|

115,000

|

|

7.3

|

Other

|

-

|

-

|

|

7.4

|

Total financing facilities

|

250,000

|

215,000

|

|

|

|

|

7.5

|

Unused financing facilities available at quarter end ($US’000)

|

35,000

|

|

7.6

|

Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well.

|

-

Bond Facility – US$100.0 million:

On 20 July 2021 the Company completed settlement of a US$100.0 million senior secured bond facility. The bonds were issued by the Company’s wholly owned subsidiary, Jervois Mining USA Limited, and are administered by the bond trustee, Nordic Trustee AS. In February 2022, Jervois Mining USA Limited completed the first US$50.0 million drawdown on the bonds, and in July 2022 the second, and final, US$50.0 million drawdown was completed.

Key terms:

-

Issuer: Jervois Mining USA Limited (wholly owned subsidiary of the Company).

-

Maturity: 5-year tenor with a maturity date of 20 July 2026.

-

Original issue discount of 2%.

-

Coupon rate: 12.5% per annum with interest payable bi-annually.

-

No amortisation – bullet payment on maturity.

-

Non-callable for 3 years, after which callable at par plus 62.5% of coupon, declining rateably to par in year 5.

-

Transaction security: First priority security over all material assets of the Issuer, pledge of all the shares of the Issuer, intercompany loans.

-

Secured Revolving Credit Facility – US$150.0 million:

On 28 October 2021 the Company’s wholly owned subsidiaries, Jervois Suomi Holding Oy and Jervois Finland Oy (together, “the Borrowers”), entered into a secured loan facility with Mercuria Energy Trading SA, a wholly owned subsidiary of Mercuria Energy Group Limited, to borrow up to US$75 million. The facility was fully drawn as of 31 March 2022. On 3 June 2022, the Borrowers increased the facility to US$150 million through the execution of the Accordion Increase (as contemplated in the facility agreement entered into on 28 October 2021).

Key terms:

-

Borrowers: Jervois Suomi Holding Oy and Jervois Finland Oy (wholly owned subsidiaries of the Company).

-

Maturity: rolling facility to 31 December 2024.

-

Interest rate: SOFR + 5.0% per annum.

-

Transaction security: First priority security over all material assets of Jervois Finland, including inventory, receivables, collection account, and shares in Jervois Finland.

|

|

8.

|

Estimated cash available for future operating activities

|

$US’000

|

|

8.1

|

Net cash from / (used in) operating activities (item 1.9)

|

(17,087)

|

|

8.2

|

(Payments for exploration & evaluation classified as investing activities) (item 2.1(d))

|

(9)

|

|

8.3

|

Total relevant outgoings (item 8.1 + item 8.2)

|

(17,096)

|

|

8.4

|

Cash and cash equivalents at quarter end (item 4.6)

|

152,647

|

|

8.5

|

Unused finance facilities available at quarter end (item 7.5)

|

35,000

|

|

8.6

|

Total available funding (item 8.4 + item 8.5)

|

187,647

|

|

|

|

|

8.7

|

Estimated quarters of funding available (item 8.6 divided by item 8.3)

|

11

|

|

Note: if the entity has reported positive relevant outgoings (i.e., a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7.

|

|

8.8

|

If item 8.7 is less than 2 quarters, please provide answers to the following questions:

|

|

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not?

|

|

Answer: N/A

|

|

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful?

|

|

Answer: N/A

|

|

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis?

|

|

Answer: N/A

|

|

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

|

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 30 January 2023

Authorised by: Disclosure Committee

(Name of body or officer authorising release – see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – e.g., Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

1 Debt drawn down represents the aggregate of amounts drawn under the US$150 million working capital facility and amounts drawn under the terms of the US$100 million Senior Secured Bonds. Amounts represent the nominal loan amounts; balances recorded in the Company’s financial statements under International Financial Reporting Standards will differ.

2 Information on the basis of preparation for the financial information included in this Quarterly Activities Report is set out on page 16 below.

3 AUD/USD exchange rate of 0.65 applied.

4 The number of options represent the number of Jervois shares that will be issued on exercise. The exercise price represents the price to be paid for the Jervois shares when issued.

Copyright (c) 2023 TheNewswire - All rights reserved.