Double-digit, year-over-year growth across all key operating metrics for the fifth consecutive quarter using counter-cyclical business model

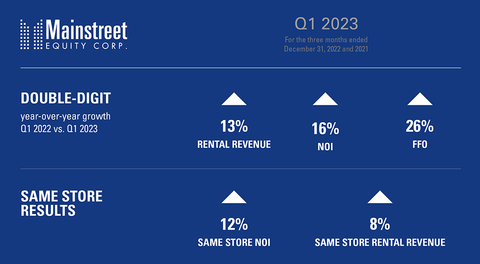

In Q1 2023, Mainstreet Equity Corp. (“Mainstreet”, TSE:MEQ) achieved double-digit, year-over-year growth across all key operating metrics for the fifth consecutive quarter. These Q1 results are the strongest that Mainstreet has posted since the beginning of the global pandemic, with funds from operations (“FFO”) growing 26%, net operating income (“NOI”) rising 16%, and revenues increasing 13%. NOI on a same-asset basis increased 12%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230214005400/en/

Mainstreet Equity Corp reports 13% growth in revenues (Graphic: Business Wire)

Bob Dhillon, Founder, President and CEO of Mainstreet, said, “These latest results are more evidence of Mainstreet’s ability to create shareholder value even in times of rapid transformation.” He added, “By taking a long-term business approach and leveraging our counter-cyclical growth strategy, we have insulated ourselves against macroeconomic shifts while yet again delivering double-digit growth across all of our major metrics.”

We believe Mainstreet’s positive Q1 results once again prove the sustainability of our value-add business model, which has allowed our management team to deliver non-dilutive growth to shareholders despite the uncommon volatility of recent economic cycles. In the last seven years—including the 2015 commodity market crash and the 2020 COVID-19 pandemic— Mainstreet has continued to generate positive returns without exception. Core to that success is Mainstreet’s long-term management style, anchored by a counter-cyclical strategy of leveraging our ample liquidity position and low-cost capital to aggressively acquire new units at distressed prices. Once acquired, we rapidly restabilize those assets to drive down cycle times and bolster net operating income. This long-term outlook was particularly evident in Q1, as Mainstreet reaped major financial benefits from strategic decisions set into motion years ago.

Mainstreet’s Q1 achievements were also a result of several highly favourable macro trends. Economic growth has surged post-pandemic, and population levels are on the rise as immigrants, foreign and domestic students and interprovincial migrants continue to flood into our core markets. Roughly 1.8 million people came to Canada between 2016 and 2021, according to StatCan data, the fastest population growth rate among G7 countries. That is likely to continue as the federal government has indicated it will accept elevated rates of newcomers (Canada’s current target of around 500,000 people per year is well higher than previous averages). Rising populations could in turn fuel further economic growth in BC, Alberta and Saskatchewan and keep rental markets structurally tight.

In 2022, Canada’s national vacancy rate on purpose-built rental apartments plunged to 1.9%, according to CMHC data, the lowest level in more than 20 years. Mainstreet vacancies reflect that wider trend, as they decreased to 4.4% in Q1 (down from 7.8% in 2022). This occurred despite the fact that 15% of our portfolio is undergoing substantial renovation and therefore considered un-stabilized.

More generally, declining vacancy rates have added to the rental market’s fundamental supply-demand imbalance. New supply has lagged demand for years, underscoring the resiliency and viability of the mid-market rental space. Given the tangible nature of our portfolio, which includes more than 16,802 rental units strategically concentrated around urban centres, Mainstreet believes that it will remain a crucial provider of affordable housing at a time when Western Canadians need it most. With an average mid-market rental rate of around $1,000, we will remain a leading provider of quality affordable living for Canada’s middle class.

Q1 2023 FINANCIAL HIGHLIGHTS

- Double-digit same-asset NOI growth (12%)

- Five consecutive quarters of double-digit growth in NOI (16%), FFO (26%) and revenue (13%)

- Rapidly expanded portfolio (acquired 838 residential apartment units YTD for $97.2 million)

- Decreased vacancy rates (4.4% compared with 7.8% in 2022) even though 15% of our portfolio is considered un-stabilized. Calgary’s vacancy rate is now 2%, Edmonton and Regina are around 5%, and Vancouver/Lower Mainland is below 1%

- Refinanced debt (secured $120 million in long-term mortgages, raising $116 million in low-cost capital for future growth)

- Maintained sizeable liquidity (approximately $390 million, including $21 million cash-on-hand; $241 million in funds expected to be raised through re-financing and financing of clear titled assets after stabilization; and $130 million available through banking facilities)

As we continue into fiscal 2023, Mainstreet is well positioned to continue asserting our 100% organic, non-dilutive growth model and extend our acquisition pipeline. Mainstreet acquired $33.6 million (261 units) in new assets, in Q1 and $97.2 million (838 units) year-to-date, including subsequent acquisitions.

CHALLENGES

Despite opportunities for growth in the coming year, inflation and rising interest rates continue to pose a challenge. The national Consumer Price Index increased 6.3% in December 2022, the latest figure — below its earlier peak but still well above average levels.

With inflation remaining high, we expect further Bank of Canada interest rate hikes in the coming year and continued macroeconomic turbulence. Increased interest rates will sharply raise the cost of Mainstreet debt, our largest expense alongside acquisitions.

Mainstreet, however, has spent years establishing a long-term debt position to fortify itself against such rate increases. By securing early finance pre-matured debts and agreeing to pay higher up-front borrowing costs on certain mortgages, we extended our obligations over longer periods (10 years instead of the typical five). Mainstreet has in turn locked in 99% of our debt into fixed-term debt with an average maturity and interest rate of 6.2 years and 2.57%, respectively.

Management believes that inflationary periods are ultimately transitory in nature. In recognition of this, we have opted for shorter-term debt maturities on our latest debts in order to reduce our exposure to interest rates, which are currently higher than previous averages. When and if interest rates fall, Mainstreet will benefit not only from more competitive acquisition costs, but also lower interest expenses (resulting in higher FFO) on refinancing after stabilization.

Inflationary pressures, meanwhile, also increase the cost of everything from labour to materials, raising our operating costs. Renovation and maintenance costs have increased in line with supply shortages for materials. While we have reduced the impact of such constraints by securing dependable suppliers in Asia, higher costs associated with global bottlenecks cannot be entirely avoided.

Labour markets remain tight, with job vacancies remaining just shy of one million in Q3 2022, according to Statistics Canada. This has raised Mainstreet’s labour costs and made hiring more challenging. That said, Mainstreet enjoys a well-established hiring record, especially through foreign worker programs.

Major fixed expenses like property taxes, insurance, and utilities also remain high. Carbon taxes, which place the financial burden on property owners, are scheduled to rise annually. We have addressed higher energy costs by securing various longer-term natural gas contracts, pursuant to which Mainstreet currently pays well below current spot prices. We also managed to reduce our insurance costs more than 13% for fiscal 2023 by obtaining improved rates and coverage.

Regardless of our efforts to counteract inflation and rising interest rates, higher costs erode our operating margins and negatively impact our bottom line. Some of the financial burden will ultimately be passed onto tenants through gradual rent increases. However, we are confident Mainstreet will remain the leading provider of quality, affordable housing in Western Canada, given our track record of operational efficiencies, value creation, solid operating platform and sound management.

OUTLOOK

Opportunistic acquisitions

As fiscal 2023 continues, Mainstreet believes the acquisition environment has entered a period of transition. Our team continues to see risk-adjusted opportunities for growth supported by our sizeable liquidity position, as higher interest rates could force more distressed sellers onto the market. Such dynamics create growth potential through opportunistic acquisitions. As ever, we will maintain our strategy of counter-cyclical growth by acquiring assets only when it prioritizes true value creation.

BC continues to thrive

We expect Vancouver / Lower Mainland will continue to drive growth and performance, as vacancies remain among the lowest in the country and rental rates among the highest. British Columbia has become central to Mainstreet’s portfolio, accounting for 42% of our net asset value (“NAV”) based on IFRS value.

With an average monthly mark-to-market gap of $498 per suite per month, 94% of our customers in the region are below the average market rent. According to our estimates, that translates into approximately $19 million in NOI growth potential after accounting for tenancy turnover and gradual rent increases.

Western bound

Alberta saw its highest-ever net migration rates in Q3 2022 as the province’s improved economic prospects and high quality of life continued to attract newcomers. According to government data, 52,582 people moved to the province over the period. That trumped the previous quarter, when a record-high 34,883 people entered Alberta.

Combined with international migration into the province—which accounted for 57% of all in-migrants—Alberta’s population grew 1.3% in Q3 2022, well above the national average, according to Statistics Canada.

Saskatchewan’s provincial in-migration grew nearly 20-fold, with 9,055 people coming to the province in Q3, compared with 478 the year prior.

Manitoba diversification

Given the abundance of opportunity we’ve seen across Western Canada, Mainstreet has continued to diversify our asset base. We first entered the Winnipeg market in 2021, and now hold three properties in Winnipeg. Subsequent to Q1 2023, Mainstreet acquired another 287-suite high-rise property in Winnipeg (expanding our total city-wide portfolio to four properties with 401 units).

Closing the NOI gap

Current market conditions create a rare opportunity for Mainstreet. Our stabilization rates are higher than average (15%) due to our high rate of counter-cyclical acquisitions in recent quarters, while our vacancy rates are lower than average (4.4%). This discrepancy provides substantial opportunity for Mainstreet to continue extracting value from existing assets by aggressively repositioning units.

The MEQ intangibles

While Mainstreet’s many tangible assets are central to our strategic position amid rising rental demand, we also boast several less obvious upsides that speak to our inherent underlying value. They include:

- Residual lands and low density portfolio: Many of Mainstreet’s assets are ripe for further development and expansion, allowing new capacity to be added at low cost

- Strong management: Mainstreet’s highly experienced team has operated through countless cycles in the market, giving us the ability to adapt as operating environments change

- Efficient operations: Mainstreet has invested resources over the past decade building a strong operating platform, including our adoption of Yardi’s IT operating system, and embracing technology to streamline operational oversight

RUNWAY ON EXISTING PORTFOLIO

- Pursuing our 100% organic, non-dilutive growth model: Using our strong potential liquidity position, estimated at $390 million, we believe there is significant opportunity to continue acquiring underperforming assets at attractive valuations.

- Boosting NOI: As of Q1 2023, 15% of Mainstreet’s portfolio was going through the stabilization process. Once stabilized, we remain confident same-asset revenue, vacancy rate, NOI and FFO will be meaningfully improved. We are cautiously optimistic that we can boost cash flow in coming quarters. In the BC market alone, we estimate that the potential upside based on mark-to-market gaps for NOI growth is approximately $19 million. The Calgary market also has substantial room for rent-to-market catch up.

- Buying back shares at a discount: We believe MEQ shares continue to trade below their true NAV, and that ongoing macroeconomic volatility could intensify that trend.

Forward-Looking Information

Certain statements contained herein constitute "forward-looking statements" as such term is used in applicable Canadian securities laws. These statements relate to analysis and other information based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. In particular, statements concerning estimates related to future acquisitions, dispositions and capital expenditures, increase or reduction of vacancy rates, increase or decrease of rental rates and rental revenue, future income and profitability, timing of refinancing of debt and completion, timing and costs of renovations, increased or decreased funds from operations and cash flow, the Corporation's liquidity and financial capacity, improved rental conditions, future environmental impact the Corporation's goals and the steps it will take to achieve them the Corporation's anticipated funding sources to meet various operating and capital obligations and other factors and events described in this document should be viewed as forward-looking statements to the extent that they involve estimates thereof. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions of future events or performance (often, but not always, using such words or phrases as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements.

Such forward-looking statements are not guarantees of future events or performance and by their nature involve known and unknown risks, uncertainties and other factors, including those risks described in this Annual Information Form under the heading "Risk Factors", that may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, costs and timing of the development of existing properties, availability of capital to fund stabilization programs, other issues associated with the real estate industry including availability but without limitation of labour and costs of renovations, fluctuations in vacancy rates, unoccupied units during renovations, rent control, fluctuations in utility and energy costs, credit risks of tenants, fluctuations in interest rates and availability of capital, and other such business risks as discussed herein. Material factors or assumptions that were applied in drawing a conclusion or making an estimate set out in the forward-looking statements include, among others, the rental environment compared to several years ago, relatively stable interest costs, access to equity and debt capital markets to fund (at acceptable costs) and the availability of purchase opportunities for growth in Canada. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, other factors may cause actions, events or results to be different than anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could vary or differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements contained herein.

Forward-looking statements are based on Management's beliefs, estimates and opinions on the date the statements are made, and the Corporation undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions should change except as required by applicable securities laws or as otherwise described therein.

Certain information set out herein may be considered as "financial outlook" within the meaning of applicable securities laws. The purpose of this financial outlook is to provide readers with disclosure regarding the Corporations reasonable expectations as to the anticipated results of its proposed business activities for the periods indicated. Readers are cautioned that the financial outlook may not be appropriate for other purposes.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230214005400/en/