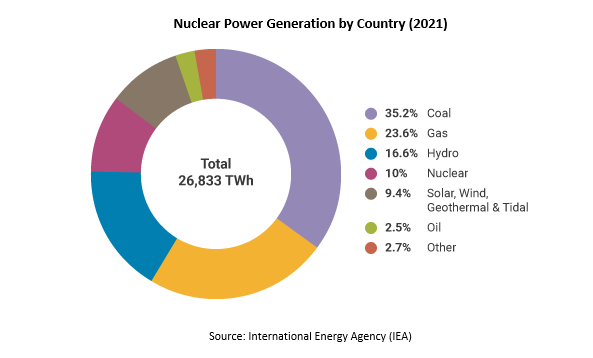

Vancouver, British Columbia, March 02, 2023 (GLOBE NEWSWIRE) -- First American Uranium Inc. (CSE:URM) (FSE: IOR) (the “Company”) is pleased to provide an overview of the uranium market and the US-specific potential for growth in nuclear power and uranium exploration and mining. Nuclear energy supplies 10% of the world’s power generation[1] and ~20% of America’s electricity. However, to reach global decarbonization targets, the International Energy Agency (IEA) projects that nuclear power production will have to increase by 80% by 2040.[2] Shawn Balaghi, First American Uranium’s CEO, commented: “Between increasing international investment in nuclear energy and rising uranium spot prices that are helping drive strong and sustainable economics, there are many factors contributing to the positive outlook for uranium. First American Uranium is excited to be working hard to become part of the US domestic supply solution at this time.”

Please click to view image

Advantages of Nuclear Energy

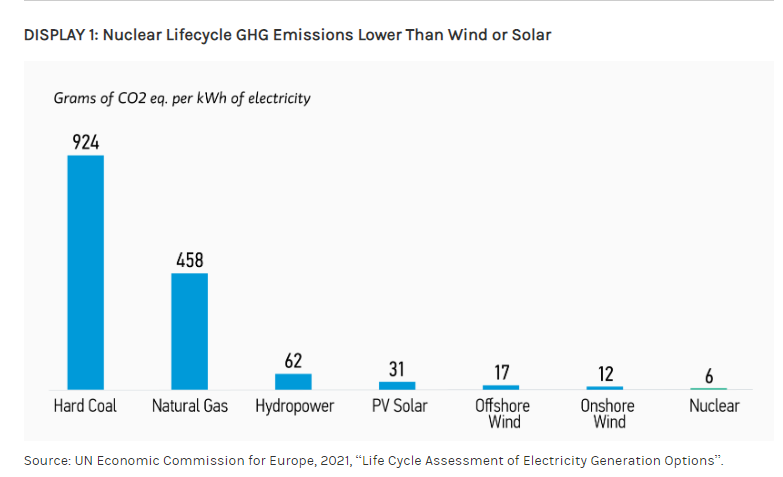

- Far lower greenhouse gas emissions than fossil fuels and even lower than solar or wind[3]

Please click to view image

- 24/7 energy supply helps stabilize the grid and prevent blackouts[1]

- Highest capacity factor of the different energy production options[1]

- One of the safest sources of energy in the world (0.07 deaths/TWH), on par with solar (0.02) and wind (0.04) while being multiple times lower than coal (24.6), oil (18.4) and natural gas (2.8)[3]

- Supports national energy security by providing electricity that is largely independent from fuel market price fluctuations[1]

- Americans support nuclear energy more than ever (69% say nuclear reduces pollution and keeps America competitive and energy independent)[4]

- The nuclear industry is a “very high performer” from an ESG (environmental, social, and governance) perspective[5]

Turning To Nuclear

Major nations are facing growing electricity demand and aggressive decarbonization targets. In turn, a growing number of countries are looking to nuclear power policies, investments and production as potential solutions to their energy mix.[6]

France recently announced €1 billion to support small nuclear reactors and pledged to construct 14 new generation reactors. South Korea set a target for nuclear to account for 30% of their total power generation. China intends to build 150 nuclear reactors over the next 15 years.[3] Even Japan, despite the 2011 Fukushima nuclear accident, recently restarted their nuclear capacity with public support at over 60%.[7]

In America, the Biden administration established a $6-billion fund to keep nuclear plants running. The administration is also providing $2.5 billion for two R&D projects into new nuclear technology,[6] and is pushing a $4.3-billion plan to buy enriched uranium from domestic producers to replace Russian imports.[8]

Meanwhile, America’s recent Inflation Reduction Act (IRA) includes ~$369 billion in climate provisions to help ensure energy security and cut US emissions by 40% before the end of the decade. The IRA includes a production tax credit to help preserve the nation’s existing fleet of nuclear plants, several tax incentives for clean energy technologies (including advanced reactors) and invests $700 million to support the development of a domestic supply chain for high-assay low-enriched uranium.[9]

Industry Fundamentals

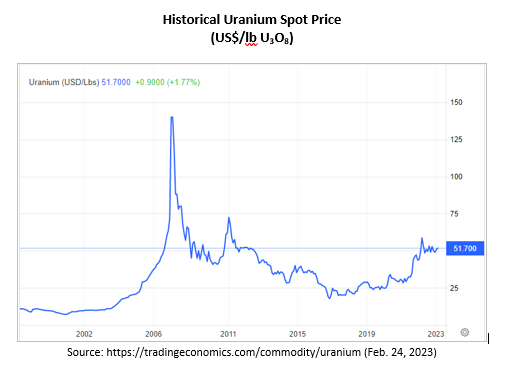

Uranium spot prices have been steadily trending up for years with little volatility, recently reaching their highest levels in over decade.

Please click to view image

Factors that could add further pressure to uranium going forward include:

- The international expansion of reliance on nuclear energy

- Utilities returning to long-term contracting (uranium contracting by American utilities rose 54% in 2022)[10]

- Uranium purchases by ETF funds, such as the Sprott Physical Uranium Trust (TSE:U.UN) that held $2.9 billion dollars as uranium as of Q1 2022[11]

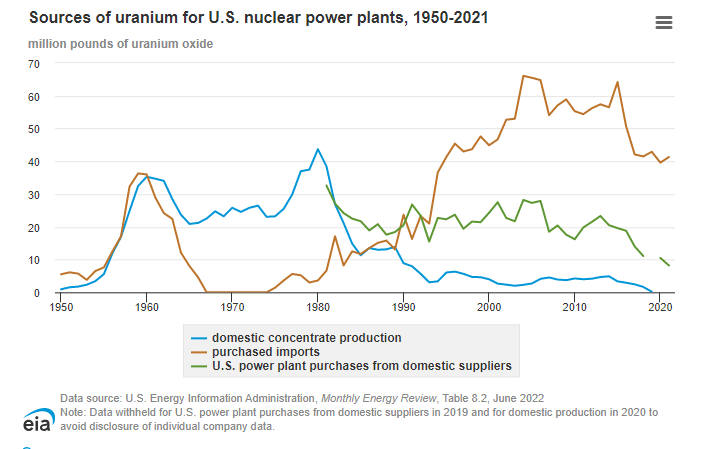

When it comes to supply, the US produces just 5% of the uranium it uses as fuel while importing the majority from Kazakhstan (35%), Canada (15%), Australia (14%), Russia (14%) and Namibia (7%).[12] US uranium imports began trending up around 1980 while production dropped sharply.[12] Over the last decade, low uranium prices driven by the reaction in some countries to the 2011 Fukushima nuclear incident in Japan, resulted in further reductions in domestic US production.[11]

Please click to view image

Today, uranium production in the US is from just one mill in White Mesa, Utah.[13] America’s declining uranium production and its dependence on foreign imports has left the nation and its nuclear energy sector vulnerable to geopolitical conflict, such as Russia’s war against Ukraine.[11]

Fortunately, the market’s dynamics have recently shifted:

- Demand for uranium is rising while secondary supplies have declined[10]

- With uranium supplies remaining tight, further price appreciation is expected[10]

- Global mine supply for 2023 is forecast at 143 million pounds U3O8 versus 181 million pounds of demand, leaving a supply shortfall that must be filled by declining secondary supplies[10]

- To maintain supply, further discoveries are required[10]

- M&A activity has increased, with major deals in 2022 including Cameco and Orano acquiring Idemitsu’s stake in Cigar Lake[14] and Uranium Energy Corp’s acquisition of UEX Corporation[15]

In turn, potential opportunities are opening up for US-targeted uranium explorers and domestic miners to help create clean energy, build national security, and meet growing market demand.

About First American Uranium Inc.

First American Uranium Inc. is engaged in the business of mineral exploration and the acquisition of mineral property assets in North America. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct its exploration programs on the Silver Lake and Red Basin properties. The Silver Lake property is situated around Goosly Lake and approximately 30 km southeast of the town of Houston, in the Omineca Mining Division, British Columbia. The Company has acquired a 60% interest in a company that indirectly holds a 100% interest (subject to a 2% NSR) in certain uranium/vanadium mineral claims located in Catron County, New Mexico.

ON BEHALF OF THE BOARD

“Shawn Balaghi”

Shawn Balaghi, Chief Executive Officer

For further information, please contact: Telephone: 1-604-683-3995

SOURCES:

1. sprott.com

2. iea.org

3. morganstanley.com

4. businesswire.com

5. reuters.com

6. nytimes.com

7. cnbc.com

8. bloomberg.com

9. energy.gov

10. northernminer.com

11. eenews.net

12. eia.gov

13. world-nuclear.org

14. orano.group

15. newswire.ca

The CSE does not accept responsibility for the adequacy or accuracy of this release.

This press release includes "forward-looking information" that is subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Forward-looking statements may include but are not limited to, statements relating to the trading of the Company's common shares on the CSE and the Company's use of proceeds and are subject to all of the risks and uncertainties normally incident to such events. Investors are cautioned that any such statements are not guarantees of future events and that actual events or developments may differ materially from those projected in the forward- looking statements. Such forward-looking statements represent management's best judgment based on information currently available. No securities regulatory authority has either approved or disapproved of the contents of this news release. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except as may be required by law.