VANCOUVER, British Columbia, March 02, 2023 (GLOBE NEWSWIRE) -- Turmalina Metals Corp. (“Turmalina”, or the “Company”; TBX-TSXV, TBXXF-OTCQX, 3RI-FSE) is pleased to provide an update on exploration plans for the 2023 exploration season at the Chanape and San Francisco de los Andes Projects (“Chanape”, and “San Francisco”, collectively the “Projects”), located 87km east of Lima, Peru and the prolific San Juan Province of Argentina respectively.

Positive results from drilling at Chanape and surface works at San Francisco have guided the planning of the next steps of exploration at these two projects for the Company. With seven priority targets identified at San Francisco and Chanape delivering high grades from the Company’s 2022 drill program the Company is well posed to carry out an aggressive exploration program in 2023 following its recently-completed financing.

Chanape Project Highlights:

- Multiple mineralized breccias identified with preliminary drill testing.

- Only 5 of over 50 known mineralised breccias drill tested to date.

- Select highlights of recent drilling in Table 1 include results such as:

- CHT-DDH-038: 39.6 m of 3.10% CuEq from 60 m

- CHT-DDH-041: 48.05 m of 3.80% CuEq from 165.7 m

San Francisco Project Highlights:

- Land position expanded to 40,340 ha (403.4 sq km): one of the largest exploration land positions in San Juan.

- Seven new high-priority targets identified.

- Recent work includes 8,406 soil samples, 1,333 m of channel samples and 7386 rock chip samples.

- Highlight results from recent work include (see Company news release of December 7, 2022):

- Tres Magos

- 18 rock chip samples and 50 channel samples over 1 g/t Au, including 12m @ 7.1 g/t Au and 115 g/t Ag, 3.7m @ 1.71 g/t Au and 102 g/t Ag, 3.5m @ 1.6 g/t Au and 30 g/t Ag and 3m @ 3.2 g/t Au and 186 g/t Ag;

- Veta Amarilla

- 5 rock chip samples over 1 g/t Au and 8 rock chip samples over 100 g/t Ag;

- Breccia Ethan

- 4 rock chip samples over 1 g/t Au and 12 rock chip samples over 1% Cu;

- Veta Rica

- 18 rock chip samples over 1 g/t Au, with up to 56 g/t Au.

- Highlight results from previous Turmalina drilling on the San Francisco de Los Andes Breccia Pipe are summarized in Table 3 and include results such as:

- SFDH-012: 109 m of 5.49% CuEq from 12 m in oxides

- SFDH-039: 72.3 m of 4.85% CuEq from 397.7 m in sulphides

Mr James Rogers, Chief Executive Officer, states:

“With excellent results from the 2022 exploration efforts in hand for the Chanape and San Francisco Projects our team is excited to be financed and ready to advance the multiple targets identified at San Francisco in Argentina and carry on drilling operations at Chanape. Both projects are continuing to deliver fantastic high-grade results and expanding the drill targets is a critical next step in our path of advancing these projects.”

At San Francisco the Company is preparing for a program of approximately 12,000 metres of everse Circulation drilling to test seven new high-priority targets generated from the diligent work of the exploration team over 2022. These targets have not yet been drill tested by previous operators. The work program will also include establishing a local trail network, trenching surface showings and further surface works to aid and assist the targeted drilling. The Company is actively preparing and mobilizing equipment to support the drill program and expects to commence drilling in late March.

At Chanape the exploration team is awaiting approval of an enlarged permit area for drilling that will enable drill-testing priority Cu-Au-Ag breccias outside of those tested in the initial phase of drilling. A diamond drilling program is expected to commence in May and will include additional definition of the mineralized breccias tested to date as well as new, previously untested targets.

The Chanape Project

The 677 ha Chanape copper-gold project is located approximately 87 km east of Lima, Peru and is accessed via 24km of unpaved road from Turmalina’s operational centre in the town of San Damian. The Chanape project is characterised by multiple tourmaline gold-silver-copper (Au-Ag-Cu) breccia pipes, with over fifty identified to date. These breccia pipes are clustered around a large, mineralised copper-molybdenum intrusion. Historical drill holes have confirmed mineralisation on breccia pipes and recent surface geological mapping have added new mineralised bodies for follow-up.

Table 1 - Highlight Results of the 2,257m Chanape total Phase 1 Program carried out in 2022 (see news releases dated January 10, 2023, December 14, 2022, November 15, 2022).

| Hole ID |

|

From |

To |

Interval |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

AuEq g/t |

CuEq % |

| CHT-DDH-034 |

Breccia 8 |

60 |

99.6 |

39.6 |

3.79 |

18.38 |

0.45 |

0.01 |

0.01 |

4.71 |

3.10 |

| CHT-DDH-034 |

including |

65.5 |

74 |

8.5 |

9.21 |

27.44 |

0.48 |

0.01 |

0.01 |

10.28 |

6.76 |

| CHT-DDH-037 |

Breccia S Antonio |

31.4 |

64.8 |

33.4 |

1.55 |

66.21 |

0.18 |

1.70 |

0.02 |

2.66 |

1.75 |

| CHT-DDH-037 |

including |

47.9 |

58.2 |

10.3 |

4.25 |

75.87 |

0.28 |

4.45 |

0.04 |

5.64 |

3.71 |

| CHT-DDH-040 |

Veta Colorada |

77.67 |

79.47 |

1.80 |

2.35 |

11 |

0.18 |

0.05 |

0.02 |

2.76 |

1.83 |

| CHT-DDH-041 |

Breccia Clint |

165.7 |

213.75 |

48.05 |

0.90 |

178 |

1.67 |

0.05 |

0.20 |

5.73 |

3.80 |

| CHT-DDH-041 |

including |

165.7 |

167.9 |

2.20 |

0.70 |

3349 |

10.82 |

0.18 |

0.28 |

60.5 |

40.1 |

| CHT-DDH-041 |

including |

192.19 |

212.6 |

20.41 |

1.01 |

47 |

2.23 |

0.04 |

0.12 |

4.98 |

3.31 |

| CHT-DDH-041 |

Breccia Clint |

222.27 |

236.66 |

14.39 |

0.98 |

56 |

2.17 |

0.05 |

0.09 |

4.98 |

3.30 |

| CHT-DDH-043 |

Breccia 8 |

59.65 |

108.7 |

49.05 |

1.14 |

20 |

0.34 |

0.03 |

0.01 |

1.90 |

1.30 |

| CHT-DDH-043 |

including |

94.7 |

107 |

12.3 |

1.95 |

29 |

0.44 |

0.06 |

0.01 |

2.97 |

2.04 |

| CHT-DDH-044 |

Breccia 8 |

64.2 |

134.35 |

70.15 |

1.01 |

20 |

0.75 |

0.03 |

0.01 |

2.36 |

1.62 |

|

including |

86.5 |

97.18 |

10.7 |

2.34 |

15 |

0.86 |

0.01 |

0.01 |

3.79 |

2.60 |

|

including |

109.8 |

134.35 |

24.55 |

1.04 |

41 |

1.40 |

0.06 |

0.03 |

3.61 |

2.48 |

| CHT-DDH-044 |

Breccia Clint |

173.3 |

203.93 |

30.63 |

0.54 |

33 |

1.65 |

0.03 |

0.06 |

3.37 |

2.31 |

|

Including |

191.86 |

203.93 |

12.07 |

0.64 |

48 |

2.01 |

0.04 |

0.07 |

4.20 |

2.88 |

*Intersections are not true widths and additional drilling and geological modelling of the mineralised zones in the breccia pipes is required to determine the true widths of the drill hole intersections. Intersections are selected based on a 0.5 g/t Au or 0.3% Cu cut-off grade, a minimum downhole length of 2m and a maximum waste inclusion of 2 consecutive meters. Equivalent gold (AuEq) and equivalent copper (CuEq) values are calculated assuming 100% recovery using USD$ 1770 oz Au, $23 oz Ag and $8300/t Cu (~$3.8/lb).

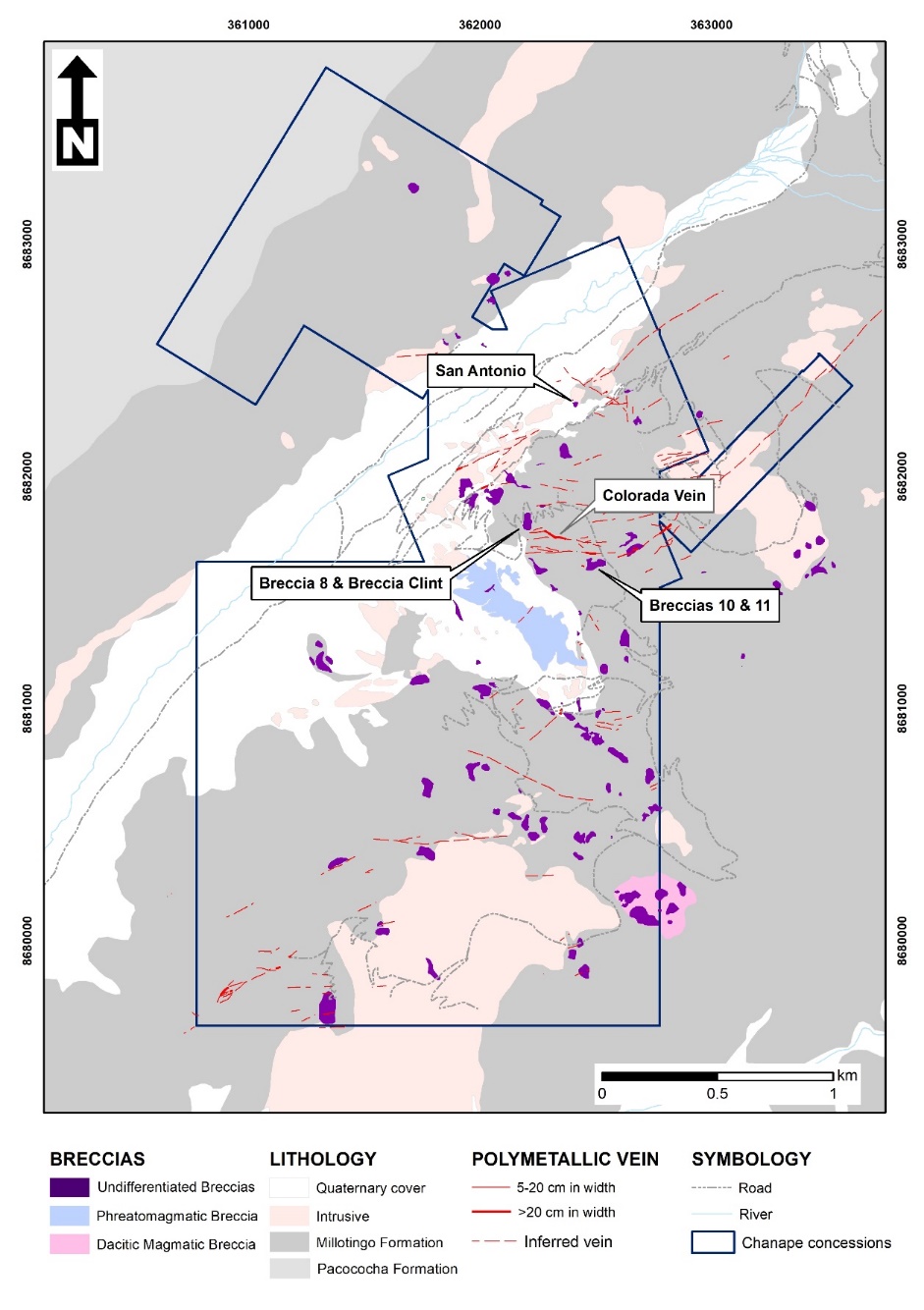

Figure 1 - Chanape Project - Geology and Prospects Drilled in 2022. The Project is characterised by over 50 tourmaline breccia pipes (purple) and multiple epithermal vein systems (red).

Turmalina’s work to date has been focused on interpreting historic work while mapping and sampling over 50 documented tourmaline breccias and epithermal veins at the project and drill-testing the best targets. A phreato-magmatic breccia, measuring 700 m by 200 meters has also been identified as a potential target for bulk tonnage mineralisation, with gold anomalism coincident with a geophysical anomaly (IP).

Turmalina has an option to acquire 100% of the Chanape Project.

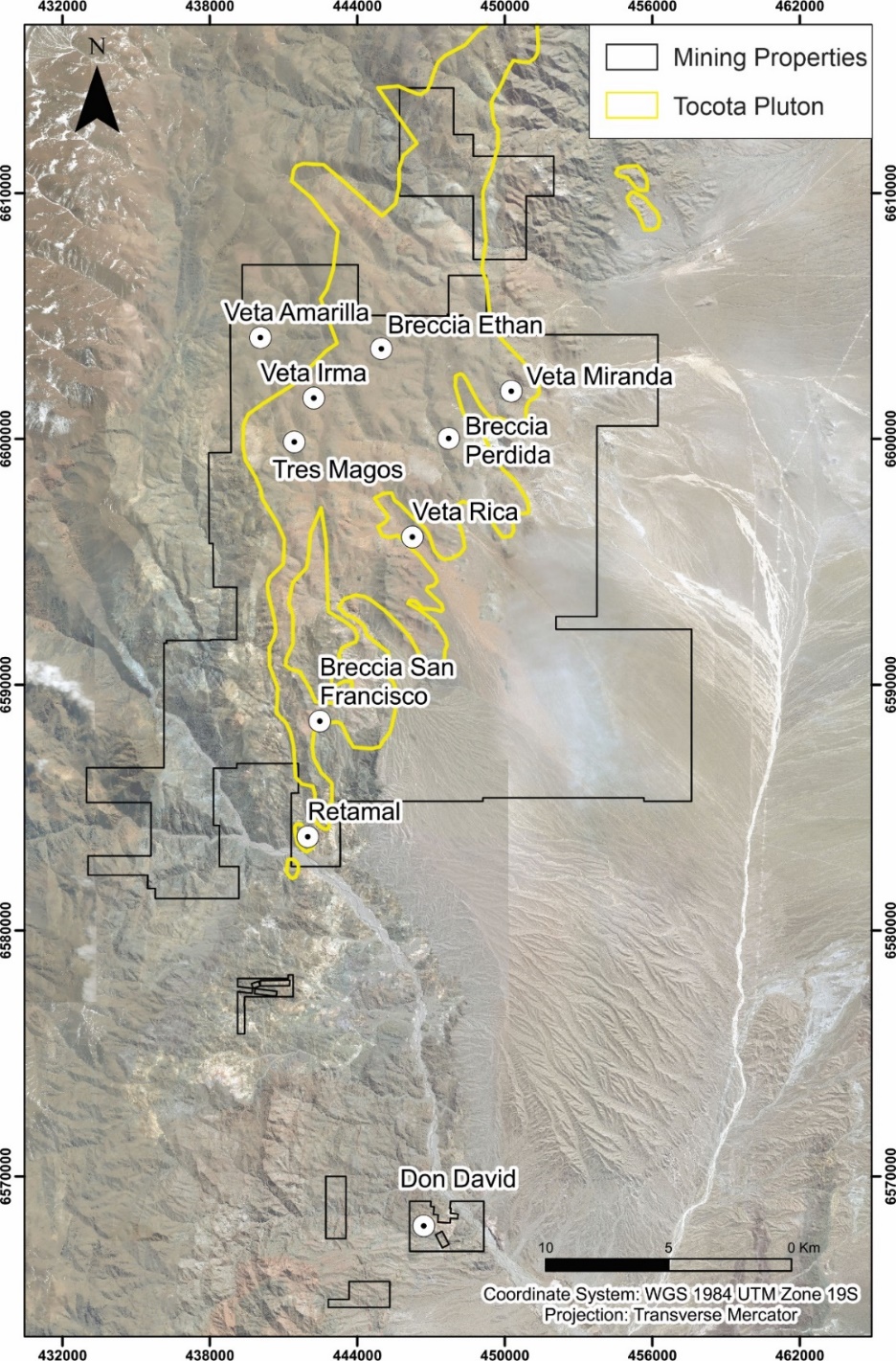

The San Francisco Project

The 40,340 ha San Francisco project is located in the pro-mining province of San Juan, Argentina, a country where there are currently 12 operating mines, 5 in construction and 20 in pre-feasibility/feasibility stage. The project benefits from well-developed infrastructure and is 130 km northeast of the regional capital San Juan.

The San Francisco Project was assembled around and includes one of the highest-grade tourmaline breccias of the same name. Limited shallow drilling and channel sampling at the SFDLA Breccia returned spectacular grades of 2-12 g/t gold and 0.3 to 3% copper over 20-40 m intervals. The mineralogy and geological setting indicates that only the top of the breccia pipe has been exposed.

The land position at San Francisco was expanded in 2022 and now includes multiple mineralised targets including 60 breccias, intrusion-related gold and epithermal vein-type targets detailed in table 2.

Turmalina has developed an operational centre in the town of Villa Nueva, where the local community welcomes new exploration efforts in the region.

Turmalina has several option agreements to acquire 100% of the SFDLA project.

Table 2 -Current exploration targets at the San Francisco Project.

| Name |

Mineralisation Style |

Work Completed |

Planned Work |

| Tres Magos |

Intrusion-related, stockwork veining with sericitic alteration |

Geological mapping, soil sampling, 83 rock chip samples and 391 channel samples over 439 meters. |

Build roads to generate road cuts for continuous channel sampling in mineralised areas and prepare access and platforms for drilling |

| Veta Amarilla |

Intermediate sulphidation epithermal vein with Au-Ag-Pd mineralisation |

Geological mapping, soil sampling, 52 rock chip samples and 92 channel samples |

Build roads for drill access and expose the veins for further channel sampling. |

| Breccia Ethan |

Quartz-tourmaline Breccia with Au-Ag-Cu mineralisation |

Geological mapping, soil sampling, 35 rock chip samples |

Build roads to expose the breccia for continuous channel sampling and prepare access for drilling. |

| Breccia Perdida |

Quartz-tourmaline breccia with Au mineralisation |

Geological mapping, 14 rock chip samples and 35 channel samples. |

Build roads to expose the breccia for continuous channel sampling and prepare access for drilling. |

| Veta Rica |

Quartz vein with Au-Ag mineralisation |

Geological mapping, 23 rock chip samples and 17 channel samples. |

Build roads to expose the veins for channel sampling and prepare access for drilling |

| Veta Miranda |

Quartz-tourmaline vein with Au-Ag-Cu mineralisation |

Geological mapping, 49 rock chip and 83 channel samples |

Build roads to expose the veins for continuous channel sampling and prepare access for drilling. |

| Don David |

Low sulphidation Au-Ag epithermal vein |

Geological mapping and 173 rock chip samples. |

Detailed mapping of the Alumbrera vein system (1.8 km long and up to 20 m thick) and further rock chip and channel sampling focused on the silicified portions of the predominantly carbonate vein. |

Table 3 - Selected highlight results from San Francisco drilling completed by Turmalina on San Francisco de Los Andes Breccia Pipe.

| Hole ID |

Target |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

AuEq g/t |

CuEq % |

| SFDH-012 |

SFDLA BX |

12 |

121 |

109 |

4.94 |

109 |

1.13 |

0.23 |

0.06 |

8.00 |

5.49 |

| SFDH-039 |

SFDLA BX |

397.7 |

470 |

72.3 |

0.71 |

100 |

3.47 |

0.3146 |

0.6915 |

7.07 |

4.85 |

| SFDH-038 |

SFDLA BX |

0 |

81 |

81 |

2.33 |

63.94 |

0.23 |

0.23 |

0.38 |

3.50 |

2.40 |

| SFDH-011 |

SFDLA BX |

25 |

108 |

83 |

4.4 |

82 |

0.43 |

0.74 |

0.52 |

6.09 |

4.18 |

| SFDH-011 |

SFDLA BX |

27 |

68 |

41 |

7.03 |

91 |

0.51 |

0.23 |

0.02 |

8.96 |

6.14 |

*Intersections are not true widths and additional drilling and geological modelling of the mineralised zones in the breccia pipes is required to determine the true widths of the drill hole intersections. Intersections are selected based on a 0.5 g/t Au or 0.3% Cu cut-off grade, a minimum downhole length of 2m and a maximum waste inclusion of 2 consecutive meters. Equivalent gold (AuEq) and equivalent copper (CuEq) values are calculated assuming 100% recovery using USD$ 1770 oz Au, $23 oz Ag and $8300/t Cu (~$3.8/lb). Results from the drilling on this project can be found in Company News releases with the following dates: August 30, June 8, March 30, January 25, 2021; December 7, October 5, August 28, March 23, 2020.

Figure 2 - Current exploration targets at the 40,340ha San Francisco project.

Grant of Options

Additionally, the Company wishes to announce the grant of 50,000 incentive stock options with an exercise price of $0.35 to certain directors, officers, employees and consultants of the company. These options will vest immediately and expire five (5) years from the date of grant.

Marketing Agreements

The Company also wishes to announce it has entered into (i) an agreement (the “OGIB Agreement”) with OGIB Corporate Bulletin (“OGIB”) dated March 1, 2023 and (ii) a consulting agreement (the “Peterson Capital Agreement”) with Peterson Capital Europe Ltd. (“Peterson Capital”) dated March 1, 2023.

Pursuant to the OGIB Agreement, OGIB will provide promotional services to the Company, including the publication of a series of online articles about the Company, for six months. The Company will pay OGIB $75,000 on approval of the TSX Venture Exchange (“TSX-V”), $75,000 within 3 months and $75,000 within 6 months.

OGIB is a subscription service based out of North Vancouver, British Columbia, which provides research on public companies. OGIB is wholly-owned by Keith Schaefer. To the knowledge of the Company, OGIB has an indirect interest in 250,000 common shares in the capital of the Company (“Common Shares”) and has a right to acquire an additional 125,000 Common Shares. Both OGIB and Mr. Schaefer are arm’s length to the Company.

Pursuant to the Peterson Capital Agreement, Peterson Capital will provide business and capital advisory services, including formulating marketing strategies and accessing marketing initiatives for increasing the Company’s exposure to potential European investor groups, on a month-to-month basis with the first billed program to be held April 3-7, 2023. Subject to the approval of the TSX-V, the Company will pay Peterson Capital a cash fee of $50,000 using cash on hand and will reimburse certain out-of-pocket expenses incurred by Peterson Capital in connection with the provision of business and capital advisory services to the Company upon entry into the agreement.

Peterson Capital is a capital markets advisory and communications firm based out of Canada, which provides advisory services, investor marketing and communications support high-growth companies. Peterson Capital is owned by Rick Peterson and is arm’s length to the Company. To the knowledge of the Company, Peterson Capital has no direct or indirect interest in any Common Shares, nor any right to acquire Common Shares.

On Behalf of the Company,

Mr James Rogers Chief Executive Officer and Director.

Website: turmalinametals.com

Address: #488 - 1090 West Georgia St, Vancouver, BC V6E 3V7.

For Investor Relations enquiries, please contact Highland Contact at +1 833 923 3334 (toll free) or via info@turmalinametals.com.

Statements

About Turmalina Metals and our projects: Turmalina Metals is a TSXV-listed exploration company focused on developing our portfolio of high-grade gold-copper-silver projects in South America. Our focus is on tourmaline breccias, a deposit style overlooked by many explorers. Turmalina Metals is led by a team responsible for multiple gold-copper-silver discoveries who are highly experienced in this deposit style. Our projects are characterised by open high-grade mineralisation on established mining licenses that present compelling drill targets. The principal project held by Turmalina is the San Francisco project in San Juan, Argentina. For further information on the San Francisco Project, refer to the technical report entitled “NI43-101 Technical Report San Francisco Copper Gold Project, San Juan Province, Argentina” dated November 17, 2019 under the Corporation’s profile at www.sedar.com. Turmalina is also exploring the Chanape project in Peru. For further information on Chanape please refer to the technical report “National Instrument 43-101 Technical Report on the Chanape Gold-Silver-Copper Project” dated July 5, 2022 under the Corporation’s profile at www.sedar.com.

Qualified Person: The scientific, technical and analytical data contained in this news release pertaining to the San Francisco and Chanape projects has been reviewed and approved by Dr. Rohan Wolfe, Technical Advisor, MAIG, who serves as the Qualified Person (QP) under the definition of National Instrument 43-101.

Forward Looking Statement: This news release contains certain "forward-looking statements" within the meaning of such statements under applicable securities law. Forward-looking statements are frequently characterized by words such as "anticipates", "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed", "positioned" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Various assumptions were used in drawing the conclusions or making the projections contained in the forward-looking statements throughout this news release. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks (including those risk factors identified in the Corporation’s prospectus dated November 21, 2019) and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The Corporation is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

There is no assurance when the government-imposed measures related to COVID-19 in Argentina and Peru will be lifted. There is uncertainty over the form and duration of government measures and multiple policy changes may occur with regards to these measures over time. The Company may not provide updates on various government measures and changes to these measures as they occur. Protocols related to COVID-19, and the effects of the pandemic on service providers located throughout South America, may lead to delays in the future reporting of results.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b1d61de9-7473-4bfa-9f2f-e2faaedec2dd

https://www.globenewswire.com/NewsRoom/AttachmentNg/3428c570-5509-4060-8dfc-89cf0bf80a31