TORONTO, March 13, 2023 (GLOBE NEWSWIRE) -- Lithium Ionic Corp. (TSXV: LTH; OTCQB: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”) reports that it has acquired 100% of Neolit Minerals Participações Ltda. (“Neolit”), a Brazilian company which owns a 40% interest in the Salinas Project (the “Project”) and has the right, subject to certain exploration commitments, to acquire up to an 85% ownership interest in the Project.

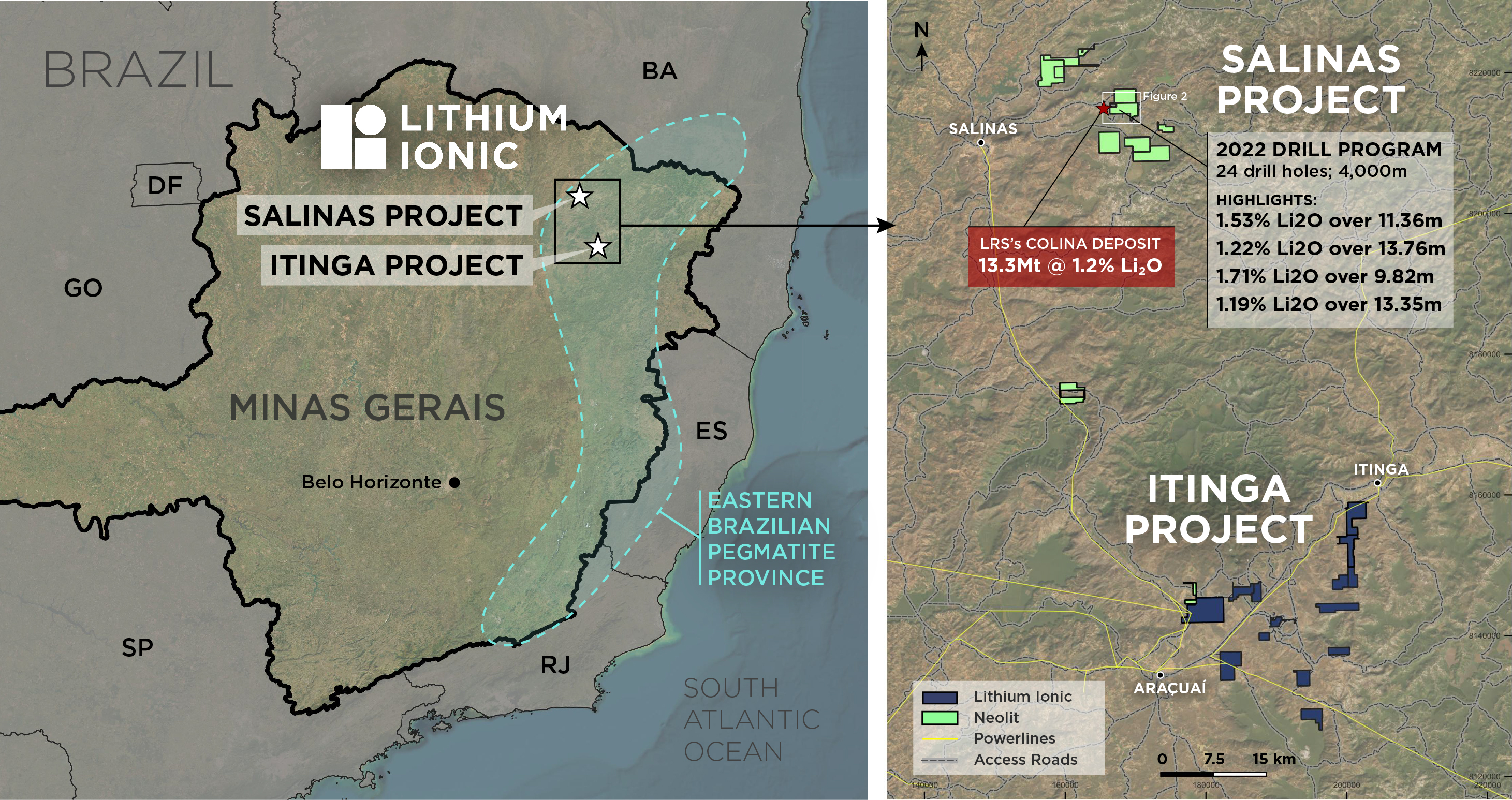

The Salinas Project currently includes nine exploration tenements totaling 5,713 hectares, which are located approximately 100 kilometres north of Lithium Ionic’s 7,700-hectare Itinga Project, in the northern region of Minas Gerais State, Brazil (See Figure 1). The spodumene-rich pegmatite bodies at the Neolit claims lie within the Salinas region, in the low-pressure, high-temperature, Curralinho Pegmatite Field of the lithium-rich Araçuaí Pegmatite District. Neolit is in the process of acquiring a binding option to acquire up to a 95% ownership interest in a 10th exploration tenement covering 184 hectares which is contiguous with the Salinas Project from an arm’s length vendor.

Highlights of the Transaction & the Salinas Project

- Lithium Ionic significantly expands its footprint in the northern region of the Eastern Brazilian Pegmatite Province, a belt which is quickly emerging as one of the largest lithium spodumene districts globally.

- Project located directly adjacent to Latin Resources’ Colina lithium deposit, which contains an estimated 13.3Mt @ 1.2% Li2O1.

- Five lithium-rich spodumene-bearing pegmatites outcropping at surface have been defined at the Salinas Project, ranging from 7 to 14 metres thick.

- A drilling program of 24 holes (4,000 metres) completed in H2 2022 by Neolit returned excellent results with intercept highlights of:

- 1.53% Li2O over 11.36m from 43.84m (SLOE-D014)

- 1.22% Li2O over 13.76m from 36.60m (SLOE-D015)

- 1.71% Li2O over 9.82m from 97.70m (SLOE-D013)

- 1.19% Li2O over 13.35m from 239.65m (SLOE-D018)

- Lithium Ionic intends to initiate a 20,000m drill program in the coming months to follow up on excellent 2022 results.

- Founder and CEO of Neolit, Dr. André Guimarães, to join Lithium Ionic as VP Business Development effective immediately.

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “These new claims represent a significant expansion over our previous land holdings and underscores our strategy of becoming a dominant lithium player in a region that is quickly emerging as one of the largest lithium spodumene provinces in the world. Neolit’s strong initial drill results along with the proximity of this Project to an established 13.3Mt grading 1.2% Li2O mineral resource makes the Salinas Project a highly prospective target in our growing portfolio and we’re looking forward to initiating the next phase of drilling and rapidly defining the size and extent of these lithium deposits. We are also very happy to add the technical strength of Dr. Guimarães to Lithium Ionic. He will be a key player in our continued growth.”

André Guimarães, founder of Neolit, commented, “We are thrilled to join the Lithium Ionic team and see our project incorporated into their portfolio. Our team has been working in the region for nearly three years, making significant advancements at the Salinas Project. Over five pegmatites, ranging from 7 to 14 metres thick and grading between 1.1 to 1.7 Li2O%, have been identified to date, all within just one of the nine tenements, which together cover nearly 6,000 hectares. The potential to expand existing pegmatites and identify new ones is very exciting and Lithium Ionic will allow us to expedite the development of the project. We admire Lithium Ionic’s experienced and proven technical and corporate team who have demonstrated their strong abilities through the rapid development of the Itinga and Galvani Projects and feel privileged to now be part of the team.”

Terms of the Agreement

Pursuant to the securities purchase agreement dated March 10, 2023, between the Company, André Guimarães (the “Vendor”) and Neolit, the Company acquired a 100% ownership interest in Neolit. The consideration for the transaction is as follows:

- A cash payment by the Company of USD$2,031,004.56 to the Vendor on closing;

- A cash payment by the Company of USD$2,570,766.82 to Neolit to settle all existing liabilities of Neolit on closing;

- Issuance of 4 million Lithium Ionic Shares to the Vendor on closing;

- Issuance of 1.5 million Lithium Ionic common share purchase warrants (the “LTH Warrants”). The LTH Warrants have an exercise price of CAD$2.25, a term of three years and only vest if Lithium Ionic establishes an independent National Instrument 43-101 compliant mineral resource estimate on the Salinas Project of at least 20 million tons with an average grade greater than 1.3% Li2O; and

- A cash payment by the Company of USD$1,500,000 to the Vendor on the 18-month anniversary of the closing of the transaction.

The transaction was completed as an expedited transaction pursuant to TSX Venture Exchange ("TSXV") Policy 5.3 - Acquisitions and Dispositions of Non-Cash Assets and remains subject to final TSXV acceptance. The transaction is at arms-length and no finder’s fees were paid in connection therewith.

Neolit’s Salinas Project Overview

The Salinas Project (“Salinas”) is located in the lithium-rich Araçuaí Pegmatite District (“APD”), the northern part of the Eastern Brazilian Pegmatite Province, which hosts the largest lithium reserves in Brazil. Salinas is situated approximately 100 kilometres north of Lithium Ionic’s Itinga claims (see Figure 1).

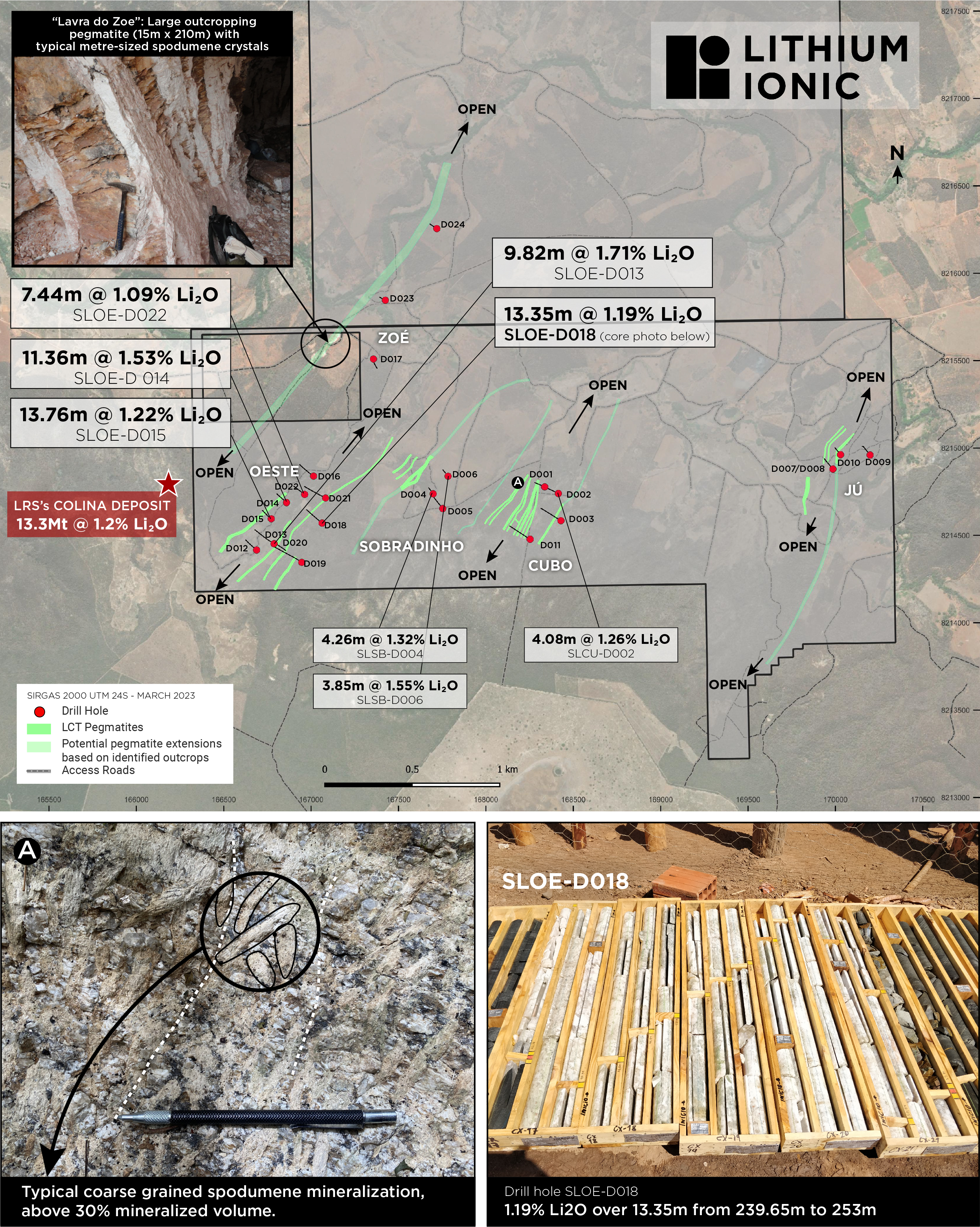

Salinas is located directly adjacent to Latin Resources’ Colina lithium deposit, which currently contains an estimated 13.3Mt @ 1.2% Li2O. It also surrounds a large outcropping pegmatite that has been mined for spodumene intermittently for several decades called “lavra do Zoe”. This pegmatite body, located only 40 metres away from Neolit’s tenement, is at least 15 metres thick and has a strike length of at least 210 metres. Metre-sized spodumene crystals are typical at this outcrop and represent 30%-40% of its total volume (see inset photo in Figure 2).

Prior to the maiden drilling program initiated by Neolit in August 2022, Neolit completed extensive geological mapping and systematic surface sampling and geochemistry which identified several occurrences of lithium mineralized pegmatites outcropping at surface. Five targets (Zoe, Oeste, Sobradinho, Cubo and Ju) across a 3.5-kilometre area, showed excellent potential to host highly evolved LCT (Lithium – Cesium – Tantalum) pegmatites, which was subsequently confirmed with drilling.

The 4,000-metre, 24-hole drill program yielded excellent results. Intercept highlights are presented below, while complete results are presented in Table 1.

Drill highlights include:

- 1.53% Li2O over 11.36m from 43.84m (SLOE-D014)

- 1.22% Li2O over 13.76m from 36.60m (SLOE-D015)

- 1.71% Li2O over 9.82m from 97.70m (SLOE-D013)

- 1.19% Li2O over 13.35m from 239.65m (SLOE-D018)

The drill program was successful in confirming several mineralized pegmatites, up to 500 metres in strike length at the Oeste Zone, however based on field observations and sampling of outcropping pegmatite occurrences, as well as interpretations of local geology, they could be multiple times larger. Lithium Ionic intends to initiate a 20,000-metre drill program at Salinas in the coming months with the aim to define the scale of these lithium deposits.

Additional Acquired Claims and Future Potential to Expand Footprint Near Itinga Project

Through the Neolit acquisition, Lithium Ionic is also acquiring 100% ownership of two claims totaling 769 hectares, located in the northern region of Minas Gerais state, Brazil. One of the claims is directly adjacent to the Vale claims acquired in January 2023 (see the Company’s January 25, 2023 press release for further details), while the other is located approximately half way between the Itinga Project claims and the Salinas Project claims (see Figure 1).

Additionally, Neolit, at its sole discretion, is able to expand its footprint in the Araçuaí region pursuant to a definitive agreement it has in place with an arm’s length party pursuant to which it can acquire claims adjacent to Lithium Ionic’s wholly owned Itinga project. Neolit can select from a land package of 10 tenements comprising 4,140 hectares owned by the vendor, the areas within these tenements Neolit considers most prospective and acquire up to a 90% ownership interest in such claims by incurring certain exploration expenditures.

Lithium Ionic will provide further updates to investors regarding any material advancements regarding this transaction in due course.

André Guimarães joins Lithium Ionic as VP of Corporate Development

Lithium Ionic is pleased to welcome the Founder and CEO of Neolit Strategic Minerals, André Guimarães, as Vice-President of Corporate Development, effective immediately, pending final TSXV approval.

André Guimarães is a geology graduate with a PhD specialization in igneous petrology who has over ten years of experience in research. Dr. Guimarães founded Neolit in early 2020, and since then has been directly involved in all corporate and exploration activities, including field work and contract negotiations. With his strong background in igneous petrology, he participates directly in the analyses and interpretation of geological data, particularly geochemical results.

Prior to his career in geology, he worked as an archaeologist who was involved in rescue archaeology projects associated with the development of mining sites in Brazil. During this time, he acquired extensive experience dealing with the necessary social-related foundational work required for the development of a mining site.

Figure 1 – Salinas and Itinga Project Location

View Figure 1 here: https://www.globenewswire.com/NewsRoom/AttachmentNg/3bab34ac-cc55-4096-837c-7fccbc3fc129

Figure 2 – Five Spodumene-bearing Pegmatite Targets, Drill Collar Locations and Intercept Highlights

*(“Lavra do Zoe” photo from the following public report: De Castro Paes, V. J., Santos, L.D., Tedeschi, M.F., Betiollo, L.M. (2016). Avaliação do Potencial do Lítio no Brasil: Área do Médio Rio Jequitinhonha, Nordeste de Minas Gerais. Serviço Geológico do Brasil (CPRM), Belo Horizonte, Série Minerais Estratégicos n.03)

View Figure 2 here: https://www.globenewswire.com/NewsRoom/AttachmentNg/6d7c6bb0-7ac7-48ca-97cd-f49927aa7afb

Table 1 – Salinas Project 4,000m Drill Program Results

| Hole ID |

Az |

Dip |

From |

To |

Metres |

Li2O (%) |

| SLCU-D001B |

295°

|

60°

|

23.68 |

27.19 |

3.51 |

0.58 |

| Incl. |

23.68 |

25.55 |

1.87 |

0.93 |

| SLCU-D001 |

295°

|

60°

|

103.66 |

108.85 |

5.19 |

0.63 |

| Incl. |

107.36 |

108.33 |

0.97 |

1.62 |

| SLCU-D002 |

295°

|

60°

|

56.11 |

60.19 |

4.08 |

1.26 |

| and |

96.74 |

97.78 |

1.04 |

0.97 |

| and |

152.40 |

154.40 |

2.00 |

1.49 |

| SLCU-D003 |

295°

|

60°

|

120.85 |

122.75 |

1.90 |

0.61 |

| and |

145.12 |

146.62 |

1.50 |

0.87 |

| and |

191.39 |

192.83 |

1.44 |

0.77 |

| and |

199.91 |

202.96 |

3.05 |

0.69 |

| SLSB-D004 |

320°

|

60°

|

66.66 |

70.92 |

4.26 |

1.32 |

| Incl. |

68.51 |

70.30 |

1.79 |

2.35 |

| and |

74.88 |

78.33 |

3.45 |

0.94 |

| SLSB-D005 |

320° |

60° |

No significant results |

| SLSB-D006 |

320° |

60° |

70.50 |

74.35 |

3.85 |

1.55 |

| SLJU-D007 |

313° |

90° |

No significant results |

| SLJU-D008 |

315° |

50° |

No significant results |

| SLJU-D009 |

315° |

60° |

No significant results |

| SLJU-D010 |

315° |

50° |

No significant results |

| SLCU-D011 |

295° |

60° |

161.76 |

162.70 |

0.94 |

1.22 |

| SLOE-D012 |

305°

|

60°

|

88.60 |

90.38 |

1.78 |

1.38 |

| and |

120.52 |

122.15 |

1.63 |

1.00 |

| SLOE-D013 |

305° |

50° |

97.70 |

107.52 |

9.82 |

1.71 |

| SLOE-D014 |

305°

|

50°

|

43.84 |

55.20 |

11.36 |

1.53 |

| Incl. |

49.84 |

53.84 |

4.00 |

1.99 |

| SLOE-D015 |

305°

|

50°

|

36.60 |

50.36 |

13.76 |

1.22 |

| Incl. |

42.72 |

45.66 |

2.94 |

1.95 |

| SLOE-D016 |

305° |

50° |

No significant results |

| SLOE-D017 |

268° |

90° |

No significant results |

| SLOE-D018 |

305°

|

50°

|

239.65 |

253.00 |

13.35 |

1.19 |

| Incl. |

242.64 |

245.32 |

2.68 |

1.86 |

| SLOE-D019 |

305° |

50° |

No significant results |

| SLOE-D020 |

125° |

90° |

No significant results |

| SLOE-D021 |

305° |

50° |

No significant results |

| SLOE-D022 |

305°

|

60°

|

102.68 |

110.12 |

7.44 |

1.09 |

| Incl. |

105.36 |

109.20 |

3.84 |

1.48 |

| SLZO-D023 |

310° |

60° |

No significant results |

| SLZO-D024 |

310° |

80° |

No significant results |

About Lithium Ionic Corp.

Lithium Ionic is a Canadian-based lithium-focused mining company with properties covering 14,182 hectares located in the prolific Araçuaí province in Minas Gerais State, Brazil, which boasts excellent infrastructure, including highways, access to hydroelectrical grid power, water, and nearby commercial ports. Its Itinga Project neighbours CBL’s Cachoeira lithium mine and Sigma Lithium Corp.’s construction-stage Grota do Cirilo project.

Qualified Persons

The technical information, including assays relating to the Salinas Project, is historical in nature and has not been independently verified by Lithium Ionic. A qualified person, as defined in National Instrument 43-101, has not done sufficient work on behalf of Lithium Ionic to classify the historical drilling reported above as current mineral resources or mineral reserves and Lithium Ionic is not treating the historical drill results as current mineral resources or mineral reserves. Each of Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, are both “qualified persons” as defined in NI 43-101 and have reviewed and approved the contents and technical disclosures in this press release.

Investor and Media Inquiries:

+1 647.316.2500

info@lithiumionic.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the prospectivity of the Company’s mineral properties, the acquisition of Neolit, the prospectivity of the Salinas Project, Neolit’s ability to increase ownership in the Salinas Project, Neolit’s ability to acquire additional mining claims or tenements, the Company’s ability to produce a NI 43-101 compliant mineral resource estimate, the mineralization and development of the Company’s mineral properties, changes to the Company’s management team, the Company’s exploration program and other mining projects and prospects thereof. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Information and links in this presentation relating to other mineral resource companies are from their sources believed to be reliable, but that have not been independently verified by the Company.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

1 Source: Latin Resources’ publicly disclosed JORC mineral resource estimate