(TheNewswire)

Toronto, ON - TheNewswire -March 15, 2023 -Helix BioPharma Corp. (TSX:HBP), (“Helix” or the “Company”), a clinical-stage biopharmaceutical company developing unique therapies in the field of immuno-oncology based on its proprietary technological platform DOS47, today announced financial results for the fiscal 2023 second quarter results for the period ending January 31, 2023.

OVERVIEW

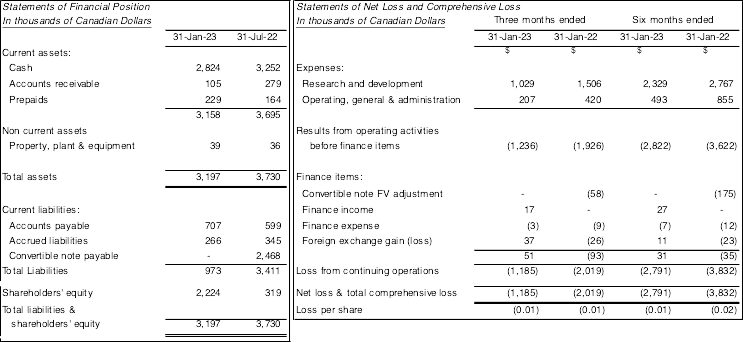

The Company reported a net loss and total comprehensive loss of $1,185,000 and $2,791,000 for the three and six-month periods ended January 31, 2023, respectively (January 31, 2022 - $2,019,000 and $3,832,000) and a loss of $0.01 and $0.01 per common share respectively (January 31, 2022– loss of $0.01 and $0.02 per common share).

Clinical development

LDOS47 in lung cancer

-

The Phase I study combination therapy in lung cancer (LDOS001) was completed and a manuscript was accepted for publication inJournal of Thoracic Oncology Clinical and Research Reports on September 2nd, 2022. The full-text open access article can be found here:https://www.jtocrr.org/article/S2666-3643(22)00132-1/fulltext

-

Another important aspect of the development of the LDOS47 platform is the combination with chemo- and/or immuno-therapy to enhance current therapies, that may boost the utility of the platform. The Company continues to hasengaged several key opinion leaders to evaluate potential combinations for partnership opportunities.

LDOS47 in pancreatic cancer

The Company's Phase I-b/II combination trial in pancreatic cancer (LDSOS006) continues to recruit patients, now in the third dosing cohort (9 µg/kg), after the successful completion of the second dosing cohort (6 µg/kg). A revision to the clinical study protocol was recently submitted to the U.S. Food and Drug Administration to permit the addition of a further dosing cohort at 13.55 µg/kg. We remain committed to this study.

Corporate development

-

On November 3, 2022, the Company announced that it had closed a private placement financing for net proceeds of CAD $4,629,019.86 from the issuance of 25,716,777 common shares at a price of $0.18 per common share. The common shares issued pursuant to the private placement were subject to a statutory hold period of four months and one day ending on March 4, 2023, in accordance with applicable securities law. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

-

On October 3, 2022, the Company announced the appointment of Dr. Frank Gary Renshaw, as the Chief Medical Officer.

-

On September 1, 2022, the Company announced the appointment of Dr. Gabrielle M Siegers, MA, Ph.D., as the Head of RD based out of the Company’s lab in Edmonton.

-

On August 30, 2022, the Company announced that it had completed the buyback of the outstanding amount of the convertible security funding agreement with Lind Global Macro Fund, LP. The Company entered into the Agreement with Lind in May 2021 and closed the first tranche under the Agreement for gross proceeds of $3,500,000 shortly thereafter. The Company has now bought back the amount outstanding of the Convertible Security under the Agreement, which is C$2,061,875.

-

On August 9, 2022, the Company announced that it has entered into a two-year scientific collaboration agreement (“Agreement”) with University Hospital Tubingen (Germany) to assess the therapeutic response of L-DOS47 in several cancer models expressing CEACAM6, with advanced preclinical metabolic imaging.

Research & development

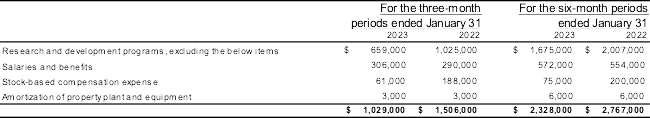

Research & development expenses for the three and six-month periods ended January 31, 2023, totalled $1,029,000 and $2,329,000 respectively (January 31, 2022– $1,506,000 and $2,767,000).

The following table outlines research and development costs expensed for the following periods:

Research and development expenditures for the three and six-month periods ended January 31, 2023, when compared to the periods ended January 31, 2022, were lower by $477,000 and 439,000 respectively. The decrease in spending is mainly the result of lower expenditures associated with research and development activities by 36% and 17% respectively as well as a 68% and 63% decrease in stock-based compensation expenses. When compared to the three and six-month periods ended January 31, 2022, the Company spent more on salaries and benefits by 6% and 3% respectively.

The Company hired biotechnology consultants to assess the Company’s drug product candidate with a focus on identifying value propositions and positioning strategies that would enable clinical adoption of L-DOS47. See “Overview” above for additional information.

Operating, general and administration

Operating, general and administration expenses for the three and six-month periods ended January 31, 2023, totalled $207,000 and 493,000 respectively (January 31, 2022 – totalled $420,000 and 855,000).

The following table outlines operating, general and administration expenses for the following periods:

Operating, general and administration expenditures for the three and six-month periods ended January 31, 2023, when compared to the three and six-month periods ended January 31, 2022, were lower by $213,000 and $362,000 respectively or 51% and 42%.

Since May 2022, the Company has made significant efforts to control and reduce its overheads expenditures. This included closing its headquarters at Richmond Hill Ontario and moving it to Grove Corporate Services offices “(Grove”) in downtown Toronto. The Company hired Grove to perform accounting and corporate secretarial services following the resignation of its previous CFO in May 2022. The savings apply to various activities including salaries, rent, legal, and other operational expenditures. Further measures are being taken which will result in more reductions in the current year.

Some expenditures in the comparative period relates to the Company’s attempt to raise additional capital as part of a qualifying transaction to list its common shares on a U.S. stock exchange, the termination of an investor relations agreement with ACM Alpha Consulting Management EST (“ACMest”) and stock-based compensation expenses of stock options granted to directors.

Several factors materialized that resulted in the Company abandoning its plans to list on a U.S. stock exchange. These include but are not limited to the increase in the percentage ownership of the Common Shares by new insiders and a decline in the price of the Common Shares making it extremely challenging for the Company to leverage the Multijurisdictional Disclosure System.

LIQUIDITY AND CAPITAL RESOURCES

The Companyreporteda netloss and total comprehensive loss of $1,185,000 and $2,791,000 forthe three and six-month periods ended January 31, 2023, respectively (January 31, 2022 - $2,019,000 and $3,832,000) and a loss of $0.01 and $0.01 per common share respectively (January 31, 2022– loss of $0.01 and $0.02 per common share). As at January 31, 2023 the Company had working capital of $2,185,000, shareholders’ equity of $2,224,000 and a deficitof$197,908,000. As at July 31, 2022, the Company had working capital of $283,000, shareholders’ equity $319,000 and a deficitof $195,117,000.

On September 12, 2022, the Company applied to the TSX to price protect a proposed $5 million financing of common shares at a price of $0.18 per share. The TSX granted a price protection letter on September 14, 2022, and the conditional approval of the placement on September 26, 2022. On November 3, 2022, the Company announced that it had closed a private placement financing for net proceeds of CAD $4,629,020 from the issuance of 25,716,777 common shares at a price of $0.18 per common share with insiders subscribing for $270,000. The common shares issued pursuant to the Private Placement are subject to a statutory hold period of four months and one day ending on March 4, 2023, in accordance with applicable securities law. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

On April 13, 2022, the Company announced that it has received conditional approval from the Toronto Stock Exchange to extend its previously announced Early Warrant Exercise Incentive Program from April 28, 2022, to May 31, 2022. The Incentive Program is a period during which holders of the Company’s eligible common share purchase warrants (“Eligible Warrants”) may take advantage of a temporary reduction in the exercise price of the Eligible Warrants to a price of C$0.26. The Eligible Warrants include an aggregate of 49,806,469 warrants that if exercised at the Incentive Exercise Price will result in the Company receiving gross proceeds of up to $12,949,682. During the three-month period ended October 31, 2022, 12,346,938 warrants were exercised for a total subscription amount of $3,210,204.

On March 11, 2022, the Company closed a private placement financing for gross proceeds of $1,001,000 from the issuance of 3,850,000 common share at a price of $0.26 per common share. On April 21, 2022, the Company closed a private placement financing for net proceeds of $2,002,000 from the issuance of 7,700,000 common shares at a price of $0.26 per common share.

In order for the Company to advance the currently planned preclinical and clinical research and development activities, its collaborative scientific research programs and pay for its overhead costs, the Company will need to raise approximately $11,000,000 through to the end of fiscal 2024. The Company projects an average monthly fixed overhead spend of approximately $230,000. This amount does not include the costs related to any of the Company’s third-party activities such as clinical studies, collaborative research activities and contract manufacturing.

.

The Company’s Statement of Financial Position and Statement of Net Loss and Comprehensive Loss for fiscal 2022 and 2021 are summarized below:

The Company’s consolidated financial statements, management’s discussion and analysis and annual information form will be filed under the Company’s profile on SEDAR at www.sedar.com, as well as on the Company’s website at www.helixbiopharma.com.

About Helix BioPharma Corp.

Helix BioPharma Corp. is a clinical-stage biopharmaceutical company developing unique therapies in the field of immune-oncology for the prevention and treatment of cancer based on our proprietary technological platform DOS47. Helix is listed on the Toronto Stock Exchange under the symbol “HBP”.

Helix BioPharma Corp.

2704, 401 Bay Street,

Toronto M5H 2Y4, Ontario,

Tel: 905-841-2300

namrata@grovecorp.ca

Forward-Looking Statements and Risks and Uncertainties

This news release contains forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities laws. Forward-looking statements are statements and information that are not historical facts but instead include financial projections and estimates, statements regarding plans, goals, objectives, intentions and expectations with respect to the Company’s future business, operations, research and development, including the focus of the Company’s primary drug product candidate L-DOS47 and other information relating to future periods.

Forward-looking statements include, without limitation, statements concerning (i) the Company’s ability to operate on a going concern being dependent mainly on obtaining additional financing; (ii) the Company’s priority continuing to be L-DOS47; (ii) the Company’s development programs, clinical studies, trials and reports for DOS-47 and L-DOS47; (iii) the Company’s development programs for DOS47 and L-DOS47; (iv) future expenditures, the insufficiency of the Company’s current cash resources and the need for financing; (v) future financing requirements, and the seeking of additional funding, and (vi) forecasts and future projections regarding development programs and expenditures. Forward-looking statements can further be identified by the use of forward-looking terminology such as “ongoing”, “estimates”, “expects”, or the negative thereof or any other variations thereon or comparable terminology referring to future events or results, or that events or conditions “will”, “may”, “could”, or “should” occur or be achieved, or comparable terminology referring to future events or results.

Forward-looking statements are statements about the future and are inherently uncertain and are necessarily based upon a number of estimates and assumptions that are also uncertain. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Forward-looking statements, including financial outlooks, are intended to provide information about management’s current plans and expectations regarding future operations, including without limitation, future financing requirements, and may not be appropriate for other purposes. Certain material factors, estimates or assumptions have been applied in making forward-looking statements in this news release, including, but not limited to, the safety and efficacy of L-DOS47; that sufficient financing will be obtained in a timely manner to allow the Company to continue operations and implement its clinical trials in the manner and on the timelines anticipated; the timely provision of services and supplies or other performance of contracts by third parties; future costs; the absence of any material changes in business strategy or plans; and the timely receipt of required regulatory approvals and strategic partner support.

The Company’s actual results could differ materially from those anticipated in the forward-looking statements contained in this news release as a result of numerous known and unknown risks and uncertainties, including without limitation, the risk that the Company’s assumptions may prove to be incorrect; the risk that additional financing may not be obtainable in a timely manner, or at all, and that clinical trials may not commence or complete within anticipated timelines or the anticipated budget or may fail; third party suppliers of necessary services or of drug product and other materials may fail to perform or be unwilling or unable to supply the Company, which could cause delay or cancellation of the Company’s research and development activities; necessary regulatory approvals may not be granted or may be withdrawn; the Company may not be able to secure necessary strategic partner support; general economic conditions, intellectual property and insurance risks; changes in business strategy or plans; and other risks and uncertainties referred to elsewhere in this news release, any of which could cause actual results to vary materially from current results or the Company’s anticipated future results. Certain of these risks and uncertainties, and others affecting the Company, are more fully described in the Company’s annual management’s discussion and analysis for the year ended July 31, 2022 under the heading “Risks and Uncertainty” and Helix’s Annual Information Form, in particular under the headings “Forward-looking Statements” and “Risk Factors”, and other reports filed under the Company’s profile on SEDAR at www.sedar.com from time to time. Forward-looking statements and information are based on the beliefs, assumptions, opinions and expectations of Helix’s management on the date of this new release, and the Company does not assume any obligation to update any forward-looking statement or information should those beliefs, assumptions, opinions or expectations, or other circumstances change, except as required by law.

Copyright (c) 2023 TheNewswire - All rights reserved.