(TheNewswire)

Vancouver, BC -TheNewswire - April 3, 2023 - Tribeca Resources Corporation (TSXV:TRBC)(“Tribeca Resources”, the “Company”) is pleased to announce results from two 250m step-out drill holes, adding 500m of additional strike length for a total of 1 km to this discovery at the Gaby target. This new discovery is part of the Company’s La Higuera iron oxide copper-gold (IOCG) project, located in the Coquimbo region of northern Chile.

Highlights:

-

Results from two drill holes forming a 500m step-out to the north have doubled the strike length of known significant copper-gold sulphide mineralization, at what is now a 1km long mineralized zone at the Gaby discovery

-

Drill hole GBY007 intersected 44m @ 0.52% copper, 0.10 g/t gold from 96m depth within a larger mineralized interval of 264m @ 0.31% copper, 0.06 g/t gold.

-

Drill hole GBY006 intersected 26m @ 0.51% copper, 0.10 g/t gold from 228m depth within 186.7m @ 0.27% copper, 0.05 g/t gold from 76m to end-of-hole.

-

The mineralization remains clearly open to the north and at depth. Integration of the step-out results with new geophysical data provides additional promising drill targets both along strike and adjacent to this discovery.

-

Logging and data collection from the drill core is being completed before planning the next phase of drilling to expand what is now a growing copper-gold discovery.

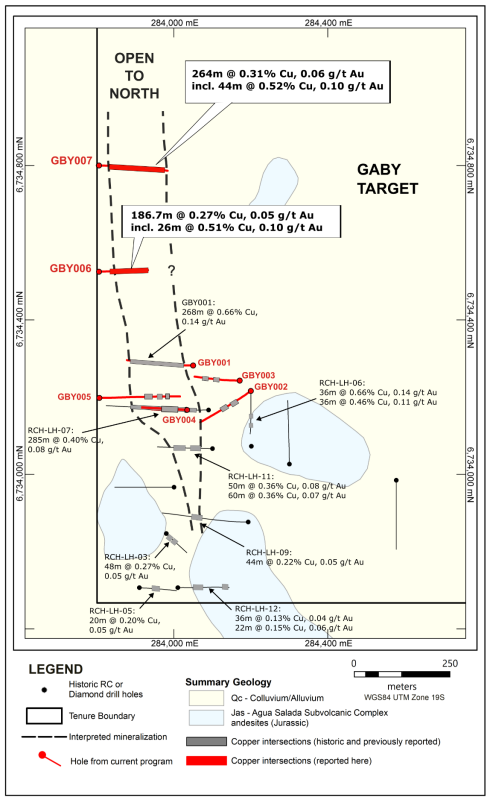

The two holes reported here have intersected an interpreted approximately 130m-wide NNW-trending sub-vertical zone of magnetite-related IOCG-style copper sulphide mineralization.

Tribeca Resources CEO, Dr Paul Gow commented:

“These drill results are highly encouraging and further validate our approach of aggressively stepping out to drill well-reasoned geophysical targets under thin gravel cover.”

“Located at just 450 metres above sea-level, and 10 km from the coast, the La Higuera project benefits from extremely favourable access to infrastructure and the possibility of year-round drilling. We look forward to continuing our efforts to increase the known size of this mineralized system during 2023.”

Table 1. Summary of significant mineralized intersections in drill holes GBY006 and GBY007.

|

HoleID

|

From (m)

|

To (m)

|

Downhole

Interval (m)

|

Cu

(%)

|

Au

(g/t)

|

Co (ppm)

|

CuEq

(%)

|

|

GBY006

|

76

|

262.7

|

186.7

|

0.27

|

0.05

|

240

|

0.31

|

|

incl.

|

122

|

178

|

56

|

0.35

|

0.07

|

271

|

0.40

|

|

incl.

|

190

|

224

|

34

|

0.28

|

0.06

|

362

|

0.35

|

|

incl.

|

228

|

254

|

26

|

0.51

|

0.10

|

312

|

0.56

|

|

GBY007

|

88

|

352

|

264

|

0.31

|

0.06

|

142

|

0.33

|

|

incl.

|

96

|

140

|

44

|

0.52

|

0.10

|

151

|

0.54

|

|

incl.

|

144

|

170

|

26

|

0.32

|

0.07

|

119

|

0.34

|

|

incl.

|

184

|

220

|

36

|

0.39

|

0.08

|

131

|

0.41

|

|

incl.

|

232

|

250

|

18

|

0.28

|

0.05

|

75

|

0.29

|

|

incl.

|

272

|

298

|

26

|

0.34

|

0.07

|

175

|

0.37

|

Note: Apart from the summary intersections (from 26-262.7m in GBY006 and 88-352m in GBY007) the grade intersections are calculated over intervals >0.2% Cu with maximum internal dilution of 10m @ 0.05% Cu and a minimum interval width of 10m. CuEq (%) grades have been calculated using recoveries from metallurgical test work undertaken in 2006 on drill core from the project, which are 90% for copper, 65% for gold and 50% for cobalt. Metal prices utilised were US$4.10/lb copper, US$1,965.80/oz gold and US$15.84/lb cobalt (based on 30 March 2023 closing spot prices).

Drill hole discussion: GBY006 and GBY007

The presence of an approximately 130m-wide NNW-trending sub-vertical mineralized envelope has been interpreted at the Gaby target. It has now been intersected in four drill holes (RCH-LH-07, GBY001, GBY006 and GBY007) on four drill sections over a 650m strike length. Together with thinner, but consistent intersections on the southern end of the zone (RCH-LH-03, RCH-LH-09 and RCH-LH-11) this provides a known strike length of 1km. The mineralization is typically present from the base of thin gravel cover that ranges in thickness from 0 to 76m.

Details of the two new drill holes reported here are as follows:

-

Drill hole GBY006 was drilled approximately 250m to the north of GBY001 (268m @ 0.66% Cu, 0.14 g/t Au) to a depth of 262.7m on section 4520N. After penetrating 76m of gravel cover it immediately encountered mineralized strongly faulted, veined and locally brecciated andesite with significant magnetite-dominated IOCG alteration. The mineralization was near continuous in the range of 0.1-0.4% Cu, with occasional 2m intervals up to a maximum of 1.48% Cu and 0.33 g/t Au, to the end of hole at 262.7m. It included a zone of higher-grade mineralization near the bottom of the hole of 26m @ 0.51% Cu, 0.10 g/t Au (0.57% CuEq) from 228-254m. The hole stopped in mineralization with the final 10.7m of the hole averaging 0.39% copper.

-

Drill hole GBY007 was located a further 280m north on section 4800N and completed at a depth of 365.85m. It penetrated 68m of gravel cover before intersecting mineralized andesite. The IOCG alteration, faulting, veining and local brecciation was similar to that encountered in GBY006. The lower portion of the hole included several thick (10-20cm) veins of hematite+chalcopyrite, one of which recorded a single 1m interval of 1.94% Cu, 0.18 g/t Au. The highest grade interval of 44m @ 0.52% Cu, 0.10 g/t Au (0.55% CuEq) was located 28m below the base of cover from 96-140m.

The holes reported here were drilled at an angle of 60°, such that if the body is vertical as interpreted the true thickness will be approximately half of the downhole thickness.

Click Image To View Full Size

Figure 1: Location of drill holes completed to date at the Gaby target and the interpreted outline of the NNW-trending mineralization.

Geophysical Data

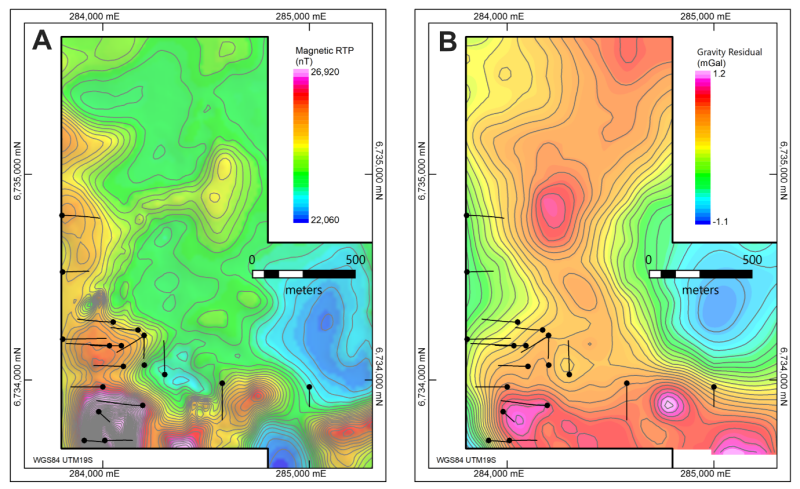

Figure 2 provides an overview of the gravity and additional ground magnetic data collected in Q4 2022 at the Gaby target. The interpretation of magnetic susceptibility data conducted on the project has yielded valuable insights, and the magnetite-associated mineralization drilled to date shows a strong spatial correlation with moderate intensity magnetic anomalism (approximately 1000 nT). The moderate magnetic trend continues to at least 400m north of drill hole GBY007.

A strong gravity anomaly of approximately 1 mGal intensity is present 400m to the east of drill hole GBY007, and is coincident with a small copper showing on sporadic outcrop. This provides an additional significant exploration target.

Click Image To View Full Size

Figure 2. Geophysical images from the Gaby discovery:

A. reduced-to-pole (RTP) ground magnetic data, and

B. gravity (bouguer) residual data. Contour intervals of 200nT and 0.1mGal for the magnetic and gravity data, respectively. The black outline is the mineral licence boundary, and the drilling to date, including by the previous operator, is shown.

Next Steps

-

Complete drill core logging and receive all assays results from the Phase I program, and revise the 3D geological model.

-

Analyze and integrate the geophysical data received as part of the Phase 1 program

-

Select targets for detailed geological mapping, surface geochemistry, and/or further geophysical surveying from the five current targets at the La Higuera project

-

Develop the Phase 2 work program

Notes on sampling and assaying

Analytical samples were collected using 1/8 of the material from each 2m interval for the reverse circulation drilling or ½ HQ core for the diamond drilling and sent to the ALS Laboratory in La Serena, Chile for preparation and then to ALS in Santiago, Chile and Lima, Peru for analysis. Preparation included crushing the RC and core samples to 70% < 2mm and pulverizing 1000g of crushed material to better than 85% < 75 microns. All samples are assayed using 30g nominal weight fire assay with AAS finish (Au-AA23) and a multi-element four acid digest ICP-AES method (ME-ICP61). Where the ME-ICP61 results were greater than 10,000 ppm Cu the assays were repeated with an ore grade four acid digest method (Cu-OG62). The QA/QC procedure for this drilling program utilizes field duplicates, certified reference standards and blanks that comprise approximately 10% of the total samples submitted. The QA/QC results indicate appropriate accuracy and precision in the assaying program.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera IOCG Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera IOCG Property.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca’s flagship property is the La Higuera IOCG project that comprises 4,047 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. The 822 hectare Gaby concession area is held under a purchase option (5% Exploration Levy on expenditure incurred during the option period; a US$2 million final payment due March 2024; with a 1% NSR Royalty granted to the owner), with the remainder of the concessions being outright owned (100%) by Tribeca Resources. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

|

Paul Gow

|

|

Thomas Schmidt

|

|

CEO and Director

|

|

President and Director

|

|

admin@tribecaresources.com

|

|

admin@tribecaresources.com

|

|

+1 604 685 9316

|

|

+1 604 685 9316

|

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the drilling program, the ability of the Company to develop and define a suitable resource at the Project and the relationship between geophysical survey results and potential mineralization.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Project.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

Copyright (c) 2023 TheNewswire - All rights reserved.