(TheNewswire)

Highlights:

-

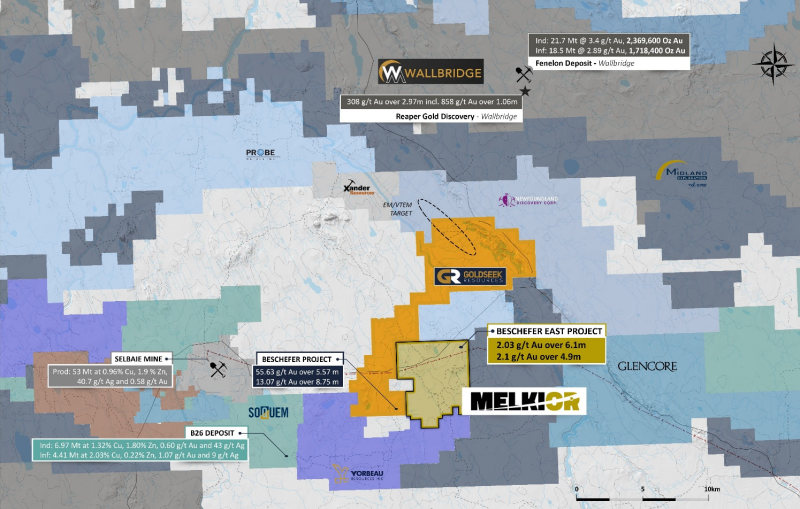

Large land package consisting of 2,906 hectares within the prolific Selbaie Camp; located 14 east and 45 km north, respectively, of the Selbaie and Casa Berardi Mines, 30 km from Wallbridge’s Fenelon Gold Deposit which hosts an indicated resource of 21.6 Mt at 3.4 g/t Au and 7 km east of SOQUEM’s B26 deposit, which hosts an indicated resource of 6.97Mt at 1.32% Cu, 1.8% Zn, 0.6 g/t Au and 43g/t Ag.1

-

Along strike of the Beschefer Project, where historical drilling has identified 55.63 g/t gold over 5.57 metres, including 224 g/t over 1.23 metres.The extension of this structure has seen limited testing on the Beschefer East side.

-

Historical hole 1172-99-30 intercepted 2.03 g/t Au over 6.1 metres with limited follow-up drilling.

-

Systematic exploration has outlined hree targeted gold structures, each 2-3 km in size, open for expansion that are largely untested. These targets also have Cu-Ag potential hosted in a felsic volcanic complex.

Timmins, Ontario – TheNewswire – April 18th, 2023 -Melkior Resources Inc. (“Melkior” or the “Company”) (TSXV:MKR) (OTC:MKRIF) is pleased to announce that it has entered into a letter of intent (the “LOI”) to acquire 100% of the Beschefer East Project (“Beschefer East” or the “Project”) from SOQUEM Inc (“SOQUEM”), an entity at arms’ length to the Company. SOQUEM is a subsidiary of Investissement Québec. The Beschefer East Project is located approximately 90 km west of Matagami and 100 km north of La Sarre, Québec, with good road access and a powerline running through the Project.

The Project has significant gold and polymetallic potential with geological similarities to SOQUEM’s B26 deposit, located 7 km east, which hosts an indicated resource of 6.97 Mt at 1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag, and an inferred resource of 4.41 Mt at 2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag (Soquem.qc.ca).1 The Project shares a border with Goldseek Resources’ Beschefer Project, where historical drilling has identified 55.63 g/t gold over 5.57 metres, including 224 g/t over 1.23 metres within the B14 Gold Zone.1

Jonathon Deluce, CEO of Melkior, stated, “We believe that the Project has significant potential given the multi-kilometre gold-copper-silver targets identified by SOQUEM. With the amount of mineralization intercepted to date amongst these large targets, we believe there is a higher metal factor source which we will target in upcoming programs. We also believe that the B14 gold zone extends onto the Beschefer East Project, which is one of our top targets for Phase 1 drilling. During our due diligence, we have been impressed by the density and quality of the database compiled by SOQUEM. This will enable us to capitalize on prior program investment while rapidly determining the next steps for the Project, including a surface geochemical survey to target a new discovery. We look forward to finalizing a definitive agreement (the “Definitive Agreement”) with SOQUEM in the coming weeks.”

Figure 1: Project Outline and Area Map

Click Image To View Full Size

Project Summary:

Location: The Project comprises 55 claims covering 2,906 hectares in the Eeyou Istchee Baie-James territory, Nord du Québec region.

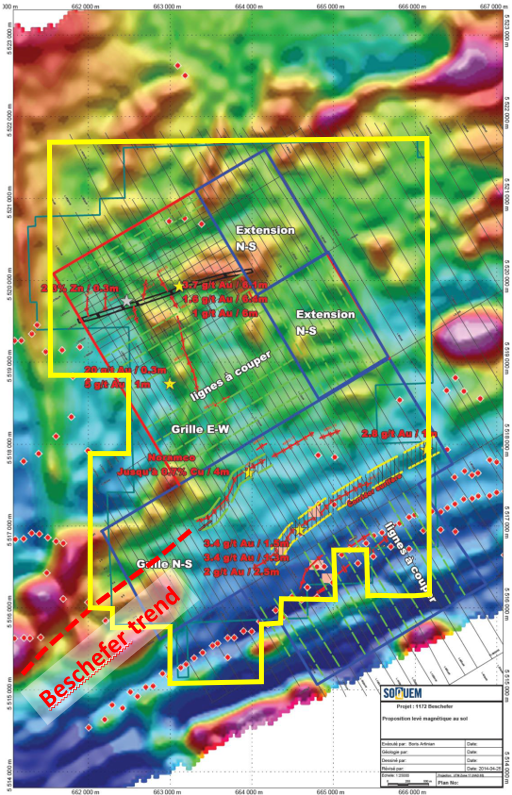

History: The Project was worked intensively from the sixties to the early nineties by BHP Billiton while operating the Selbaie Mine. The use of diverse geophysical approaches in conjunction with overburden gold sampling was essential due to the thick overburden blanket. It led to the discovery of multiple gold, copper, silver, and zinc anomalies in a felsic volcanic rock environment.

The Project was then systematically explored by SOQUEM between 1992 and 2012, building a tight grid of geophysical anomalies, followed by drill testing. Exploration was done using a checkered geophysics line pattern to evaluate the potential of different structural orientations. Around 300km of surveyed lines were completed in conjunction with drilling 11,200 metres distributed in 42 holes. The Company aims to expand on the gold, copper and silver anomalies identified in prior drill programs and integrate data to confirm gold trends spatially associated with extensive low-grade base metal mineralized systems.

Results: The best gold results were obtained from the Power Line target located in the northern part of the Project. Hole 1172-99-30 returned a series of individual mineralized intervals from 2 to 5 g/t over lengths of 0.5 to 6 metres within a large interval of 70 metres. Hole 1172-13-40 intercepted 2.1 g/t over 5.4 metres, including 7.9 g/t over 0.9 metres. Gold mineralization is hosted in a quartz-carbonate centimetric veins network cross-cutting felsic to the intermediate volcanic rock affected by variable pervasive alteration associated with minor amounts of pyrite. Hole 1172-98-24 intersected the same type of mineralization but was hosted in deformed and carbonate-altered andesite located in the southern half of the property.

Short anomalous copper anomalies were intersected in a sector identified as the Noramco target. From prior SOQUEM programs, the best results were 0.26 % over 4.8 metres and 0.24% over 4 metres (1172-98-24 and 1172-99-30, respectively).

A summary of selected historical drill results is reported in Table 1:

|

Drill Hole

|

From (m)

|

To (m)

|

Length (m)1

|

Au (g/t)

|

|

1172-98-24

|

196.0

|

197.5

|

1.3

|

3.2

|

|

1172-99-30

|

127.7

|

128.7

|

1

|

4.99

|

|

184.1

|

184.7

|

0.6

|

5.38

|

|

191.8

|

197.9

|

6.1

|

2.03

|

|

1172-13-40

|

92.1

|

97

|

4.9

|

2.1

|

|

Incl.

|

92.1

|

93

|

0.9

|

7.88

|

|

1172-13-41

|

37

|

43

|

6

|

1

|

|

Drill Hole

|

From (m)

|

To (m)

|

Length (m)1

|

Cu (%)

|

|

1172-98-28

|

146.57

|

151.4

|

4.8

|

0.26

|

|

1172-13-34

|

171

|

175

|

4

|

0.24

|

Notes:

-

True widths of mineralization are not known.

-

Some intervals presented vary from those in Figure 1 due to the table including re-assaying results.

Geology: The Project is located in the eastern part of the Brouillan volcanic complex, which is a part of the North Volcanic Zone of the Abitibi Greenstone Belt. The drill coverage has highlighted the felsic dome facies, along with related lapillis and fine tuffs that have been affected by a north-east trending polyphased folding pattern. To the south, basalt and gabbros have been identified interlayered with graphitic sediments and cherts. Hydrothermal alterations have favorable characteristics for the exploration of volcanogenic massive sulfides deposits (VMS). On the west side of the Brouillan syn-volcanic intrusion, the Selbaie Mine produced 53 Mt of ore at grades of 0.96% Cu, 1.9% Zn, 40.7 g/t Ag, and 0.58 g/t Au. The rock units of the Project have been affected by deformation and structural elements related to the Bapst Fault. Additionally, the north-east deformation zones, including the extension of the Beschefer gold structure, are interpreted to pass through the property.

Figure 2: Property Wide Targets

Note:

-

Approximate updated property boundary shown in yellow.

Terms of the LOI Agreement:

Under the terms of the LOI, Melkior has the right to earn a 100% interest in the Project through an option, subject to a net smelter return royalty of up to 2.5% on certain claims made up of a historical NSR of 1.5% and 1% granted to SOQUEM. To earn an undivided 100% interest in the Project, Melkior must make total cash payments of $50,000, issue $500,000 worth of common shares in the capital of Melkior to SOQUEM and incur Work Expenditures of $1,500,000 in total, all in accordance with the anniversary dates in the table below:

|

Date

|

Cash

|

Shares

|

Work Expenditures

|

|

Upon execution of the Definitive Agreement

|

$50,000

|

$50,000 worth of common shares issued at the higher of 0.20 per share or the weighted average price of the common shares for the 10 trading days immediately preceding the date of the Definitive Agreement

|

NA

|

|

On or before the first anniversary of the execution of the Definitive Agreement

|

$0

|

$100,000 worth of common shares issued at the higher of 0.20 per share or the weighted average price of the common shares for the 10 trading days immediately preceding the first anniversary of the Definitive Agreement

|

$375,000 in aggregate Work Expenditures

|

|

On or before the second anniversary of the execution of the Definitive Agreement

|

$0

|

$150,000 worth of common shares issued at the higher of 0.20 per share or the weighted average price of the common shares for the 10 trading days immediately preceding the second anniversary of the Definitive Agreement

|

$750,000 in Work Expenditures in the aggregate (including the $375,000 Year 1 Work Expenditures)

|

|

On or before the third anniversary of the execution of the Definitive Agreement

|

$0

|

$200,000 worth of common shares issued at the higher of 0.20 per share or the weighted average price of the common shares for the 10 trading days immediately preceding the third anniversary of the Definitive Agreement

|

$1,500,000 in Work Expenditures in the aggregate (including the Year 1 and Year 2 Work Expenditures)

|

The LOI will shortly be replaced with the Definitive Agreement and the Definitive Agreement and issuance of shares to SOQUEM thereunder is subject to TSX Venture Exchange (“TSXV”) approval and the Company’s filing requirements with TSXV. All common shares of Melkior issued under the Definitive Agreement will be subject to a hold period of 4 months and one day from the date of issuance.

Qualified Person

This press release was reviewed and approved by Martin Demers, P.Geo, OGQ No 770, who is a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release. Mr. Demers is a consultant for Melkior.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

Source of information:

1. ARTINIAN, B., DESBIENS-LEVESQUE, J.-F., 2014. RAPPORT D'EXPLORATION AUTOMNE 2013, BESCHEFER (1172). SOQUEM INC, rapport statutaire soumis au gouvernement du Québec; GM 68956, 366 pages, 11 plans.

2. Rapport de la campagne de forages – Décembre 1995/Janvier 1996 – Projet Beschfer (#1172-1), Verschelden R., Soquem, Assesssment report GM-56628.

3. NI 43-101 Technical Report for the Detour-Fenelon Gold Trend Property, Quebec, Canada, March 3,2023

ON BEHALF OF THE BOARD

Jonathon Deluce, CEO

For more information, please contact:

Melkior Resources Inc.

E-mail: info@melkior.com

Tel: 226-271-5170

The reader is invited to visit Melkior’s web site https://www.melkior.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release, and include statements with respect to the anticipated timing of entry into the Definitive Agreement and closing and payments thereunder and statements with respect to the non- current 43-101 resource estimates on the property to be acquired by the Company. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with the failure to complete the terms of the Agreement, possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company’s business and prospects.; the business and operations of the Company; unprecedented market and economic risks associated with current unprecedented market and economic circumstances due to the COVID-19 pandemic, as well as those risks and uncertainties identified and reported in the Company's public filings under its SEDAR profile at www.sedar.com. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions or changes in factors affecting such forward-looking statements.

1 References to nearby properties is for information purposes only and there are no assurances the Company will receive the same results.

Copyright (c) 2023 TheNewswire - All rights reserved.