All sites on plan, Company on track to meet annual production and cost guidance Tasiast, Paracatu and La Coipa deliver strong production, margins and cash flow

TORONTO, May 09, 2023 (GLOBE NEWSWIRE) -- Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the “Company”) today announced its results for the first-quarter ended March 31, 2023.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. Please refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on page 28 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

Q1 2023 highlights from continuing operations:

- The Company is on track to meet its 2023 annual guidance.

- Production of 466,022 gold equivalent ounces (Au eq. oz.), a 23% year-over-year increase, and sales of 490,330 Au eq. oz.

- Production cost of sales1 of $987 per Au eq. oz. sold and all-in sustaining cost2 of $1,321 per Au eq. oz. sold.

- Margins3 of $907 per Au eq. oz. sold.

- Operating cash flow4 of $259.0 million and adjusted operating cash flow2 of $358.2 million.

- Reported net earnings5 of $90.2 million, or $0.07 per share, with adjusted net earnings2, 6 of $87.6 million, or $0.07 per share2.

- Cash and cash equivalents of $471.0 million, and totalliquidity7 of approximately $1.7 billion at March 31, 2023.

- Kinross’ Board of Directors declared a quarterly dividend of $0.03 per common share payable on June 15, 2023 to shareholders of record at the close of business on June 1, 2023.

Operational and development project highlights:

- In the first quarter, Tasiast achieved two record-production months in January and March driven by record grades, and successfully completed a planned shutdown in February related to the Tasiast 24k expansion project. The Tasiast 24k project remains on budget and on schedule to reach 24,000 tonnes per day throughput in mid-2023.

- Paracatu was a solid contributor with higher year-over-year production at lower costs.

- La Coipa achieved record grades and recoveries since restarting operations last year and generated strong cash flow.

- The exploration program at Great Bear in Red Lake, Ontario, continues to make excellent progress. In 2023, Kinross expects to further delineate the deposit at depth and add inferred resource ounces. Drilling results continue to confirm gold mineralization at good widths and high grades, including at depths of 1.3 kilometres.

Environment, Social and Governance (ESG):

- Kinross published its 2022 Sustainability and ESG Report on May 9, 2023, detailing its refreshed ESG strategy as well as a comprehensive summary of its performance over the past year.

- In the most important area of safety, Kinross advanced its people-centric safety philosophy through new site level engagement programs and enhanced information sharing across operations.

- Bald Mountain was awarded the 2022 Reclamation Award for ‘Leadership in Concurrent Mine Reclamation.’

- Kinross advanced its Diversity, Equity and Inclusion (DEI) strategy in 2022, achieving the highest percentage of women employees at Kinross in the last five years, including the highest percentage of women in Science, Technology, Engineering and Mathematics (STEM) roles and 33% women on its Senior Leadership Team.

CEO commentary:

J. Paul Rollinson, President and CEO, made the following comments in relation to 2023 first-quarter results:

“Kinross delivered a strong first quarter with contributions from all of our sites resulting in a 23% increase in year-over-year production. Tasiast, La Coipa and Paracatu delivered strong production, margins and cash flow, including two record production months and record grades at Tasiast. Our U.S. operations delivered on plan as we continue to reinvest in our future with a focus on higher-margin opportunities.

“We continue to make excellent progress advancing our pipeline of development and exploration projects. The Tasiast 24k project is on schedule to reach nameplate capacity mid-year and the Tasiast solar power plant is expected to come online by the end of the year. At Great Bear, drilling results continue to confirm mineralization with good widths and high grades including at depths of more than one kilometre.

“Our portfolio of operations is well positioned and on track to deliver our annual production and cost guidance. We continue to maintain our financial strength and excellent liquidity, while bolstering our investment-grade balance sheet and continuing with our return of capital program.

“Mining responsibly and our strong commitment to ESG are integral to our business and are embedded in our culture and core values. We are pleased to publish our 2022 Sustainability and ESG Report which details our ESG strategy as well as another strong year of performance in this important area. Our goal is to be a partner of choice in the communities in which we operate while continuing to deliver meaningful and lasting benefits to all of our stakeholders. We remain focused on our commitment to reduce greenhouse gas emission intensity (on a per gold equivalent ounce basis) by 30% by 2030, driven by interim targets and a focus on continuous improvement and innovation.”

Summary of financial and operating results

|

Three months ended |

|

March 31, |

| (unaudited, in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) |

2023 |

2022 |

Operating Highlights |

|

|

| Total gold equivalent ounces from continuing operations(a),(b) |

|

|

| Produced |

|

466,022 |

|

378,421 |

| Sold |

|

490,330 |

|

373,728 |

|

|

|

| Financial Highlights from Continuing Operations(a) |

|

|

| Metal sales |

$ |

929.3 |

$ |

700.9 |

| Production cost of sales |

$ |

483.9 |

$ |

363.1 |

| Depreciation, depletion and amortization |

$ |

211.9 |

$ |

166.5 |

| Operating earnings |

$ |

143.9 |

$ |

102.5 |

| Net earnings from continuing operations attributable to common shareholders |

$ |

90.2 |

$ |

81.3 |

| Basic earnings per share from continuing operations attributable to common shareholders |

$ |

0.07 |

$ |

0.06 |

| Diluted earnings per share from continuing operations attributable to common shareholders |

$ |

0.07 |

$ |

0.06 |

| Adjusted net earnings from continuing operations attributable to common shareholders(c) |

$ |

87.6 |

$ |

68.8 |

| Adjusted net earnings from continuing operations per share(c) |

$ |

0.07 |

$ |

0.05 |

| Net cash flow of continuing operations provided from operating activities |

$ |

259.0 |

$ |

97.9 |

| Adjusted operating cash flow from continuing operations(c) |

$ |

358.2 |

$ |

249.1 |

| Capital expenditures from continuing operations(d) |

$ |

221.2 |

$ |

100.7 |

| Free cash flow from continuing operations(c) |

$ |

37.8 |

$ |

(2.8 |

| Average realized gold price per ounce from continuing operations(e) |

$ |

1,894 |

$ |

1,876 |

| Production cost of sales from continuing operations per equivalent ounce(b) sold(f) |

$ |

987 |

$ |

972 |

| Production cost of sales from continuing operations per ounce sold on a by-product basis(c) |

$ |

929 |

$ |

966 |

| All-in sustaining cost from continuing operations per ounce sold on a by-product basis(c) |

$ |

1,284 |

$ |

1,227 |

| All-in sustaining cost from continuing operations per equivalent ounce(b) sold(c) |

$ |

1,321 |

$ |

1,231 |

| Attributable all-in cost(g) from continuing operations per ounce sold on a by-product basis(c) |

$ |

1,616 |

$ |

1,466 |

| Attributable all-in cost(g) from continuing operations per equivalent ounce(b) sold(c) |

$ |

1,634 |

$ |

1,468 |

| (a) |

Results for the three months ended March 31, 2023 and 2022 are from continuing operations and exclude results from the Company’s Chirano and Russian operations due to the classification of these operations as discontinued and their later sale in 2022. The comparative information for the three months ended March 31, 2022, as previously presented in the MD&A and financial statements for the three months ended March 31, 2022, has been updated retrospectively to exclude results from the Company’s Chirano operations. |

| (b) |

“Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the first quarter of 2023 was 83.82:1 (first quarter of 2022 - 78.19:1). |

| (c) |

The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages 17 to 22 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. |

| (d) |

“Capital expenditures from continuing operations” is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. |

| (e) |

“Average realized gold price per ounce from continuing operations” is defined as gold metal sales from continuing operations divided by total gold ounces sold from continuing operations. |

| (f) |

“Production cost of sales from continuing operations per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold from continuing operations. |

| (g) |

“Attributable all-in cost” includes Kinross’ share of Manh Choh (70%) costs. |

|

|

The following operating and financial results are based on first-quarter gold equivalent production:

Production: Kinross produced 466,022 Au eq. oz. in Q1 2023 from continuing operations, compared with 378,421 Au eq. oz. in Q1 2022. The 23% year-over-year increase was primarily attributable to the ramp up of production at La Coipa in 2022 and higher production at Paracatu, Round Mountain and Fort Knox.

Sales: Kinross sold 490,330 Au eq. oz. in Q1 2023 from continuing operations, compared with 373,728 Au eq. oz. in Q1 2022. The year-over-year increase is primarily due to higher production and timing of gold equivalent ounces sold.

Average realized gold price: The average realized gold price from continuing operations in Q1 2023 was $1,894 per ounce, compared with $1,876 per ounce in Q1 2022.

Revenue: During the first quarter, revenue from continuing operations increased to $929.3 million, compared with $700.9 million during Q1 2022. The 33% increase is due to an increase in gold equivalent ounces sold and an increase in average realized gold price.

Production cost of sales: Production cost of sales1 from continuing operations per Au eq. oz. sold was $987 for the quarter, compared with $972 in Q1 2022, primarily due to higher costs at the Company’s Nevada operations, largely offset by increased production.

Production cost of sales from continuing operations per Au oz. sold2 on a by-product basis was $929 in Q1 2023, compared with $966 in Q1 2022, based on gold sales of 461,696 ounces and silver sales of 2,400,198 ounces.

Margins3: Kinross’ margin from continuing operations per Au eq. oz. sold was $907 for Q1 2023, in line with the Q1 2022 margin of $904.

All-in sustaining cost2: All-in sustaining cost from continuing operations per Au eq. oz. sold was $1,321 in Q1 2023, compared with $1,231 in Q1 2022.

In Q1 2023, all-in sustaining cost from continuing operations per Au oz. sold on a by-product basis was $1,284, compared with $1,227 in Q1 2022.

Operating cash flow: Operating cash flow from continuing operations4 was $259.0 million for Q1 2023, compared with $97.9 million for Q1 2022.

Adjusted operating cash flow from continuing operations2 increased to $358.2 million in Q1 2023, compared with $249.1 million for Q1 2022.

Free cash flow2: Free cash flow from continuing operations in Q1 2023 was $37.8 million, which includes total working capital changes8 representing an outflow of $99.2 million, compared with a net outflow of $2.8 million in Q1 2022, which included total working capital changes8 representing an outflow of $151.2 million.

Earnings: Reported net earnings5 from continuing operations was $90.2 million, or $0.07 per share for Q1 2023, compared with reported net earnings of $81.3 million, or $0.06 per share, for Q1 2022. The increase in reported net earnings was mainly due to the increase in margins.

Adjusted net earnings from continuing operations2,6 was $87.6 million, or $0.07 per share, for Q1 2023, compared with $68.8 million, or $0.05 per share, for Q1 2022.

Capital expenditures: Capital expenditures from continuing operations increased to $221.2 million for Q1 2023, compared with $100.7 million for Q1 2022, primarily due to an increase in capital stripping at Tasiast, Fort Knox and Bald Mountain and development activities at Manh Choh.

Balance sheet

As of March 31, 2023, Kinross had cash and cash equivalents of $471.0 million, compared with $418.1 million at December 31, 2022.

The Company had additional available credit9 of approximately $1.3 billion and total liquidity7 of approximately $1.7 billion.

Return of capital

As part of its continuing quarterly dividend program, the Company declared a dividend of $0.03 per common share payable on June 15, 2023, to shareholders of record as of June 1, 2023.

Under the Company’s current share buyback program, the amount of capital returned through buybacks is based on excess cash (defined as free cash flow after paying interest and dividends) generated in each quarter, with actual share repurchases occurring on a one quarter lag basis. As such, there were no repurchases in the first quarter and the Company expects to repurchase shares in the second half of the year.

Operating results

Mine-by-mine summaries for 2023 first-quarter operating results may be found on pages 12 and 16 of this news release. Across the portfolio, all projects are on plan and met quarterly production targets. Highlights include the following:

At Tasiast, production was lower quarter-over-quarter and year-over-year primarily due to lower throughput as a result of the planned shutdown in February mainly for tie-ins at the Tasiast 24k project. Notwithstanding the planned shutdown, monthly production records were achieved in both January and March as the lower quarter-over-quarter throughput was partially offset by improving recoveries and record-high grades as a result of mine sequencing. Cost of sales per ounce sold was higher compared with the previous quarter due to lower production, and lower year-over-year mainly due to lower operating waste mined in the first quarter of 2023.

At Paracatu, production was on plan and increased year-over-year primarily due to higher throughput, grades and recoveries, and decreased quarter-over-quarter mainly due to expected lower grades and recoveries as a result of planned mine sequencing, partially offset by higher throughput. Cost of sales per ounce sold was lower year-over-year mainly due to increased production and higher quarter-over-quarter mainly due to lower production.

At Fort Knox, production was lower compared with the previous quarter mainly due to the seasonal effect of fewer ounces recovered from the heap leach pads. Year-over-year production increased largely due to higher mill production as a result of higher grades processed. Production cost of sales per ounce sold was in line quarter-over-quarter, and lower year-over-year due to higher production.

At Round Mountain, production was slightly lower than the previous quarter mainly due to fewer ounces recovered from the heap leach pads. Production increased year-over-year due to an increase in ounces recovered from the heap leach pads. Cost of sales per ounce sold increased quarter-over-quarter due to lower production and lower capital development, and increased year-over-year due to inflationary cost pressures on power and reagent costs, maintenance supplies and lower capital development.

At Bald Mountain, production decreased quarter-over-quarter mainly due to fewer ounces recovered from the heap leach pads related to a decrease in tonnes placed on the heap leach pads, partially offset by higher grades. Year-over-year production decreased mainly due to fewer tonnes placed on the heap leach pads and lower grades. Cost of sales per ounce sold increased quarter-over-quarter due to lower production and year-over-year largely due to higher reagent costs and royalties. The unprecedented winter snowfall had an impact on mining and stacking activities at Bald Mountain, however the site achieved quarterly production targets and has made strong progress catching up on mining activities in April.

At La Coipa, production was lower compared with the previous quarter mainly due to the planned mill shutdown to increase mill reliability, resulting in lower throughput, partially offset by higher grades and strong recoveries. Cost of sales per ounce sold increased quarter-over-quarter mainly due to lower production. The Company continues to focus on optimizing the plant and maintaining the outperformance on recovery, and production at La Coipa remains on plan for the year. La Coipa poured first gold in February 2022 and ramped up in the second half of the year.

Development projects and exploration update

Tasiast

The Tasiast 24k project continues to progress on budget and on schedule to reach designed throughput of 24,000 t/d by mid-year and ramp-up to operate consistently at this design throughput by the end of the year. The successful execution of the mill shutdown in February put into operation a new vibrating screen at the SAG discharge, as well as an upgrade to a higher capacity SAG primary cyclone cluster. Mechanical and electrical installation works are substantially advanced on the pre-classification circuit (the remaining 24k debottlenecking scope), with pre-commissioning of subsystems having commenced in April and phased commissioning expected to continue through to the end of June. A shutdown is planned in June in connection with the 24k expansion project.

The 34MW Tasiast solar power plant continues to advance and is on schedule for completion by the end of the year. All photovoltaic modules have arrived and procurement is substantially complete with all critical equipment on site or in transit. Civil works are well advanced and mechanical assembly installation is progressing well as the installation of the first photovoltaic modules started in April.

Great Bear

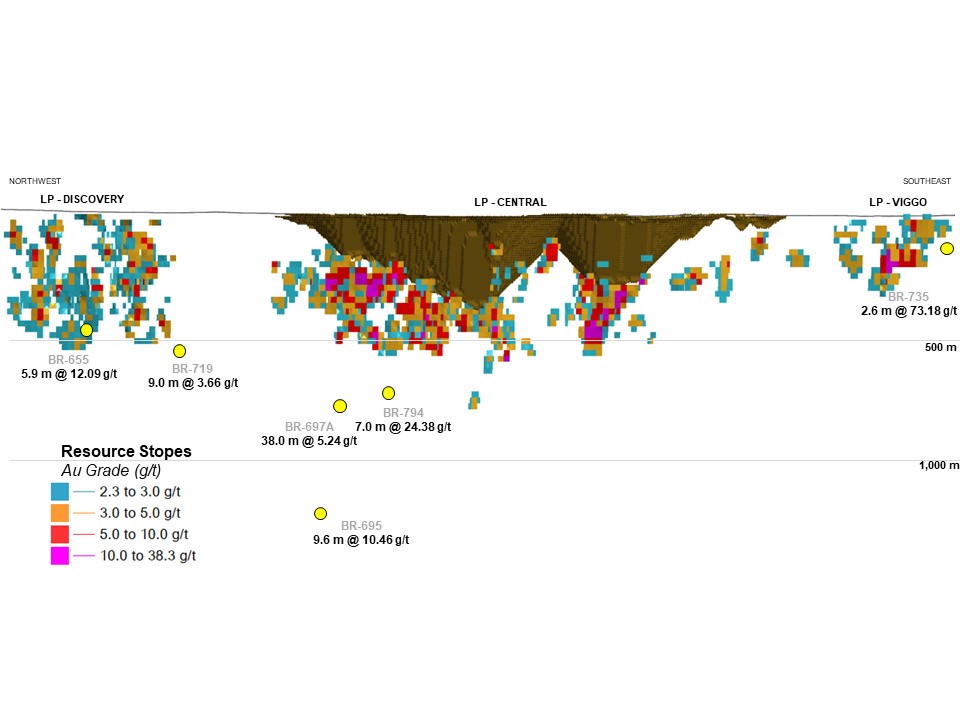

The Company continues to make excellent progress at the Great Bear project in Red Lake, Ontario. In the first quarter, Kinross drilled approximately 38,000 metres as part of its robust exploration and infill drilling program. Kinross’ focus this year is on inferred drilling in the area half a kilometre to one kilometre below surface. This work will be complemented by exploration drilling along strike of the LP Fault zone and around the Hinge and Limb zones that have seen little exploration drilling for new mineralization beyond the known zones, with the goal of further delineating the deposit at depth as well as adding inferred resource ounces.

Since its last update on February 13, 2023, the Company has received additional assay results, with a selection of the new results from targets at the LP Fault and Limb zones highlighted in the table below. Notable exploration results at Great Bear in the first quarter include:

- BR-695 (Yuma) – 9.6m @ 10.5 g/t at a depth of 1,300m

- BR-697A (Yuma) – 38m @ 5.2 g/t, including 4.2m @ 32.4 g/t, at a depth of 800m

- BR-735 (Viggo) – 2.6m @ 73 g/t, at a depth of 100m

- DL-132 (Limb) – 5.9m @ 7.8 g/t at a depth of 900m

Results-to-date continue to support the view of a high-grade deposit that underpins the prospect of a large, long-life mining complex with the recent results continuing to demonstrate the high-grade nature of the mineralization. Hole BR-695, the deepest hole to date on the property, intersected a 9.6m interval at 10.5 g/t gold at a vertical depth of 1.3 kilometres. The latest results also confirm the system has broad zones of mineralization as seen in hole BR-697A that intersected a 38m interval at 5.2 g/t gold including a 4.2m interval of 32.4 g/t gold, at a vertical depth of 800m. Hole BR-735 intersected 2.6m at 73 g/t gold at a vertical depth of 100m and extends the strike length of the Viggo mineralization. In the Limb zone (Red Lake style of mineralization) hole DL-132 intersected 5.9m of 7.8 g/t gold at a vertical depth of 900m, once again demonstrating that this system also continues at depth.

The Company is also progressing studies and permitting for an advanced exploration program that would establish an underground decline to obtain a bulk sample and allow for more efficient exploration of deeper areas of the LP Fault zone, along with the nearby Hinge and Limb gold zones. Kinross is targeting a potential start of the surface construction for the advanced exploration program as early as 2024.

Baseline environmental surveys, local community socio-economic studies and engineering activities required for the permitting process for the main project are progressing well. The Company continues to work together to build a mutually beneficial relationship with the Wabauskang and Lac Seul First Nations, on whose traditional territories the project is located, and is providing support for their technical resources in the area of environmental monitoring. Kinross continues to advance technical studies and permitting activities, with plans to release the results of this work in the form of a preliminary economic assessment in 2024.

Selected Great Bear Drill Results

See Appendix A for full results.

| Hole ID |

|

From

(m)

|

To

(m) |

Width

(m) |

True

Width (m) |

Au

(g/t) |

Target

|

| BR-655 |

|

542.9 |

592.2 |

49.3 |

36.0 |

2.88 |

Discovery |

| BR-655 |

including |

549.0 |

552.9 |

3.9 |

2.8 |

3.52 |

|

| BR-655 |

and including |

577.8 |

585.9 |

8.1 |

5.9 |

12.09 |

|

| BR-655 |

and |

598.3 |

610.0 |

11.7 |

8.7 |

1.11 |

|

| BR-655 |

and |

628.8 |

632.0 |

3.3 |

2.5 |

0.53 |

|

| BR-655 |

and |

648.0 |

652.2 |

4.1 |

3.5 |

0.83 |

|

| BR-655 |

and |

688.5 |

695.5 |

7.0 |

5.2 |

3.44 |

|

| BR-655 |

including |

688.5 |

693.8 |

5.3 |

3.9 |

3.96 |

|

| BR-655 |

and |

708.0 |

712.5 |

4.5 |

3.8 |

0.51 |

|

| BR-695 |

|

1,363.8 |

1,373.3 |

9.5 |

8.6 |

2.07 |

Yuma |

| BR-695 |

including |

1,363.8 |

1,367.4 |

3.6 |

3.3 |

5.02 |

|

| BR-695 |

|

1,530.0 |

1,551.0 |

21.0 |

19.1 |

1.14 |

|

| BR-695 |

|

1,556.5 |

1,602.2 |

45.7 |

41.6 |

2.71 |

|

| BR-695 |

including |

1,556.5 |

1,567.0 |

10.6 |

9.6 |

10.46 |

|

| BR-695 |

including |

1,561.4 |

1,565.0 |

3.7 |

3.3 |

24.38 |

|

| BR-695 |

|

1,617.2 |

1,620.0 |

2.8 |

2.5 |

5.31 |

|

| BR-697A |

|

968.8 |

971.8 |

3.0 |

2.8 |

0.46 |

Yuma |

| BR-697A |

and |

1,004.2 |

1,046.2 |

42.1 |

38.0 |

5.24 |

|

| BR-697A |

including |

1,027.4 |

1,032.0 |

4.7 |

4.2 |

32.35 |

|

| BR-697A |

and |

1,044.2 |

1,044.9 |

0.8 |

0.7 |

64.50 |

|

| BR-719 |

|

620.7 |

627.6 |

6.8 |

5.3 |

0.82 |

Bruma |

| BR-719 |

and |

680.4 |

706.3 |

25.9 |

19.4 |

2.05 |

|

| BR-719 |

including |

682.0 |

694.0 |

12.0 |

9.0 |

3.66 |

|

| BR-735 |

|

120.0 |

123.0 |

3.0 |

2.6 |

73.18 |

Viggo |

| BR-735 |

including |

121.5 |

123.0 |

1.5 |

1.3 |

146.00 |

|

| BR-794 |

|

942.0 |

953.5 |

11.5 |

9.0 |

3.77 |

Yauro |

| BR-794 |

including |

942.0 |

944.0 |

2.0 |

1.6 |

6.54 |

|

| BR-794 |

and including |

952.0 |

952.8 |

0.8 |

0.6 |

35.60 |

|

| BR-794 |

and |

964.0 |

972.0 |

8.0 |

7.0 |

24.38 |

|

| BR-794 |

and |

997.4 |

1,013.0 |

15.7 |

11.4 |

1.76 |

|

| BR-794 |

and |

1,083.6 |

1,088.7 |

5.1 |

3.9 |

1.23 |

|

| DL-132 |

|

898.1 |

904.8 |

6.7 |

5.4 |

3.62 |

Limb |

| DL-132 |

including |

899.1 |

904.8 |

5.7 |

4.6 |

4.14 |

|

| DL-132 |

and |

1,059.9 |

1,066.7 |

6.8 |

5.9 |

7.75 |

|

| DL-132 |

including |

1,060.9 |

1,061.5 |

0.6 |

0.5 |

76.40 |

|

Results are preliminary in nature and are subject to on-going QA/QC. Lengths are subject to rounding.

See Appendix B for a LP Fault zone long section.

Manh Choh

At the 70% owned Manh Choh project, activities remain on schedule and on budget, with the early works program completed successfully. The camp is now operational, supporting the construction activities underway, and is being managed by an Alaska-based firm. Long lead procurement orders have been expedited and onboarding of key construction and operational contractors continues to advance as planned for both the Manh Choh site and Fort Knox mill modifications. The public comment period for the operating permits was successfully completed and the overall permitting process remains on track. The Company continues to plan for the construction ramp-up with a steadfast focus on developing the mine while keeping the safety of our people and the environment at the forefront and continuing to build strong relationships with communities and the Native Village of Tetlin.

The Company announced on July 27, 2022, that it was proceeding with the Manh Choh project as the operator of the joint venture. Initial production from Manh Choh is expected in the second half of 2024 and is expected to add approximately 640,000 attributable Au eq. oz. to the Company’s production profile over its approximately 4.5 year life-of-mine.

Chile

Kinross’ activities in Chile are currently focused on La Coipa and potential opportunities to extend its mine life. The Lobo-Marte project continues to provide optionality as a potential large, low-cost mine upon the conclusion of mining at La Coipa. While the Company focuses its technical resources on La Coipa, it will continue to engage and build relationships with communities related to Lobo-Marte and government stakeholders.

Curlew Basin exploration

At the CurlewBasin exploration project in Washington State, located approximately 35 kilometres north of the Company’s Kettle River mill by paved road, underground exploration drill results continue to confirm vein extensions and continuity within high priority target areas. Exploration drilling is underway and will continue throughout the remainder of the year with the goal of building on the resource.

Exploration drill results received during the quarter include:

- LP – 3.0m @ 37.3 g/t Au and 6.9m @ 11.7 g/t Au (1136 & 1135)

- K5N – 2.3m @ 24.2 g/t Au and 2.7m @ 20.7 g/t Au (1402)

- K5S – 2.8m @ 10.6 g/t Au and 4.8m @ 8.75 g/t Au (1147)

Round Mountain Phase X and Gold Hill exploration

Kinross continues to focus on progressing the higher-margin, higher-return underground opportunities at Phase X and Gold Hill.

Construction of the exploration decline at Phase X started in the first quarter and underground development is progressing to start definition drilling in early 2024. The Company is also advancing studies and permitting for a potential underground mine at Phase X in parallel with the underground development to advance our path to production.

Phase X is a continuation of the world-class Round Mountain low sulfidation epithermal system (over 16Moz. produced which consists of disseminated gold hosted in a rhyolite tuff). This mineralized zone progressively deepens westward due to a combination of a gentle west-dip and down-dropping along a series of ‘Basin and Range’ faults.

At the Gold Hill exploration project, located approximately seven kilometres northeast of Round Mountain, drilling commenced early this year with four drill rigs and permitting for an underground decline is progressing. Exploration drilling is focused on extending the Jersey vein and testing continuity of the mid-Atlantic vein zone. Drilling thus far has successfully intersected the targeted veins and assays will be included in the Company’s second quarter results.

Gold Hill is a low sulfidation epithermal vein system consisting of high-grade narrow quartz veins with significant strike continuity. Historic underground mining (current pit area) produced approximately 40koz with a grade of 10g/t Au.

Company Guidance

The following section of the news release represents forward-looking information and users are cautioned that actual results may vary. We refer to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on page 28.

The Company is on track to meet its 2023 production guidance of 2.1 million Au eq. oz. (+/- 5%). Production is expected to increase following the first quarter, largely driven by expected higher production at Tasiast and La Coipa, as well as the seasonal impacts on mining at Paracatu and the Company’s US heap leach operations. Kinross’ annual production is expected to remain stable in 2024 and 2025 at 2.1 million and 2.0 million attributable10 Au eq. oz. (+/- 5%), respectively.

The Company is also on track to meet its 2023 guidance for production cost of sales, all-in sustaining cost and attributable11 capital expenditures.

Environment, Social and Governance (ESG) update

Kinross published its 2022 Sustainability and ESG Report on May 9, 2023, detailing its approach to sustainability, its ESG strategy and strong performance in this area over the past year. At the core of Kinross’ business is its commitment to safety and the health of its people, environmental stewardship, and the well-being of its host communities.

Access the full Sustainability and ESG Report here: www.kinross.com/2022-Sustainability-and-ESG-Report

For highlights of the Report, read here: www.kinross.com/Kinross-release-2022-Sustainability-and-ESG-Report

Kinross’ updated ESG strategy outlines three key pillars – Workforce and Community, Natural Capital, and Climate and Energy – through to 2030 and beyond as priority focus areas to make strong contributions and build shared value.

Kinross’ leading performance was reinforced by continued high ratings and rankings within our peer group. The Company achieved its highest S&P ESG Global rating in 2022, ranking in the 97th percentile, the highest ever placement for Kinross, improved its Sustainalytics risk rating score with a significant 10-point increase, and maintained its ‘A’ position with MSCI for the third-consecutive year.

Kinross obtained external assurance of both selected ESG performance metrics and conformance with the Responsible Gold Mining Principles established by the World Gold Council and, following the Company’s normal practice, has provided Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) indices.

Other highlights from the 2022 Sustainability and ESG Report include:

- In the most important area of safety, improvements were made across all leading areas including a “Critical Risk Management Blitz” to identify opportunities and weaknesses and launching a new Global Safety Learning Forum to advance Kinross’ people-centric safety philosophy through site level engagement and information sharing across operations.

- In 2022, Kinross generated $2.9 billion in economic benefits in its host countries through taxes, wages, procurement and community support, including donations. Since 2010, $44 billion has been contributed to the economies of Kinross’ host countries.

- Kinross made strides in its DEI strategy achieving the highest percentage of women employees at Kinross in the last five years, including the highest percentage of women in STEM roles at 15% and the highest percentage of women in management positions, including 33% women on its Senior Leadership Team. At sites, high-levels of in-country employment were maintained with 99% of non-management employees and 87% of management from within host countries.

- For reclamation efforts that go beyond standard reclamation requirements, Bald Mountain was awarded the 2022 Reclamation Award for ‘Leadership in Concurrent Mine Reclamation’ from the Nevada Division of Environmental Protection, Nevada Department of Wildlife (NDOW), US Forest Service, US Bureau of Land Management (BLM) and the Nevada Division of Minerals.

In the first quarter of 2023, Kinross maintained its strong ESG performance, including setting up a cross-functional Corporate Human Rights Task Force that is focused on delivering a four-part action plan. In host communities, more than $1.3 million of monetary and in-kind contributions were made through site community investment strategies and a high level of stakeholder interaction was maintained.

Kinross maintained close engagement with Indigenous communities related to its projects and operations, including advancing discussions with the Wabauskang and Lac Seul First Nations on how the Great Bear project can provide long-lasting benefits to their communities. At Manh Choh, the Alaska Department of Labor and Workforce Development provided the University of Alaska Fairbank’s Mining and Training Petroleum Service program with a $300,000 grant, in partnership with Kinross Alaska, to support local communities with the training and skills needed to secure jobs at Manh Choh. In Chile, eight members of the Colla indigenous communities related to La Coipa and Lobo Marte graduated from an adult education program. Learn more about Kinross’ work with the Colla community here: https://youtu.be/4we2gHyBEWg.

Conference call details

In connection with this news release, Kinross will hold a conference call and audio webcast on Wednesday, May 10, 2023, at 7:45 a.m. EDT to discuss the results, followed by a question-and-answer session. To access the call, please dial:

Canada & US toll-free – 1 (888) 330-2446; Passcode: 4915537

Outside of Canada & US – 1 (240) 789-2732; Passcode: 4915537

Replay (available up to 14 days after the call):

Canada & US toll-free – 1-800-770-2030; Passcode: 4915537

Outside of Canada & US – 1-647-362-9199; Passcode: 4915537

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com. The audio webcast will be archived on www.kinross.com.

This release should be read in conjunction with Kinross’ 2023 first-quarter unaudited Financial Statements and Management’s Discussion and Analysis report at www.kinross.com. Kinross’ 2023 first-quarter unaudited Financial Statements and Management’s Discussion and Analysis have been filed with Canadian securities regulators (available at www.sedar.com) and furnished with the U.S. Securities and Exchange Commission (available at www.sec.gov). Kinross shareholders may obtain a copy of the financial statements free of charge upon request to the Company.

Virtual Annual Meeting of Shareholders

Kinross’ Annual Meeting of Shareholders will be held on Wednesday, May 10, 2023, at 10:00 a.m. EDT.

The Company has elected to hold a virtual meeting via a live audio webcast to provide enhanced flexibility and opportunity for shareholder participation irrespective of their geographic location and share ownership. Further, with advancements in conferencing technology and the residual impacts of the COVID-19 pandemic, Kinross believes this expedient approach will still provide the same level of disclosure, transparency and participation as previous meetings.

The virtual meeting will be accessible online at: web.lumiagm.com/417158950.

Voting and participation instructions for eligible shareholders are provided in the Company’s Notice of Annual Meeting of Shareholders and Management Information Circular.

The link to the virtual meeting will also be accessible at www.kinross.com and will be archived for later use.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol:K) and the New York Stock Exchange (symbol:KGC).

Media Contact

Victoria Barrington

Senior Director, Corporate Communications

phone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

Chris Lichtenheldt

Vice-President, Investor Relations

phone: 416-365-2761

chris.lichtenheldt@kinross.com

Review of operations

|

|

|

|

|

|

|

|

Three months ended March 31,

(unaudited) |

Gold equivalent ounces

|

|

|

|

|

|

|

|

Produced |

|

Sold |

|

Production cost of

sales ($millions) |

|

Production cost of

sales/equivalent ounce sold |

|

2023 |

2022 |

|

2023 |

2022 |

|

2023 |

2022 |

|

2023 |

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Fort Knox |

65,387 |

54,803 |

|

65,404 |

52,813 |

|

$ |

77.6 |

$ |

67.4 |

|

$ |

1,186 |

$ |

1,276 |

| Round Mountain |

58,832 |

45,319 |

|

58,226 |

46,959 |

|

|

96.5 |

|

52.3 |

|

|

1,657 |

|

1,114 |

| Bald Mountain |

33,828 |

36,071 |

|

47,283 |

41,017 |

|

|

58.0 |

|

40.3 |

|

|

1,227 |

|

983 |

| United States Total |

158,047 |

136,193 |

|

170,913 |

140,789 |

|

|

232.1 |

|

160.0 |

|

|

1,358 |

|

1,136 |

|

|

|

|

|

|

|

|

|

|

|

|

| Paracatu |

123,334 |

108,009 |

|

128,344 |

101,886 |

|

|

118.0 |

|

106.6 |

|

|

919 |

|

1,046 |

| La Coipa |

53,596 |

524 |

|

61,780 |

- |

|

|

44.9 |

|

- |

|

|

727 |

|

- |

| Maricunga |

- |

- |

|

814 |

858 |

|

|

0.5 |

|

0.7 |

|

|

614 |

|

816 |

| Tasiast |

131,045 |

133,695 |

|

128,479 |

130,195 |

|

|

88.4 |

|

95.8 |

|

|

688 |

|

736 |

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing Operations Total |

466,022 |

378,421 |

|

490,330 |

373,728 |

|

|

483.9 |

|

363.1 |

|

|

987 |

|

972 |

|

|

|

|

|

|

|

|

|

|

|

|

| Discontinued Operations |

|

|

|

|

|

|

|

|

|

|

|

| Kupol |

- |

95,891 |

|

- |

85,937 |

|

|

- |

|

65.4 |

|

$ |

- |

$ |

761 |

| Chirano (100%) |

- |

34,929 |

|

- |

35,810 |

|

|

- |

|

47.6 |

|

|

- |

|

1,329 |

|

- |

130,820 |

|

- |

121,747 |

|

|

- |

|

113.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interim condensed consolidated balance sheets

| (unaudited, expressed in millions of U.S. dollars, except share amounts) |

|

|

|

|

|

|

|

|

|

|

|

As at |

|

|

March 31, |

|

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

| Assets |

|

|

|

|

| Current assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

471.0 |

|

|

$ |

418.1 |

|

| Restricted cash |

|

|

10.9 |

|

|

|

10.1 |

|

| Accounts receivable and other assets |

|

|

290.5 |

|

|

|

318.2 |

|

| Current income tax recoverable |

|

|

6.5 |

|

|

|

8.5 |

|

| Inventories |

|

|

1,138.9 |

|

|

|

1,072.2 |

|

| Unrealized fair value of derivative assets |

|

|

23.0 |

|

|

|

25.5 |

|

|

|

|

1,940.8 |

|

|

|

1,852.6 |

|

| Non-current assets |

|

|

|

|

| Property, plant and equipment |

|

|

7,793.1 |

|

|

|

7,741.4 |

|

| Long-term investments |

|

|

100.2 |

|

|

|

116.9 |

|

| Other long-term assets |

|

|

660.8 |

|

|

|

680.9 |

|

| Deferred tax assets |

|

|

5.5 |

|

|

|

4.6 |

|

| Total assets |

|

$ |

10,500.4 |

|

|

$ |

10,396.4 |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| Current liabilities |

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

479.3 |

|

|

$ |

550.0 |

|

| Current income tax payable |

|

|

44.6 |

|

|

|

89.4 |

|

| Current portion of long-term debt and credit facilities |

|

|

535.3 |

|

|

|

36.0 |

|

| Current portion of provisions |

|

|

50.8 |

|

|

|

50.8 |

|

| Other current liabilities |

|

|

16.4 |

|

|

|

25.3 |

|

|

|

|

1,126.4 |

|

|

|

751.5 |

|

| Non-current liabilities |

|

|

|

|

| Long-term debt and credit facilities |

|

|

2,158.9 |

|

|

|

2,556.9 |

|

| Provisions |

|

|

799.1 |

|

|

|

755.9 |

|

| Long-term lease liabilities |

|

|

24.0 |

|

|

|

23.1 |

|

| Other long-term liabilities |

|

|

125.0 |

|

|

|

125.3 |

|

| Deferred tax liabilities |

|

|

311.2 |

|

|

|

301.5 |

|

| Total liabilities |

|

$ |

4,544.6 |

|

|

$ |

4,514.2 |

|

|

|

|

|

|

| Equity |

|

|

|

|

| Common shareholders’ equity |

|

|

|

|

| Common share capital |

|

$ |

4,480.2 |

|

|

$ |

4,449.5 |

|

| Contributed surplus |

|

|

10,641.1 |

|

|

|

10,667.5 |

|

| Accumulated deficit |

|

|

(9,198.2 |

) |

|

|

(9,251.6 |

) |

| Accumulated other comprehensive income (loss) |

|

|

(36.1 |

) |

|

|

(41.7 |

) |

| Total common shareholders’ equity |

|

|

5,887.0 |

|

|

|

5,823.7 |

|

| Non-controlling interests |

|

|

68.8 |

|

|

|

58.5 |

|

| Total equity |

|

|

5,955.8 |

|

|

|

5,882.2 |

|

| Total liabilities and equity |

|

$ |

10,500.4 |

|

|

$ |

10,396.4 |

|

|

|

|

|

|

| Common shares |

|

|

|

|

| Authorized |

|

Unlimited

|

|

|

Unlimited |

|

| Issued and outstanding |

|

|

1,227,563,020 |

|

|

|

1,221,891,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interim condensed consolidated statements of operations

| (unaudited, expressed in millions of U.S. dollars, except share and per share amounts) |

|

|

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue |

|

|

|

|

| Metal sales |

|

$ |

929.3 |

|

|

$ |

700.9 |

|

|

|

|

|

|

| Cost of sales |

|

|

|

|

| Production cost of sales |

|

|

483.9 |

|

|

|

363.1 |

|

| Depreciation, depletion and amortization |

|

|

211.9 |

|

|

|

166.5 |

|

| Total cost of sales |

|

|

695.8 |

|

|

|

529.6 |

|

| Gross profit |

|

|

233.5 |

|

|

|

171.3 |

|

| Other operating expense |

|

|

31.2 |

|

|

|

15.2 |

|

| Exploration and business development |

|

|

34.0 |

|

|

|

23.4 |

|

| General and administrative |

|

|

24.4 |

|

|

|

30.2 |

|

| Operating earnings |

|

|

143.9 |

|

|

|

102.5 |

|

| Other income (expense) - net |

|

|

4.4 |

|

|

|

(6.7 |

) |

| Finance income |

|

|

9.4 |

|

|

|

2.2 |

|

| Finance expense |

|

|

(27.5 |

) |

|

|

(21.2 |

) |

| Earnings from continuing operations before tax |

|

|

130.2 |

|

|

|

76.8 |

|

| Income tax (expense) recovery - net |

|

|

(39.8 |

) |

|

|

4.5 |

|

| Earnings from continuing operations after tax |

|

|

90.4 |

|

|

|

81.3 |

|

| Earnings (loss) from discontinued operations after tax |

|

|

- |

|

|

|

(605.2 |

) |

| Net earnings (loss) |

|

$ |

90.4 |

|

|

$ |

(523.9 |

) |

| Net earnings from continuing operations attributable to: |

|

|

|

|

| Non-controlling interests |

|

$ |

0.2 |

|

|

$ |

- |

|

| Common shareholders |

|

$ |

90.2 |

|

|

$ |

81.3 |

|

| Net earnings (loss) from discontinued operations attributable to: |

|

|

|

|

| Non-controlling interests |

|

$ |

- |

|

|

$ |

(0.1 |

) |

| Common shareholders |

|

$ |

- |

|

|

$ |

(605.1 |

) |

| Net earnings (loss) attributable to: |

|

|

|

|

| Non-controlling interests |

|

$ |

0.2 |

|

|

$ |

(0.1 |

) |

| Common shareholders |

|

$ |

90.2 |

|

|

$ |

(523.8 |

) |

| Earnings per share from continuing operations attributable to common shareholders |

|

|

|

|

| Basic |

|

$ |

0.07 |

|

|

$ |

0.06 |

|

| Diluted |

|

$ |

0.07 |

|

|

$ |

0.06 |

|

| Earnings (loss) per share from discontinued operations attributable to common shareholders |

|

$ |

- |

|

|

$ |

(0.48 |

) |

| Basic |

|

$ |

- |

|

|

$ |

(0.48 |

) |

| Diluted |

|

|

|

|

| Earnings (loss) per share attributable to common shareholders |

|

|

|

|

| Basic |

|

$ |

0.07 |

|

|

$ |

(0.41 |

) |

| Diluted |

|

$ |

0.07 |

|

|

$ |

(0.41 |

) |

|

|

|

|

|

Interim condensed consolidated statements of cash flows

| (unaudited, expressed in millions of U.S. dollars) |

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| Net inflow (outflow) of cash related to the following activities: |

|

|

|

|

|

| Operating: |

|

|

|

|

|

| Earnings from continuing operations after tax |

|

|

$ |

90.4 |

|

|

$ |

81.3 |

|

| Adjustments to reconcile net earnings from continuing operations to net cash provided from operating activities: |

|

|

|

|

|

| Depreciation, depletion and amortization |

|

|

|

211.9 |

|

|

|

166.5 |

|

| Finance expense |

|

|

|

27.5 |

|

|

|

21.2 |

|

| Deferred tax expense (recovery) |

|

|

|

9.0 |

|

|

|

(16.9 |

) |

| Foreign exchange losses and other |

|

|

|

15.4 |

|

|

|

6.8 |

|

| Reclamation expense (recovery) |

|

|

|

4.0 |

|

|

|

(9.8 |

) |

| Changes in operating assets and liabilities: |

|

|

|

|

|

| Accounts receivable and other assets |

|

|

|

20.0 |

|

|

|

48.3 |

|

| Inventories |

|

|

|

(43.2 |

) |

|

|

(89.3 |

) |

| Accounts payable and accrued liabilities |

|

|

|

(5.8 |

) |

|

|

(27.8 |

) |

| Cash flow provided from operating activities |

|

|

|

329.2 |

|

|

|

180.3 |

|

| Income taxes paid |

|

|

|

(70.2 |

) |

|

|

(82.4 |

) |

| Net cash flow of continuing operations provided from operating activities |

|

|

|

259.0 |

|

|

|

97.9 |

|

| Net cash flow of discontinued operations provided from operating activities |

|

|

|

- |

|

|

|

98.4 |

|

| Investing: |

|

|

|

|

|

| Additions to property, plant and equipment |

|

|

|

(221.2 |

) |

|

|

(100.7 |

) |

| Interest paid capitalized to property, plant and equipment |

|

|

|

(38.3 |

) |

|

|

(10.6 |

) |

| Acquisitions net of cash acquired |

|

|

|

- |

|

|

|

(1,027.5 |

) |

| Net disposals (additions) to long-term investments and other assets |

|

|

|

15.3 |

|

|

|

(13.9 |

) |

| Increase in restricted cash - net |

|

|

|

(0.8 |

) |

|

|

(1.7 |

) |

| Interest received and other - net |

|

|

|

2.7 |

|

|

|

1.1 |

|

| Net cash flow of continuing operations used in investing activities |

|

|

|

(242.3 |

) |

|

|

(1,153.3 |

) |

| Net cash flow of discontinued operations provided from (used in) investing activities |

|

|

|

5.0 |

|

|

|

(17.0 |

) |

| Financing: |

|

|

|

|

|

| Proceeds from drawdown of debt |

|

|

|

100.0 |

|

|

|

1,097.6 |

|

| Interest paid |

|

|

|

(24.2 |

) |

|

|

(24.7 |

) |

| Payment of lease liabilities |

|

|

|

(15.5 |

) |

|

|

(5.4 |

) |

| Dividends paid to common shareholders |

|

|

|

(36.8 |

) |

|

|

(38.9 |

) |

| Other - net |

|

|

|

7.2 |

|

|

|

5.9 |

|

| Net cash flow of continuing operations provided from financing activities |

|

|

|

30.7 |

|

|

|

1,034.5 |

|

| Net cash flow of discontinued operations provided from financing activities |

|

|

|

- |

|

|

|

- |

|

| Effect of exchange rate changes on cash and cash equivalents of continuing operations |

|

|

|

0.5 |

|

|

|

- |

|

| Effect of exchange rate changes on cash and cash equivalents of discontinued operations |

|

|

|

- |

|

|

|

(3.8 |

) |

| Increase in cash and cash equivalents |

|

|

|

52.9 |

|

|

|

56.7 |

|

| Cash and cash equivalents, beginning of period |

|

|

|

418.1 |

|

|

|

531.5 |

|

| Reclassified to assets held for sale |

|

|

|

- |

|

|

|

(134.0 |

) |

| Cash and cash equivalents, end of period |

|

|

$ |

471.0 |

|

|

$ |

454.2 |

|

|

|

|

|

|

|

Operating Summary

|

|

Mine |

Period |

Tonnes Ore Mined |

Ore

Processed (Milled) |

Ore

Processed (Heap Leach) |

Grade (Mill) |

Grade (Heap Leach) |

Recovery (a)(d) |

Gold Eq Production(b) |

Gold Eq Sales(b) |

Production cost of sales |

Production cost of sales/oz(c) |

Cap Ex - sustaining(e) |

Total Cap Ex (e) |

DD&A |

|

|

|

(’000 tonnes) |

(’000 tonnes) |

(’000 tonnes) |

(g/t) |

(g/t) |

(%) |

(ounces) |

(ounces) |

($ millions) |

($/ounce) |

($ millions) |

($ millions) |

($ millions) |

| Americas |

Fort Knox |

Q1 2023 |

7,412 |

1,966 |

5,972 |

0.78 |

0.22 |

82 |

% |

65,387 |

65,404 |

$ |

77.6 |

$ |

1,186 |

$ |

38.6 |

$ |

39.1 |

$ |

18.6 |

| Q4 2022 |

12,205 |

2,395 |

11,454 |

0.69 |

0.20 |

79 |

% |

83,739 |

87,061 |

$ |

102.1 |

$ |

1,173 |

$ |

34.4 |

$ |

39.1 |

$ |

40.9 |

| Q3 2022 |

15,547 |

2,477 |

13,120 |

0.71 |

0.21 |

80 |

% |

75,522 |

74,221 |

$ |

88.6 |

$ |

1,194 |

$ |

30.5 |

$ |

31.0 |

$ |

21.8 |

| Q2 2022 |

14,591 |

2,260 |

12,785 |

0.72 |

0.19 |

81 |

% |

77,184 |

77,698 |

$ |

92.6 |

$ |

1,192 |

$ |

12.1 |

$ |

13.1 |

$ |

26.1 |

| Q1 2022 |

13,743 |

1,852 |

13,010 |

0.66 |

0.17 |

80 |

% |

54,803 |

52,813 |

$ |

67.4 |

$ |

1,276 |

$ |

1.7 |

$ |

2.9 |

$ |

20.9 |

| Round Mountain |

Q1 2023 |

5,019 |

878 |

4,367 |

0.81 |

0.44 |

79 |

% |

58,832 |

58,226 |

$ |

96.5 |

$ |

1,657 |

$ |

7.4 |

$ |

7.4 |

$ |

34.6 |

| Q4 2022 |

5,177 |

962 |

4,772 |

0.74 |

0.36 |

74 |

% |

61,929 |

67,484 |

$ |

95.1 |

$ |

1,409 |

$ |

41.1 |

$ |

41.1 |

$ |

19.1 |

| Q3 2022 |

8,856 |

1,021 |

8,336 |

0.64 |

0.27 |

79 |

% |

62,417 |

61,757 |

$ |

87.0 |

$ |

1,409 |

$ |

24.7 |

$ |

24.7 |

$ |

17.6 |

| Q2 2022 |

6,702 |

945 |

6,515 |

0.67 |

0.32 |

78 |

% |

56,709 |

51,455 |

$ |

74.8 |

$ |

1,454 |

$ |

20.5 |

$ |

20.6 |

$ |

11.7 |

| Q1 2022 |

3,767 |

929 |

3,208 |

0.80 |

0.36 |

79 |

% |

45,319 |

46,959 |

$ |

52.3 |

$ |

1,114 |

$ |

15.9 |

$ |

16.0 |

$ |

12.1 |

| Bald Mountain |

Q1 2023 |

1,864 |

- |

1,857 |

- |

0.47 |

nm |

33,828 |

47,283 |

$ |

58.0 |

$ |

1,227 |

$ |

6.1 |

$ |

25.2 |

$ |

33.9 |

| Q4 2022 |

3,002 |

- |

2,957 |

- |

0.37 |

nm |

58,521 |

66,847 |

$ |

62.8 |

$ |

939 |

$ |

17.2 |

$ |

37.4 |

$ |

63.4 |

| Q3 2022 |

4,152 |

- |

4,152 |

- |

0.37 |

nm |

65,394 |

52,472 |

$ |

51.2 |

$ |

976 |

$ |

10.4 |

$ |

28.2 |

$ |

39.1 |

| Q2 2022 |

4,945 |

- |

4,945 |

- |

0.60 |

nm |

54,108 |

54,472 |

$ |

54.5 |

$ |

1,001 |

$ |

5.0 |

$ |

16.2 |

$ |

38.4 |

| Q1 2022 |

3,870 |

- |

3,870 |

- |

0.63 |

nm |

36,071 |

41,017 |

$ |

40.3 |

$ |

983 |

$ |

2.7 |

$ |

5.8 |

$ |

35.1 |

| Paracatu |

Q1 2023 |

8,056 |

15,130 |

- |

0.37 |

- |

79 |

% |

123,334 |

128,344 |

$ |

118.0 |

$ |

919 |

$ |

27.8 |

$ |

27.8 |

$ |

40.4 |

| Q4 2022 |

13,324 |

13,847 |

- |

0.50 |

- |

81 |

% |

180,809 |

183,190 |

$ |

130.3 |

$ |

711 |

$ |

43.9 |

$ |

43.9 |

$ |

52.7 |

| Q3 2022 |

11,752 |

13,797 |

- |

0.45 |

- |

79 |

% |

159,113 |

152,616 |

$ |

131.1 |

$ |

859 |

$ |

33.6 |

$ |

33.6 |

$ |

47.2 |

| Q2 2022 |

11,011 |

15,133 |

- |

0.35 |

- |

75 |

% |

129,423 |

133,472 |

$ |

129.6 |

$ |

971 |

$ |

31.2 |

$ |

31.2 |

$ |

46.0 |

| Q1 2022 |

6,165 |

13,645 |

- |

0.33 |

- |

75 |

% |

108,009 |

101,886 |

$ |

106.6 |

$ |

1,046 |

$ |

16.0 |

$ |

16.0 |

$ |

39.6 |

| La Coipa(f) |

Q1 2023 |

748 |

691 |

- |

1.68 |

- |

88 |

% |

53,596 |

61,780 |

$ |

44.9 |

$ |

727 |

$ |

1.6 |

$ |

25.4 |

$ |

36.4 |

| Q4 2022 |

1,047 |

933 |

- |

1.47 |

- |

84 |

% |

67,683 |

68,135 |

$ |

39.4 |

$ |

578 |

$ |

2.6 |

$ |

46.0 |

$ |

25.6 |

| Q3 2022 |

1,079 |

637 |

- |

1.19 |

- |

83 |

% |

33,955 |

24,681 |

$ |

12.1 |

$ |

490 |

$ |

2.9 |

$ |

34.7 |

$ |

- |

| Q2 2022 |

550 |

321 |

- |

0.74 |

- |

69 |

% |

7,414 |

7,099 |

$ |

5.6 |

$ |

789 |

$ |

1.6 |

$ |

39.0 |

$ |

- |

| Q1 2022 |

174 |

58 |

- |

0.41 |

- |

82 |

% |

524 |

- |

$ |

- |

$ |

- |

$ |

0.7 |

$ |

35.8 |

$ |

- |

| West Africa |

Tasiast |

Q1 2023 |

1,690 |

1,208 |

- |

3.49 |

- |

91 |

% |

131,045 |

128,479 |

$ |

88.4 |

$ |

688 |

$ |

14.6 |

$ |

64.6 |

$ |

46.2 |

| Q4 2022 |

3,737 |

1,627 |

- |

3.21 |

- |

90 |

% |

143,002 |

147,019 |

$ |

96.2 |

$ |

654 |

$ |

38.3 |

$ |

90.3 |

$ |

48.7 |

| Q3 2022 |

4,437 |

1,741 |

- |

2.72 |

- |

89 |

% |

132,754 |

128,014 |

$ |

94.8 |

$ |

741 |

$ |

3.6 |

$ |

33.4 |

$ |

58.0 |

| Q2 2022 |

3,053 |

1,680 |

- |

2.51 |

- |

89 |

% |

129,140 |

114,064 |

$ |

93.3 |

$ |

818 |

$ |

6.7 |

$ |

24.3 |

$ |

56.4 |

| Q1 2022 |

3,462 |

1,524 |

- |

2.54 |

- |

94 |

% |

133,695 |

130,195 |

$ |

95.8 |

$ |

736 |

$ |

4.1 |

$ |

19.4 |

$ |

57.1 |

| (a) |

Due to the nature of heap leach operations, recovery rates at Bald Mountain cannot be accurately measured on a quarterly basis. Recovery rates at Fort Knox and Round Mountain represent mill recovery only. |

| (b) |

Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the average spot market prices for the commodities for each period. The ratios for the quarters presented are as follows: Q1 2023: 83.82:1; Q4 2022: 81.88:1; Q3 2022: 89.91:1; Q2 2022: 82.77:1; Q1 2022: 78.19:1. |

| (c) |

“Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold from continuing operations. |

| (d) |

“nm” means not meaningful. |

| (e) |

“Total Cap Ex” is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. “Capital expenditures - sustaining” is a non-GAAP financial measure. The definition and reconciliation of this non-GAAP financial measure is included on page 22 of this news release. |

| (f) |

La Coipa silver grade and recovery were as follows: Q1 2023: 125.77 g/t, 70%; Q4 2022: 137.53 g/t, 68%; Q3 2022: 121.06 g/t, 61%; Q2 2022: 56.04 g/t, 43%; Q1 2022: nm. |

|

|

Reconciliation of non-GAAP financial measures and ratios

The Company has included certain non-GAAP financial measures and ratios in this document. These financial measures and ratios are not defined under International Financial Reporting Standards (IFRS) and should not be considered in isolation. The Company believes that these financial measures and ratios, together with financial measures and ratios determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these financial measures and ratios is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These financial measures and ratios are not necessarily standard and therefore may not be comparable to other issuers.

All the non-GAAP financial measures and ratios in this document are from continuing operations and exclude results from the Company’s Chirano and Russian operations due to the classification of these operations as discontinued. The comparative information as previously presented in the MD&A and financial statements for the three months ended March 31, 2022, has been recast to exclude Chirano. As a result of the exclusion of Chirano, the following non-GAAP financial measures and ratios are no longer on an attributable basis, but on a total basis: production cost of sales from continuing operations per ounce sold on a by-product basis and all-in-sustaining cost from continuing operations per equivalent ounce sold and per ounce sold on a by-product basis.

Adjusted net earnings from continuing operations attributable to common shareholders and adjusted net earnings from continuing operations per share are non-GAAP financial measures and ratios which determine the performance of the Company, excluding certain impacts which the Company believes are not reflective of the Company’s underlying performance for the reporting period, such as the impact of foreign exchange gains and losses, reassessment of prior year taxes and/or taxes otherwise not related to the current period, impairment charges (reversals), gains and losses and other one-time costs related to acquisitions, dispositions and other transactions, and non-hedge derivative gains and losses. Although some of the items are recurring, the Company believes that they are not reflective of the underlying operating performance of its current business and are not necessarily indicative of future operating results. Management believes that these measures and ratios, which are used internally to assess performance and in planning and forecasting future operating results, provide investors with the ability to better evaluate underlying performance, particularly since the excluded items are typically not included in public guidance. However, adjusted net earnings from continuing operations and adjusted net earnings from continuing operations per share measures and ratios are not necessarily indicative of net earnings from continuing operations and earnings per share measures and ratios as determined under IFRS.

The following table provides a reconciliation of net earnings from continuing operations to adjusted net earnings from continuing operations for the periods presented:

|

| (unaudited, expressed in millions of U.S dollars, |

Three Months Ended |

| except per share amounts) |

March 31, |

|

|

2023 |

|

|

2022 |

|

|

|

|

| Net earnings from continuing operations attributable to common shareholders - as reported |

$ |

90.2 |

|

$ |

81.3 |

|

| Adjusting items: |

|

|

| Foreign exchange (gains) losses |

|

(3.8 |

) |

|

4.1 |

|

| Foreign exchange gains on translation of tax basis and foreign exchange on deferred income taxes within income tax expense |

|

(13.2 |

) |

|

(15.7 |

) |

| Taxes in respect of prior periods |

|

12.0 |

|

|

5.7 |

|

| Reclamation expense (recovery) |

|

4.0 |

|

|

(9.8 |

) |

| Other(a) |

|

(1.2 |

) |

|

3.5 |

|

| Tax effects of the above adjustments |

|

(0.4 |

) |

|

(0.3 |

) |

|

|

(2.6 |

) |

|

(12.5 |

) |

| Adjusted net earnings from continuing operations attributable to common shareholders |

$ |

87.6 |

|

$ |

68.8 |

|

| Weighted average number of common shares outstanding - Basic |

|

1,225.0 |

|

|

1,264.5 |

|

| Adjusted net earnings from continuing operations per share |

$ |

0.07 |

|

$ |

0.05 |

|

| Basic earnings from continuing operations per share attributable to common shareholders - as reported |

$ |

0.07 |

|

$ |

0.06 |

|

|

|

|

| (a) |

Other includes various impacts, such as one-time costs at sites, and gains and losses on the sale of assets and hedges, which the Company believes are not reflective of the Company’s underlying performance for the reporting period. |

|

|

Free cash flow from continuing operations is a non-GAAP financial measure and is defined as net cash flow of continuing operations provided from operating activities less additions to property, plant and equipment. The Company believes that this measure, which is used internally to evaluate the Company’s underlying cash generation performance and the ability to repay creditors and return cash to shareholders, provides investors with the ability to better evaluate the Company’s underlying performance. However, the free cash flow from continuing operations measure is not necessarily indicative of operating earnings or net cash flow of continuing operations provided from operating activities as determined under IFRS.

The following table provides a reconciliation of free cash flow from continuing operations for the periods presented:

|

|

|

|

|

|

Three months ended |

| (unaudited, expressed in millions of U.S dollars) |

|

March 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

| Net cash flow of continuing operations provided from operating activities - as reported |

$ |

259.0 |

|

$ |

97.9 |

|

|

|

|

|

| Less: Additions to property, plant and equipment |

|

(221.2 |

) |

|

(100.7 |

) |

|

|

|

|

| Free cash flow from continuing operations |

$ |

37.8 |

|

$ |

(2.8 |

) |

|

|

|

|

|

|

|

|

Adjusted operating cash flow from continuing operations is a non-GAAP financial measure and is defined as net cash flow of continuing operations provided from operating activities excluding certain impacts which the Company believes are not reflective of the Company’s regular operating cash flow and excluding changes in working capital. Working capital can be volatile due to numerous factors, including the timing of tax payments. The Company uses adjusted operating cash flow from continuing operations internally as a measure of the underlying operating cash flow performance and future operating cash flow-generating capability of the Company. However, the adjusted operating cash flow from continuing operations measure is not necessarily indicative of net cash flow of continuing operations provided from operating activities as determined under IFRS.

The following table provides a reconciliation of adjusted operating cash flow from continuing operations for the periods presented:

|

|

|

|

Three months ended |

| (unaudited, expressed in millions of U.S dollars) |

March 31, |

|

|

2023 |

|

|

2022 |

|

|

|

|

| Net cash flow of continuing operations provided from operating activities - as reported |

$ |

259.0 |

|

$ |

97.9 |

|

|

|

|

| Adjusting items: |

|

|

| Working capital changes: |

|

|

| Accounts receivable and other assets |

|

(20.0 |

) |

|

(48.3 |

) |

| Inventories |

|

43.2 |

|

|

89.3 |

|

| Accounts payable and other liabilities, including income taxes paid |

|

76.0 |

|

|

110.2 |

|

| Total working capital changes |

|

99.2 |

|

|

151.2 |

|

| Adjusted operating cash flow from continuing operations |

$ |

358.2 |

|

$ |

249.1 |

|

|

|

|

|

|

|

Production cost of sales from continuing operations per ounce sold on a by-product basis is a non-GAAP ratio which calculates the Company’s non-gold production as a credit against its per ounce production costs, rather than converting its non-gold production into gold equivalent ounces and crediting it to total production, as is the case in co-product accounting. Management believes that this ratio provides investors with the ability to better evaluate Kinross’ production cost of sales per ounce on a comparable basis with other major gold producers who routinely calculate their cost of sales per ounce using by-product accounting rather than co-product accounting.

The following table provides a reconciliation of production cost of sales from continuing operations per ounce sold on a by-product basis for the periods presented:

|

|

|

(unaudited, expressed in millions of U.S. dollars,

|

|

Three months ended |

| except ounces and production cost of sales per equivalent ounce) |

|

March 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

| Production cost of sales from continuing operations - as reported |

$ |

483.9 |

|

$ |

363.1 |

|

| Less: silver revenue(a) |

|

(54.9 |

) |

|

(4.4 |

) |

| Production cost of sales from continuing operations net of silver by-product revenue |

$ |

429.0 |

|

$ |