Announced Positive Top-Line Final Results from Phase 2 Randomized Clinical Trial of BX1000

Hosted Key Opinion Leader Webinar to Highlight Potential of BX1000 and Neuromuscular Blocking Agent Portfolio

Secured $4 Million in Gross Proceeds from Public Offering in May

MALVERN, Pa., May 12, 2023 (GLOBE NEWSWIRE) -- Baudax Bio, Inc. (Nasdaq:BXRX) (the “Company”), a pharmaceutical company focused on innovative products for hospital and related settings, today reported financial results for the quarter ended March 31, 2023, and provided a business update.

“During the first quarter we made significant progress advancing our neuromuscular blocking agent (NMB) portfolio, announcing positive topline results from our Phase 2 randomized trial of BX1000 and continuing to enroll our Phase 1 dose escalation trial for BX2000,” said Gerri Henwood, President and Chief Executive Officer of Baudax Bio. “Positive top line results from our Phase 2 trial demonstrate that BX1000 was effective at all doses, and compares favorably to rocuronium, with predictable onset and offset. We believe that when BX 1000 is combined with our reversal agent BX3000, it may provide even faster control/reversal of neuromuscular paralysis for surgical patients. These very encouraging data and the potential of our NMB portfolio were highlighted in the Key Opinion Leader webinar we were pleased to host recently. The webinar featured distinguished anesthesiologists Drs. Todd M Bertoch and Harold S. Minkowitz, who shared their experiences with the current standard of care and perspectives on the unmet need for improved NMB and reversal agents and can be found on the Events pages of our website”.

“In addition to announcing Phase 2 topline results for BX1000, during the quarter we also continued to enroll our dose escalation study for BX2000, our ultrashort acting NMB,” continued Ms. Henwood. We expect to complete this study by approximately the end of 2023. BX3000, our NMB reversal agent, remains on track, and we expect to complete the nonclinical and manufacturing studies needed to support an IND filing for BX3000 in late summer of 2023.

“On May 1st, we closed a $4 million financing through a public offering. We also executed the asset transfer of ANJESO® to Alkermes, which included the elimination of further payment obligations to Alkermes. These events will allow us to progress development of product candidates for ambulatory surgery centers and other acute care settings, which we believe may represent important innovations in NMBs along with a proprietary reversal agent,” concluded Ms. Henwood.

First Quarter 2023 and Recent Business Highlights

NMB Portfolio

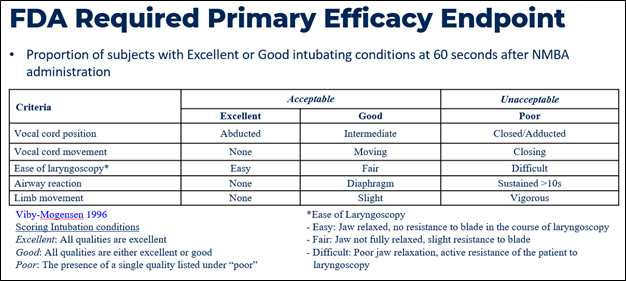

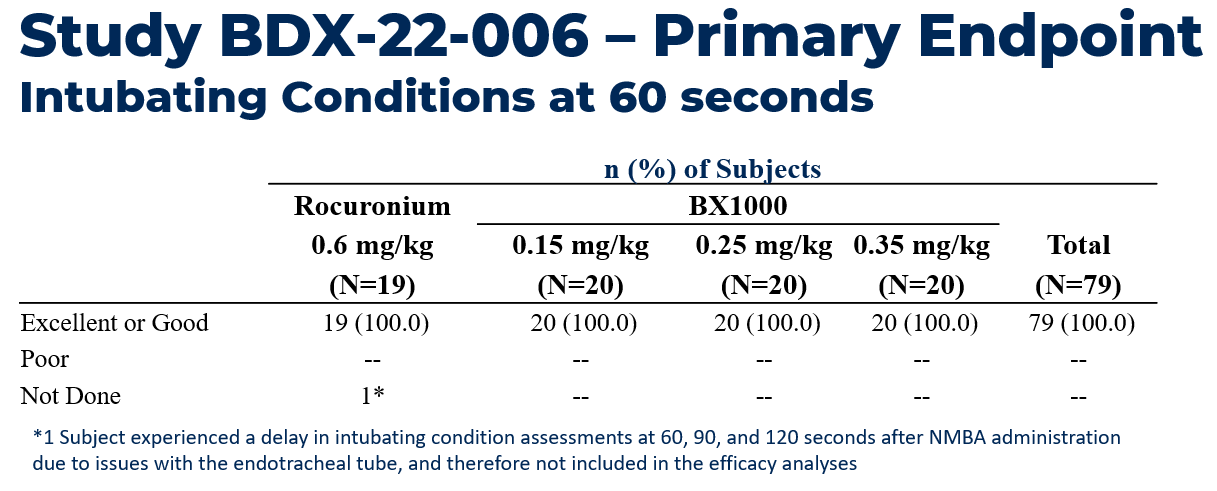

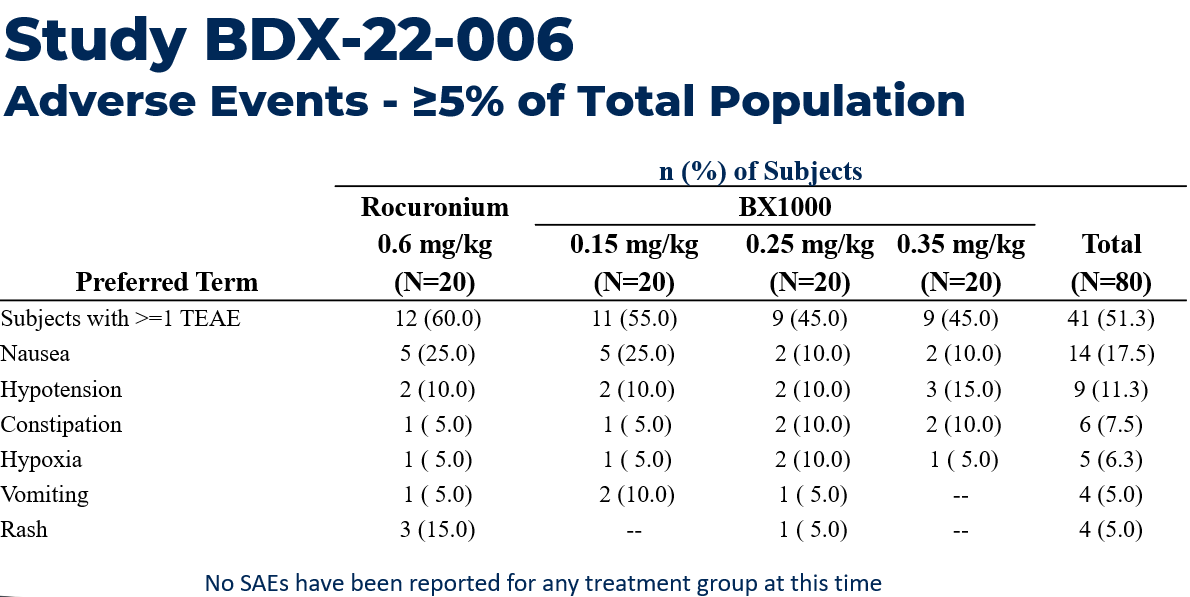

- BX1000 Phase 2 Top-Line Data. The Company announced positive top-line results from its Phase 2 clinical trial of BX1000 for neuromuscular blockade (NMB) in patients undergoing elective surgery. Results of the study showed that BX1000 met the primary endpoint of readiness for intubation (evaluated as “Good” or “Excellent”) at all dose levels assessed. No severe adverse events were observed in any dose regimen.

Results showed that all patients in three BX1000 study cohorts were observed to have met the criteria for Good or Excellent intubating conditions at 60 seconds (see Table 1 and Table 2). There was evidence of a dose-response across the three doses of BX1000, and the degree of blockade for the highest dose group appears comparable to that of the “standard” dose of rocuronium (0.6 mg/kg) employed in the study. Study treatments were generally well tolerated, with no occurrence of severe or serious adverse events. The frequency and severity of adverse events was similar across all four dose groups, and no notable events were aggregated in any one dose group (See table 3).

A further patient safety follow-up at 28 days after surgery as well as additional analyses of EMG neuromuscular blockade data is anticipated in the coming weeks. The Company will be continuing the development program for BX 1000 with a target of submitting a New Drug Application (“NDA”).

The Company hosted a key opinion leader webinar to discuss the Phase 2 results and opportunity represented by BX1000 and its NMB portfolio. The event, titled Innovation in Anesthesia: BX1000 for Neuromuscular Blockade (NMB), features Dr. Todd M. Bertoch, Chief Executive Officer of JBR Clinical Research, and Dr. Harold S. Minkowitz, Associate Director for Clinical Research at The University of Texas MD Anderson Cancer Center Department of Anesthesiology and Perioperative Medicine and discusses in greater detail results from the Phase 2 trial of BX1000 for neuromuscular blockade (NMB) in patients undergoing elective surgery. A recording of the presentation can be found on the Baudax Bio website under the Events section.

- BX2000 (IV Ultra-short duration of action). Cohort enrollment is ongoing for the Phase I dose escalation study evaluating the safety, tolerability, and pharmacokinetics of BX2000 in intubated healthy volunteers. This study is comprised of likely seven or eight dosing cohorts and each cohort is planned to enroll eight patients. The first and second cohorts have been dosed and enrollment of the third cohort is underway. The Company expects to complete enrollment of the remaining cohorts in the study by the end of 2023.

- BX3000 (Reversal agent). Baudax Bio expects to complete nonclinical studies and manufacturing data required to support the IND for BX3000 in late summer of 2023. Early single agent clinical trials of BX3000 will not require intubation and so would be expected to progress quickly once the IND is active, and trials are ready to initiate. The Company believes progress towards a reversal study using BX3000 in patients who have received BX1000 could begin before the end of 2023.

The Company believes the data from the ongoing clinical trials for BX1000 and BX2000 will contribute to decisions to move forward later in 2023.

Corporate and Financial

- Closed $4 million public offering – On May 1, 2023, the Company closed a public offering of an aggregate of 3,478,262 shares of its common stock (or pre-funded warrants in lieu thereof), together with accompanying common stock purchase warrants, at a public offering price of $1.15 per share (or pre-funded warrant) and accompanying warrants. Each share of common stock (or pre-funded warrant) was sold in the offering together with one Series A-5 warrant to purchase one share of common stock at an exercise price of $1.15 per share and one Series A-6 warrant to purchase one share of common stock at an exercise price of $1.15 per share. The Series A-5 warrants are exercisable immediately and will expire five years from the date of issuance, and the Series A-6 warrants are exercisable immediately and will expire eighteen months from the date of issuance. Gross proceeds from the offering, before deducting the placement agent's fees and other offering expenses, were approximately $4 million. The Company intends to use the net proceeds from this offering for pipeline development activities and general corporate purposes.

- Alkermes Asset Transfer Agreement - On March 29, 2023, the Company entered into an Asset Transfer Agreement with Alkermes Pharma Ireland Limited (“Alkermes”) (the “Transfer Agreement”). Under the terms of the Transfer Agreement, the Company transferred the rights to certain patents, trademarks, equipment, data and other rights related to ANJESO® (the “Assets”) to Alkermes. The Company withdrew the New Drug Application (“NDA”) related to ANJESO. Additionally, under the Transfer Agreement, the Company granted Alkermes a non-exclusive, perpetual and irrevocable, royalty-free and fully paid-up worldwide license, to the additional intellectual property owned by the Company necessary to or useful to exploit ANJESO®. In consideration of the transfer of the Assets, the parties agreed to the termination of (i) the Purchase and Sale Agreement, dated March 7, 2015 by and among Alkermes, the Company and the other parties thereto (as amended, the “PSA”), (ii) the Asset Transfer and License Agreement, dated April 10, 2015 by and among Alkermes, the Company and the other parties thereto (as amended, the “ATLA”); and (iii) the Development, Manufacturing and Supply Agreement, dated as of July 10, 2015 by and between the Company and Alkermes (as amended, the “Manufacturing Agreement”) between the parties related to ANJESO (the PSA, ATLA and Manufacturing Agreement, collectively, the “ANJESO Agreements”). In connection with the termination of the ANJESO Agreements, no further payments of any kind pursuant to the ANJESO Agreements will be payable by the Company to Alkermes.

- Consent to Credit Agreement – On March 29, 2023 the Company entered into a Consent to Credit agreement by and among the Company, Baudax Bio N.A. LLC (“Baudax LLC”), Baudax Bio Limited, Wilmington Trust, National Association, solely in its capacity as administrative and collateral agent (the “Agent”) and the lenders party thereto (the “Lenders”). The Amendment amends that certain Credit Agreement, dated as of May 29, 2020, by and among the Company, the Agent, and the Lenders (as amended, the “Credit Agreement”). Pursuant to the terms of the Amendment, the Lenders consented to the transactions contemplated by the Transfer Agreement (as defined below) and agreed to release and discharge any liens granted or held by the Lenders in respect of the Assets (as defined below). Pursuant to the terms of the Transfer Agreement, the parties also agreed to, among other things, amend the minimum liquidity covenants under the Credit Agreement to require that the Company maintains $2.5 million of liquidity at all times.

Financial Results for the Three Months Ended March 31, 2023

As of March 31, 2023, Baudax Bio had cash and cash equivalents of $3.8 million.

Research and development expenses from continuing operations for the three months ended March 31, 2023 were $2.9 million compared to $0.7 million for the three months ended March 31, 2022. The increase of $2.2 million was primarily due to an increase in clinical and preclinical trials costs associated with our NMB program of $1.7 million and an increase in general expenses, including consulting and other outside service expenses, of $0.5 million.

Selling, general and administrative expenses from continuing operations for the three months ended March 31, 2023 were $1.8 million compared to $6.9 million for the same prior year period. The decrease of $5.1 million was primarily a result of a reduction in personnel costs of $3.5 million, a decrease in public company costs of $0.7 million, a decrease in consulting expenses of $0.5 million, and a decrease of $0.5 million in patent legal and other expenses.

Baudax Bio reported net loss from continuing operations of $(7.4) million, or $(3.19) per share, for the three months ended March 31, 2023. Net loss from continuing operations for the three months ended March 31, 2022 was $(8.2) million, or $(81.16) per share.

About Baudax Bio’s Neuromuscular Blocking Agents (NMBs)

Baudax Bio holds exclusive global rights to two novel NMBs, BX1000, an intermediate duration, clinical stage blocking agent, and BX2000, an ultra-short duration, clinical stage blocking agent, as well as a proprietary chemical reversal agent, BX3000, undergoing nonclinical studies intended to support an investigational new drug (IND) submission in 2023. BX3000 is a specific reversal agent that may rapidly reverse BX1000 and BX2000. All three agents are licensed from Cornell University. We believe these agents, when an NMB and BX3000 are administered in succession, allow for a rapid onset of centrally acting neuromuscular blockade, followed by a rapid reversal of the neuromuscular blockade with BX3000. These novel agents have the potential to meaningfully reduce time to onset and reversal of blockade and improve the reliability of onset and offset of neuromuscular blockade. This can potentially reduce time in operating rooms or post operative suites, or PACU, resulting in potential clinical and cost advantages, as well as valuable cost savings for hospitals and ambulatory surgical centers and has the potential for an improved clinical profile in terms of safety.

About Baudax Bio

Baudax Bio is a pharmaceutical company focused on innovative products for acute care and related settings. The Company has a pipeline of innovative pharmaceutical assets including two clinical-stage, novel neuromuscular blocking (NMBs) agents, one that recently completed a Phase II clinical trial and an additional unique NMB undergoing a dose escalation Phase I clinical trial, as well as a proprietary chemical reversal agent specific to these NMBs, which is currently undergoing nonclinical and manufacturing studies to prepare for an expected IND filing in late summer of 2023. For more information, please visit www.baudaxbio.com.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements, including statements relating to the clinical development of Baudax Bio’s product candidates, reflect Baudax Bio’s expectations about its future performance and opportunities that involve substantial risks and uncertainties. When used herein, the words “anticipate,” “believe,” “estimate,” “may,” “upcoming,” “plan,” “target,” “goal,” “intend” and “expect” and similar expressions, as they relate to Baudax Bio or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information available to Baudax Bio as of the date of publication of this press release and are subject to a number of risks, uncertainties, and other factors that could cause Baudax Bio’s performance to differ materially from those expressed in, or implied by, these forward-looking statements. These risks and uncertainties include, among other things, risks related to market, economic and other conditions, the ongoing economic and social consequences of the COVID-19 pandemic, Baudax Bio’s ability to advance its current product candidate pipeline through pre-clinical studies and clinical trials, that interim results may not be indicative of final results in clinical trials, that earlier-stage trials may not be indicative of later-stage trials, the approvability of product candidates, Baudax Bio’s ability to raise future financing for continued development of its product candidates such as BX1000, BX2000 and BX3000, Baudax Bio’s ability to pay its debt and satisfy conditions necessary to access future tranches of debt, Baudax Bio’s ability to comply with the financial and other covenants under its credit facility, Baudax Bio’s ability to manage costs and execute on its operational and budget plans, Baudax Bio’s ability to achieve its financial goals; Baudax Bio’s ability to maintain listing on the Nasdaq Capital Market; and Baudax Bio’s ability to obtain, maintain and successfully enforce adequate patent and other intellectual property protection. These forward-looking statements should be considered together with the risks and uncertainties that may affect Baudax Bio’s business and future results included in Baudax Bio’s filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to Baudax Bio, and Baudax Bio assumes no obligation to update any forward-looking statements except as required by applicable law.

CONTACTS:

Investor Relations Contact:

Mike Moyer

LifeSci Advisors

mmoyer@lifesciadvisors.com

TABLES

Table 1:

Table 2:

Table 3:

| BAUDAX BIO, INC. AND SUBSIDIARIES |

|

| Consolidated Balance Sheets |

|

| (Unaudited) |

|

| (amounts in thousands, except share and per share data) |

|

|

|

|

|

| Assets |

|

March 31, 2023 |

|

December 31, 2022 |

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

3,803 |

|

$ |

5,259 |

|

|

|

Prepaid expenses and other current assets |

|

305 |

|

|

303 |

|

|

|

Current assets of discontinued operation |

|

— |

|

|

785 |

|

|

|

|

|

|

|

Total current assets |

$ |

4,108 |

|

$ |

6,347 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

1 |

|

|

9 |

|

|

|

Goodwill |

|

2,127 |

|

|

2,127 |

|

|

|

Other long-term assets |

|

829 |

|

|

854 |

|

|

|

Non-current assets of discontinued operation |

|

— |

|

|

695 |

|

|

|

|

|

|

|

Total assets |

$ |

7,065 |

|

$ |

10,032 |

|

|

| Liabilities and Shareholders' (Deficit) Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

3,837 |

|

|

3,198 |

|

|

|

Accrued expenses and other current liabilities |

|

2,534 |

|

|

2,364 |

|

|

|

Current portion of long-term debt, net |

|

6,000 |

|

|

5,600 |

|

|

|

Current liabilities of discontinued operation |

|

— |

|

|

10,298 |

|

|

|

|

|

|

|

Total current liabilities |

|

12,371 |

|

|

21,460 |

|

|

|

Long-term debt, net |

|

1,433 |

|

|

1,519 |

|

|

|

Other long-term liabilities |

|

574 |

|

|

598 |

|

|

|

Non-current liabilities of discontinued operation |

|

— |

|

|

10,697 |

|

|

|

|

|

|

|

Total liabilities |

|

14,378 |

|

|

34,274 |

|

|

| Shareholders’ (deficit) equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value. Authorized, 10,000,000 shares; issued and outstanding, 0 shares at March 31, 2023 and December 31, 2022 |

|

— |

|

|

— |

|

|

|

Common stock, $0.01 par value. Authorized, 190,000,000 shares; issued and outstanding, 2,585,702 shares at March 31, 2023 and 1,623,913 shares at December 31, 2022 |

|

26 |

|

|

16 |

|

|

|

Additional paid in-capital |

|

172,161 |

|

|

166,646 |

|

|

|

Accumulated deficit |

|

(179,500 |

) |

|

(190,904 |

) |

|

|

|

|

|

|

Total shareholders’ deficit |

|

(7,313 |

) |

|

(24,242 |

) |

|

|

|

|

|

|

Total liabilities and shareholders’ deficit |

$ |

7,065 |

|

$ |

10,032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BAUDAX BIO, INC. AND SUBSIDIARIES |

| Consolidated Statements of Operations |

| (Unaudited) |

| (amounts in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

| Operating expenses: |

|

|

|

|

|

|

Research and development |

|

$ |

2,917 |

|

$ |

694 |

|

|

Selling, general and administrative |

|

|

1,771 |

|

|

6,934 |

|

|

Change in warrant valuation |

|

|

— |

|

|

(5 |

) |

|

|

|

|

|

Total operating expenses |

|

|

4,688 |

|

|

7,623 |

|

|

|

|

|

|

Operating loss from continuing operations |

|

|

(4,688 |

) |

|

(7,623 |

) |

| Other expense: |

|

|

|

|

|

|

|

Other expense, net |

|

|

(2,698 |

) |

|

(571 |

) |

|

|

Net loss from continuing operations |

|

$ |

(7,386 |

) |

$ |

(8,194 |

) |

| Income (loss) on discontinued operation |

|

|

18,790 |

|

|

(4,615 |

) |

|

|

Net income (loss) |

|

$ |

11,404 |

|

$ |

(12,809 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share information: |

|

|

|

|

|

| Net loss per share from continuing operations, basic and diluted |

|

$ |

(3.19 |

) |

$ |

(81.16 |

) |

| Net income (loss) per share from discontinued operation, basic and diluted |

|

|

8.10 |

|

|

(45.71 |

) |

| Net income (loss) per share, basic and diluted |

|

$ |

4.91 |

|

$ |

(126.87 |

) |

| Weighted average common shares outstanding, basic and diluted |

|

|

2,318,539 |

|

|

100,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|