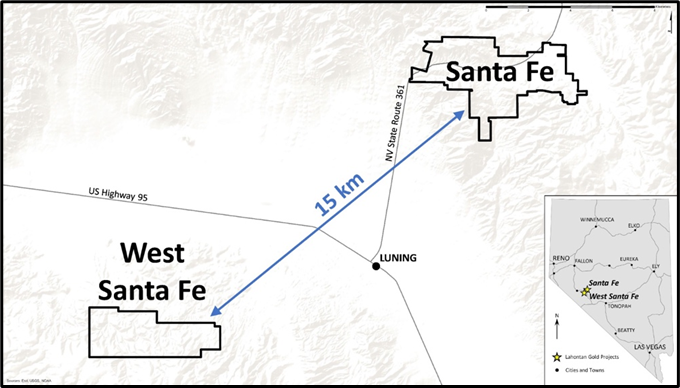

TORONTO, ON / ACCESSWIRE / May 15, 2023 / Lahontan Gold Corp (TSXV:LG)(OTCQB:LGCXF) (the "Company" or "Lahontan") is pleased to announce that it has signed a binding term sheet (the "Term Sheet") with a wholly-owned subsidiary of Emergent Metals Corp (collectively "Emergent") to acquire the advanced West Santa Fe gold-silver exploration project ("West Santa Fe"; also known as Mindora), located only 15 km West of Lahontan's Flagship asset, the Santa Fe Mine, in Nevada's prolific Walker Lane. West Santa Fe hosts an oxidized gold-silver mineralized system in a geologic setting nearly identical to Santa Fe. Previous exploration drilling at West Santa Fe totals over 13,000 metres in 171 drill holes; only five holes are deeper than 165 metres. Modeling of drill hole data by Lahontan geologists outlines a shallow gold and silver system with a sufficient volume to host 0.5 to 1.0M ounces of oxidized gold and silver mineralization in an open-pit mining configuration[1].

The Term Sheet requires Lahontan to make payments totalling US$1.8M over a seven-year period to Emergent, back-end loaded (please see details of the Term Sheet below) to exercise an option to acquire a 100% interest in the 11.8 square kilometre property. The option payments (excepting the $10,000 signing payment) can be made in a combination of cash and shares at Lahontan's discretion. In addition, the Company will commit to exploration expenditures totalling US$1.4M over the same seven-year period, these expenditures that should be sufficient to define an initial mineral resource estimate for West Santa Fe. The initial option payments and work commitments can be easily accommodated by Lahontan's current cash position and budget.

Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: "The acquisition of West Santa Fe will be a significant milestone for Lahontan: A "bolt-on" asset which is accretive to the Santa Fe Mine that has the potential to add significant oxide gold and silver resource ounces for the Company. Back-end loaded, the Term Sheet allows Lahontan to conduct a definitive exploration program on the property with low monetary commitment by Lahontan, yet provides exposure to considerable resource upside. Combined with the continued organic growth of gold and silver resources at the Santa Fe Mine through drilling, West Santa Fe can help Lahontan accelerate the value-creation process for its shareholders by controlling multiple Top-Shelf precious metal exploration and mine development projects in a Tier One mining jurisdiction."

Geology and Mineral Potential of West Santa Fe

Gold and silver mineralization at West Santa Fe occurs as a sediment-hosted epithermal Au-Ag system hosted by Triassic age carbonate and volcanic rocks, a setting very similar to the Santa Fe Mine. Shallow gold and silver mineralization are localized to East-Northeast trending faults and offset by Northwest striking faults, a classic Walker Lane setting. In addition to over 13,000 metres of drilling, previous exploration activity at West Santa Fe includes: Geophysical studies including IP and aerial magnetic surveys, geochemical surveys including over 1,250 soil samples, and detailed geologic mapping.

[1] The exploration target at West Santa Fe is conceptual in nature and is based on the size of the known mineralized zones, and gold and silver grades from historical drilling. The qualified person has not completed sufficient work to verify the historical information on West Santa Fe and this information should not be relied on.

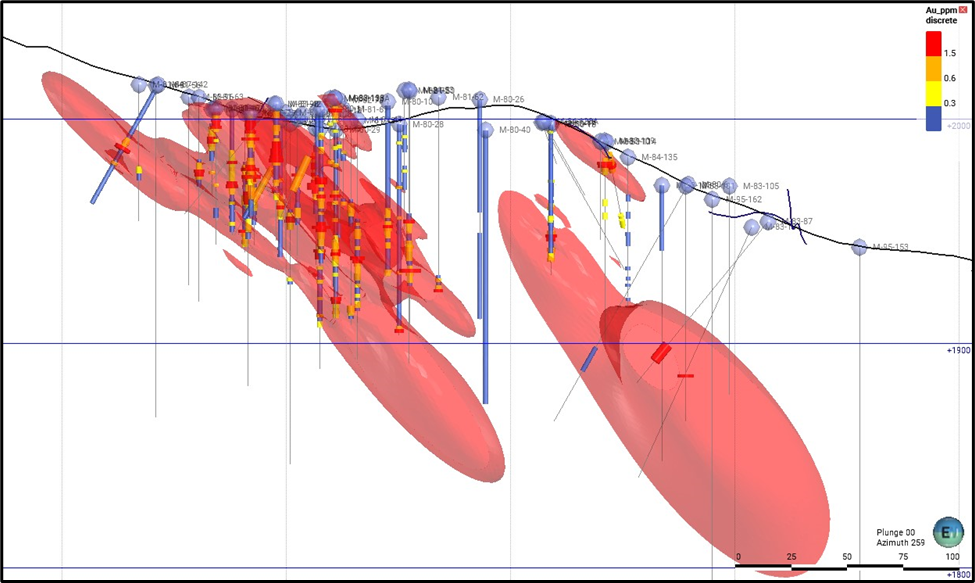

Modeling of the historical drill hole data by Lahontan geologists defines a continuous zone of gold and silver mineralization which extends from the surface down-rake to the East-Northeast. Utilizing a 0.31 g/t gold mineralized shell defined by historical drill hole data, outlines a large continuously mineralized area at West Santa Fe that has the potential to host a significant gold and silver resource1 (please see diagram below). Additional exploration drilling will be needed to define mineral resources and to validate the historical drill hole data base.

Simple representation of drill holes and gold-silver mineral potential at West Santa Fe. Cross section looks West-Southwest with South-Southwest to the left and North-Northeast to the right. Grade shell is 0.31 g/t Au and is continuous in the mineralized zones. Within the core of the minerlaized area, grades exceed 1.5 g/t gold. Minerlization extends down-dip to the Northeast for several hundred metres where it remains open at depth and relatively shallow due to topography (please note scale).

Location of the West Santa Fe Project, Mineral County, Nevada. Lahontan's land holdings in the Walker Lane now total 49 square kilometres.

Details of the Binding Term Sheet

The Term Sheet defines the terms and conditions under which Lahontan and Emergent will enter into a definitive agreement (the "Agreement"), pursuant to which the Company will be granted an option (the "Option") to acquire a 100% interest in West Santa Fe from a 100% owned subsidiary of Emergent. To exercise the Option in full, the Company must make cash payments in the aggregate amount of US$1.8 million and incur US$1.4 million in expenditures on West Santa Fe over a seven-year period, as follows:

- The Company shall make the following cash payments:

| Timing |

Amount ($US) |

| Upon Signing of the Term Sheet |

$10,000 |

| First Anniversary of signing of the Agreement* |

$20,000 |

| Second Anniversary of signing of the Agreement * |

$25,000 |

| Third Anniversary of signing of the Agreement* |

$25,000 |

| Fourth Anniversary of signing of the Agreement* |

$30,000 |

| Fifth Anniversary of signing of the Agreement* |

$30,000 |

| Sixth Anniversary of signing of the Agreement* |

$40,000 |

| Seventh Anniversary of signing of the Agreement* |

$1,620,000 |

| Total |

$1,800,000 |

*50% of these payments may be made in common shares of Lahontan Gold Corp. at Lahontan's discretion. Lahontan may accelerate these payments by paying the remaining balance of the purchase price at any time during the option period.

- The Company shall incur the following expenditures on West Santa Fe:

|

Timing

|

Amount ($US)

|

|

December 31, 2024

|

$150,000

|

|

December 31, 2025

|

$150,000

|

|

December 31, 2026

|

$200,000

|

|

December 31, 2027

|

$200,000

|

|

December 31, 2028

|

$200,000

|

|

December 31, 2029

|

$250,000

|

|

Seventh Anniversary of signing of the Agreement

|

$250,000

|

|

Total

|

$1,400,000

|

Note:

- Work Commitments include, but are not limited to, geological, geochemical, and geophysical studies, exploration drilling and support activities, reasonable management costs associated with the proceeding items, any payments associated with maintaining the underlying agreements in good standing including BLM and County fees. Any excess expenditures, in any year, under the Work Commitments scheduled above can be credited against subsequent Work Commitment expenditures in a future year.

Upon exercise of the Option, Emergent shall transfer 100% of its interest in the mineral claims to Lahontan within 30 days. As part of the transfer, Lahontan will grant a 1% NSR royalty in favor of Emergent over the claims it acquired from Nevada Sunrise LLC (unpatented lode mining claims Mind 1 through Mind 12). In addition, Lahontan will grant a 1.5% NSR in favor of Emigrant for any additional claims not currently having a NSR royalty. Lahontan will have the right to purchase 50% of this 1.5% NSR royalty for US$200,000 prior to the fifth anniversary of signing of the Agreement or for US$500,000 after the fifth anniversary of the signing of the Agreement. The maximum NSR royalty on any portion of the West Santa Fe Project will be 1.5%.

The completion of the transaction contemplated by the Term Sheet remains subject to a forty-five (45) day due diligence period, approval of the board of directors of the Company, the board of directors of Emergent, the approval of all regulatory authorities and other approvals, including the approval of the TSX Venture Exchange.

Qualified Persons Review

The technical and scientific information contained within this news release have been reviewed and approved by Quentin J. Browne, MSc., a Qualified Person as defined by National Instrument 43-101 policy. The Qualified Person has not completed sufficient work to verify the historical information on West Santa Fe, the Company believes the historical resource estimates to be both relevant and reliable. The information provides an indication of the exploration potential of West Santa Fe but may not be representative of expected results.

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mineral exploration company that holds, through its US subsidiaries, three top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 19 km2 Santa Fe Mine, had past production of 345,000 ounces of gold and 711,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Bureau of Mines and Geology, 1995). The Santa Fe Mine has an Indicated Mineral Resource of 1,112,000 oz Au Eq(grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 544,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). The Company will continue to aggressively explore Santa Fe during 2023 and begin the process of evaluating development scenarios to bring the Santa Fe Mine back into production. Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., is the Qualified Person for the Company and approved the technical content of this news release. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the Santa Fe Project Technical Report, Authors: Trevor Rabb and Darcy Baker, P. Geos. Effective Date: December 7, 2022, Report Date: March 2, 2023. The Technical Report is available on the Company's website and SEDAR.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

SOURCE: Lahontan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/754855/Lahontan-Signs-Binding-Term-Sheet-to-Acquire-Strategic-Advanced-Gold-Silver-Project-Adjacent-to-Santa-Fe