Calgary, Alberta, Canada, May 18, 2023 (GLOBE NEWSWIRE) -- Volt Lithium Corp. (TSX-V: VLT, OTCQB: VLTLF, FSE: I2D) (“Volt” or the “Company”) is pleased to announce the completion of an initial resource report, prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) (the “Technical Report”), indicating an inferred mineral resource of 4.3 million tonnes of lithium carbonate equivalent (“LCE”) at the Company’s Rainbow Lake Property.

Key Highlights:

- 4.3 million tonnes of LCE in the Inferred Mineral Resource category from the Devonian aged Sulphur Point, Muskeg and Keg River (the “Elk Point Group”) aquifers.

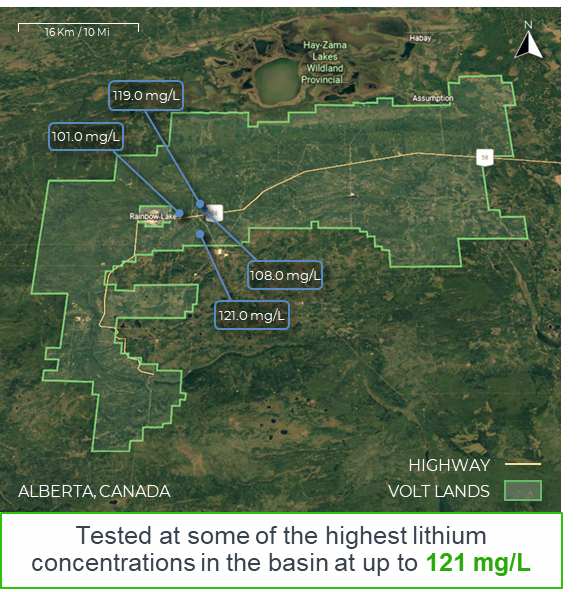

- Rainbow Lake Property has an estimated 99.0 billion barrels (15.7 billion cubic metres (m3)) of brine, more than 20 billion barrels higher than the 78 billion barrels previously estimated, with lithium concentrations as high as 121 mg/L and an estimated average associated lithium concentration of 51 mg/L.

- The Inferred Mineral Resource equates to 215 times the estimated peak production of20,000 tonnes per year, demonstrating the sheer size and scale of this lithium asset.

- Results from Volt’s current pilot project are anticipated before the end of Q2/23.

- Volt’s total land position at Rainbow Lake equals ~430,000 acres (~670 sections) and features over1,300 producing wells from which to source brine.

- Volt intends to focus development on those areas of its asset base featuring the highest lithium concentrations, including the regions highlighted on the map below, where testing demonstrated concentrations between 101 and 121 mg/L in the Muskeg Formation , levels that are expected to drive strong economic returns and robust cash flows.

“Receipt of this Technical Report represents a landmark milestone and defining moment for Volt as we confirm an estimated 4.3 million tonnes of LCE with concentrations as high as 121 mg/L across parts of our land base, underpinning our commitment to be an integral part of the clean energy transition,” commented Alex Wylie, President and CEO of Volt. “With this Technical Report in hand, we have a strong foundation to continue developing our assets with the goal of increasing the resource estimate and further expanding our high lithium concentrations. We are at a true inflection point in Volt’s journey as we advance our goal of becoming North America’s first commercial producer of lithium from oilfield brine, which will set the stage for the Company to secure additional assets and oil and gas company partnerships where we can apply our proprietary technology to target the efficient and profitable extraction of lithium from brine.”

The Company would like to thank its staff and contractors for their diligence, tireless efforts and safe execution in achieving this significant corporate milestone, as well as the cooperation of the producing oil and gas partners across Volt’s permit areas to obtain the brine samples.

NI 43-101 Technical Report:Mineral Resource Estimate at Rainbow Lake Property

The NI 43-101 Technical Report for the Rainbow Lake Property is being prepared and will be filed on SEDAR and the Company’s website within the coming week, and no later than 45 days. Following is a summary of the key technical highlights from the Technical Report:

Qualified Persons

The Resource estimate, along with various scientific and technical information in this press release, has been prepared by Volt’s multi-disciplinary team of Meghan Klein, P.Eng and Doug Ashton, P. Eng of Sproule Associates Limited ("Sproule"), a global leader in subsurface fluid resource evaluations with over seventy years of experience. Dmitry Deryushkin. P. Geo., M.Eng and Jesse Williams-Kovacs, P.Eng. of Subsurface Dynamics Inc. co-authored the Technical Report and were responsible for the preparation and completion of the geological portion of the Technical Report including geomodelling. Each of the above persons meet the qualifications for a Qualified Person (QP) within the meaning of NI 43-101.

Estimate Methodology

The estimate was completed using volumetric analytics based on geological parameters that include aquifer geometry, porosity, permeability, pressure, and lithium concentrations. The mineral resource estimate benefited from a considerable amount of data compiled by the oil and gas industry and made public by the Government of Alberta.

Key data sets used to determine aquifer brine parameters in the resource area include:

- drill stem tests (pressure, water quality, and permeability),

- core plug analyses (porosity and permeability),

- core logging and facies description (geometry of the aquifer),

- downhole wireline logs (lithology, total porosity, effective porosity, and permeability),

- sampling compositional analysis (lithium concentration), and

- historical production volumes of hydrocarbons and water (context for aquifer pressure and continuity).

Within each of the three Elk Point Group aquifers, the lithium concentrations are as follows:

- Muskeg aquifer: concentrations in the range of 34.2 to 121.0 mg/L, with an average of 92.3 mg/L based on testing conducted by Volt and verified by third party labs, while Government Data was in the range of 36.0 to 52.0 mg/L with an average of 42.7 mg/L.

- Keg River aquifer: concentrations in the range of 36.7 to 62.1 mg/L, with an average of 48.7 mg/L based on testing conducted by Volt and verified by third party labs, while Government Data was in the range of 32.0 to 54.0 mg/L with an average of 40.4 mg/L.

- Sulphur Point aquifer: concentrations in the range of 29.0 to 51.0 mg/L with an average of 40.3 mg/L, based on Government Data.

A total of 41 samples of lithium measurements, including public and private data, were used to generate the estimated lithium concentration across the Rainbow Lake Property. Numerous lithium brine samples were available for all three formations in the area of interest, including both historical public samples, as well as samples that had been compiled for an open file report prepared by the Alberta Energy Regulator and Alberta Geological Survey, led by Lyster et al., and samples collected by Volt in 2022 and 2023.

To estimate a lithium Inferred Mineral Resource across the Rainbow Lake Property area, a volumetric analysis based on bulk rock volume, petrophysical properties, and lithium concentration data was used to define the initial estimates of reservoir in-place volumes. Based on sensitivity analysis, it is reasonable to expect that most of the Inferred Mineral Resource volume estimated can be moved into Indicated and Measured Resources as exploration activities, geomodel enhancements and additional statistical modeling resolve and manage uncertainties related to the geological parameters associated with the project.

As of the effective date of the Technical Report, Inferred Mineral Resources, estimated in accordance with NI 43-101 and using CIM definition standards (2014), and CIM (2012, 2019) and OSC (2011) guidance, and documented above are considered uncertain based on current known geological attributes across the Rainbow Lake Property to be defined as reserves. The mineral resources documented in this Technical Report do not demonstrate the economic viability necessary to be classified as mineral reserves at this time.

About Volt

Volt is a lithium development and technology company aiming to be North America’s first commercial producer of lithium hydroxide and lithium carbonates from oilfield brine. Our strategy is to generate value for shareholders by leveraging management’s hydrocarbon experience and existing infrastructure to extract lithium deposits from existing wells, thereby reducing capital costs, lowering risks and supporting the world’s clean energy transition. With four differentiating pillars, and a proprietary Direct Lithium Extraction (“DLE”) technology, Volt’s innovative approach to development is focused on allowing the highest lithium recoveries with lowest costs, positioning us well for future commercialization. We are committed to operating efficiently and with transparency across all areas of the business staying sharply focused on creating long-term, sustainable shareholder value. Investors and/or other interested parties may sign up for updates about the Company’s continued progress on its website: https://voltlithium.com/.

Contact Information

For Investor Relations inquiries or further information, please contact:

Alex Wylie, President & CEO

awylie@voltlithium.com

M: +1.403.830.5811

Forward Looking Statements

This news release includes certain “forward-looking statements” and “forward-looking information” within the meaning of applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or information. Statements, other than statements of historical fact, may constitute forward looking information and include, without limitation, statements about future exploration activities; the preparation and disclosure of a NI 43-101 technical report; the merits of the Rainbow Lake Project; the disclosure of additional technical information and recommended exploration activities for the Rainbow Lake Project; the financial position, assets, liabilities and loss position of Volt; Volt’s future financial commitments; Volt’s expected financial position and financial commitments following completion of the Acquisition; the satisfaction of closing conditions and completion of the Acquisition; the merits of the Acquisition; the ownership and management of the Company upon closing; the minerals targeted by Volt; that the Acquisition accelerates the execution of the Company’s strategy; and the expected closing of the Acquisition. Forward-looking statements and forward-looking information also include any statements relating to future mineral production, liquidity, enhanced value and capital markets profile of Volt, future growth potential for Volt and its business, and future exploration plans. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions regarding, among other things, the closing of the Acquisition; the approval of the TSXV; and the ability of the parties to complete the Acquisition as contemplated in the Agreement. Assumptions have also been made regarding, among other things, the price of copper, lithium and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Volt’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms, that the geological, metallurgical, engineering, financial and economic advice that the Company has received is reliable and are based upon practices and methodologies which are consistent with industry standards. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies and may prove to be incorrect. Additionally, there are known and unknown risk factors which could cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of well results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; inability to obtain TSXV approval on terms acceptable to the Company and the Vendors; inability to satisfy the closing conditions of the Agreement; inability to realize the expected synergies from the Acquisition; the need for cooperation of government agencies in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; increased costs and restrictions on operations due to compliance with environmental and other requirements; increased costs affecting the metals industry and increased competition in the metals industry for properties, qualified personnel, and management. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.