(TheNewswire)

MAY 30, 2023 – TheNewswire - HOUSTON, TX, USA – Select Sands Corp. (“Select Sands”, “We” or the “Company”) (TSXV:SNS), (OTC:SLSDF) today announced operational and financial results for the three months ended March 31, 2023 (“Q1 2023”), and the filing of its financial statements and associated management’s discussion and analysis on www.sedar.com. All dollar references in this release are in U.S. dollars.

KEY HIGHLIGHTS

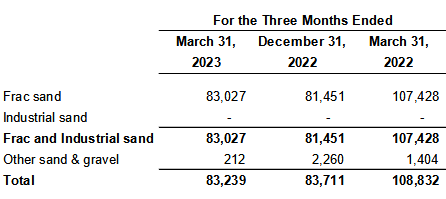

- Sold 83,027 tons of frac and industrial sand during Q1 2023 compared to 81,451 tons in the three months ended December 31, 2022 (“Q4 2022”) and 107,428 tons in the three months ended March 31, 2022 (“Q1 2022”).

-

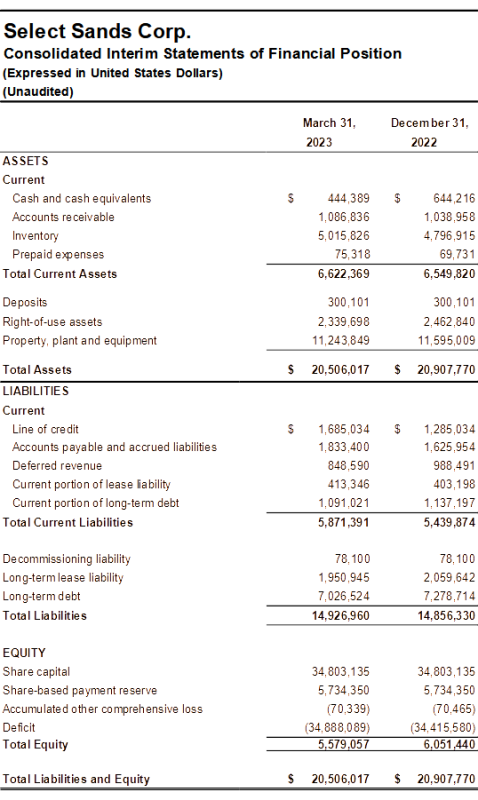

As of March 31, 2023, cash and cash equivalents were $0.4 million, accounts receivable was $1.1 million, inventory was $5.0 million, working capital was $0.8 million and total debt was $8.1 million (including $7.0 million long-term). Of note, the Company has received full payment on all of its accounts receivable balance outstanding on March 31, 2023.

-

(1)Adjusted EBITDA is a non-IFRS financial measure and is described and reconciled to net (loss) income in the table later in this release under the section titled “Non-IFRS Financial Measures”.

Zig Vitols, President and Chief Executive Officer, commented, “We were pleased to see higher sequential sales volumes during the first quarter and remain focused on supporting oil and gas operators in their ongoing field development efforts designed to maximize the ultimate recovery of their inventory of assets. These operators recognize the superior benefits afforded by our premium Northern White Sand product offerings that are locatedmuch closer to key oil basins in the Southern U.S. compared to the majority of other Northern White Sand producers. As in the past, I want to thank our workforce for their tireless efforts as we strive to continue to provide our customers with a superior product and exemplary service.”

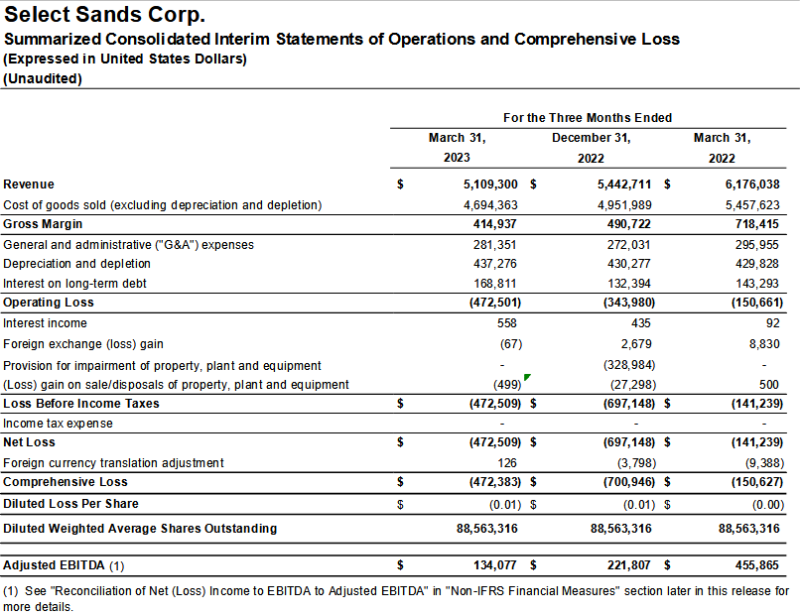

FINANCIAL SUMMARY

The following table includes summarized financial results for the three months ended March 31, 2023, December 31, 2022 and March 31, 2022:

Click Image To View Full Size

SALES VOLUMES

Select Sands sold 83,027 tons of frac and industrial sand during Q1 2023, which was 2% higher than sales of 81,451 tons in Q4 2022. Sales volume levels for Q1 2023 were below the full shipment capability of the Company’s Arkansas’ operations (approximately 150,000 tons per quarter). This presents the opportunity for continued improvement in sales volumes (and the ability to spread fixed costs over a wider base of tons produced) over time.

For Q2 2023, the Company expects frac and industrial sand sales volumes of approximately 45,000 to 60,000 tons.

OPERATIONS UPDATE

Contributing to Select Sands’ outlook is Baker Hughes’ recently published weekly drilling rig count estimates that show a U.S. onshore count of 720 rigs as of May 19, 2023, which was substantially flat with the same time last year. The Company remains focused on positioning its operations to capitalize on this positive trend by further leveraging its high-quality product offerings. This includes serving the needs of customers in the Eagle Ford shale basin in South Texas. Select Sands’ George West transload facility continues to operate 24 hours per day and seven days per week, including offering transload for other rail shippers as appropriate. The facility has recently enhanced its tons per day capabilities to meet the requests who have short notice spot demand.

OUTLOOK

Mr. Vitols concluded, “Our second quarter sales volumes outlook reflects the continued evolvement of one of our largest customer’s schedule of field development activities and previous product purchase obligations. We view the anticipated decline in sales volumes for the second quarter as temporary and expect to see an increase to more recent historical activity levels in the second half of 2023 assuming a continued solid industry commodity pricing backdrop and an anticipated improvement in the spot sales environment. As in the past, we will continue to capitalize on available opportunities to strategically enhance our cost structure for the benefit of our shareholders. We appreciate the ongoing support of our shareholders as we remain focused on growing the business through targeted internal initiatives and evaluation of external opportunities designed to prudently expand the business and provide a solid risk-adjusted return on investment.”

ADDITIONAL MANAGEMENT COMMENTARY

An audio recording of management’s additional comments related to its results and outlook will be posted to the Company’s website (https://www.selectsands.com/) under the Investors section in the next week.

ABOUT SELECT SANDS CORP.

Select Sands Corporation is an industrial silica product company, which wholly owns a Northern White silica sands property and related production facilities located near Sandtown, Arkansas. Select Sands’ goal is to become a key supplier of premium industrial silica sand and frac sand to North American markets. Select Sands’ Arkansas properties have a significant logistical advantage of being significantly closer to oil and gas markets located in Oklahoma, Texas, Louisiana, and New Mexico than the majority of sources of similar sands from the Northern mid-west area such as Wisconsin. Select Sands also operates a transload facility in George West, Texas in Live Oak County that serves customers operating in the Eagle Ford Shale Basin. The facility has a capacity for 180 rail cars and is equipped with two offload/loading stations with dedicated silos for a high throughput capacity. In addition to transloading Select Sands products, the Company sells other sand products from this facility and is able to offer transload services.

FORWARD-LOOKING STATEMENTS

This news release includes forward-looking information and statements, which may include, but are not limited to, information and statements regarding or inferring the future business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs of the Company. Information and statements which are not purely historical fact are forward-looking statements. The forward-looking statements in this press release relate to comments that include, but are not limited to, statements related to expected current and future state of operations, sales volumes for 2023, customer activity levels, and the unique market position of the Company. Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein. Although the Company believes that any forward-looking information and statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such information and statements, there can be no assurance that any such forward-looking information and statements will prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking information and statements. Any forward-looking information and statements herein are made as of the date hereof, and except as required by applicable laws, the Company assumes no obligation and disclaims any intention to update or revise any forward-looking information and statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking information and statements herein, whether as a result of new information, future events or results, or otherwise, except as required by applicable laws.

COMPANY CONTACTS

Please visit www.selectsands.com or contact:

|

Zigurds Vitols

President & CEO

Phone 844-806-7313

|

W. Joe O’Rourke

Vice President Sales & Marketing

Phone: (713) 689-8000

Joe.orourke@selectsands.com

|

|

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

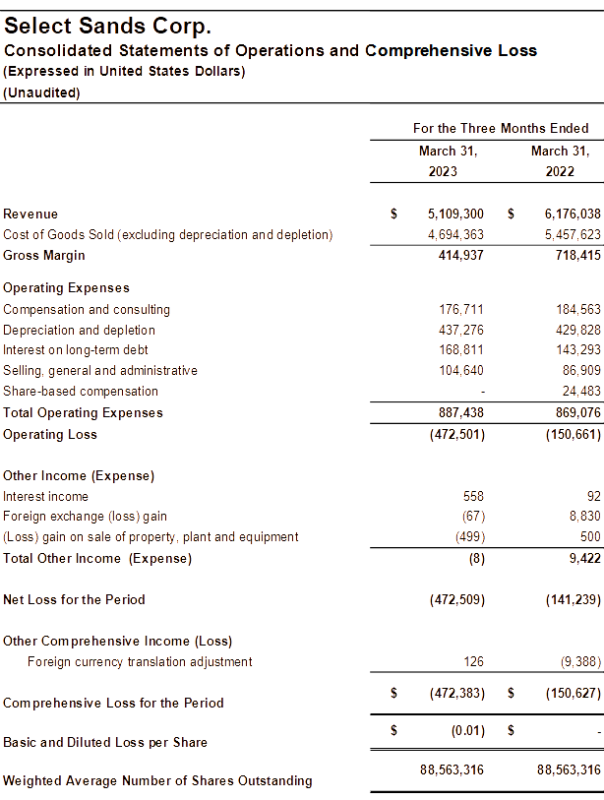

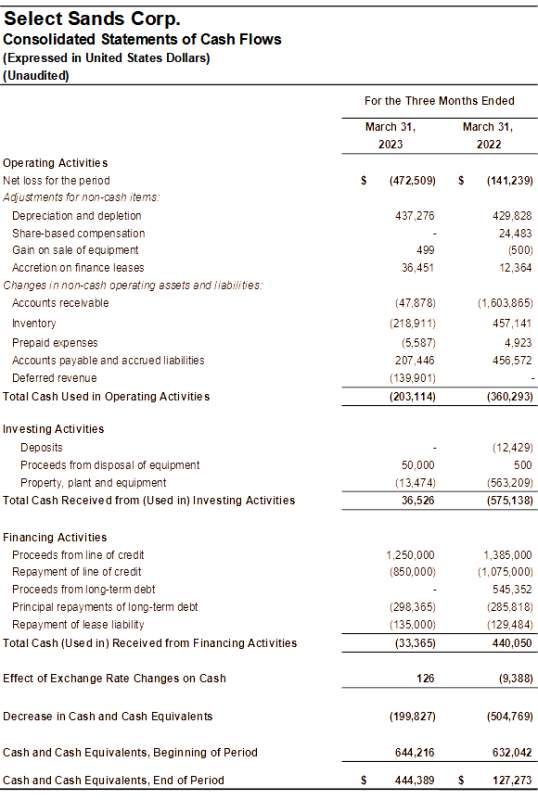

Click Image To View Full Size

Click Image To View Full Size

Click Image To View Full Size

NON-IFRS FINANCIAL MEASURES

The following information is included for convenience only. Generally, a non-IFRS financial measure is a numerical measure of a company’s performance, cash flows or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS. Adjusted EBITDA is not a measure of financial performance (nor does it have a standardized meaning) under IFRS. In evaluating non-IFRS financial measures, investors should consider that the methodology applied in calculating such measures may differ among companies and analysts.

The Company uses both IFRS and certain non-IFRS measures to assess operational performance and as a component of employee remuneration. Management believes certain non-IFRS measures provide useful supplemental information to investors in order that they may evaluate Select Sands' financial performance using the same measures as management. Management believes that, as a result, the investor is afforded greater transparency in assessing the financial performance of the Company. These non-IFRS financial measures should not be considered as a substitute for, nor superior to, measures of financial performance prepared in accordance with IFRS.

|

Reconciliation of Net Loss to EBITDA to Adjusted EBITDA

|

|

|

|

|

|

Three Months Ended

|

|

March 31,

|

December 31,

|

March 31,

|

|

2023

|

2022

|

2022

|

|

Net Loss

|

($472,509)

|

($697,148)

|

($141,239)

|

|

Add Back:

|

|

|

|

|

Depreciation and depletion

|

437,276

|

430,277

|

429,828

|

|

Interest on long-term debt

|

168,811

|

132,394

|

143,293

|

|

Share-based compensation

|

-

|

-

|

24,483

|

|

EBITDA

|

$133,578

|

($134,477)

|

$456,365

|

|

Add Back:

|

|

|

|

|

Provision for impairment of property, plant and equipment

|

-

|

328,984

|

-

|

|

Loss (gain) on sale of property, plant and equipment

|

499

|

27,298

|

(500)

|

|

Adjusted EBITDA

|

$134,077

|

$221,805

|

$455,865

|

As reflected in the above tables for the periods presented, the Company defines EBITDA as net loss adjusted for items listed. The Company defines Adjusted EBITDA as net loss adjusted for select items used to estimate EBITDA with additional adjustments as listed in the above table to estimate Adjusted EBITDA. Select Sands uses Adjusted EBITDA as a supplemental financial measure of its operational performance. Management believes Adjusted EBITDA to be an important measure as they exclude the effects of items that primarily reflect the impact of long-term investment and financing decisions, rather than the performance of the Company’s day-to-day operations. As compared to net loss according to IFRS, this measure is limited in that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in the Company's business, the charges associated with impairments, termination costs, transaction costs or other items management views as unusual or one-time in nature. Management evaluates such items through other financial measures such as capital expenditures and cash flow provided by operating activities. The Company believes that these measurements are useful to measure a company’s ability to service debt and to meet other payment obligations or as a valuation measurement.

INDICATED RESOURCES DISCLOSURE

The Company advises that the production decision on the Sandtown deposit (the Company’s current “Sand Operations”) was not based on a Feasibility Study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that production will occur as anticipated or that anticipated production costs will be achieved.

Copyright (c) 2023 TheNewswire - All rights reserved.