Vancouver, British Columbia, May 31, 2023 (GLOBE NEWSWIRE) -- NevGold Corp. (“NevGold” or the “Company”) (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) is pleased to announce that it has established a new British Columbia subsidiary, 1416753 B.C. Ltd. (“SubCo”) to focus on its high-grade Ptarmigan silver-copper-lead-zinc project in southeastern BC. SubCo has also entered into an option agreement dated May 26, 2023 (the “Option Agreement”) to acquire a portfolio of advanced exploration assets including two copper-gold-silver projects and three lithium projects in British Columbia (collectively, the “Option Projects”) from Eagle Plains Resources Ltd. (“EPL” or the “Optionor”, TSXV:EPL). The Option Agreement and Option Projects are described in more detail below.

NevGold intends to prepare SubCo for a future subsequent going public transaction through either a spin-out, merger, or sale.

Highlights

- Unlocks immediate value from Ptarmigan with 25 million shares of SubCobeing issued to NevGold to the benefit of NevGold shareholders;

- Further exposure for NevGold shareholders to five promising copper, gold, silver, and lithium projects through the Option Agreement with EPL;

- Large land positions totalling over 310 km2 (or 31,028 hectares) in highly prospective districts in Southeast British Columbia, Toodoggone, and Atlin (see Figure 2);

- Ptarmigan (NevGold), Lost Horse (Option Project), and Acacia (Option Project) have numerous “drill-ready” targets;

- Operating partnership between experienced NevGold and EPL teams on BC projects;

- Allows NevGold to maintain 100% focus on Western USA oxide, heap-leach gold projects including Nutmeg Mountain (Idaho), Limousine Butte (Nevada), and Cedar Wash (Nevada)

NevGoldCEO, Brandon Bonifacio, comments:“The creation of the focused British Columbia SubCo extracts immediate value for our shareholders with 25 million shares being issued to NevGold. The SubCoprovides exposure to a highly prospective portfolio of advanced exploration assets including high-grade silver-lead zinc, copper, gold, and lithiumin British Columbia which can be financed separately without impacting the NevGoldcapital structure and technical resources. Ptarmigan has significant value, but within the NevGold portfolio gets zero value ascribed due to our focus on our gold assets in the Western USA.Partnering with Eagle Plains allows us to strengthen our presence in BC while also building an efficient, well-established operating platform. The transaction allows NevGold to remain laser focused on being one of the go-to companies for oxide, heap-leach gold in the Western USA and it will deliver tremendous value to our shareholders as the BC focused company is daylighted to the public market.”

Eagle Plains VP Exploration, Chuck Downie, comments:“We are lookingforward to workingalongside the NevGold team to advancethese BC criticalmetalsprojects. Webelieve the synergies betweenourcompanieswill fast-trackdiscoverypotential and create value for both Eagle Plains and NevGoldshareholders.”

The Option Agreement

Subject to the terms and conditions of the Option Agreement, the Optionor granted to SubCo the sole and exclusive irrevocable right and option (the “Option”) to acquire an undivided 100% interest in the Option Projects free and clear of any encumbrance, other than certain net smelter return (“NSR”) royalties.

In connection with the Option Agreement, NevGold intends to transfer its Ptarmigan property to SubCo in consideration for 25,000,000 SubCo common shares, representing 100% of the outstanding share capital before the share issuances under the Option Agreement.

SubCo may exercise the Option at its sole discretion by completing the following:

- Issuing the following SubCo shares to EPL (the Optionor):

(i) on or before the Option closing date, 5,000,000 SubCo shares; and

(ii) on or within 10 business days of the closing of a going public transaction involving SubCo, an additional 5,000,000 SubCoshares; and

- Incurring the minimum expenditures on the Option Projects:

(iii) on or before December 31, 2023, $500,000 of expenditures; and

(iv) on or before December 31, 2024, $500,000 of additional expenditures.

Upon the exercise of the Option, SubCo has agreed to grant EPL a 2% NSR royalty on certain Option Projects without underlying royalties, with a buy-down option for SubCo of a 1% NSR royalty for C$1,000,000. Some of the Option Projects are subject to underlying royalties. The NSR royalties on each individual project will be capped at an aggregate 2% NSR.

Upon SubCo completing a going public transaction, EPL has agreed to enter into an Investor Rights Agreement with the resulting issuer in which EPL will agree to certain resale conditions on the shares it holds of the resulting issuer for as long as it holds greater than 5% of the outstanding shares. If SubCo does not complete a going public transaction by June 30, 2024, or such later date agreed between the parties, EPL may terminate the Option Agreement and the Option Projects will revert to EPL.

The obligations of SubCo to complete the transactions contemplated by the Option Agreement are subject to the receipt by NevGold and SubCo of all required regulatory approvals, including the approval of the TSX Venture Exchange. The SubCo shares issued under the terms of the Option Agreement will be subject to an indefinite hold period under applicable securities laws that will expire four months and one day after the later of the date of issuance of the SubCo shares and the date that SubCo has become a reporting issuer in any jurisdiction of Canada.

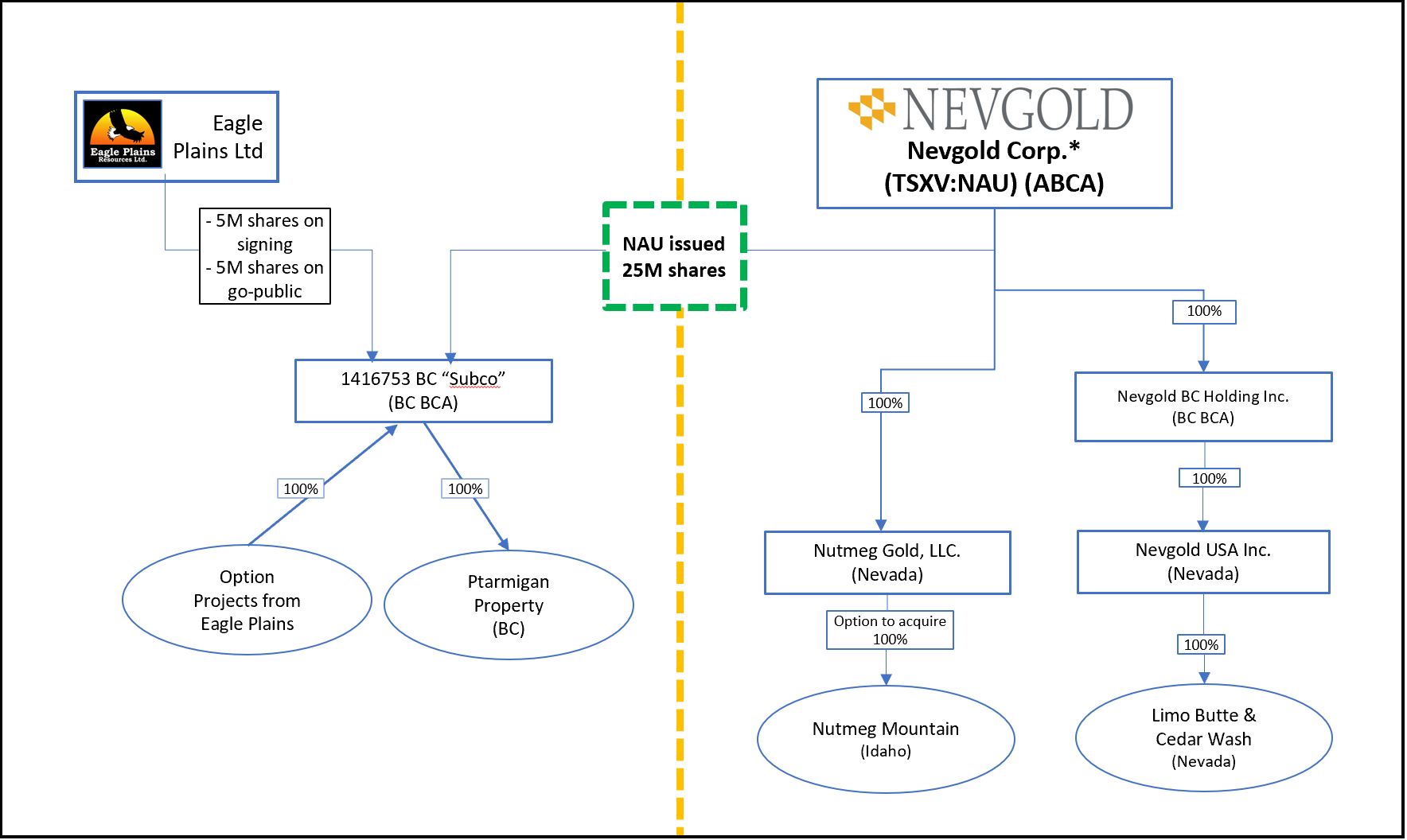

Figure 1 – Arrangement Structure.

To view image please click here

Option Projects

The Option Projects comprise over 20,000 hectares and are currently held by Eagle Plains Resources, and are summarized below:

| Property Name |

District |

Commodity |

Geology |

Area (Ha) |

| Lost Horse |

Central BC |

Au, Cu |

Epithermal Au, Porphyry Cu |

2,170 |

| Acacia |

Central BC |

Au, Ag, Zn, Pb, Cu |

VMS |

4,857 |

| Findlith |

SE BC |

Lithium |

Lithium-pegmatite |

2,307 |

| Toodoggone |

N. Central BC |

Lithium |

Lithium-pegmatite |

7,154 |

| Surprise Lake |

Atlin |

Lithium |

Lithium-pegmatite |

4,492 |

| Total Option |

|

|

|

20,980 |

| Ptarmigan |

SE BC |

Ag, Au, Zn, Pb, Cu |

CRD, Porphyry Cu |

10,048 |

| Total |

|

|

|

31,028 |

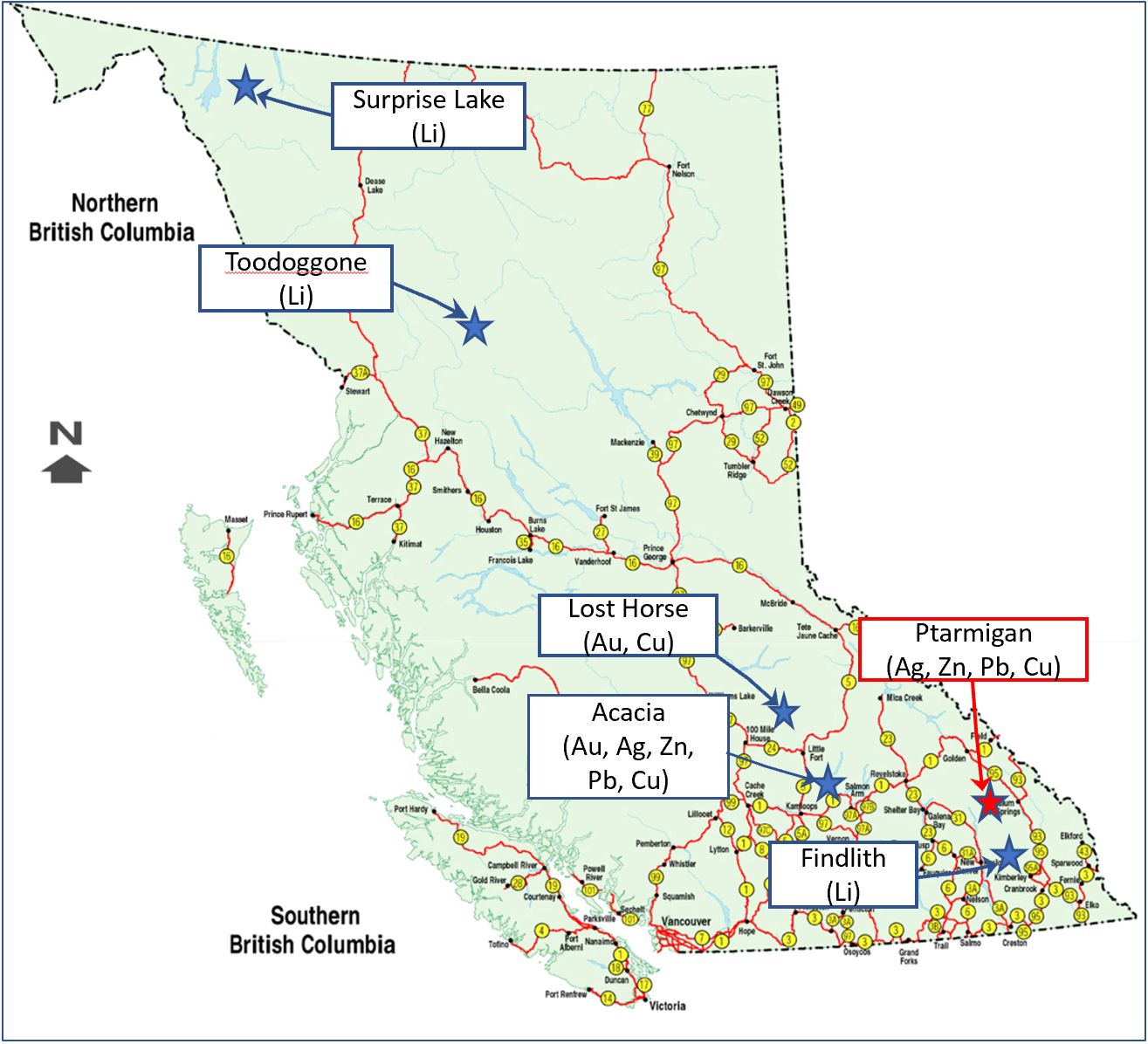

The location of Ptarmigan (red) and the Option Projects (blue) are shown on the map below.

Figure 2 – Location of Projects.

To view image please click here

Ptarmigan (10,048 ha) is a district-scale, high-grade polymetallic project located in southeast British Columbia. The project has had approximately C$7 million spent historically on geophysical and geochemical analysis, surface mapping, and over 14,000 meters of diamond drilling. Some of the high-grade historical results include:

- Drill results:

- 3.65 m of 2,455 g/t Ag, 1.00 g/t Au, 0.91% Cu

- Includes 0.33 m of 22,945 g/t Ag, 5.75 g/t Au, 8.24% Cu

- 1.16 m of 2,315 g/t Ag, 1.64 g/t Au, 1.10% Cu

- 6.80 m of 452 g/t Ag, 0.52 g/t Au, 0.26% Cu

- 3.69 m of 635 g/t Ag, 0.82 g/t Au, 0.33% Cu

- 6.41 m of 96 g/t Ag, 0.36 g/t Au, 0.20% Cu, 3.70% Pb

- 4.90 m of 120 g/t Ag, 3.22% Pb

- Geochemical samplings results:

- 1,171 g/t Ag, 0.96 g/t of Au, 0.30% Cu, 29.7% Pb

- 2,210 g/t Ag, 1.8 g/t Au, 1.4% Cu

- 3,188 g/t Ag, 0.22% Cu, 29.4% Pb

Additional details relating to the geology and interpretation of the drill results for Ptarmigan are contained in the NevGold’s public disclosure and other material filed on SEDAR. Based on the best information available, NevGold’s Qualified Person is of the opinion that the historical drilling was conducted in accordance with current industry best practices, norms and protocols with respect to drill sample security, integrity, core logging, splitting of core, insertion of blanks and standards and transportation to an industry-accredited lab facility.

Lost Horse (2170 ha) is strategically-positioned and surrounded by active exploration and drilling by New Gold Inc. and the project has similar geological characteristics including numerous prospective copper and gold occurrences. Historical work at Lost Horse includes surface mapping, geochemical and geophysical analysis. Eagle Plains has submitted an application to the BC Ministry for Energy, Mines and Low Carbon Innovation for a Multi Year Area Based Permit (“MYAB”) which includes diamond drilling.

Acacia (4857 ha) is located 60 km northeast of Kamloops, BC and is considered to have excellent potential for volcanogenic massive sulphide (“VMS”) deposits. The project is situated southeast and on the same geological trend as the Rea Gold, K7, and Twin 3 deposits, and the previously-mined Samatosum Mine which was in production from 1989-1992. Historical work at the project includes surface mapping, geochemical and geophysical analysis, channel sampling, and approximately 4,450 meters of drilling. The project is fully permitted with a Multi Year Area Based Permit (“MYAB”) issued through the BC Ministry for Energy, Mines and Low Carbon Innovation. Some of the key historical results include:

- Drill results:

- 0.72 g/t Au over 10.3 meters

- 3.9 g/t Au over 1.0 meters

- 3.6 g/t Au over 1.0 meters

- Channel sampling results:

- 1.78 g/t au over 10.0 meters

- 15.5 g/t Au, 9.3 g/t Ag, 0.84% Pb, 3.7% Zn over 0.6 meters

Based on the best information available, NevGold’s Qualified Person is of the opinion that the historical drilling was conducted in accordance with current industry best practices, norms and protocols with respect to drill sample security, integrity, core logging, splitting of core, insertion of blanks and standards and transportation to an industry-accredited lab facility.

Findlith (2307 ha) is located 35 km northwest of Cranbrook, BC. The property is underlain by a granitic batholith as well as pegmatitic intrusions. Numerous beryl occurrences have been documented on the property which indicates the pegmatites are very prospective for lithium.

Surprise Lake (4492 ha) and Toodoggone (7154 ha) are early-stage projects that were acquired based on favorable regional geochemical results and prospective geology that indicate the potential for lithium mineralization in pegmatites. Neither property has previously been evaluated for lithium mineralization, and both are considered highly prospective for lithium bearing pegmatites.

Technical information contained in this news release has been reviewed and approved by Derick Unger, CPG, the Company’s Vice President, Exploration, who is NevGold’s qualified person under National Instrument 43-101 and responsible for technical matters of this release.

ON BEHALF OF THE BOARD

“Signed”

Brandon Bonifacio, President & CEO

For further information, please contact Brandon Bonifacio at bbonifacio@nev-gold.com, call 604-337-4997, or visit our website at www.nev-gold.com.

About the Company

NevGold is an exploration and development company targeting large-scale mineral systems in the proven districts of Nevada, Idaho, and British Columbia. NevGold owns a 100% interest in the Limousine Butte and Cedar Wash gold projects in Nevada, and the Ptarmigan silver-polymetallic project in Southeast BC, and has an option to acquire 100% of the Nutmeg Mountain gold project in Idaho.

Please follow @NevGoldCorp on Twitter, Facebook, LinkedIn, Instagram, and YouTube.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements that are based on the Company’s current expectations and estimates. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “suggest”, “indicate” and other similar words or statements that certain events or conditions “may” or “will” occur. Forward-looking statements in this news release include statements regarding the closing of the Option Agreement, the completion of the conditions to exercise the Option, regulatory approval for the Option Agreement, the nature and the intention to complete a going public transaction of SubCo and future exploration and development programs of the Company and SubCo. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include the ability of SubCo to complete all option conditions to acquire the Option Projects, obtaining all regulatory approval for the Option and uncertainties relating to the proposed going public transaction of SubCo and exploration and development activities. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.