Highlights:

- Measured & Indicated resource of 2.99Mt @ 0.4% Cu and 4 g/t Ag constrained within a shallow open pit with cut-off grade of 0.2% Cu

- Estimate is based on 66 drill holes totaling 10,150 m completed between 2017 and 2022

- Mineral resource estimate confirms the potential of hub-and-spoke model for the Mitchi project

- Current study confirms the deposit is amenable to open pit mining operations with at-surface mineralization and relatively low strip ratios

- A Preliminary Economic Assessment will be completed to evaluate the capital costs of a hub-and-spoke model centered around the Sherlock zone and the existing infrastructure around the Fer à Cheval outfitter

- Genevieve Ayotte, CPA, joining the board of directors

- Shareholders are invited to join the Annual General Meeting on Friday June 16, 2023 at 10am at the following link: Teams link

MONTREAL, June 15, 2023 (GLOBE NEWSWIRE) -- Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce the successful completion of its maiden mineral resource estimate (“MRE”) for the Sherlock zone, Mitchi Project. The independent MRE was prepared by InnovExplo Inc. in accordance with NI 43-101 regulations.

“The Sherlock zone maiden mineral resource estimate achieved its goal. The study’s objective was to delineate the first open pit for our hub-and-spoke model that we envision for the Mitchi project. With the first shallow open pit with mineralization from surface established, we can proceed to the next stages in development and exploration. The upcoming Preliminary Economic Assessment (PEA) will establish all the economic parameters for such operation. The PEA will need to take into consideration all the infrastructure already presents around the Fer à Cheval outfitter, a major operational hub in the area. The PEA results will guide the next infill drilling program while other exploration activities will focus on identifying the best potential open pit targets that could feed ore to the same mill.” commented Kiril Mugerman, President & CEO of Kintavar Exploration.

Mineral Resource Estimate

| Mitchi Project |

Mineral Resources |

Tonnes |

Copper (%) |

Silver (g/t) |

Lbs of Copper |

Ounces of Silver |

Sherlock

|

Measured |

6,000 |

0.47 |

2.4 |

57,200 |

400 |

| Indicated |

2,983,000 |

0.40 |

4.0 |

26,305,300 |

385,500 |

| Measured + Indicated |

2,989,000 |

0.40 |

4.0 |

26,362,500 |

385,900 |

| Inferred |

85,000 |

0.35 |

3.8 |

653,400 |

10,200 |

Notes to the 2023 MRE

- The independent and qualified persons for the 2023 MRE, as defined by NI 43-101, are Olivier Vadnais-Lebanc, P. Geo., and Simon Boudreau, P.Eng. all from InnovExplo Inc. The effective date of the 2023 MRE is June 12, 2023.

- These mineral resources are not mineral reserves, because they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects of economic viability.

- The MRE follows CIM Definition Standards (2014) and CIM MRMR Best Practice Guidelines (2019).

- The estimate encompasses 25 mineralized envelopes modeled using GenesisTM software. Thickness varies from 0.88m to 8.56m, with an average thickness of 3.16m. A modeling cutoff grade of 0.1% Cu was used to create the envelopes.

- No assays were capped. Compositing of 1.0 m in length was completed using the grade of the adjacent material when assayed or a value of zero when not assayed.

- The estimate was completed using a sub-block model in Surpac 2022. A 4m x 4m x 4m parent block size was used with 1m x 1m x 1m sub-blocks. The mineral resources were estimated using hard boundaries on composited assays with the inverse distance to square power (ID2) method.

- A density value of 2.79 g/cm3 was assigned to the mineralized envelopes, of 2.61 g/cm3 was assigned to dyke envelopes and a density value of 2.91 g/cm3 was assigned to the enveloping waste material.

- The mineral resource estimate is classified as Measured, Indicated and Inferred. Measured mineral resources were defined for blocks inside geological resource solids classified as Indicated within 10 m of surface outcrops. Indicated resources are defined with a minimum of three (3) drill holes in areas where the drill spacing is less than 35 m. The Inferred category is defined with two (2) drill holes in areas where the drill spacing is less than 55 m where there is reasonable geological and grade continuity.

- The reasonable prospects for eventual economic extraction requirement is satisfied by using reasonable cut-off grades for an open pit extraction scenario and constraining pit shells (Whittle optimization) with wall angle of 50° in rock and 30° in overburden. The estimate is reported at a cut-off grade of 0.2% Cu. The estimate was calculated using a price of US$3.80 per pound of copper, USD:CAD exchange rate of 1.32, industrial sorting recovery of 81% with a mass pull of 45%, metallurgical recovery of 85% for copper at a concentrate grade of 40% copper, mining cost of $3.00/t in rock and 2.10$/t in overburden, transport cost of $90.00/t concentrate, G&A cost of $9.50/t, sorting cost of $0.40/t, and processing cost of $20.00/t. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.). Silver is treated as a by-product in the MRE.

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in pounds of in-situ metal rounded to the nearest thousand for copper and nearest hundred for silver. Any discrepancy in the totals is due to rounding effects. Rounding followed the recommendations of NI 43-101.

- The qualified persons are not aware of any problem related to the environment, permits or mining titles, or related to legal, fiscal, socio-political, commercial issues, or any other relevant factor not mentioned in this Technical Report that could have a significant impact on the 2023 MRE.

The resource estimate was based on a traditional metallurgical study (flotation) completed in 2019 and a well established XRF sorting technology for which a study was completed earlier in 2023.

All samples have been sent and prepared (PREP-31) by ALS Global laboratory in Val-d’Or. For base metals and silver, the pulp was sent to ALS Global laboratory in Vancouver for multi-elemental analysis by four acid digestion (ME-ICP61) with ICP-AES finish. Samples with assays higher than 10,000 ppm Cu, Zn or Pb, or 100 ppm Ag were reanalyzed with over limits methods (CU-OG62, ZN-OG62, PB-OG62, or AG-OG62) at the ALS Global Vancouver laboratory. Quality controls include systematic addition of blank samples and certified copper standards to each batch of samples sent to the laboratory.

New Director Appointment and Annual General Meeting

Kintavar is very pleased to announce the nomination of Genevieve Ayotte as a new candidate for directorship. The new director will be proposed at Kintavar’s next Annual General Meeting (“AGM”). The AGM will take place on Friday June 16, 2023 at 10 a.m. (Eastern Time) at McMillan LLP 1000, Sherbrooke W, Suite 2700, Montreal, Quebec. Shareholders are invited to attend in person or by joining remotely through the following link: Teams link

Ms. Genevieve Ayotte is a member of the Certified Professional Accountants of Quebec and graduated from HEC Montréal with a Bachelor’s in Business Management and a D.E.S.S in public accounting (2008). Outside of Ms. Ayotte’s accounting profession, she also serves as President of Women in Mining- Montreal. Since 2008, Ms. Ayotte developed extensive mining knowledge, specifically in public accounting at PricewaterhouseCoopers LLP (PwC). As a director in audit at the Montreal office, she has worked with many Canadian mining companies, including Arianne Phosphate which she joined as their Chief financial officer in 2022. “Genevieve is an experienced professional with detailed knowledge of Kintavar from her time worked at PWC. Her involvement in the mining industry in Quebec and extensive knowledge in public accounting will be an important asset as we move the Mitchi project to the next phase of development” mentioned Mugerman.

NI-43-101 Disclosure

The qualified persons independent of the issuer, responsible for estimating the resources of the Mitchi property, within the meaning of NI 43-101, are Messrs. Olivier Vadnais-Leblanc, P.Geo., and Simon Boudreau, P.Eng., of InnovExplo Inc.

MM. Vadnais-Leblanc and Boudreau declare that they have read this press release and that the scientific and technical information relating to the resource estimate presented therein is correct.

Alain Cayer, P.Geo., MSc., Vice-President Exploration of Kintavar, is Qualified Person under NI 43‐101 guidelines who supervised and approved the preparation of the technical information in this news release.

The NI 43-101 Mineral Resource Estimate and Technical report will be filed on Sedar within 45 days of this press release.

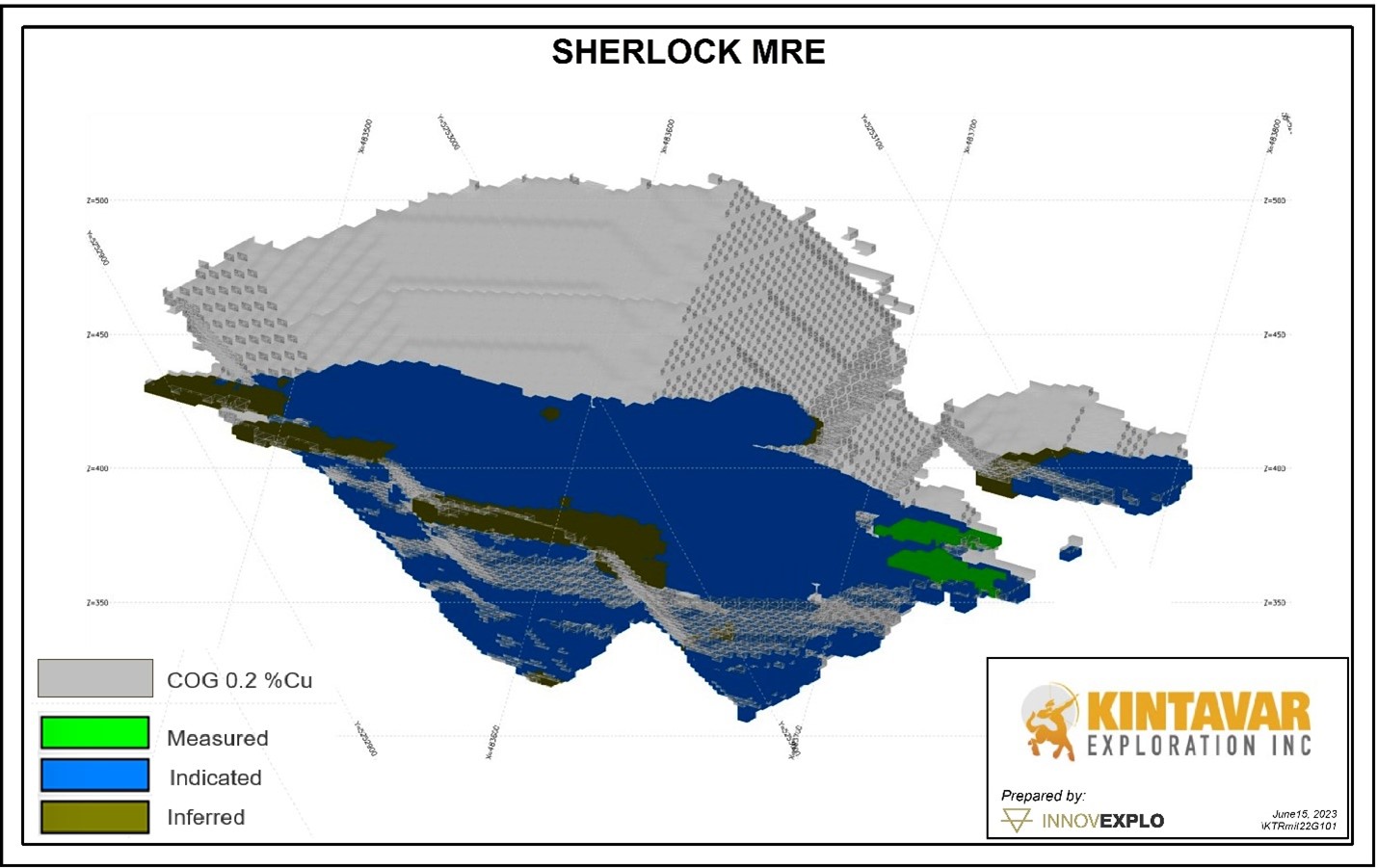

Figure 1: Sherlock Zone resource categories within a pit boundary at a cut-off grade of 0.2% Cu. (pdf)

About Kintavar Exploration & the Mitchi – Wabash Properties

Kintavar Exploration is a Canadian mineral exploration Corporation engaged in the acquisition, assessment, exploration and development of gold and base metal mineral properties. Its flagship project is the Mitchi – Wabash copper-silver district (approx. 39 000 hectares, 100% owned) located 100 km north of the town of Mont-Laurier and 15 km East of the town of Parent in Quebec. Both properties cover an area of more than 300 km2 accessible by a network of logging and gravel roads with access to hydro-electric power already on site, major regional roads including railroad and a spur. The properties are located in the north-western portion of the central metasedimentary belt of the Grenville geological province. The projects primarily focus on sediment-hosted stratiform copper type mineralization (SSC) but include Iron Oxide Copper Gold (IOCG) and skarn type targets. Osisko holds a 2% NSR on 27 claims of the southern portion of the Mitchi property, outside of the sedimentary basin. Kintavar also has exposure in the gold greenstones of Quebec by advancing the Anik Gold Project in a partnership with IAMGOLD and several early-stage projects that were optioned by Gitennes Exploration.

Kintavar supports local development in the Mitchi-Wabash region where it owns and operates the Fer à Cheval outfitter (www.feracheval.ca), a profitable and cashflow generating operation where it employs local workforce. It as well works with local First Nations to provide training and employment.

For further information contact:

Kiril Mugerman, President and CEO

Phone: +1 450 641 5119 #5653

Email: kmugerman@kintavar.com

Web: www.kintavar.com

Forward looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains statements that may constitute “forward-looking information” or “forward looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking information and statements may include, among others, statements regarding future plans, costs, objectives or performance of the Corporation, or the assumptions underlying any of the foregoing. In this news release, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” “target” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including additional closings of the private placement referred to above, or if any of them do so, what benefits the Corporation will derive. Forward-looking statements and information are based on information available at the time and/or management's good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions and other unpredictable factors, many of which are beyond the Corporation’s control. These risks, uncertainties and assumptions include, but are not limited to, those described under “Risk Factors” in the Corporation’s management’s discussion and analysis for the fiscal year ended December 31, 2022, which is available on SEDAR at www.sedar.com; they could cause actual events or results to differ materially from those projected in any forward-looking statements. The Corporation does not intend, nor does the Corporation undertake any obligation, to update or revise any forward-looking information or statements contained in this news release to reflect subsequent information, events or circumstances or otherwise, except if required by applicable laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/68384a3b-c7e2-4242-af80-e8a6218789b5