HIGHLIGHTS

- Major Western Australian gold developer De Grey Mining Ltd (ASX: DEG) (“De Grey”) to spend up to A$25 million on exploration of Novo’s Becher Gold Project (“Becher”) and adjacent tenements, encompassing approximately 1,000 sq. km, through an earn-in and joint venture (“Egina JV”) under a binding Heads of Agreement (the “Agreement”).

- De Grey will earn a 50% direct stake in the relevant tenements by spending A$25 million on exploration within four years, with a minimum commitment of A$7 million within 18 months, at which time the 50/50 Egina JV will be established.

- De Grey will manage all exploration under the earn-in and become the manager of the Egina JV once established.

- Novo’s flagship Becher tenements are adjacent to De Grey’s 11.7 Moz Au (JORC 2012)1 Mallina Gold Project on which De Grey expects to release a Definitive Feasibility Study in Q3 2023.

- Novo’s exploration program to date has confirmed that Becher has the geological indicators of potential discovery success.

- De Grey has separately agreed to take a cornerstone investment of A$10 million in Novo common shares for an approximate 11.6% post-financing undiluted interest in Novo and will become the Company’s largest single shareholder.

- The cornerstone investment underpins Novo’s exciting exploration portfolio and growth strategy.

- The cornerstone private placement to De Grey will be completed at Novo's current spot price of C$0.255 per common share.

- De Grey has also been granted a financing participation right and board nomination right and will be subject to extended contractual hold period and orderly sale restrictions subsequent to expiry of such hold period.

- Novo has commenced a process to seek a dual listing on the Australian Securities Exchange (“ASX”) through an initial public offering (“IPO”), with further updates to follow.

- Argonaut has been appointed lead manager to the IPO.

- A listing on the ASX would complement Novo’s current TSX and OTCQX listings and is a logical next step given the location of Novo’s assets.

- Novo will commence a strategic review of the Nullagine Gold Project to assess value maximising options for shareholders.

- The exploration success at Becher is testament to the credentials of Novo’s experienced management and exploration team that will continue to focus on opportunities for major gold discoveries.

- Novo will continue to focus on exploration with drilling programs planned for Nunyerry North and Balla Balla in the Pilbara, and Belltopper in Victoria in the second half of 2023.

- This transaction with De Grey will result in Novo having an unaudited consolidated cash position of approximately C$29.8 million / A$33.0 million.

Commenting on De Grey becoming a joint venture partner and cornerstone investor, Novo Executive Co-Chairman and Acting CEO Mike Spreadborough said, “Attracting a joint venture partner and cornerstone investor like De Grey is a strong endorsement of Novo, our team, exploration efforts to date, the Becher Project and our project generation abilities. I would like to welcome De Grey as a major shareholder of Novo and look forward to working with them as we focus on pursuing the next major gold project in the Pilbara”.

“De Grey is the right strategic partner for Becher with their understanding of the area, geology and what is required to make a major discovery within the region, highlighted by their 11.7 Moz Mallina Gold Project1, which sits only ~28km ENE of Becher”.

“De Grey has committed to a minimum exploration spend of A$7 million within 18 months, and potentially up to A$25 million, over the next four years to advance the strong platform already established by Novo. The Novo exploration team has achieved a great deal of success at Becher to date, with reconnaissance exploration zeroing in on key initial targets with results from these programs hitting all the right indicators”.

“The future for Novo is promising; we have a tier-one strategic partner, supportive major shareholders, a highly prospective exploration portfolio, an A-grade exploration team and funding to continue progressing on our path of exploring and defining potential standalone gold projects that can deliver value to our shareholders.”

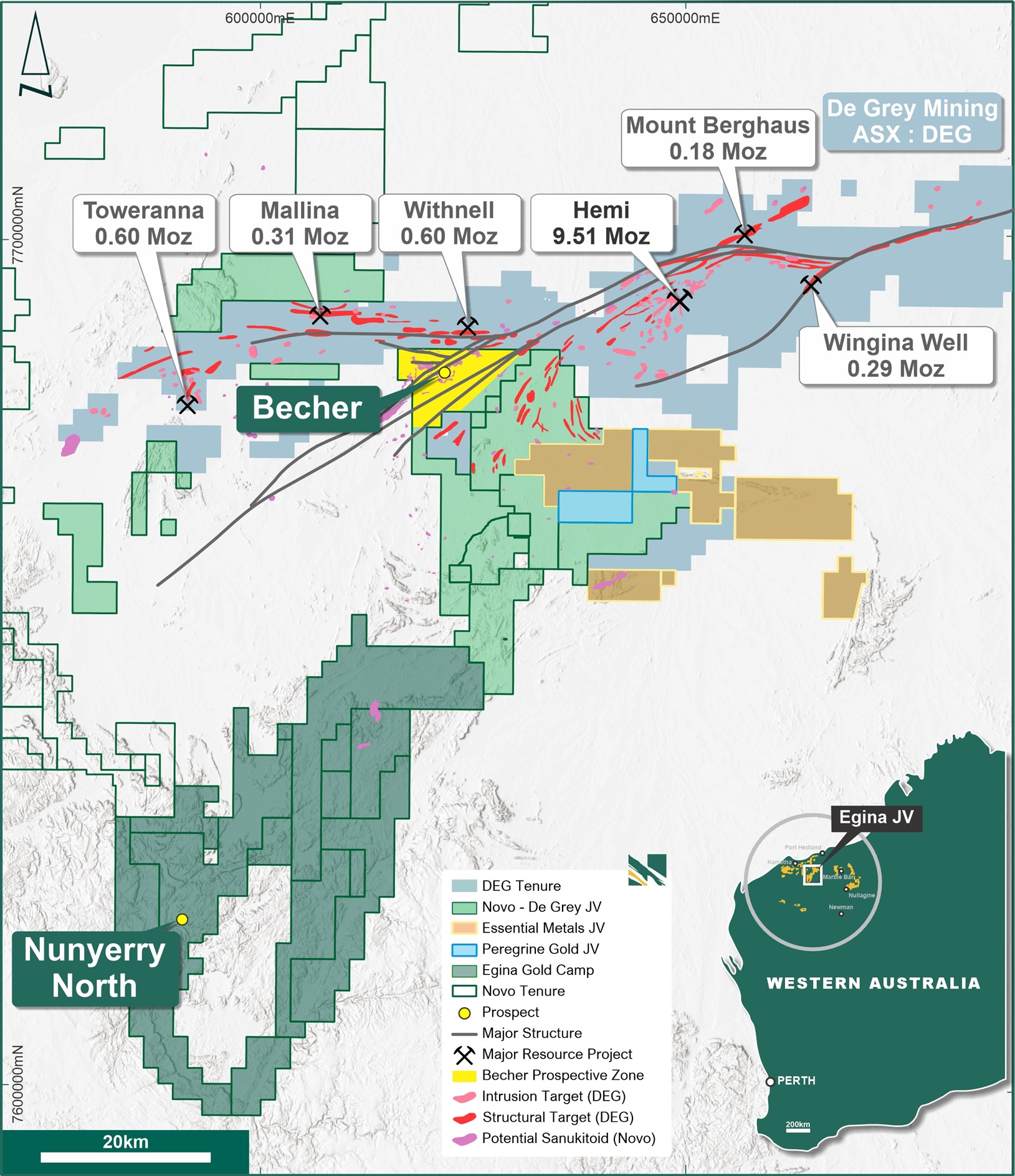

Figure 1 - Egina JV tenure2 is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f1b94588-0a25-4dbf-8653-d1ffe801cc39

VANCOUVER, British Columbia, June 21, 2023 (GLOBE NEWSWIRE) -- Novo Resources Corp. (“Novo” or the “Company”) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to announce that major ASX-listed Western Australian gold developer De Grey (ASX: DEG) has been granted the right to earn a 50% interest in the Egina JV by spending up to A$25 million on exploration within four years. This strategic agreement between De Grey and Novo follows a successful period of exploration completed at Becher by Novo since September 2022.

The Egina JV will encompass, Novo’s Becher Gold Project (“Becher”) and adjacent tenements that cover approximately 1,000 sq. km of existing Novo tenements.

Becher is located in the northern sector of the Egina Gold Camp, ~28 km along trend from De Grey’s Hemi deposit within the 11.7 Moz Au (JORC 2012)1 Mallina Gold Project. The Egina JV tenements are considered highly prospective for large scale, intrusion-related gold deposits similar to the Hemi deposit, as well as shear-hosted orogenic deposits similar to De Grey’s Withnell and Mallina deposits.

De Grey will separately make a cornerstone private placement investment of A$10 million into Novo at a price of C$0.255 per common share (the “Financing”). De Grey will become Novo’s largest single shareholder with an approximate 11.6% post-Financing undiluted interest in Novo.

Over the last 9 months, Novo has prioritised work at Becher and completed a large amount of exploration drilling with 2,130 aircore drill holes completed for over 50,000 m. The results from this program have been very promising, with drilling highlighting mineralisation under shallow cover in both intrusions and sedimentary rocks and, importantly, displaying geological indicators of potential discovery success.

Novo will now partner with De Grey to continue exploration efforts at Becher and is hopeful of discovering the next major Pilbara gold project.

Novo is a dedicated gold explorer which owns an exciting exploration portfolio located in the premium Australian gold jurisdictions of the Pilbara and Victoria. In the Pilbara, outside of the Becher Project, other current key exploration targets include Nunyerry North located in the southern sector of the Egina Gold Camp, and Balla Balla located north of Karratha. Novo is also exploring in Victoria at its Belltopper Project located south of the Fosterville mine in the Bendigo Tectonic Zone, where over 60 Moz Au were produced historically.

Led by a talented and experienced management and exploration team, Novo has the right team and credentials to make discoveries and build sizeable resources.

About De Grey

De Grey is a Western Australian gold explorer and project development company, with its activities focussed on the 100% owned Mallina Gold Project in the Pilbara region of WA. At Mallina, De Grey made a large scale, high value, near surface gold discovery at an area called Hemi.

The Hemi gold discovery is intrusion hosted and is rapidly moving towards De Grey’s development goal of defining a Tier 1 project with true district-scale potential. Mineralisation in the Hemi area has been identified over a large area and a 9.5-million-ounce Mineral Resource1 was updated in June 2023. The discovery remains open in multiple directions and at depth. Overall, the total Mallina Gold Project Mineral Resource is now 11.7 million ounces1 and includes the Hemi deposits 30km to the north east and Withnell deposits located only 10km north of the Becher prospect area.

De Grey expects to complete a Definitive Feasibility Study on the Mallina Gold Project in the September quarter 2023, and continues to focus exploration on new discoveries throughout the Mallina Gold Project. The Egina JV provides De Grey with an expanded footprint and extensions to the highly prospective stratigraphy and structures.

For De Grey, the addition of the Egina Project tenements to the broader Mallina Gold Project is an important step in its strategy to discover and grow a large resource base centred around the future Hemi processing plant. The new tenements represent a substantial opportunity for De Grey to discover new large scale, intrusion-related gold deposits similar to Hemi, as well as shear-hosted orogenic gold deposits.

Earn-In and Joint Venture

A number of Novo’s wholly-owned Australian subsidiaries have executed the Agreement with De Grey, pursuant to which De Grey has been granted the right to earn a 50% interest in the Egina JV (Figure 1) by incurring up to A$25 million in exploration expenditure within 48 months (the “Earn-In”).

Once De Grey completes the Earn-In, the resultant Egina JV will be fully documented by way of a formal joint venture agreement between the parties. Novo and De Grey will, under the Egina JV, be required to co-fund exploration expenditure according to their pro-rata interests in the Egina JV. De Grey has the right to terminate the Earn-In after incurring a minimum of A$7 million in exploration expenditure within 18 months (in which case it would forfeit any interest in the relevant tenements).

Certain tenements comprising the Egina Project are currently subject to pre-existing joint ventures into which Novo has already earned an interest. The Agreement includes a mechanism by which such joint ventures may be incorporated into the Egina JV, subject to agreement with relevant joint venture partners.

The Earn-In and Egina JV are otherwise subject to industry-standard earn-in and joint venture conditions, including information sharing, quarterly technical meetings, mutual pre-emptive rights and extension of the Earn-In period due to reasonable delays in accessing priority areas of the Egina Project. De Grey will manage exploration activities under the Earn-In, and De Grey will also manage the resultant joint venture provided that its interest remains at or above 50%. The Egina JV is also subject to an industry-standard dilution clause, with dilution below 10% resulting in the conversion of a party’s interest to a 1% net smelter returns royalty.

Cornerstone Investment

Novo expects to close the Financing raising gross proceeds of A$10 million (approximately C$8.97 million) through the issue of 35,223,670 common shares (“Shares”) to De Grey at Novo’s current spot price of C$0.255 per Share promptly following receipt of Toronto Stock Exchange (“TSX”) acceptance of notice of the Financing.

Immediately subsequent to closing of the Financing, De Grey will hold an approximate 11.6% undiluted interest in Novo and will become the Company’s largest single shareholder.

All Shares issued in the Financing will be subject to a statutory hold period expiring four months and one day following the closing of the Financing, along with an additional voluntary contractual hold period (the “Contractual Hold Period”) expiring one year following the closing of the Financing. However, if the Company has not received a formal listing decision letter from ASX (see below) within six months following the closing of the Financing, the Contractual Hold Period will expire six months following the closing of the Financing. The Shares will be subject to orderly sale restrictions subsequent to the expiry of the Contractual Hold Period.

Commencing six months following closing of the Financing and subject to De Grey maintaining at least a 12.5% undiluted interest in Novo at all times (the “Nomination Threshold”), De Grey has a one-time right to nominate a director to Novo’s board. However, if Novo has not received a formal listing decision letter from ASX listing within six months following closing of the Financing, the Nomination Threshold will decrease to 10%. De Grey also has the right to participate in any raising conducted in conjunction with an ASX listing to ensure it holds up to a maximum undiluted post-financing interest of 12.5% of Novo.

The net proceeds from the Financing will primarily be used by Novo to fast-track exploration at the Company’s key projects, including Nunyerry North, Balla Balla and Belltopper, as well as for general working capital purposes.

The Financing is subject to receipt of approval from the TSX.

Argonaut PCF Limited of Perth, Western Australia was financial adviser to Novo on this transaction and will receive a cash finder’s fee of A$0.5 million (approximately C$0.45 million) in connection with the Financing.

Intention to seek Dual-Listing on ASX

Novo is also pleased to announce that it has commenced a process to seek a dual listing on the ASX.

The Board believes that an ASX listing would be a logical next step for Novo given the location of its assets and management team. Further, Novo believes that listing on the ASX would deliver a number of potential benefits for Novo and its shareholders, including:

- Ability to enhance the profile of Novo across a broader mix of stakeholder groups

- Increasing liquidity and accessing potential new sources of equity

- Engaging and attracting additional institutional investment and equity research coverage

The ASX would provide a natural fit for Novo to list and grow due to historical investor appetite for exploration companies with projects located in Australia. Novo has been listed on the TSXV/TSX since 2015, has developed a supportive, long-term investor register and remains committed to this investor group and intends to maintain its TSX and OTCQX listings.

The Company will provide further updates as this process progresses. There is no guarantee that the Company will list on the ASX or will be granted approval to do so.

Nullagine Gold Project Strategic Review

The Nullagine Gold Project (“NGP”) consists of the Mosquito Creek Basin (“MCB”), the Beatons Creek Project and the Golden Eagle Processing Facility. The NGP remains in care and maintenance following suspension of operations in September 2022.

Novo will commence a strategic review of the Nullagine Gold Project to assess value maximising options for shareholders which may include development, joint ventures or divestment.

The Golden Eagle Plant is a tier-one facility which hosts a 1.5 Mtpa nameplate capacity (historically operated at 1.8 Mtpa) conventional gold gravity/CIL processing facility 4 MW SAG mill. The plant is supported by surrounding infrastructure, which includes a 10 MW diesel power station, 230-person accommodation village, offices, workshops and warehouse.

The Beatons Creek project hosts an Indicated Mineral Resource of 3.05 million tonnes at 2.4 g/t Au for 234,000 oz Au and an Inferred Mineral Resource of 0.83 million tonnes at 1.6 g/t Au for 42,000 oz Au3. Reference should be made to the technical report entitled “NI 43-101: Mineral Resource Update, Beatons Creek Gold Project, Nullagine, Western Australia” with an effective date of June 30, 2022 and an issue date of December 16, 2022 (the “Technical Report”), prepared for Novo by Dr. Simon Dominy (FAusIMM(CP) FAIG(RPGeo) FGS(CGeol)), Ms. Janice Graham (MAIG), Mr. Jeremy Ison (FAusIMM), and Mr. Royce McAuslane (FAusIMM) (collectively, the “QP’s”). The QP’s are qualified persons as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The Technical Report is available under the Company’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) website at www.sedar.com (filing date: December 16, 2022) and on the Company’s website at www.novoresources.com.

Deferral of 2023 Annual General Meeting

As a result of the potential ASX listing, the Company has sought and obtained approval from the TSX to defer its annual general meeting (“AGM”) to no later than September 29, 2023. The Company will provide an update on the timing of its AGM in due course.

QP STATEMENTS

Mr. Iain Groves (MAIG), is the qualified person, as defined under NI 43-101, responsible for, and having reviewed and approved, the geological and exploration information contained in this news release pertaining to the Egina Gold Project other than information concerning De Grey’s Mallina Gold Project. Mr. Groves is Novo’s Exploration Manger – West Pilbara.

Mr. Alwin Van Roij (MAIG), is the qualified person, as defined under NI 43-101, responsible for, and having reviewed and approved, the technical information contained in this news release pertaining to the Nullagine Gold Project other than information concerning the Technical Report. Mr. Van Roij is Novo’s Exploration Manger – East Pilbara.

ABOUT NOVO

Novo explores and develops its prospective land package covering approximately 10,500 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper Project in the Bendigo Tectonic Zone of Victoria, Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its stakeholders. For more information, please contact Michael Spreadborough at +61-419-329-687 or mike.spreadborough@novoresources.com, or Leo Karabelas at +1-416-543-3120 or leo@novoresources.com.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Michael Spreadborough”

Michael Spreadborough

Executive Co-Chairman and Acting CEO

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the use of the net proceeds from the Financing, the intention to undertake an IPO on the ASX, and planned exploration activities. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, receipt of TSX acceptance of notice of the Financing, receipt of ASX approval to the listing of Novo, investor interest in the IPO, customary risks of the resource industry and the risk factors identified in Novo’s annual information form for the year ended December 31, 2022, which is available under Novo’s profile on SEDAR at www.sedar.com. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

Notes

1 De Grey has reported that its Hemi deposit at the Mallina Gold Project is comprised of Measured Mineral Resources of 4.7 Mt @ 1.7 g/t Au for 265 koz Au, Indicated Mineral Resources of 184.1 Mt @ 1.3 g/t Au for 7,798 koz Au, and Inferred Mineral Resources of 89.2 Mt @ 1.3 g/t Au for 3,684 koz Au, as those categories are defined in the JORC Code (as defined in NI 43-101). Refer to De Grey’s public disclosure record for further details. No assurance can be given that a similar or any mineral resource estimate will be determined at Novo’s Becher Project.

2 De Grey has reported that, at the Mallina Gold Project, its (i) Mount Berghaus deposit is comprised of Indicated Mineral Resources of 1 Mt @ 1.7 g/t Au for 53 koz Au and Inferred Mineral Resources of 3.4 Mt @ 1.2 g/t Au for 128 koz Au, (ii) Wingina Well deposit is comprised of Measured Mineral Resources of 3.1 Mt @ 1.7 g/t Au for 173 koz Au, Indicated Mineral Resources of 1 Mt @ 1.4 g/t Au for 43 koz Au, and Inferred Mineral Resources of 1.4 Mt @ 1.6 g/t Au for 72 koz Au, (iii) Toweranna open pit deposit is comprised of Indicated Mineral Resources of 8.3 Mt @ 1.6 g/t Au for 418 koz Au and Inferred Mineral Resources of 2.5 Mt @ 1.5 g/t Au for 120 koz Au, (iv) Toweranna underground deposit is comprised of Indicated Mineral Resources of 0.1 Mt @ 3.0 g/t Au for 11 koz Au and Inferred Mineral Resources of 0.5 Mt @ 2.9 g/t Au for 49 koz Au, (v) Mallina deposit is comprised of Indicated Mineral Resources of 1.6 Mt @ 1.2 g/t Au for 64 koz Au and Inferred Mineral Resources of 5.1 Mt @ 1.5 g/t Au for 243 koz Au, (vi) Withnell open pit deposit is comprised of Measured Mineral Resources of 1.3 Mt @ 1.5 g/t Au for 62 koz Au, Indicated Mineral Resources of 3 Mt @ 1.8 g/t Au for 178 koz Au, and Inferred Mineral Resources of 0.7 Mt @ 2.0 g/t Au for 43 koz Au, (vii) Withnell underground deposit is comprised of Indicated Mineral Resources of 0.1 Mt @ 4.3 g/t Au for 16 koz Au and Inferred Mineral Resources of 2.4 Mt @ 3.9 g/t Au for 301 koz Au, and (viii) Hemi deposit is comprised of Indicated Mineral Resources of 165.7 Mt @ 1.3 g/t Au for 6,876 koz Au and Inferred Mineral Resources of 70.2 Mt @ 1.2 g/t Au for 2,632 koz Au, as those categories are defined in the JORC Code (as defined in NI 43-101). Refer to De Grey’s public disclosure record for further details. No assurance can be given that a similar or any mineral resource estimate will be determined at Novo’s Becher Project.

3 Refer to the Company’s news release dated November 2, 2022.