WEBCAST TO BE HELD ON JUNE 27, 2023 @ 10:00 AM EST.

To join the webinar, register here

TORONTO, June 26, 2023 (GLOBE NEWSWIRE) -- Wallbridge Mining Company Limited (TSX:WM, OTCQX:WLBMF) (“Wallbridge” or the “Company”) is pleased to report positive results from the Preliminary Economic Assessment (“PEA”) completed on its still growing, 100%-owned Fenelon gold project (“Fenelon” or the “Project”) located in the Abitibi Greenstone Belt, along the Detour-Fenelon Gold Trend, Quebec (Table 1).

Tony Makuch, Chairman of Wallbridge, stated:

“Projects such as Fenelon, with a projected annual production profile of more than 200,000 gold ounces, located in a mining-friendly jurisdiction with established infrastructure, having substantial exploration upside and access to clean hydro-electric energy are highly desirable yet exceedingly rare in the mining industry today. We are extremely pleased that the PEA on Fenelon alone is demonstrating robust economics at this early stage. We expect further improvements as we continue to add to the resource base through our exploration efforts at Fenelon and elsewhere on our very large land position in the northern Abitibi greenstone belt.”

All results herein are reported in Canadian dollars unless otherwise indicated.

PEA SUMMARY

- Average annual gold production of 212,000 oz over 12.3 years.

- Average annual free cash flow of $157 million over life of mine (“LOM”).

- After-tax NPV of $721 million at base case gold price of US$1,750 and $C/US$ of 1.30

- After-tax NPV of $1,070 million at spot gold price of US$1,950 and $C/US$ of 1.34

- Initial capital expenditures of $645 million.

- Sustaining capital expenditures of $594 million.

- Total cash costs of US$749/oz.

- All-in-sustaining costs of US$924/oz.

Marz Kord, Wallbridge’s President and Chief Executive Officer, commented:

“Wallbridge acquired the original Fenelon property in 2016 with a small historic resource based on sporadic geological work by previous owners. Since then, we have been very successful in delineating a multi-million-ounce gold resource, which remains open in virtually all directions. Fenelon has now reached another milestone with a robust PEA that demonstrates a viable path to development and attractive economic returns based on conservative assumptions. The PEA was designed to be rigorous, using current cost data from contractors, suppliers and mining companies operating in the region to arrive at realistic projections. It represents a compelling starting point to build upon as we scope out the full opportunity at Fenelon and Martiniere, the two most advanced projects on our large, underexplored property.

Over the next few months, we will evaluate alternatives to advance Fenelon. While doing so, we will continue to test new areas of mineralization at Fenelon. We have a great near-term opportunity to incorporate satellite deposits such as Martiniere into future studies, with the potential for substantial synergies on a district scale. Our 2023 exploration programs will further delineate the size and scale of the Fenelon and Martiniere deposits while also targeting new greenfield discoveries on our land package.”

Table 1: PEA Summary of Key Metrics and Project Economics

| Description |

Unit |

Base Case

|

Spot Prices |

| Metal Prices/FX |

|

|

|

| Gold (Au) |

US$/oz |

$1,750 |

$1,950 |

| Currency Exchange Rate |

C$/US$ |

|

1.30 |

|

1.34 |

| Production Data |

|

|

|

| Milled Tonnes |

million tonnes |

|

31 |

|

| Gold Grade Mined |

g/t |

|

2.73 |

|

| Gold Recovery |

% |

|

96 |

|

| Daily Mill Throughput |

tpd |

|

7,000 |

|

| Mine Life |

years |

|

12.3 |

|

| Avg Annual Production |

oz Au |

|

212,000 |

|

| Recovered Gold |

million oz |

|

2.61 |

|

| Operating Costs |

|

|

|

| Total Cash Costs 1,3 |

$/tonne milled |

|

82 |

|

| Total Cash Costs 1,3 |

US$/oz |

|

749 |

|

| All-in Sustaining Costs2,3 |

US$/oz |

|

924 |

|

| Capital Costs |

|

|

|

| Initial Capital3 |

$ million |

|

645 |

|

| Sustaining Capital3 |

$ million |

|

594 |

|

| Financial Analysis |

|

|

|

| Pre-Tax NPV 5% |

$ million |

|

1,210 |

|

1,788 |

| Pre-Tax IRR |

% |

|

23.0 |

|

30.8 |

| After-Tax NPV 5% |

$ million |

|

721 |

|

1,070 |

| After-Tax IRR |

% |

|

18 |

|

24 |

| Payback Period (Production Start) |

years |

|

5.4 |

|

4.2 |

- Total cash costs include mining, processing, tailings, surface infrastructures, transport, G&A and royalty costs.

- All-in sustaining cost (“AISC”) includes total cash costs, sustaining capital expenses to support the on-going operations, and closure and rehabilitation costs divided by payable gold ounces.

- Non-IFRS financial performance measures with no standardized definition under IFRS. Refer to note at end of this press release.

Financial Analysis

At base case gold price of US$1,750/oz, the Project generates after-tax Net Present Value (“NPV”) of $721 million using 5% discount rate and an after-tax Internal Rate of Return (“IRR”) of 18%.

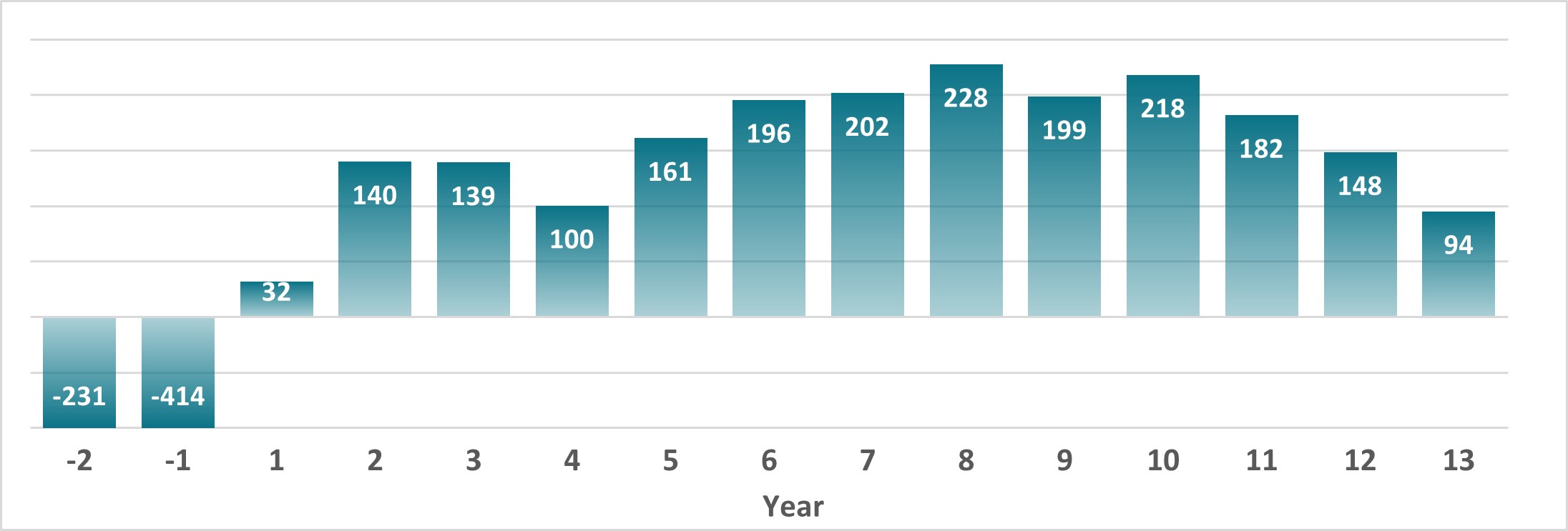

The Project generates cumulative free cash flow of $1,395 million and average annual free cash flow of $157 million over a mine life of 12.3 years (Figure 1). Total taxes payable over LOM at the base case gold price is $792 million.

Figure 1. Project After-Tax Cash Flow

Sensitivities

The PEA financial economic analysis is significantly influenced by gold prices. At a spot gold price of US$1,950/oz and FX of 1.34, the Project generates an after-tax NPV of $1,070 million and an after-tax IRR of 24% with a payback period of 4.2 years from the commencement of production (Table 2).

Table 2: PEA Sensitivity to Gold Price, Operating Costs & Capital Costs

Gold Price

US $/oz |

FX |

NPV

$M |

IRR

% |

Payback

Years |

| $1,600 |

1.30 |

512 |

14 |

6.2 |

| $1750 |

1.30 |

721 |

18 |

5.4 |

| $1,900 |

1.30 |

923 |

21 |

4.6 |

| $1,950 – Spot |

1.34 |

1,070 |

24 |

4.2 |

| Operating Costs |

NPV

$M |

|

Capital Costs |

NPV

$M |

| Base Case -10% |

823 |

|

Base Case -10% |

786 |

| Base Case |

721 |

|

Base Case |

721 |

| Base Case +10% |

614 |

|

Base Case +10% |

653 |

| Base Case +20% |

506 |

|

Base Case +20% |

586 |

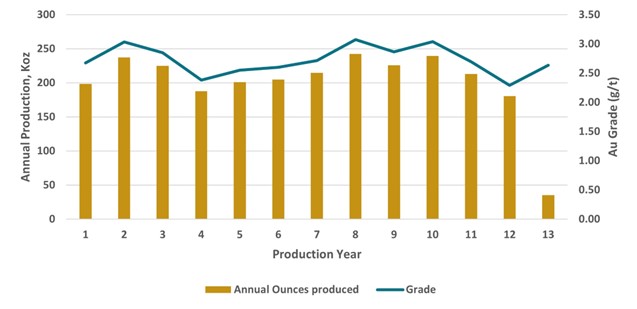

Production

Annual production over LOM is expected to average 212,000 ounces with peak year production of 240,000 ounces (Figure 2).

Figure 2. Production Profile

Capital Costs

The initial capital costs are estimated at $645 million, and the sustaining capital is estimated at $594 million (Tables 3 & 4). A contingency of $54 million and $44 million is included in initial and sustaining capital costs, respectively.

Initial and sustaining capital costs were estimated based on current costs received from vendors as well as developed from first principles, while some were estimated based on factored references and experience from similar operating projects.

Table 3: Initial Capital

| Cost Element |

Initial Capital ($M)1,2

|

| Mill |

220 |

|

| Paste Plant |

46 |

|

| Tailings and Water Treatment |

36 |

|

| Capitalized Operating (Pre-production) |

99 |

|

| Surface Civil & Infrastructure |

87 |

|

| Mining Equipment |

18 |

|

| Underground Development |

83 |

|

| Hydro Electric Line & Distribution |

55 |

|

| Total Initial Capital |

$645 |

|

- All values stated are undiscounted. No depreciation of costs was applied.

- Non-IFRS financial performance measures with no standardized definition under IFRS. Refer to note at end of this press release.

Table 4: Sustaining Capital

| Cost Element |

Sustaining Capital ($M)1,2

|

| Production Shaft |

143 |

|

| Mining Equipment |

140 |

|

| Development |

158 |

|

| Tailings & Water Treatment |

63 |

|

| Paste Distribution Network |

13 |

|

| Underground Infrastructure |

45 |

|

| Surface Infrastructure |

26 |

|

| Closure |

8 |

|

| Total Sustaining Capital |

$594 |

|

- All values stated are undiscounted. No depreciation of costs was applied.

- Non-IFRS financial performance measures with no standardized definition under IFRS. Refer to note at end of this press release.

Cash Costs

The total cash costs including the 4% royalties, is estimated at $82/t milled or US$749/oz payable gold. The AISC is estimated at US$924/oz payable gold.

Operating cost estimates were developed using first principles methodology, vendor quotes, and productivities being derived from benchmarking and industry practices.

Table 5: Total Cash Costs

|

LOM Total

$ million |

Average LOM

($/tonne milled) |

Average LOM

(US$/oz) |

| Mining |

1,320 |

42.7 |

391 |

| Processing |

521 |

16.8 |

153 |

| Water Treatment & Tailings |

51 |

1.6 |

15 |

| General & Admin. |

408 |

13.2 |

120 |

| Royalty (4%) |

237 |

7.7 |

70 |

| Total Cash Costs 1,2 |

2,537 |

82.0 |

749 |

- Total operating costs include mining, processing, tailings, surface infrastructures, transport, G&A and royalty costs.

- Non-IFRS financial performance measures with no standardized definition under IFRS. Refer to note at end of this press release.

Opportunities

The main opportunities for the Project that have been identified include:

| Opportunity |

Potential Benefits |

| Additional infill drilling at Fenelon |

Would likely increase the resource grade and ounces and convert more inferred to measured and indicated categories. |

| Additional exploration drilling at Fenelon |

Deposit is open in all directions. Would likely increase the mineral resources and extend mine life. |

| Additional technical studies (borrow pits, geotechnical investigation, hydrogeology, geochemical) |

Would likely improve project economics by reducing the capital requirements. |

| Additional geotechnical/rock mechanics |

Would likely reduce crown pillar thicknesses thus increasing overall ounces. |

| Additional metallurgical studies, paste fill testing, and tailings testing |

Would likely lower project operating costs. |

| Additional waste rock sampling |

Would likely identify clean waste rock to reduce site infrastructure costs. |

| Additional drilling at Martiniere |

Would likely add organic production growth by increasing mineral resources and converting from inferred to measured and indicated categories. |

| Additional exploration outside the current mineral resources |

Large, underexplored land package. Potential for new discoveries to add organic production growth. |

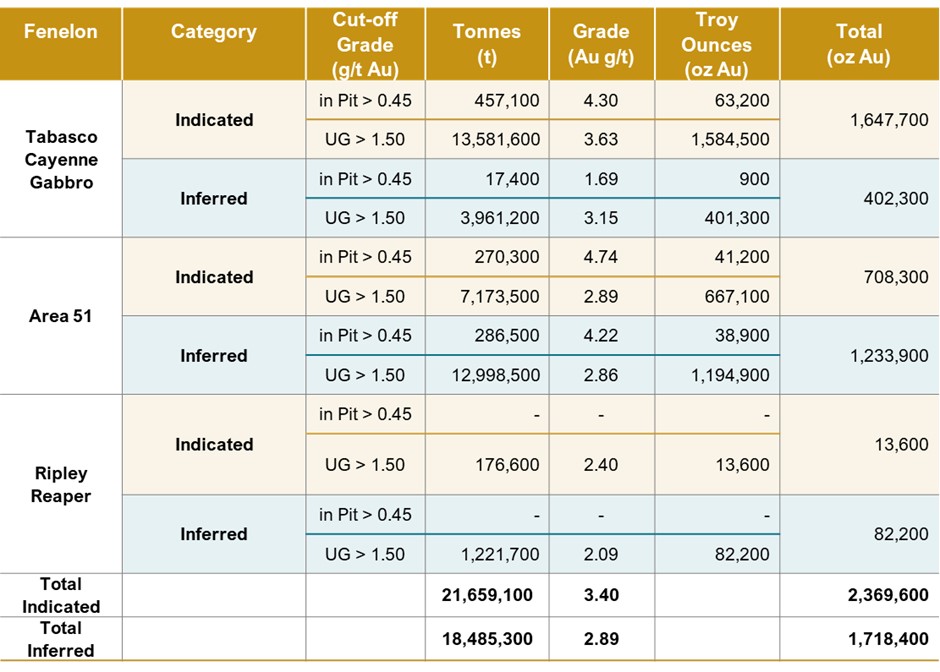

Mineral Resource Estimate

The PEA is based on the 2023 Fenelon Deposit Mineral Resource Estimate (“MRE”) and contains indicated and inferred mineral resource. Carl Pelletier, P.Geo., Vincent Nadeau-Benoit, P.Geo., Simon Boudreau, P.Eng. and Marc R, Beauvais, P.Eng., all of InnovExplo Inc. (“InnovExplo”) are the independent qualified persons within the meaning of NI 43-101 for the 2023 Fenelon MRE.

Table 6: Fenelon Deposit Mineral Resource Estimate

Notes:

- The independent and qualified persons for the current Detour-Fenelon Gold Trend 2023 MRE are Carl Pelletier, P.Geo., Vincent Nadeau-Benoit, P.Geo., Simon Boudreau, P.Eng. and Marc R, Beauvais, P.Eng., of InnovExplo Inc. The Detour-Fenelon Gold Trend 2023 MRE follows 2014 CIM Definition Standards and 2019 CIM MRMR Best Practice Guidelines. The effective date of the Detour-Fenelon Gold Trend 2023 MRE is January 13, 2023.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

- The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issue, that could materially affect the potential development of mineral resources other than those discussed in the Detour-Fenelon Gold Trend 2023 MRE.

- For Fenelon, 112 high-grade zones and seven (7) low-grade envelopes were modelled in 3D to the true thickness of the mineralization. Supported by measurements, a density value of 2.80 g/cm3 was applied to the blocks inside the high-grade zones, and 2.81 g/cm3 was applied to the blocks inside the low-grade envelopes. High-grade capping was done on raw assay data and established on a per-zone basis and ranges between 25 g/t and 100 g/t Au for the high-grade zones (except for the high-grade zones Chipotle and Cayenne 3 a high-grade capping values of 330 g/t Au was applied) and ranges between 4 g/t and 10 g/t Au for the low-grade envelopes. Composites (1.0 m) were calculated within the zones and envelopes using the grade of the adjacent material when assayed or a value of zero when not assayed. A minimum mining width of 2 metres was used for underground stope optimization.

- The criterion of reasonable prospects for eventual economic extraction has been met by having constraining volumes applied to any blocks (potential surface and underground extraction scenario) using Whittle and DSO and by the application of cut-off grades. The cut-off grade for the Fenelon deposit was calculated using a gold price of US$1,600 per ounce; a CA/US exchange rate of 1.30; a refining cost of $5.00/t; a processing cost of $18.15/t; a mining cost of $5.50/t (bedrock) or $2.15/t (overburden) for the surface portion, a mining cost of $65.00/t for the underground portion and a G&A cost of $9.20/t. Values of metallurgical recovery of 95.0% and royalty of 4.0% were applied during the cut-off grade calculation. The cut-off grade for the Martiniere deposit was calculated using a gold price of US$1,600 per ounce; a CA/US exchange rate of 1.30; a refining cost of $5.00/t; a processing cost of $18.15/t; a mining cost of $4.55/t (bedrock) or $2.15/t (overburden) for the surface portion, a mining cost of $118.80/t for the underground portion using the long-hole mining method (LH), a mining cost of $130.70/t for the underground portion using the cut and fill mining method (C & F), a G&A cost of $9.20/t and a transport to process cost of $6.50/t. Values of metallurgical recovery of 96.0% and royalty of 2.0% were applied during the cut-off grade calculation. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

- Results are presented in-situ. Ounce (troy) = metric tons x grade/31.10348. The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

Mining

The underground mine will have a production rate of 7,000 tpd over a 12.3-year mine life. A total of 30.8 Mt of mineralized material at an average grade of 2.73 g/t will be extracted from three different mining zones:

- Tabasco-Cayenne zones with 68.5% of the ounces to be mined;

- Area 51 zones with 31.1% of the ounces to be mined; and

- Gabbro zones with 0.4% of the ounces to be mined.

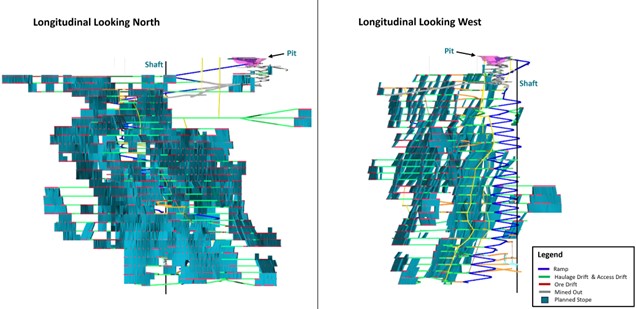

The mining method will be long hole with longitudinal stopes for 5 to 8 metres width, corresponding to 40% of the stope tonnage. Transverse stopes are designed for stopes with 8 to +15 metres width, which account for 60% of the remaining stope tonnage. (Figure 3)

Stope dimensions are 30 metres (A51 Zones) to 40 metres (Tabasco-Cayenne Zones) in height, 5 to 15 metres in width and 20 to 25 metres in length. The average size of the stopes from all zones is approximately 15,000 tonnes and about 150 stopes will be mined annually. Mining recovery is estimated at 96%. Stope backfilling will be done with cemented rock fill (50%) and rock fill (50%) or with paste backfill depending on the stope dimensions and sequence.

Development will be done with a mining contractor during Pre-Production Year 1. Starting at Pre-production Year 2, development will be done with owner equipment-personnel. Development priority is to develop the main Tabasco ramp and to access production centers. The development mineralized material will generate 10% of the total gold production.

The mining fleet, comprised of 99 pieces of mobile equipment, will be purchased via a lease financing agreement. Supporting underground infrastructure includes several main pumping stations, two ventilation and heating systems and one exhaust raise.

Figure 3. LOM schematic

Metallurgy

Metallurgical test work was completed in two phases in 2020 and 2021 on material from Area 51 and Tabasco-Cayenne zones by SGS Canada Inc.

Grindability testing was completed in 2021, including SAG mill comminution test. The samples were characterized as hard with respect to resistance to impact breakage during SMC test, with Axb drop weight test values ranging from 23 to 31. Bond rod mill index results are in a range of 15.6 to 16.9 kWh/tonne, which can be classified as moderately hard to hard range. The bond ball index ranges from 13.4 to 16.2 kWh/tonne, considered as in the medium range of hardness.

Gravity gold recovery testing was done in 2021 on representative composite sample of Tabasco-Cayenne and Area 51 zone material. Gold recoveries to the gravity concentrate were as high as 66.5% for Tabasco-Cayenne and 84.3% for Area 51, in line with prior testing in 2020. The results of gold gravity recovery testing show the need for a gravity circuit in the process flowsheet.

Cyanidation testing was completed in 2020 on representative samples following gravity recovery. Overall, gold recoveries ranged from 94.6% to 96.9% for the Tabasco Zone and 95.3% to 97.1% for Area 51.

Based on 2020 and 2021 testing and planned process flowsheet, the estimated process plant payable gold recovery is to average 96.0% over the LOM.

Processing

A total of 7,000 tpd of material will be processed in the plant, which will consist of a semi-autogenous grinding mill in closed circuit with a pebble crusher and ball mill in closed circuit with cyclones (SABC circuit). The crushing circuit will consist of a temporary crusher at surface operated by a contractor until the production shaft is operational. Once the shaft is operating, the material will be crushed underground prior to hoisting. A gravity circuit followed by leaching will recover coarse gold from the cyclone underflow, while the cyclone overflow is treated in one pre-leach tank and in a seven-tank carbon in-leach circuit, followed by SO2/Air cyanide destruction. Gold will be recovered in an adsorption-desorption-recovery Zedra process circuit and electrowinning cells with gold room recovery and production of gold bars, which will be shipped to mint facilities for purification.

The SO2/Air circuit is followed by a tailings flotation circuit with sulphide concentrate to produce paste backfill to send underground and/or dry for tailings storage.

The process plant building will include a laboratory, mill maintenance workshop, offices and a dry.

Figure 4. Process Flow Sheet

Surface Infrastructure

The Project is approximately 75 kilometres from the town of Matagami in Quebec and is accessible via a 24-kilometre forestry road from Hwy. 810. The existing Fenelon camp site includes a welcome center, 155-room dormitories, dry, kitchen, dining room, game room, workshop and first nation cultural center.

The existing mine site includes core shack, modular offices, garage, water treatment plant, air ventilation-heating system to serve underground opening, an open pit and a portal connecting to an underground ramp. The camp and mine site are served by diesel generators for electricity production. All these facilities will be used at the start of the Project, and will be upgraded, expanded or replaced during construction and operations.

The mining and processing infrastructure will be located at the Fenelon site. The mine envisions the upgrade of existing surface infrastructure: site access road, potable water and sewage systems, underground mine portal, mine ventilation systems (intake and exhaust), main and remote gatehouses, surface maintenance shop, waste rock stockpile, overburden stockpile, and mineralized material stockpile. The Project will require construction of the following infrastructure items: 7,000 tpd process plant complex, paste plant, offices, dry, truck shop and warehouse; 20 kilometres of 120 kV overhead transmission line; 120 kV main substation; final effluent water treatment plant; surface water management facility, including ditches, pond and pumping stations; service and haulage roads; and tailings management facility.

The camp site will be expanded to 370 rooms with associated kitchen, dining room and game-exercise room. A local office with 25 places is planned in a nearby town to support administration, communication, human resources and technical personnel.

Figure 5. Fenelon Location Map

Figure 6. Mine Site

Production Shaft and Underground Infrastructure

The construction of the shaft is planned to start in Year 2 of production and be fully operational prior to Year 5 of production.

The surface infrastructure for the production shaft consists of a steel headframe with backlegs, a hoist room building, a silo and a conveyor feeding the process plant dome stockpile. The shaft is dedicated for material handling only. The skip will be raised to the surface in a dedicated rope guided shaft by a double drum hoist located on the surface in a 1,040 metre deep shaft.

The construction of the following infrastructure is envisioned for the underground material handling complex: a grizzly on top of a 4-metre diameter by 25-metre high silo for the mineralized material. The same is planned for the waste rock. Both would be equipped with a rock breaker. The mineralized material from the silo will go through a crushing plant equipped with a jaw crusher and sacrificial conveyor. The crushed mineralized material will then be accumulated in a 6.1-metre diameter by 25-metre high silo. A loading station with an apron fed conveyor from the waste and crushed mineralized material silos will bring the material to measuring boxes to be loaded into the 18-tonne skip and hoisted to the surface.

Tailings Management and Paste Plant

The desulfurized thickened tailings from the mill operations will be managed with two approaches: used as underground paste backfill or disposed on surface as high-density thickened tailings. From the tailing thickener underflow will be pumped either to the paste backfill plant or to the tailings management facility (“TMF”).

The selected site is located 1.4 kilometres northwest of the existing small pit.

The waste rock proposed for construction coming from underground development, may be metal leaching. As a mitigation measure, an impervious geomembrane will be installed to encapsulate the waste rock. A geomembrane is also considered on the bottom of the emergency cell.

At the paste backfill plant, thickened sulphide tailings are stored in a large, agitated tank which is sized to provide several days of storage at peak sulphide production from the mill. When the paste backfill plant is running, tailings from the filter feed tank are fed to a single vacuum disc filter for dewatering. The vacuum filter cake feeds the paste mixer. The thickened sulphide tailings are also pumped into the paste mixer during backfill production for inclusion in the paste recipe. This is the primary means of sulphide tailings disposal – underground in the paste backfill. The other streams reporting into the paste mixer to achieve the target recipe are binder (a slag cement mixture) and slump water if required to further control the paste density. The paste backfill will be distributed throughout the mine using either a single paste pump or gravity depending on the location of the stope.

Water treatment

All contact water, including groundwater, surface runoff and water from the TMF shall be collected and treated at the water treatment plant before being discharged to the environment.

Environment and Permitting

In Northern Quebec (James Bay region located south of the 55th parallel), all mining developments must follow the environmental assessment (“EA”) and review procedures under the Regulation respecting the environmental and social impact assessment (“ESIA”) and review procedure applicable to the territory of James Bay and Northern Québec. Additionally, with a planned production capacity of 7,000 tpd, the mining project exceeds the 5,000 tpd threshold for the federal environmental assessment procedure, therefore an EA in compliance with the requirements of the new Impact Assessment Act (S.C. 2019, c. 28, s. 1) will be required.

The acquisition of baseline environmental knowledge on the Fenelon property began several years ago and is still ongoing today. To date, preliminary environmental characterizations of the physical environment and biological environment have been carried out and/or are ongoing. Confirmation of the regulatory context made it possible to identify the scope of the environmental studies required to obtain environmental authorizations. Inventory work is underway to fill these gaps.

To date, no major environmental issues have been identified in the work undertaken. The situation of the woodland caribou, designated as vulnerable in Quebec and threatened at the federal level, remains uncertain to date in the Project area with regard to future legal protection of its habitat.

A preliminary geochemical characterization program has been in progress since 2020 to identify the geo-environmental characteristics of ore and mine wastes and classify their environmental risk (e.g., for acid rock drainage and metal leaching) based on Québec provincial guidance documents. Findings from the geochemical study have been incorporated into the Project design.

Closure

A closure and rehabilitation plan for the land affected by the Project will be prepared and submitted for authorization. The preliminary concept for site closure is estimated at $10.5 million. The current financial deposit for site closure is estimated at $2.9 million for a net closure cost of $7.6 million.

Stakeholder Engagement

The Project is located in the Nord-du-Québec region, within the James Bay and Northern Qué bec Agreement territory on Category III lands, managed by the Eeyou Istchee James Bay Regional Government, with exclusive trapping rights for the Crees. The Project site is located on lands that are part of the traditional territories claimed by the Cree people of Waskaganish and Washaw Sibi, and by the Algonquin people of Abitibiwinni (Pikogan). The Project is located on a Washaw Sibi trapline.

Wallbridge has always prioritized engaging stakeholders and implementing a consultation plan. Over 130 communication activities have been conducted since acquisition, including meetings, site visits, and workshops. The First Nation communities of Washaw Sibi, Waskaganish and Abitibiwinni (Pikogan) have been extensively consulted. Concerns raised include employment, entrepreneurial opportunities, training, land use and disturbance, water quality, impacts to wildlife, and the cumulative effects of all projects in the area. To date, Wallbridge has taken actions to address these concerns and promote local benefits, including a hiring and contracting policy and the construction of a Cultural Centre. Furthermore, Wallbridge signed a Pre-Development Agreement with the Cree Nations of Waskaganish and Washaw Sibi and the Cree Nation Government in 2022. Wallbridge is committed to continuing consultations with First Nations, local communities, and stakeholders through the EA process.

Workforce

During production, the average number of employees and contractors will be 535 with a maximum at 670. The working schedule for hourly workers is based on 7 days at site (10 or 12 hours per day) and 7 days off site. The working schedule for staff is based on 5 days at site and 2 days off. The maximum employees and contractor on site will reach 340.

During the pre-production period, the average number of employees, contractor and construction workers will be 490 with a peak of 690 during the second half of pre-production Year 2.

Next Steps

The positive results of the PEA study warrants advancing the Project to the next study stages. In order to advance the Project to pre-feasibility study level, the following programs are required:

- Infill diamond drilling to convert inferred resources to indicated resources.

- Metallurgical study including more variability testing.

- Detailed characterization and testing of thickened tailing and paste.

- Detailed geochemical characterization of waste and ore rock.

- Detailed characterization of rock mass and stope design.

- Detailed geotechnical investigation at various infrastructure sites.

- Detailed hydrogeology studies to better characterize major structures.

- Revised underground mine planning and scheduling based on revised MRE.

- Trade-off studies on material handling system, stope backfill, and electric equipment.

- Detailed unit cost evaluation for development and mining.

Independence and Responsibilities

The PEA was prepared for Wallbridge Mining by independent consulting firms with their respective responsibilities listed in Table 7. The Qualified Persons (“QP”) are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the PEA. Each QP has reviewed and approved the content of this press release.

All scientific and technical data contained in this presentation has been reviewed and approved by Francois Chabot, Eng., Wallbridge’s Manager of Technical Services, a QP for the purposes of NI 43-101.

The Company cautions that the results of the PEA are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them to be classified as mineral reserves. There is no certainty that the results of the PEA will be realized.

Table 7: Consulting Firm, Area of Responsibility and Qualified Person

| Consulting Firms |

Area of Responsibility |

Qualified Person1 |

|

| InnovExplo Inc. |

|

- Carl Pelletier, P.Geo.,

- Vincent Nadeau-Benoit, P.Geo.,

- Simon Boudreau, P.Eng.,

- Marc R, Beauvais, P.Eng.

|

| InnovExplo Inc. |

- Mine design and scheduling, mine capital, and operating costs; G&A cost estimates and financial analysis

|

|

| G-Mining Services |

- Metallurgy, processing plant design, capital, and operating cost estimates.

|

|

| BBA Inc. |

- Tailings management site design, capital, and operating costs; and reclamation costs.

|

- Luciano Piciacchia, P.Eng., Ph.D.

- Mélanie Turgeon, P.Eng.

|

| WSP |

- Infrastructure & material handling, and capital cost estimate.

- Rock mass classification, and stope design.

- Environment

|

- Jonathan Cloutier, P.Eng

- André Harvey, Eng.

- Nathalie Fortin, P.Eng., M.Env.

|

| Responsible Mining Solutions Corp. |

- Paste plant design, capital, and operating costs.

|

- Roberge, Jean-Louis, Eng.

|

| ASDR Canada Inc. |

- Water treatment plant design, capital, and operating costs.

- UG dewatering design, capital, and operating costs.

|

- Dan Chen, P. Eng.

- Martin Lessard, Eng.

|

| Hydro-Ressources Inc. |

- Mine hydrogeology and site hydrology.

|

- Michael Verreault, Eng., M.Sc.A.

|

The QPs mentioned above have reviewed and approved their respective technical information contained in this press release.

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of inferred mineral resources. Inferred mineral resources are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. There is no guarantee that inferred mineral resources can be converted to indicated or measured mineral resources, and as such, there is no guarantee the project economics described herein will be achieved.

A NI 43-101 technical report supporting the PEA will be filed on SEDAR within 45 days of this press release and will be available at that time on the Company’s website.

Webcast

Wallbridge management will host a webinar to discuss the Fenelon PEA results.

Date and Time: Tomorrow, Tuesday, June 27th, 2023, starting at 10:00 a.m. EDT

Registration: To participate in the webinar, please register here:https://us06web.zoom.us/webinar/register/WN_UERQ0nCNSLq2WSQPQJQm9w

A presentation that summarizes the PEA results of the Project is available on the Company’s website.

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects along the Detour-Fenelon Gold Trend while respecting the environment and communities where it operates.

Wallbridge’s flagship project, Fenelon Gold (“Fenelon”), is located on the highly prospective Detour-Fenelon Gold Trend Property in Québec’s Northern Abitibi region. An updated mineral resource estimate completed in January 2023 yielded significantly improved grades and additional ounces at the 100%-owned Fenelon and Martiniere projects, incorporating a combined 3.05 million ounces of indicated gold resources and 2.35 million ounces of inferred gold resources. Fenelon and Martiniere are located within an 830 km2 exploration land package controlled by Wallbridge. In addition, Wallbridge believes that the extensive land package is extremely prospective for the discovery of additional gold deposits.

Wallbridge also holds a 19.9% interest in the common shares of Archer Exploration Corp. (“Archer”) as a result of the sale of the Company’s portfolio of nickel assets in Ontario and Québec in November of 2022.

Wallbridge will continue to focus on its core Detour-Fenelon Gold Trend Property while enabling shareholders to participate in the potential economic upside in Archer.

For further information please visit the Company’s website at www.wallbridgemining.com or contact:

Wallbridge Mining Company Limited

Marz Kord, P. Eng., M. Sc., MBA

President & CEO

Tel: (705) 682‒9297 ext. 251

Email: mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics, MBA

Capital Markets Advisor

Email: vvargas@wallbridgemining.com

Cautionary Note Regarding Forward-Looking Information

This press release contains forward-looking statements or information (collectively, “FLI”) within the meaning of applicable Canadian securities legislation. FLI is based on expectations, estimates, projections, and interpretations as at the date of this press release.

All statements, other than statements of historical fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, FLI can be identified by the use of statements that include words such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved.”

FLI herein includes, but is not limited to, statements regarding the results of the Fenelon PEA, including the production, operating cost, capital cost and cash cost estimates, the projected valuation metrics and rates of return, and the cash flow projections, as well as the anticipated permitting requirements and Project design, including processing and tailings facilities, infrastructure developments, metal recoveries, mine life and production rates for the Project, the potential to further enhance the economics of the Project and optimize the design, potential timelines for obtaining the required permits and financing. Forward-looking information is not, and cannot be, a guarantee of future results or events.

FLI is designed to help you understand management’s current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances, except as may be required by law. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI or information contained herein.

Assumptions upon which FLI is based, without limitation, include the results of exploration activities, the Company’s financial position and general economic conditions; the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; potential changes in project parameters or economic assessments; the legitimacy of title and property interests in the Project; the accuracy of key assumptions, parameters or methods used to estimate the MREs and in the PEA; the ability of the Company to obtain required approvals; geological, mining and exploration technical problems; failure of equipment or processes to operate as anticipated; the evolution of the global economic climate; metal prices; foreign exchange rates; environmental expectations; community and non-governmental actions; any impacts of COVID-19 on the Project; and, the Company’s ability to secure required funding. Risks and uncertainties about Wallbridge's business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI.

Non-IFRS Financial Measures

Wallbridge has included certain non-IFRS financial measures in this press release, such as initial capital expenditures, sustaining capital expenditures, total cash costs and all in sustaining costs, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other companies. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Non-IFRS financial measures used in this press release and common to the gold mining industry are defined below.

Total Cash Costs and Total Cash Costs per Ounce

Total cash costs are reflective of the cost of production. Total cash costs reported in the PEA include mining costs, processing, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total cash costs per ounce is calculated as total cash costs divided by payable gold ounces.

All-In Sustaining Costs and All-In Sustaining Costs per Ounce

All-in sustaining costs and all-in sustaining costs per ounce are reflective of all of the expenditures that are required to produce an ounce of gold from operations. All-in sustaining costs reported in the PEA include total cash costs, sustaining capital, closure costs, but exclude corporate general and administrative costs. All-in sustaining costs per ounce is calculated as all-in sustaining costs divided by payable gold ounces.

A description of the significant cost components that make up the forward looking non-IFRS financial measures of total cash costs and all in sustaining costs per ounce of payable gold produced is shown in the table below.

|

Payable Ounces |

LOM Costs

(millions) |

US$ Per Ounce |

| Cash Operating Costs |

2,606,384 |

2,299,4 |

679 |

| Royalties |

|

237.2 |

70 |

| Total Cash Costs |

|

2,536.6 |

749 |

| Sustaining Capital Expenditures and Closure |

|

594.4 |

175 |

| All in Sustaining Costs |

|

3,131.0 |

924 |

Cautionary Note to United States Investors

Wallbridge Mining prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to mineral resources in this press release are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended ("CIM Standards"). The U.S. Securities and Exchange Commission (the "SEC") has adopted amendments effective February 25, 2019 (the "SEC Modernization Rules") to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934. As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", which are defined in substantially similar terms to the corresponding CIM Standards. In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be substantially similar to the corresponding CIM Standards.

U.S. investors are cautioned that while the foregoing terms are "substantially similar" to corresponding definitions under the CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral resources that Wallbridge Mining may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had Wallbridge Mining prepared the resource estimates under the standards adopted under the SEC Modernization Rules. In accordance with Canadian securities laws, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances were permitted under NI 43-101.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ed2c0ec-91e2-43a1-a62a-92bdcd005daf

https://www.globenewswire.com/NewsRoom/AttachmentNg/53e9a456-8119-4229-9494-754152602298

https://www.globenewswire.com/NewsRoom/AttachmentNg/713ffca7-06c4-44c9-9ece-f2eabc501587

https://www.globenewswire.com/NewsRoom/AttachmentNg/6b4d27cd-d2fa-4475-bec9-4d4e03a7234f

https://www.globenewswire.com/NewsRoom/AttachmentNg/cdb97e83-07b5-4ea8-96e6-b90ac37d88c9

https://www.globenewswire.com/NewsRoom/AttachmentNg/0395338c-b876-40c5-8d6c-786f7bdd395d

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ac89b5f-7dc6-4f15-b4c7-25c65d585da4