Metals Acquisition Limited (NYSE: MTAL):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230731323815/en/

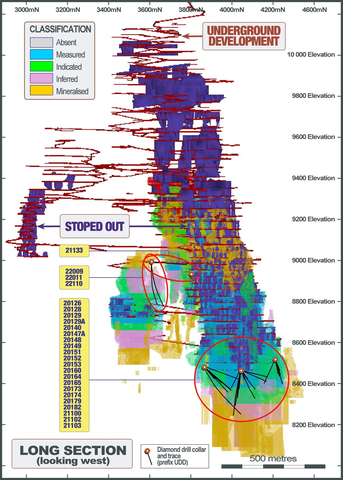

Figure 1 - Location Drill Results relative to QTSN and QTSC (Graphic: Business Wire)

- Metals Acquisition Limited (NYSE: MTAL.U) (“MAC”) is pleased to provide an update from the ongoing resource infill and near mine exploration drill program at the CSA Mine

- All drill results are from drilling that has been completed after the December 2022 Mineral Resource Estimate (“MRE”)

- Results demonstrate the continuity of the deposits at the CSA Mine and the high-grade nature of the deposits

- Results are being incorporated into the 2023 Resource and Reserve update

- Results include

- 4.6m @ 9.2% Cu and 43 g/t Ag from 142m in UDD20128

- 25.5 @ 12.7% Cu and 55 g/t Ag from 150.5m in UDD20128

- 20.7m @ 14.4% Cu and 61 g/t Ag from 150.5m in UDD20147A

- 7m @ 10.9% Cu and 50 g/t Au from 144m in UDD20129

- 8.1 m @ 11.1% Cu and 46 g/t Ag from 152.2 m in UDD20129A

- 28.7m @ 10.6% Cu and 41 g/t Ag from 179.8 m in UDD20140

- 6.7m @ 10.4% Cu and 45 g/t Ag from 179m in UDD21053

- 21.5m @ 7.7% Cu and 32 g/t Ag from 139.7 in UDD21049

- 4.3m @ 11.8% Cu and 45 g/t Ag from 189.0m in UDD22100

- Refer to Table 1 for the complete list of drill results

Commentary

Mick McMullen, MAC CEO, said: "These drill results are simply stunning and showcase the high-grade ore body of the CSA Mine. There are very few similar grade mines available for investors to directly participate in that are also located in Tier 1 jurisdictions. The mine has been out of the public domain for 24 years and these type of drill results are a testament of MAC’s rationale for acquiring the operation.

The mine has continued with the resource infill and near mine exploration program since the completion of the last resource update in December 2022. This has been aimed at improving confidence in the Inferred Resource and identifying additional mineralization that could be converted to a Mineral Resource.

Drilling has continued to demonstrate the continuity and high-grade nature of the CSA ore bodies as shown in Table 1 below. These holes are predominately across the QTSN and QTSC deposits and are indicative of the high-grade mineralization found at the CSA Mine. Additionally, within QTSN and QTSC the drilling has highlighted potential lode extensions down dip and along section and opportunities for thicker lode interpretations.

In the QTSN deposit drilling has been targeted at the boundary of the Measured and Inferred resource to upgrade the classification as well as deeper into the Inferred resource to both upgrade the classification and to push the Inferred resource boundary deeper. As shown in Figure 1, mineralisation is known to extend at least 400m below the base of the current Inferred resource and drilling is targeting converting this to a resource over time, subject to results.

In the QTSC deposit, drilling has successfully intersected mineralisation up dip of the current resource (Figure 4) in UDD22100. Mineralisation at QTSC is typically narrower than QTSN but very high grade. This mineralization is close to existing development and can be brought into the mine plan relatively easily.

These results confirm our view that the CSA Mine has the potential to continue to be one of the highest-grade copper mines globally for the foreseeable future with potential to expand the mineral resource.

Drilling is continuing and results will be incorporated into the updated 2023 Mineral Resource Estimate which can then be used for the updated 2023 Reserve estimate.”

Note on Qualified Person(s)

The drilling results contained in this news release have been prepared in accordance with Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission (“Subpart 1300”).This news release has been reviewed by Patrick John Adams, BSc. FAusIMM Principle Geologist and Rebecca Prain BSc. Managing Director from Cube Consulting for Metals Acquisition Limited. Acting within the scope of their expertise, Patrick John Adams and Rebecca Prain, as Qualified Persons as defined by Subpart 1300, has reviewed the information provided and finds it to be accurate and reflect facts.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonization of the global economy.

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future performance of the CSA Mine and anticipated financial impacts and other effects of the proposed business combination, the satisfaction of the closing conditions to the proposed transaction and the timing of the completion of the proposed transaction. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things; the supply and demand for copper; the future price of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in mineral resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and dependence on key management personnel and executive officers; and other risks and uncertainties indicated from time to time in the definitive proxy statement/prospectus relating to the business combination that MAC filed with the SEC, including those under “Risk Factors” therein, and in MAC’s other filings with the SEC. MAC cautions that the foregoing list of factors is not exclusive. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or CSA Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward- looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Table 1 - Summary of Significant Drill Results Post the 2022 Resource

|

Hole ID

|

Easting

|

Northing

|

RL

|

Depth

|

Planned Azimuth

|

Planned Dip

|

From

|

To

|

m

|

Cu %

|

Ag g/t

|

|

UDD20126

|

5,873.360

|

3,864.430

|

8,475.118

|

241.90

|

65.00

|

-20.00

|

105.00

|

112.00

|

7.00

|

4.3

|

19

|

|

UDD20128

|

5,873.250

|

3,864.860

|

8,474.537

|

260.00

|

55.00

|

-30.00

|

142.00

|

146.60

|

4.60

|

9.2

|

43

|

|

UDD20128

|

|

|

|

|

|

|

150.50

|

176.00

|

25.50

|

12.7

|

55

|

|

UDD20129

|

5,873.330

|

3,864.640

|

8,474.758

|

153.10

|

61.50

|

-26.10

|

144.00

|

151.00

|

7.00

|

10.9

|

50

|

|

UDD20129A

|

5,873.360

|

3,864.540

|

8,474.639

|

260.00

|

61.50

|

-30.00

|

152.20

|

160.30

|

8.10

|

11.1

|

46

|

|

UDD20140

|

5,872.610

|

3,864.840

|

8,474.039

|

400.20

|

50.00

|

-50.00

|

179.80

|

208.50

|

28.70

|

10.6

|

41

|

|

UDD20147A

|

5,873.000

|

3,865.510

|

8,475.224

|

280.00

|

45.00

|

-14.00

|

177.00

|

197.70

|

20.70

|

14.4

|

61

|

|

UDD21048

|

5,900.240

|

4,044.780

|

8,459.993

|

211.70

|

108.60

|

-26.00

|

107.80

|

127.50

|

19.70

|

8.0

|

31

|

|

UDD21049

|

5,899.320

|

4,045.240

|

8,459.525

|

275.20

|

105.50

|

-50.00

|

76.00

|

82.50

|

6.50

|

12.3

|

0

|

|

UDD21049

|

|

|

|

|

|

|

139.70

|

161.20

|

21.50

|

7.7

|

32

|

|

UDD21051

|

5,899.840

|

4,045.370

|

8,460.078

|

215.00

|

101.20

|

-32.20

|

61.90

|

68.10

|

6.20

|

9.1

|

32

|

|

UDD21051

|

|

|

|

|

|

|

117.00

|

135.50

|

18.50

|

5.0

|

18

|

|

UDD21052

|

5,899.730

|

4,045.280

|

8,459.543

|

230.30

|

102.00

|

-43.00

|

100.00

|

106.25

|

6.25

|

10.0

|

51

|

|

UDD21052

|

|

|

|

|

|

|

122.90

|

141.50

|

18.60

|

5.4

|

26

|

|

UDD21053

|

5,899.050

|

4,045.230

|

8,459.598

|

285.00

|

107.00

|

-58.00

|

179.00

|

195.70

|

16.70

|

10.4

|

45

|

|

UDD21060

|

5,899.410

|

4,046.360

|

8,460.841

|

205.00

|

81.00

|

-13.30

|

127.95

|

143.00

|

15.05

|

5.3

|

26

|

|

UDD21064

|

5,899.010

|

4,046.540

|

8,460.008

|

242.00

|

71.32

|

-40.00

|

180.10

|

194.00

|

13.90

|

5.1

|

19

|

|

UDD21065

|

5,899.080

|

4,046.710

|

8,460.354

|

215.50

|

70.00

|

-28.00

|

159.00

|

172.00

|

13.00

|

5.4

|

19

|

|

UDD21073

|

5,898.840

|

4,047.180

|

8,460.876

|

225.00

|

57.00

|

-15.00

|

151.00

|

169.00

|

18.00

|

4.4

|

25

|

|

UDD21074

|

5,898.710

|

4,047.460

|

8,460.978

|

230.00

|

51.00

|

-11.00

|

146.80

|

157.80

|

11.00

|

5.2

|

32

|

|

UDD21079

|

5,843.430

|

4,212.300

|

8,514.441

|

319.80

|

104.00

|

-20.00

|

176.00

|

183.25

|

7.25

|

8.3

|

54

|

|

UDD21082

|

5,843.540

|

4,211.590

|

8,514.281

|

304.80

|

86.00

|

-14.00

|

173.70

|

183.00

|

9.30

|

7.7

|

19

|

|

|

|

|

|

|

|

|

218.30

|

223.60

|

5.30

|

6.0

|

14

|

|

|

|

|

|

|

|

|

289.10

|

293.80

|

4.70

|

5.6

|

54

|

|

UDD21100

|

5,843.560

|

4,211.580

|

8,514.101

|

200.00

|

85.50

|

-17.30

|

173.60

|

180.30

|

6.70

|

9.4

|

49

|

|

UDD21102

|

5,843.470

|

4,211.460

|

8,513.863

|

205.50

|

90.00

|

-22.00

|

177.80

|

188.50

|

10.70

|

7.4

|

40

|

|

UDD21103

|

5,843.460

|

4,211.420

|

8,513.672

|

330.00

|

88.00

|

-26.00

|

180.00

|

183.60

|

3.60

|

12.0

|

55

|

|

|

|

|

|

|

|

|

186.60

|

190.00

|

3.40

|

3.1

|

10

|

|

|

|

|

|

|

|

|

216.00

|

220.50

|

4.50

|

4.0

|

6

|

|

|

|

|

|

|

|

|

299.85

|

304.55

|

4.70

|

5.7

|

6

|

|

UDD21133

|

5,720.360

|

3,801.140

|

8,930.207

|

272.00

|

87.50

|

2.00

|

168.00

|

171.90

|

3.90

|

5.6

|

17

|

|

|

|

|

|

|

|

|

176.00

|

180.50

|

4.50

|

10.4

|

31

|

|

|

|

|

|

|

|

|

184.30

|

193.00

|

8.70

|

4.9

|

26

|

|

UDD22009

|

5,976.270

|

3,606.920

|

8,991.961

|

330.00

|

81.00

|

-55.00

|

232.55

|

236.00

|

3.45

|

11.1

|

31

|

|

UDD22009

|

|

|

|

|

|

|

250.00

|

253.20

|

3.20

|

8.1

|

25

|

|

UDD22011

|

5,976.390

|

3,606.390

|

8,992.128

|

334.50

|

90.00

|

-53.00

|

102.20

|

105.80

|

3.60

|

9.7

|

37

|

|

|

|

|

|

|

|

|

221.60

|

225.65

|

4.05

|

4.0

|

7

|

|

|

|

|

|

|

|

|

238.00

|

242.70

|

4.70

|

4.2

|

4

|

|

UDD22100

|

5,978.400

|

3,607.240

|

8,993.906

|

225.00

|

85.00

|

4.00

|

176.90

|

180.50

|

3.60

|

5.5

|

5

|

|

|

|

|

|

|

|

|

189.00

|

193.30

|

4.30

|

11.8

|

45

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20230731323815/en/