HALIFAX, NS / ACCESSWIRE / August 24, 2023 / Silver Tiger Metals Inc. (TSXV:SLVR)(OTCQX:SLVTF) ("Silver Tiger" or the "Corporation") is pleased to report gold and silver extraction results from initial scoping-level metallurgical test work from its high-grade silver-gold El Tigre Project in Sonora, Mexico (the "El Tigre Project"). The Corporation also expects to release an updated and expanded mineral resource estimate and Preliminary Economic Assessment (PEA) in Q3 2023.

METALLURGICAL TEST WORK

Preliminary metallurgical work demonstrates excellent recoveries of silver, gold, copper, zinc and lead in the Sulphide and Black Shale Zones with silver equivalent recoveries of 95.7% and 98.1%, respectively. The newly discovered, high-grade Sulphide and Black Shale Zones have been the focus of recent drilling and they show great exploration potential being open both laterally and at depth.

Previous drilling of the Surface Stockwork Zone has indicated a mineralized zone in excess of 100 meters true width. With high recoveries of 78.1% silver equivalency in column testing, simulating a heap leaching process, the Corporation sees the potential for an open pit low-cost heap leach process. This open pit heap leach process will be defined as part of the upcoming PEA.

Results reported in this news release pertain to test work conducted by SGS Lakefield in Ontario in 2022 and 2023 on the Au-Ag mineralization from the Surface Stockwork Zone and Ag-Au-Zn-Cu-Pb mineralization from the Black Shale, Sulphide Zones and High-Grade Silver Veins. An updated and expanded mineral resource estimation and PEA for the El Tigre deposit is expected to be released during Q3 2023.

Highlights Include:

- Preliminary rougher flotation tests of the Black Shale Zone recovered 91.1% copper, 98.2% lead, 98.8% zinc, 91.9% gold, and 98.4% silver. Overall Silver Equivalent Recovery - 98.1%

- Preliminary rougher flotation tests of the Sulphide Zone recovered 94.2% copper, 95.3% lead, 97.6% zinc, 79.6% gold, and 96.0% silver. Overall Silver Equivalent Recovery - 95.7%

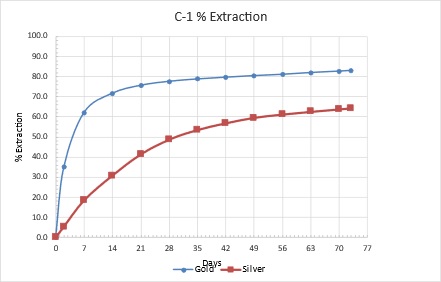

- Surface Stockwork Zone column test extractions recovered - 83.1% Gold, 64.3% Silver at 3/8-in crush size (leach profile shown in Figure 3) with no requirement for agglomeration indicated in these tests. Overall Silver Equivalent Recovery - 78.1%

- Also notable is the low cyanide consumption of 0.68 kg per tonne and lime consumption of 2.33 kg per tonne

Glenn Jessome, President and CEO, stated: "Based on representative samples from the Sulphide, Black Shale and Surface Stockwork Zones, we are pleased to report very high silver, gold and base metal recoveries. For flotation tests of the Sulphide and Black Shale Zones we note tremendous recoveries of 96 to 98% total silver equivalency for the milling process on the underground deposit; and for the open pit heap leach column tests we note that silver equivalency recoveries average above 78%, which represents a high recovery for a low-cost leaching process."

Mr. Jessome further stated: "Metallurgy is critically important to understanding the potential economics of a mineral project and these new results give us great encouragement that the upcoming PEA may show robust economics for the underground and open pit deposits."

Estimated and Expanded Mineral Resource Estimate and PEA

An updated and expanded mineral resource estimation and PEA for the El Tigre deposit is expected to be released during Q3 2023.

Black Shale and Sulphide Flotation Samples and Testing

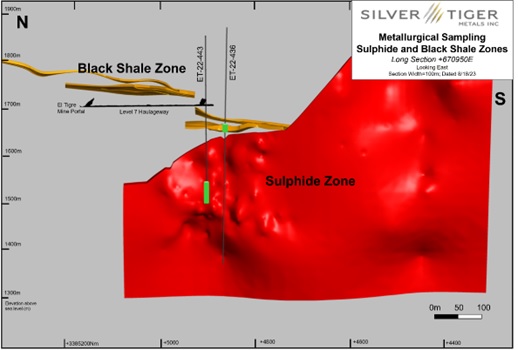

Two (2) drill hole composites were sampled and shipped to SGS Lakefield for the flotation scoping test work. Shown in Figure 1, these two drill holes (ET-22-436, Black Shale Zone; ET-22-443 Sulphide Zone) were crushed, ground to 74 microns and subjected to rougher flotation to produce two (2) concentrates - copper/lead (with gold and silver) and zinc (with gold and silver).

Standard flotation methods were carried out to produce the copper/lead concentrate while depressing the zinc followed by a zinc flotation. Testing to optimize recovery and cleaner concentrate grades is underway and will be reported when finalized. This ongoing testing will confirm marketable grades and confirm associated net smelter return (NSR) of the products.

The calculated head samples for the testing are shown in Table 1 below:

| Zone |

Hole # |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

| Black Shale |

ET-22-436 |

0.23 |

384 |

0.39 |

2.33 |

6.36 |

| Sulphide |

ET-22-443 |

0.15 |

645 |

0.81 |

2.51 |

5.63 |

Indicative recoveries from the scoping testing are shown based on the calculated head from the testing in Table 2 below:

| Indicative Recoveries |

% Cu |

%Pb |

%Zn |

%Au |

%Ag |

| Black Shale |

91.1 |

98.2 |

98.8 |

91.9 |

98.4 |

| Sulphide |

94.2 |

95.3 |

97.6 |

79.6 |

96.0 |

Metallurgical Sampling - Surface Stockwork Zone

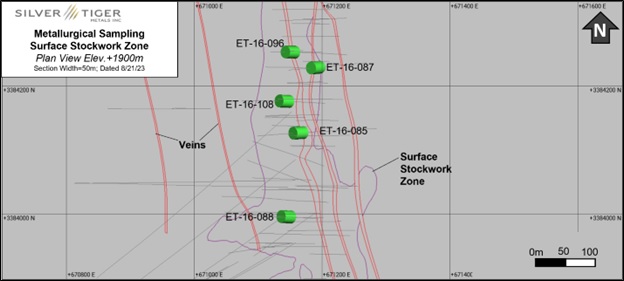

The samples consisted of five (5) drill holes within the Surface Stockwork Zone and were crushed and composited for the metallurgical testing to give approximate average deposit grades. The location and details of the holes are given in Figure 2 and Table 1. The column testing (C1 and C2) was done on these five (5) hole composites.

The summary of the five (5) holes analysis are shown in Table 3:

| U/G Heap Leach Samples |

|

|

|

|

Hole #

|

Sample #

|

Weight (Kg)

|

Au (g/t)

|

Ag (g/t)

|

AuEq (g/t)*

|

AgEq (g/t)*

|

| ET-16-085 |

C-1,2

|

83.0

|

0.42

|

30.71

|

0.78

|

66.27

|

| ET-16-087 |

C-1,2

|

74.1

|

0.82

|

3.29

|

0.86

|

72.71

|

| ET-16-088 |

C-1,2

|

84.0

|

0.58

|

20.13

|

0.82

|

69.34

|

| ET-16-096 |

C-1,2

|

75.7

|

0.70

|

11.92

|

0.84

|

71.02

|

| ET-16-108 |

C-1,2

|

81.8

|

0.47

|

25.14

|

0.77

|

65.36

|

| Composite |

|

398.6

|

0.68

|

20.30

|

0.93

|

75.72

|

|

|

|

|

|

|

|

|

* AuEq (gold equivalent) and AgEq (silver equivalent) calculated with ratio of 81.5:1

Quality/Assurance/Quality Control (QA/QC) Measures and Analytical Methods.

The drill core for metallurgical testing were drilled to normal industry standards with core and rejects stored at the El Tigre Project. Sample rejects were stored in clearly labeled, plastic bags before being palletized prior to shipping to SGS Lakefield by DHL.

SGS Statement of Qualifications - SGS Canada Natural Resources Lakefield conforms to the requirements of ISO/IEC 17025 and is accredited by the Standards Council of Canada for specific tests as indicated on their scope of accreditation.

Qualified Person

Dave Duncan P. Geo, VP Exploration of Silver Tiger, and David J. Salari, P. Eng., President of D.E.N.M. Engineering Ltd, are the Qualified Persons as defined under National Instrument 43-101. Mr. Duncan and Mr. Salari have reviewed and approved the scientific and technical information in this press release.

About Silver Tiger and the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian company whose management has more than 25 years' experience discovering, financing and building large epithermal silver projects in Mexico. Silver Tiger's 100% owned 28,414 hectare Historic El Tigre Mining District is located in Sonora, Mexico. Principled environmental, social and governance practices are core priorities at Silver Tiger.

The El Tigre historic mine district is located in Sonora, Mexico and lies at the northern end of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, including Dolores, Santa Elena and Las Chispas at the northern end. In 1896, gold was first discovered on the property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining high-grade silver veins in the area with production coming from 3 parallel veins the El Tigre Vein, the Seitz Kelley Vein and the Sooy Vein. Underground mining on the middle El Tigre vein extended 1,450 meters along strike and was mined on 14 levels to a depth of approximately 450 meters. The Seitz Kelley Vein was mined along strike for 1 kilometer to a depth of approximately 200 meters. The Sooy Vein was only mined along strike for 250 meters to a depth of approximately 150 meters. Mining abruptly stopped on all 3 of these veins when the price of silver collapsed to less than 20¢ per ounce with the onset of the Great Depression. By the time the mine closed in 1930, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012). The average grade mined during this period was over 2 kilograms silver equivalent per ton.

For further information, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@silvertigermetals.com

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding potential mineralization, resources and reserves, the ability to convert inferred resources to indicated resources, the ability to complete future drilling programs and infill sampling, the ability to extend resource blocks, the similarity of mineralization at El Tigre to Delores, Santa Elena and Chispas, exploration results, and future plans and objectives of Silver Tiger, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "may", "is expected to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective" and "outlook" and other similar words. Although Silver Tiger believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Silver Tiger's expectations include risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by Silver Tiger with securities regulators.

SOURCE: Silver Tiger Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/776457/Strong-Metallurgical-Test-Results-at-El-Tigre