VANCOUVER, British Columbia, Sept. 21, 2023 (GLOBE NEWSWIRE) -- Great Pacific Gold Corp. ("Great Pacific Gold,” “GPAC,” or the "Company") (TSXV: GPAC) (OTCQX: FSXLF) (Germany: 4TU) is pleased to announce that it has completed its acquisition of Wild Dog Resources Inc. (“WDR”) pursuant to the terms of an amalgamation agreement (the “Amalgamation Agreement”) with 15103452 Canada Inc., a wholly-owned subsidiary of GPAC (“GPAC Sub”), and WDR. WDR owns and/or has the right to earn an interest in three (3) separate high-grade gold-copper mineral properties located in Papua New Guinea (“PNG”): the Wild Dog Project, the Arau Project and the Kesar Creek Project (collectively, the “WDR Properties”) through Exploration Licenses ("EL") and Exploration License Applications ("ELA").

Highlights of Acquisition:

- 2166 sq. km land position assembled via the acquisition of interests in a variety of ELs and ELAs

- includes 614 sq. km project contiguous with and SE of K92 Mining Inc. exploration tenements

- includes 130 sq. km project contiguous with and NW of K92 Mining Inc. tenements, 10 km from mining operations

- PNG ELs and ELAs contain multiple high priority gold and copper targets

Bryan Slusarchuk, CEO of GPAC, states, “We are pleased to diversify our portfolio with these high-quality gold and copper assets in PNG. With the financial and technical experience of various team members in PNG, we are in an excellent position to unlock the potential upside of these high-grade assets. We look forward to building on the excellent work that WDR has completed on multiple high priority gold and copper drill targets across the land package.”

Terms of the Acquisition

Pursuant to the Amalgamation Agreement, in consideration of WDR:

- The shareholders of WDR (the “WDR Shareholders”) received an aggregate of approximately 16,161,441 common shares of GPAC (the “Common Shares”), and each WDR Shareholder received one (1) Common Share for every 7.028 WDR Shares held (the “Exchange Ratio”) (rounded down to the nearest whole number of Common Shares).

- The Common Shares issued to the WDR Shareholders are subject to voluntary restrictions on resale, of which 33.3% of the Common Shares will not be subject to restrictions on resale, 33.3% of the Common Shares will be subject to restrictions on resale for a period of three (3) months following closing of the Acquisition (“Closing”) and 33.4% of the Common Shares will be subject to restrictions on resale for a period of six (6) months following Closing.

- The warrantholders of WDR (the “WDR Warrantholders”) received an aggregate of approximately 526,892 Common Share purchase warrants (the “Warrants”), and each WDR Warrantholder received Warrants exercisable to acquire such number of Common Shares as is equal to the number of WDR Shares issuable under each such WDR Share purchase warrant (a “WDR Warrant”) previously held by such WDR Warrantholder multiplied by the Exchange Ratio (rounded down to the nearest whole number of Common Shares) at an exercise price per Common Share equal to the exercise price of such WDR Warrant per WDR Share divided by the Exchange Ratio until the expiry time of such WDR Warrant.

- The optionees of WDR (the “WDR Optionees”) were granted an aggregate of approximately 1,553,679 stock options of GPAC (the “Options”), and each WDR Optionee was granted Options exercisable to acquire such number of Common Shares as is equal to the number of WDR Shares issuable under each such stock option of WDR (a “WDR Option”) previously held by such WDR Optionee multiplied by the Exchange Ratio (rounded down to the nearest whole number of Common Shares) at an exercise price per Common Share equal to the exercise price of such WDR Option per WDR Share divided by the Exchange Ratio until the expiry time of such WDR Option.

Immediately prior to Closing, WDR had a working capital of C$1,000,000, excluding payments due prior to Closing under the agreements relating to the WDR Properties, payments made to satisfy all accrued fees and termination benefits under the executive compensation agreements and payments of corporate and legal costs in the ordinary course of business.

On Closing, GPAC appointed Iain Martin, a director of WDR, as a director of GPAC.

Information Concerning the WDR Properties

The WDR Properties comprise of a 2,166 sq. km mineral exploration land package in PNG consisting of two ELs and multiple ELAs.

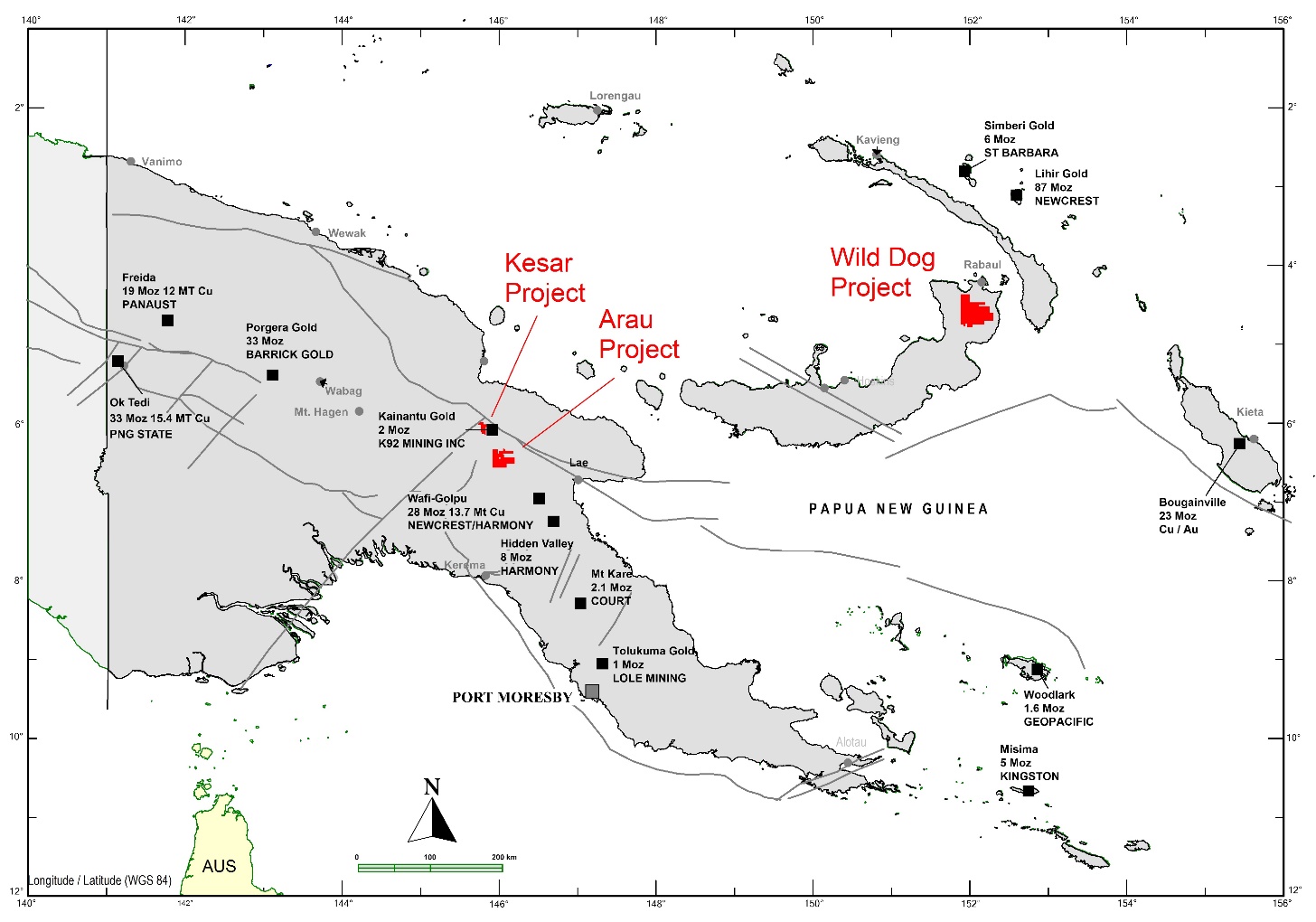

Figure 1. Papua New Guinea Project Location Map

The Wild Dog Project

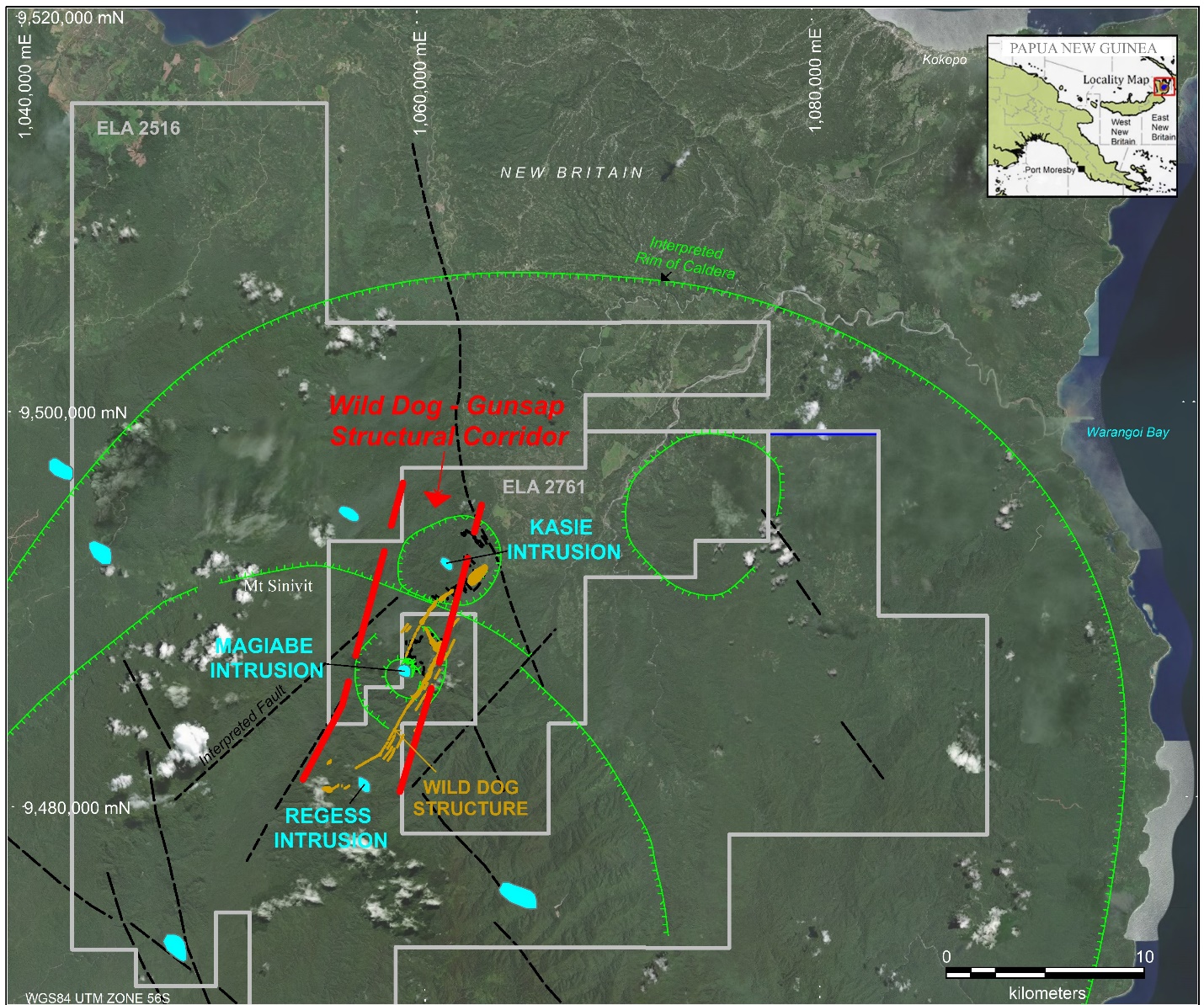

The Wild Dog Project consists of one EL and one ELAs (ELA 2516 and EL 2761) totalling 1424 sq. km, which are located on the island of New Britain and are approximately 50 km southwest of Rabaul and Kokopo, PNG.

The Wild Dog Project occurs within a major NNE trending structure of at least 26 km in length which transect apparent volcanic caldera structures and intrusions. During the Mio-Pliocene at least three volcanic centres, known as the Nengmutka, Keravat and Sikut calderas, were localised along this horst and graben zone. This structural corridor constitutes an epithermal and porphyry hydrothermal-magmatic mineralized field.

The Nengmutka Caldera, which hosts the Wild Dog deposit, is characterised by a suite of calc-alkaline andesite breccia and ash flow tuff known as the Nengmutka Volcanics (Lindley, 1988). This formation has been mapped over an area of 600 sq. km. Tonalite of the Arabam Diorite intrudes the volcanic sequence and appears to be partly coeval with the caldera related volcanism.

The precious metal prospects are associated with epithermal type veining that contain gold-silver-telluride (Au-Ag-Te) mineralisation. Gold and silver occur as native metals and as telluride minerals. Porphyry copper-gold type mineralization also occurs associated with these intrusion centres that usually underly the epithermal systems. The whole of the recognised belt is held within the Wild Dog tenements.

Within the central part of the Wild Dog project, a significant structural corridor called the “Wild Dog – Gunsap Corridor” occurs. The corridor is at least 15 km long and up to 4 km wide and hosts at least three porphyry copper-gold prospects and several epithermal gold deposits and prospects.

The original Wild Dog epithermal gold deposit occurs within the “Wild Dog – Gunsap Corridor” in the central part of the tenements. It was discovered in 1983, with exploration including extensive mapping, trenching, rock sampling and drilling between 1983 and 2005 by various explorers. New Guinea Gold Limited operated a small open pit mining operation from 2007 and 2011. No exploration has occurred since the closure of the mine.

Figure 2. Wild Dog Project Location and Tenements Maps

Historical work completed by a previous operator returned significant gold assays. Channel sampling at the Kavursuki Prospect yields 4m at 9.41 g/t Au and at the Kargalio Vein 6m at 11.5 g/t Au.

Drilling of the Kavursuki Prospect by previous explorers, located within the Wild Dog Zone and north of the former Wild Dog mine, also yielded positive high-grade results.

Table 1 – Kavursuki Prospect Significant Drill Intercepts

| Hole ID |

N |

E |

RL |

Depth |

Azim |

Dip |

From (m) |

Length (m) |

Au g/t |

Cu ppm |

| 90KVD005 |

9490500 |

395008 |

787 |

85.60 |

101.50 |

-45.00 |

5.35 |

1.25 |

12.80 |

1200 |

| 90KVD009 |

9490834 |

395227 |

758 |

93.85 |

101.50 |

-45.00 |

44.65 |

3.75 |

11.21 |

639 |

| 10KVD016 |

9490464 |

394971 |

798 |

51.00 |

101.50 |

-50.00 |

35.44 |

8.06 |

6.49 |

194 |

| 10KVD017 |

9490464 |

394970 |

798 |

50.00 |

101.50 |

-65.00 |

29.08 |

1.12 |

33.70 |

120 |

| 11KVD019 |

9490496 |

395039 |

807 |

45.10 |

101.50 |

-60.00 |

11.10 |

5.25 |

9.45 |

167 |

| 11KVD020 |

9490537 |

395045 |

805 |

50.90 |

101.50 |

-50.00 |

32.45 |

11.05 |

3.18 |

377 |

| 11KVD025 |

9490809 |

395241 |

752 |

45.20 |

101.50 |

-50.00 |

14.75 |

8.15 |

18.77 |

2801 |

| 11KVD026 |

9490810 |

395272 |

776 |

51.70 |

281.50 |

-60.00 |

33.80 |

5.10 |

14.70 |

101 |

| 11KVD027 |

9490870 |

395252 |

767 |

56.10 |

101.50 |

-50.00 |

30.70 |

1.90 |

10.35 |

46 |

Apart from the drilling conducted at the former Wild Dog gold mine there remain several drill intercepts that require further exploration outside of the mine environment as tabulated below, apart from the various trenching and channel sampling targets.

Table 2 – Wild Dog Prospect Area Significant Drill Intercepts

| Hole ID |

N |

E |

RL |

Depth |

Azim |

Dip |

From |

Length |

Au g/t |

Cu ppm |

| 86WDD020 |

9489141 |

394278 |

983 |

259.35 |

103.50 |

-60.00 |

129.35 |

7.70 |

5.28 |

902 |

| 87WDD024 |

9489117 |

394316 |

965 |

152.55 |

98.50 |

-60.00 |

138.25 |

5.10 |

8.32 |

8556 |

| 87WDD027 |

9489115 |

394325 |

965 |

200.40 |

98.50 |

-60.00 |

117.95 |

6.20 |

19.13 |

786 |

| 87WDD040A |

9489219 |

394320 |

994 |

280.99 |

103.50 |

-60.00 |

148.60 |

4.20 |

12.50 |

4066 |

| 87WDD045 |

9489235 |

394287 |

988 |

300.20 |

103.50 |

-60.00 |

201.30 |

2.85 |

16.94 |

32123 |

| 87WDD051 |

9489249 |

394257 |

985 |

309.10 |

103.50 |

-60.00 |

253.95 |

6.05 |

7.29 |

2054 |

| 87WDD058 |

9489285 |

394359 |

977 |

285.90 |

101.50 |

-60.00 |

147.00 |

12.45 |

4.96 |

6694 |

| 87WDD064 |

9489179 |

394289 |

1001 |

290.60 |

101.50 |

-60.00 |

158.00 |

14.95 |

2.73 |

650 |

| 87WDD065 |

9489160 |

394330 |

996 |

250.10 |

101.50 |

-60.00 |

142.70 |

4.65 |

5.49 |

3246 |

| 87WDD069 |

9489139 |

394375 |

991 |

123.50 |

101.50 |

-60.00 |

88.55 |

7.75 |

7.12 |

7151 |

| 08WDD111 |

9489393 |

394513 |

906 |

100.00 |

281.50 |

-60.00 |

48.40 |

7.10 |

5.47 |

931 |

| 85WDD014 |

9488708 |

394260 |

954 |

86.20 |

113.50 |

-51.00 |

48.25 |

5.25 |

9.79 |

10863 |

| 86WDP010 |

9488839 |

394302 |

909 |

60.00 |

83.50 |

-60.00 |

34.00 |

6.00 |

6.71 |

5047 |

| 87WDD040A |

9489219 |

394320 |

994 |

280.99 |

103.50 |

-60.00 |

164.55 |

13.50 |

8.56 |

3056 |

| 90WDD086 |

9488948 |

394337 |

890 |

79.00 |

78.50 |

-50.00 |

18.45 |

11.25 |

16.22 |

3473 |

| 97WD098 |

9489389 |

394487 |

905 |

39.00 |

98.50 |

-45.00 |

12.00 |

8.00 |

9.73 |

NA* |

NA* - not assayed or not available.

Table 3 – Mengmut Prospect Significant Drilling Intercepts

| Hole ID |

North |

East |

RL |

Depth |

Azim |

Dip |

From |

Length |

Au g/t |

Cu ppm |

| MRC01 |

9487963 |

393871 |

968 |

20.00 |

0.00 |

-90.00 |

2.00 |

18.00 |

3.05 |

3084 |

| MRC02 |

9487978 |

393874 |

971 |

30.00 |

0.00 |

-90.00 |

0.00 |

18.00 |

3.07 |

1053 |

| 90WDD087 |

9488091 |

394082 |

1021 |

61.95 |

101.50 |

-50.00 |

7.30 |

1.35 |

5.02 |

1650 |

| 90WDD088 |

9488104 |

394070 |

1023 |

40.30 |

101.50 |

-50.00 |

21.30 |

1.55 |

3.95 |

25 |

| MMD003 |

9486870 |

393532 |

924 |

104.00 |

133.00 |

-50.00 |

|

2.35 |

4.42 |

NA* |

| MMD006 |

9486770 |

393479 |

945 |

122.05 |

133.00 |

-50.00 |

|

2.55 |

4.16 |

NA* |

Additionally, multiple samples collected from a historic stockpile near the Wild Dog Zone returned bonanza grades of gold and copper including Sample 30104 which assayed 242 g/t Au, 601 g/t Ag, 9.52% Cu and Sample 68001 which assayed 122.5 g/t Au, 350 g/t Ag and 11% Cu.

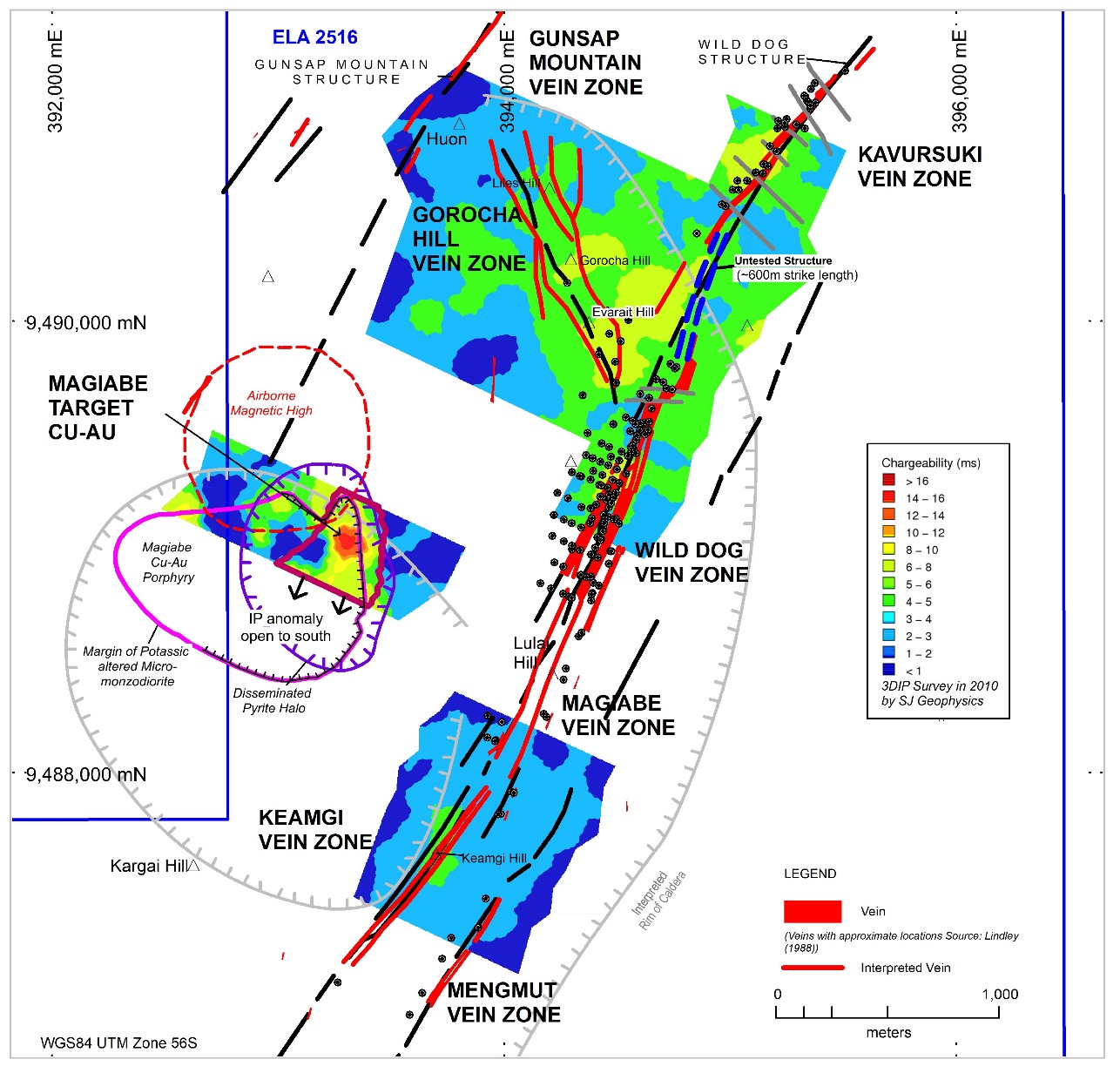

Figure 3 - Previous IP exploration survey at Wild Dog Project.

The exploration program at the Wild Dog Project will initially focus on drilling extensions to known gold mineralization within the Wild Dog – Kavursuki mineralized corridor (Tables 1 & 2) as well as other targets within the Wild Dog Structure such as Mengmut prospect (Table 3). Other targets to be explored include the copper-gold Magiabe porphyry target as well as regional geochemical targets established by previous explorers. Extension of the IP coverage in the Magiabe area could better define the target. Orientation soil geochemistry and auger drilling through the shallow cover sequence in prospective areas will be undertaken (Figure 3).

The details of the underlying agreements on the Wild Dog Property are set forth in the news release dated July 5, 2023.

The Arau Project

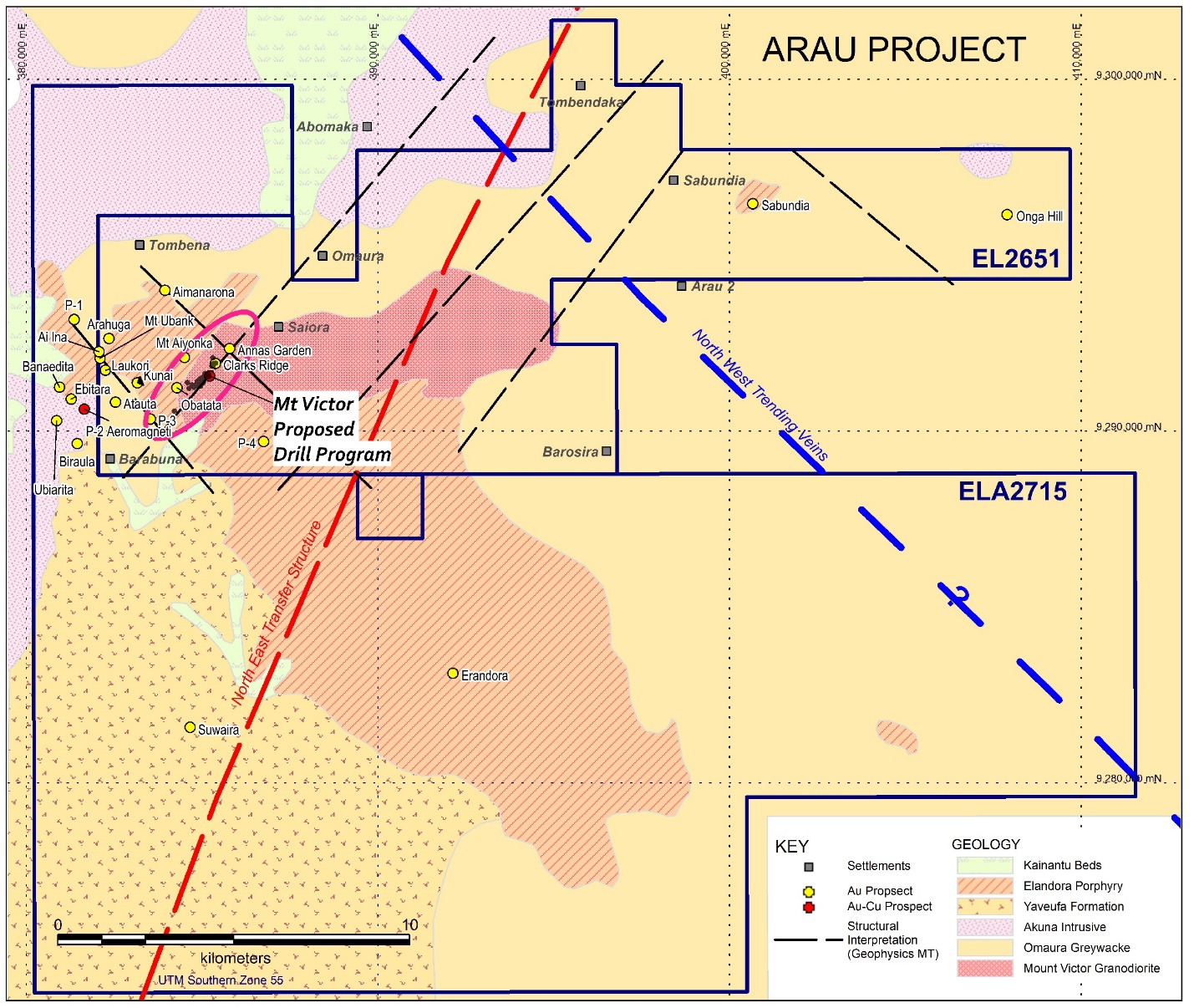

The Arau Project consists of one EL (EL 2651) and one ELA (ELA 2715), located in the Kainantu region, Eastern Highlands Province, PNG, which are immediately east of and adjoining the Kainantu gold mine owned by K92 Mining Inc.

Initial exploration work by previous operators has identified two potential deposit types at the Arau Project:

- epithermal-high sulphidation gold (Sabudia Hill, Onga Hill and Erandora prospects) and

- copper-gold porphyry prospects (Mt. Victor, Mt. Aiyonka, Ebitara and P1 prospects).

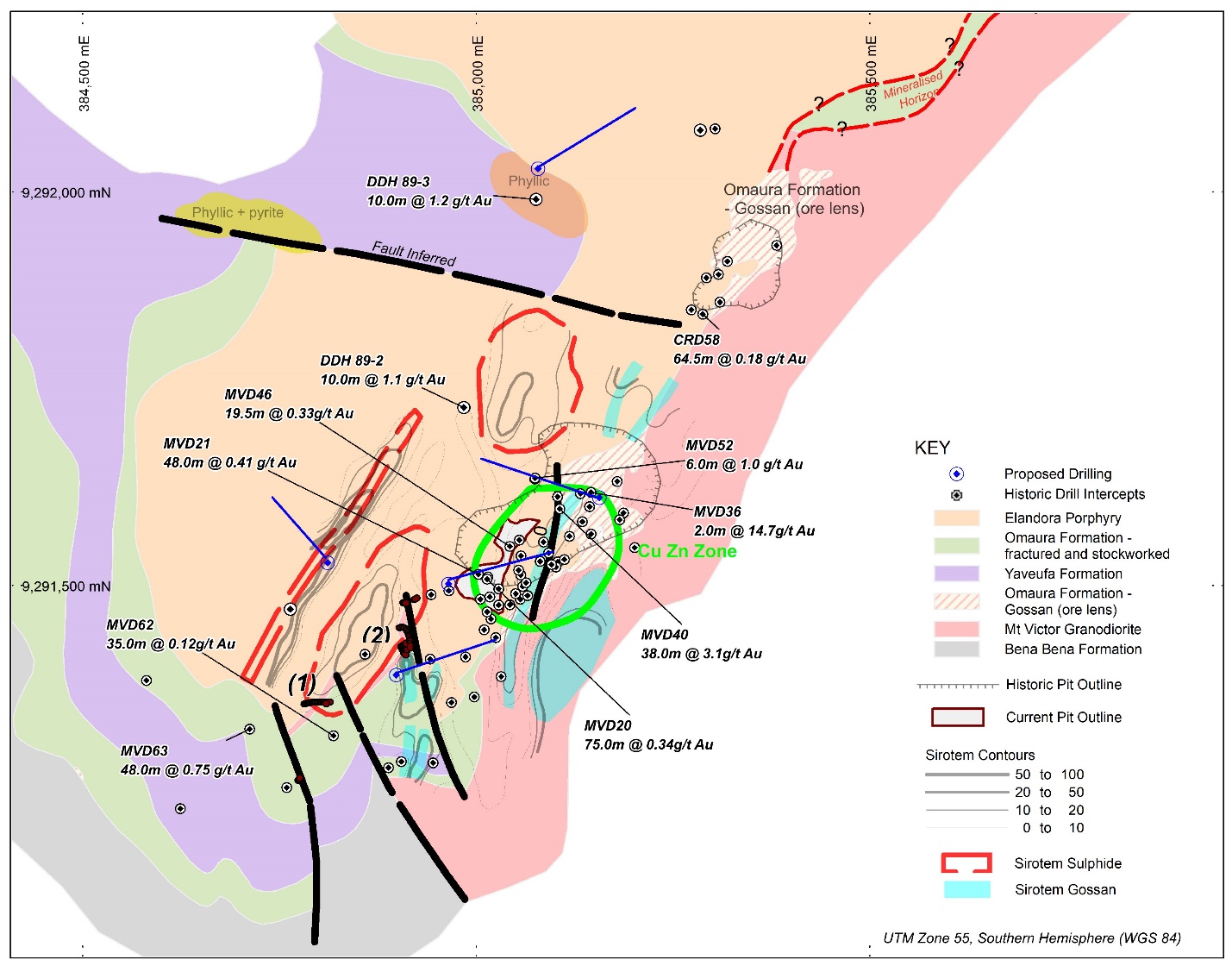

Within the licence area, the Mt. Victor Prospect (copper-gold porphyry target) covers an area of 800m by 400m, and previous drilling suggests that the prospect area is a multiple phase intrusion complex that is copper, and gold mineralized. It is a drill ready prospect in which previous channel sampling has identified the following strong gold grades:

- 38m @ 2.64 g/t Au

- 12m @ 5.5 g/t Au

- 18m @ 2.4 g/t Au

- 10m @ 3.7 g/t Au.

These channel samples are in the central part of the Mt Victor prospect southwest of the former Mt Victor gold mine (Figure 5). Previous drilling was carried out in the 1980s, and all drillholes presented were vertical, which is not appropriate for the subvertical fault zones present within the prospect.

Figure 4 Arau Project Geology and Prospect Location map

Figure 5 – Arau Project, Mt Victor Prospect detailed map.

Table 4 – Mt Victor Prospect Significant Drill Intercepts

| Hole ID |

E* |

N* |

Depth |

From (m) |

Length (m) |

Au g/t |

Cu ppm |

Notes |

| CRD58 |

385177 |

9291680 |

64.5 |

0 |

64.5 |

0.18 |

106 |

granodiorite intruded by diorite |

| DDH89-1 |

384650 |

9291308 |

260 |

234 |

5 |

0.85 |

NA |

disseminated copper mineralization |

| DDH89-2 |

384965 |

9291825 |

300 |

43 |

10 |

1.10 |

NA |

under review |

| DDH89-3 |

384873 |

9291562 |

300 |

213 |

10 |

1.20 |

NA |

under review |

| MVD07 |

384746 |

9291253 |

52.8 |

0 |

52.8 |

0.10 |

384 |

altered pyritic diorite |

| MVD08 |

384831 |

9291327 |

30 |

16 |

14 |

0.19 |

373 |

argillic altered QFP |

| MVD09 |

384853 |

9291333 |

36 |

34 |

2 |

0.29 |

NA |

epidote altered intrusive rock |

| MVD20 |

384900 |

9291345 |

75 |

0 |

75 |

0.34 |

304 |

argillic altered brecciated porphyry |

| MVD21 |

384890 |

9291353 |

48 |

0 |

48 |

0.41 |

329 |

diorite/QFP brecciated contact |

| MVD36 |

385032 |

9291456 |

24 |

22 |

2 |

14.70 |

463 |

altered pyritic porphyry |

| MVD40 |

384994 |

9291435 |

38 |

0 |

38 |

3.10 |

1400 |

silica epidote altered porphyry |

| MVD46 |

384932 |

9291388 |

34.5 |

15 |

19.5 |

0.33 |

117 |

epidote pyrite altered porphyry |

| MVD50 |

385068 |

9291469 |

29 |

16 |

13 |

0.13 |

722 |

clay altered granodiorite |

| MVD52 |

384962 |

9291475 |

30 |

14 |

16 |

1.01 |

77 |

sericite epidote altered porphyry |

| MVD62 |

384704 |

9291152 |

75 |

40 |

35 |

0.12 |

287 |

kspar epidote altered porphyry |

| MVD63 |

384596 |

9291160 |

48 |

0 |

48 |

0.75 |

373 |

diorite intruded by pyritic porphyry |

Initial drilling at the Arau Project will involve five angled diamond drill holes to follow up on a successful electromagnetic survey and previous excellent geochemical sampling results.

The details of the underlying agreement on the Arau Property are set forth in the news release dated July 5, 2023.

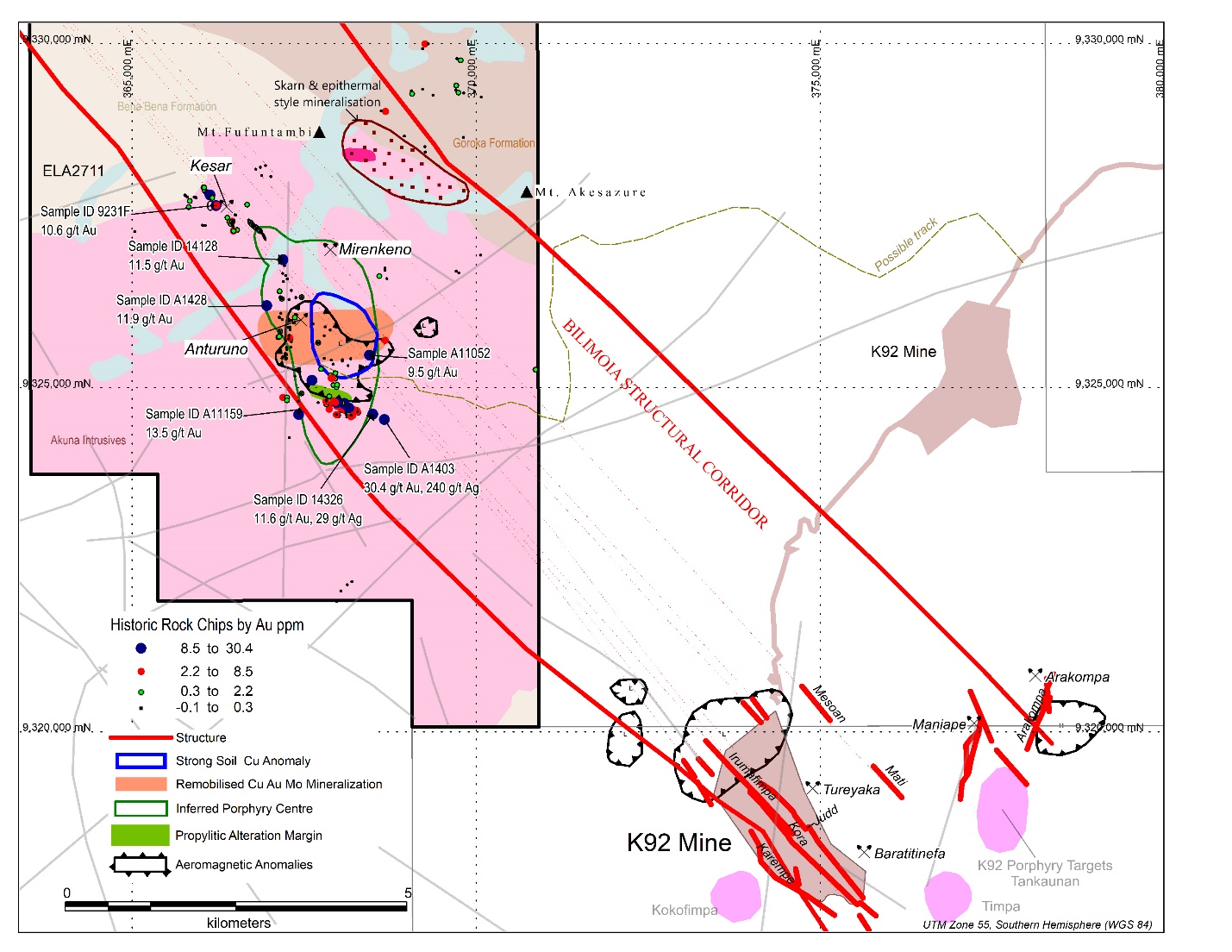

The Kesar Creek Project

The Kesar Creek Project consists of one ELA, ELA 2711, and is located 10 km from the Kora gold deposit owned by K92 Mining Inc (Figure 6).

Exploration at Kesar Creek has identified the presence of semi-massive copper rich sulphide mineralization associated with quartz veins on strike to the Kora gold deposit, as well as the potential for copper-gold porphyry prospects within the tenement. Although limited exploration has been carried out at Kesar Creek, initial rock sampling programs returned high-grade gold-copper-silver values including:

- Rock sample no 14128 at 11.5 g/t Au

- Rock sample no A1428 at 11.9 g/t Au

- Rock sample no 9231F at 10.6 g/t Au

- Rock sample no 14236 at 11.6 g/t Au, 29 g/t Ag

- Rock sample no. A14023 at 30.4 g/t Au, 240 g/t Ag, 0.13% Cu

The details of the underlying agreement on the Kesar Creek Property are set forth in the news release dated July 5, 2023.

Figure 6 - Kesar Creek project map with key geological features.

About GPAC

Great Pacific Gold has a portfolio of high-grade gold projects in Papua New Guinea (“PNG”) and Australia.

In PNG, Great Pacific Gold recently acquired a significant 2,166 sq. km mineral exploration land package in PNG. The land package comprises two ELs and multiple ELAs. It includes both early-stage and advanced-stage exploration targets with high-grade epithermal vein and porphyry-style mineralisation present.

The Arau Project consists of one granted exploration license, EL 2651, and one exploration license application, ELA 2715, located in the Kainantu region, and includes the Mt. Victor Prospect, where previous drilling found a multiple phase intrusion complex hosting copper and gold mineralisation.

The Wild Dog Project consists of one granted exploration license, EL 2761, and one exploration license application, ELA 2516, located on the island of New Britain and about 50 km southwest of Rabaul and Kokopo, PNG.

The Kesar Creek Project consists of one exploration license application, ELA 2711, and is located 10 km west of the K92 Gold Mine owned and operated by K92 Mining Inc.

In Australia, Great Pacific Gold began with two, 100% owned, high-grade gold projects called the Lauriston and Golden Mountain Projects, and has since acquired a large area of granted and application tenements containing further epizonal (low-temperature) high-grade gold mineralisation and associated intrusion-related gold mineralization all in the state of Victoria, Australia. The Great Pacific Gold land package, assembled over a multi-year period, notably includes the Lauriston Project which is a 666 sq. km property immediately to the south of and within the same geological framework that hosts Agnico Eagle Mines Ltd’s Fosterville gold mine and associated exploration tenements. The Golden Mountain Project is an intrusion-related gold project on the edge of the Strathbogie granite and occurs at the northern end of the Walhalla Gold Belt. The acquired projects include the epizonal gold Providence Project containing the Reedy Creek goldfield which adjoins the Southern Cross Gold’s (ASX:SXG) Sunday Creek exploration project and a large group of recently consolidated granted tenements called the Walhalla Gold Belt Project, which contain a variety of epizonal and intrusion related style gold mineralisation. Additionally, Great Pacific Gold has another gold-focused project called the Moormbool project which has epizonal style gold mineralisation and associated potential intrusion-related gold mineralisation, as well as the Beechworth Project occurs in the northeast of the state and contains intrusion related and mesozonal gold mineralization.

All of GPAC’s properties are 100% owned and have had historical gold production from hard rock sources despite limited modern exploration and drilling.

Qualified Person

The technical content of this news release has been reviewed, verified and approved by Rex Motton, AusIMM (CP), COO of GPAC, a Qualified Person under the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Motton is responsible for the technical content of this news release.

On behalf of GPAC

Rex Motton

Chief Operating Officer and Director

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Great Pacific Gold cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Great Pacific Gold's limited operating history, its exploration and development activities on its mineral properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward looking information. Except as required under applicable securities legislation, Great Pacific Gold does not undertake to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information: Adam Ross, Investor Relations, Direct: (604) 229-9445, Toll Free: 1(833) 923-3334, Email: info@fostervillesouth.com

Photos accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3679f61d-f6e1-494a-a77c-5a727c52e65b

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3f9d09a-c7a5-43cd-a68f-31c4b26b578a

https://www.globenewswire.com/NewsRoom/AttachmentNg/d9df4e0e-2ca7-43bf-88f6-5b74a5ee349c

https://www.globenewswire.com/NewsRoom/AttachmentNg/ee885d8c-e51f-4f16-acc1-ae6a02079bb2

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f9b30ba-3977-4f33-9b7f-9e2990f8c7ea

https://www.globenewswire.com/NewsRoom/AttachmentNg/6d3e872e-1847-4df6-a0fb-9f2cc942119c