(TheNewswire)

Toronto, Ontario - TheNewswire -October 27, 2023 - Helix BioPharma Corp. (TSX:HBP), (“Helix” or the “Company”), a clinical-stage biopharmaceutical company developing unique therapies in the field of immuno-oncology based on its proprietary technological platform DOS47, today announced financial results for the 2023 fiscal year ended July 31, 2023.

OVERVIEW

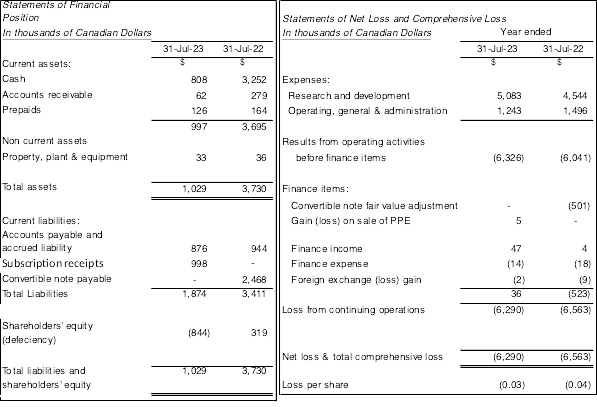

The Company reported a net loss and total comprehensive loss of $6,290,000 for the year ended July 31, 2023, (July 31, 2022 - $6,563,000) and a loss of $0.03 per common share (July 31, 2023– loss of $0.04 per common share).

Clinical development

LDOS47 in lung cancer

The Phase II study of combination therapy in lung cancer (LDOS003) was halted in the dose escalation portion of the study in 2020 at the height of pandemic lockdown and the final clinical trial report was further delayed amidst war in Ukraine where all subjects were recruited. The company is now preparing to submit the final clinical study report to regulatory authorities later this month.

LDOS47 in pancreatic cancer

The Company's Phase I-b/II combination trial in pancreatic cancer (LDSOS006) continues to recruit patients, now in the fourth dosing cohort (13.55 µg/kg), after successfully completing the second dosing cohort (9 µg/kg) in July 2023. We remain committed to this study.

Another important aspect of the development of the LDOS47 platform is the combination with chemo- and/or immuno-therapy to enhance current therapies, that may boost the utility of the platform. The Company continues to engage several key opinion leaders to evaluate potential combinations for partnership opportunities in other CEACAM6 expressing tumors.

Corporate development

-

On August 15, 2023, the Company announced that it had closed a private placement financing for net proceeds of CAD $2,998,000 from the issuance of 16,655,557 common shares at a price of $0.18 per common share. The common shares issued pursuant to the private placement were subject to a statutory hold period of four months and one day ending on December 16, 2023, in accordance with applicable securities law. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

-

On November 3, 2022, the Company announced that it had closed a private placement financing for net proceeds of CAD $4,629,019.86 from the issuance of 25,716,777 common shares at a price of $0.18 per common share. The common shares issued pursuant to the private placement were subject to a statutory hold period of four months and one day ending on March 4, 2023, in accordance with applicable securities law. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

-

On October 3, 2022, the Company announced the appointment of Dr. Frank Gary Renshaw, as the Chief Medical Officer.

-

On September 1, 2022, the Company announced the appointment of Dr. Gabrielle M Siegers, MA, Ph.D., as the Head of RD based out of the Company’s lab in Edmonton.

-

On August 30, 2022, the Company announced that it had completed the buyback of the outstanding amount of the convertible security funding agreement with Lind Global Macro Fund, LP. The Company entered into the Agreement with Lind in May 2021 and closed the first tranche under the Agreement for gross proceeds of $3,500,000 shortly thereafter. The Company has now bought back the amount outstanding of the Convertible Security under the Agreement, which is C$2,061,875.

-

On August 9, 2022, the Company announced that it has entered into a two-year scientific collaboration agreement (“Agreement”) with University Hospital Tubingen (Germany) to assess the therapeutic response of L-DOS47 in several cancer models expressing CEACAM6, with advanced preclinical metabolic imaging.

Research & development

Research & development expenses for the year ended July 31, 2023, totalled $5,281,000 (July 31, 2022 – $4,544,000).

The following table outlines research and development costs expensed for the following periods (in thousands of Canadian dollars):

Research and development expenditures for the year ended July 31, 2023, when compared to the year ended July 31, 2022, were higher by $539,000 or 12%. The increase in spending is mainly the result of higher expenditure associated with clinical and pre-clinical research and development activities. Stock-based compensation expenses were lower by $14,000 and salaries and benefits were lower by $67,000 when compared to the year ended July 31, 2022. The Company hired biotechnology consultants to assess the Company’s drug product candidate with a focus on identifying value propositions and positioning strategies that would enable clinical adoption of L-DOS47. See “Overview” above for additional information.

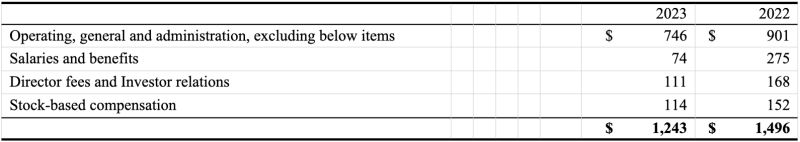

Operating, general and administration

Operating, general and administration expenses for the year ended July 31, 2023, totalled $1,243,000 (July 31, 2022 – totalled $1,496,000).

The following table outlines operating, general and administration expenses for the following periods (in thousands of Canadian dollars):

Click Image To View Full Size

Operating, general and administration expenditures for the year ended July 31, 2023, when compared to the year ended July 31, 2022, were lower by $253,000 or 17%. Since May 2022, the Company has made significant efforts to control and reduce its overheads expenditures. This included closing its headquarters at Richmond Hill Ontario and moving it to Grove Corporate Services offices “(Grove”) in downtown Toronto. The Company hired Grove to perform accounting and corporate secretarial services following the resignation of its previous CFO in May 2022. The savings apply to various activities including salaries, rent, legal, and other operational expenditures. Further measures are being taken which will result in more reductions in the current year. In general, administrative savings were made in operating expenses ($80,000), Wages ($275,000) and Director and IR fees ($57,000). Stock-based compensation was higher by $160,000.

LIQUIDITY AND CAPITAL RESOURCES

Since inception, the Company has mainly relied on financing its operations from public and private sales of equity. The Company does not have any credit facilities and is therefore not subject to any externally imposed capital requirements or covenants. The Company manages its liquidity risk by continuously monitoring forecasts and actual cash flow from operations and anticipated investment and financing activities.

The Companyreporteda netloss and total comprehensive loss of $6,290,000 forthe year ended July 31, 2023, (July 31, 2022 - $6,563,000) and a loss of $0.03 per common share (July 31, 2022 - $0.04 per common share). As of July 31, 2023, the Company had a working capital deficiency of $877,000, shareholders’ equity deficiency of $844,000 and a deficitof$201,407,000. As of July 31, 2022, the Company had working capital of $283,000, shareholders’ equity $319,000 and a deficitof $195,117,000.

On July 19, 2023, the Company applied to the TSX to price protect a proposed $3 million financing of common shares at a price of $0.18 per share. The TSX granted the conditional approval of the placement on July 19, 2023. On August 15, 2023, the Company announced that it had closed the private placement financing for gross proceeds of CAD $2,998,000 from the issuance of 16,655,557 common shares at a price of $0.18 per common share.

On September 12, 2022, the Company applied to the TSX to price protect a proposed $5 million financing of common shares at a price of $0.18 per share. The TSX granted a price protection letter on September 14, 2022, and the conditional approval of the placement on September 26, 2022. On November 3, 2022, the Company announced that it had closed a private placement financing for net proceeds of CAD $4,629,020 from the issuance of 25,716,777 common shares at a price of $0.18 per common share with insiders subscribing for $270,000. The common shares issued pursuant to the Private Placement are subject to a statutory hold period of four months and one day ending on March 4, 2023, in accordance with applicable securities law. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

In order for the Company to advance the currently planned preclinical and clinical research and development activities, its collaborative scientific research programs and pay for its overhead costs, the Company will need to raise approximately $11,000,000 through to the end of fiscal 2025. The Company projects an average monthly fixed overhead spend of approximately $200,000. This amount does not include the costs related to any of the Company’s third-party activities such as clinical studies, collaborative research activities and contract manufacturing.

The Company’s Statement of Financial Position and Statement of Net Loss and Comprehensive Loss for fiscal 2023 and 2022 are summarized below:

The Company’s consolidated financial statements, management’s discussion and analysis and annual information form will be filed under the Company’s profile on SEDAR+ at https://www.sedarplus.ca/landingpage/ as well as on the Company’s website at www.helixbiopharma.com.

About Helix BioPharma Corp.

Helix BioPharma Corp. is a clinical-stage biopharmaceutical company developing unique therapies in the field of immune-oncology for the prevention and treatment of cancer based on our proprietary technological platform DOS47. Helix is listed on the Toronto Stock Exchange under the symbol “HBP”.

Helix BioPharma Corp.

2704, 401 Bay Street,

Toronto M5H 2Y4, Ontario,

Tel: 905-841-2300

namrata@grovecorp.ca

Forward-Looking Statements and Risks and Uncertainties

This news release contains forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities laws. Forward-looking statements are statements and information that are not historical facts but instead include financial projections and estimates, statements regarding plans, goals, objectives, intentions and expectations with respect to the Company’s future business, operations, research and development, including the focus of the Company’s primary drug product candidate L-DOS47 and other information relating to future periods.

Forward-looking statements include, without limitation, statements concerning (i) the Company’s ability to operate on a going concern being dependent mainly on obtaining additional financing; (ii) the Company’s priority continuing to be L-DOS47; (ii) the Company’s development programs, clinical studies, trials and reports for DOS-47 and L-DOS47; (iii) the Company’s development programs for DOS47 and L-DOS47; (iv) future expenditures, the insufficiency of the Company’s current cash resources and the need for financing; (v) future financing requirements, and the seeking of additional funding, and (vi) forecasts and future projections regarding development programs and expenditures. Forward-looking statements can further be identified by the use of forward-looking terminology such as “ongoing”, “estimates”, “expects”, or the negative thereof or any other variations thereon or comparable terminology referring to future events or results, or that events or conditions “will”, “may”, “could”, or “should” occur or be achieved, or comparable terminology referring to future events or results.

Forward-looking statements are statements about the future and are inherently uncertain and are necessarily based upon a number of estimates and assumptions that are also uncertain. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Forward-looking statements, including financial outlooks, are intended to provide information about management’s current plans and expectations regarding future operations, including without limitation, future financing requirements, and may not be appropriate for other purposes. Certain material factors, estimates or assumptions have been applied in making forward-looking statements in this news release, including, but not limited to, the safety and efficacy of L-DOS47; that sufficient financing will be obtained in a timely manner to allow the Company to continue operations and implement its clinical trials in the manner and on the timelines anticipated; the timely provision of services and supplies or other performance of contracts by third parties; future costs; the absence of any material changes in business strategy or plans; and the timely receipt of required regulatory approvals and strategic partner support.

The Company’s actual results could differ materially from those anticipated in the forward-looking statements contained in this news release as a result of numerous known and unknown risks and uncertainties, including without limitation, the risk that the Company’s assumptions may prove to be incorrect; the risk that additional financing may not be obtainable in a timely manner, or at all, and that clinical trials may not commence or complete within anticipated timelines or the anticipated budget or may fail; third party suppliers of necessary services or of drug product and other materials may fail to perform or be unwilling or unable to supply the Company, which could cause delay or cancellation of the Company’s research and development activities; necessary regulatory approvals may not be granted or may be withdrawn; the Company may not be able to secure necessary strategic partner support; general economic conditions, intellectual property and insurance risks; changes in business strategy or plans; and other risks and uncertainties referred to elsewhere in this news release, any of which could cause actual results to vary materially from current results or the Company’s anticipated future results. Certain of these risks and uncertainties, and others affecting the Company, are more fully described in the Company’s annual management’s discussion and analysis for the year ended July 31, 2023 under the heading “Risks and Uncertainty” and Helix’s Annual Information Form, in particular under the headings “Forward-looking Statements” and “Risk Factors”, and other reports filed under the Company’s profile on SEDAR at www.sedar.com from time to time. Forward-looking statements and information are based on the beliefs, assumptions, opinions and expectations of Helix’s management on the date of this new release, and the Company does not assume any obligation to update any forward-looking statement or information should those beliefs, assumptions, opinions or expectations, or other circumstances change, except as required by law.

__________

Copyright (c) 2023 TheNewswire - All rights reserved.