Highlights:

- Robust economics: pre-tax net present value (“NPV”) of C$1.53 billion, post-tax NPV of C$910 million, pre-tax internal rate of return (“IRR”) of 34.4%, post-tax IRR of 24.4% at US$1,750 per ounce.

- At the current gold price of approximately US$2,000 per ounce, pre-tax NPV5% increases to $2.29 billion and pre-tax IRR increases to 47.8%.

- 12.6-year mine life, yielding 24% more gold ounces over 2021 PEA, 77% in the Measured and Indicated category.

- 23% increase in average annual gold production to 255,000 ounces over the life of the mine (“LOM”), with 281,000 ounces average annual production over the first 5 years.

- Average cash cost of US$841/oz Au, all-in sustaining (“AISC”) cost of US$1,038/oz Au.

- Initial Capital Expenditure of C$602 million.

- Project advancing towards pre-feasibility, focusing on reducing the permitting timeline and resource growth/conversion.

TORONTO, Feb. 13, 2024 (GLOBE NEWSWIRE) -- Probe Gold Inc. (TSX: PRB) (“Probe” or the “Company”) is pleased to announce positive results from the independent updated Preliminary Economic Assessment (“PEA”) for its 100%-owned Novador Project (formerly known as Val-d’Or East) (the “Project”) located near Val-d’Or, Québec. The updated PEA provides a base case assessment of developing the Novador mineral resource by open pit and underground mining, and gold recovery with a standard free milling flowsheet, incorporating gravity and leaching of the gravity tails, with 50% estimated to be recovered via gravity. The economic model supports an operation with a high rate of return over a 12.6-year mine life, with significant average annual production of 255,000 ounces, an increase of 23% from the 2021 PEA. The updated PEA was prepared by Ausenco Engineering Canada ULC (“Ausenco”) in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The updated NI 43-101 PEA Technical Report will be filed on SEDAR within 45 days of this announcement.

David Palmer, President and Chief Executive Officer of Probe, states, “Our initial goal for the Company was to discover a gold deposit capable of producing 200,000 ounces per year and we have now achieved an average of over 250,000 ounces per year, over a mine life of almost 13 years, with a resource that is still growing. From our last PEA in 2021 we have demonstrated numerous improvements: our potential production has increased by 23%, our post-tax NPV is up over 50% to $910 million, we have simplified our milling by removing ore sorting, and we have room for additional improvement in the Pre-Feasibility Study (“PFS”). Novador is a large, sustainable mining project leveraged to the gold price with a production profile capable of producing nearly 300,000 ounces per year in the first five years, marking a significant improvement over the previous PEA. To have gold production of this capacity in a safe and stable jurisdiction like Quebec distinguishes Novador as one of the pre-eminent gold development projects in the world and we see its potential in providing great benefits not only to our shareholders but also to the communities that surround it. We will continue to focus on de-risking and permitting Novador in order to add value in the most efficient and effective way possible.”

Yves Dessureault, Chief Operating Officer of Probe, states, “This updated PEA has surpassed our expectations again and it clearly shows a robust and significant project. Following 581,000 metres of drilling and numerous technical and field studies to support robust design criteria, the project is on solid foundations. We have also integrated project elements to reduce its environmental footprint by taking advantage of its proximity to existing infrastructure. For example, the project includes rail delivery to site for reagents and consumables, electrification of open pit mining equipment (drills and shovels), backfilling of two open pits (one with waste rock and the other with tailings) and dry staking of filtered tailings. With the permitting process initiated last fall with the submission of the initial project description to the Impact Assessment Agency of Canada, we now have a better-defined project and are now ready to further engage with the provincial, federal authorities and the various stakeholders. Clearly, this project connects us with a bright future.”

Description of the Novador Project and PEA

The PEA is preliminary in nature and includes Inferred Mineral Resources considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the results of the PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

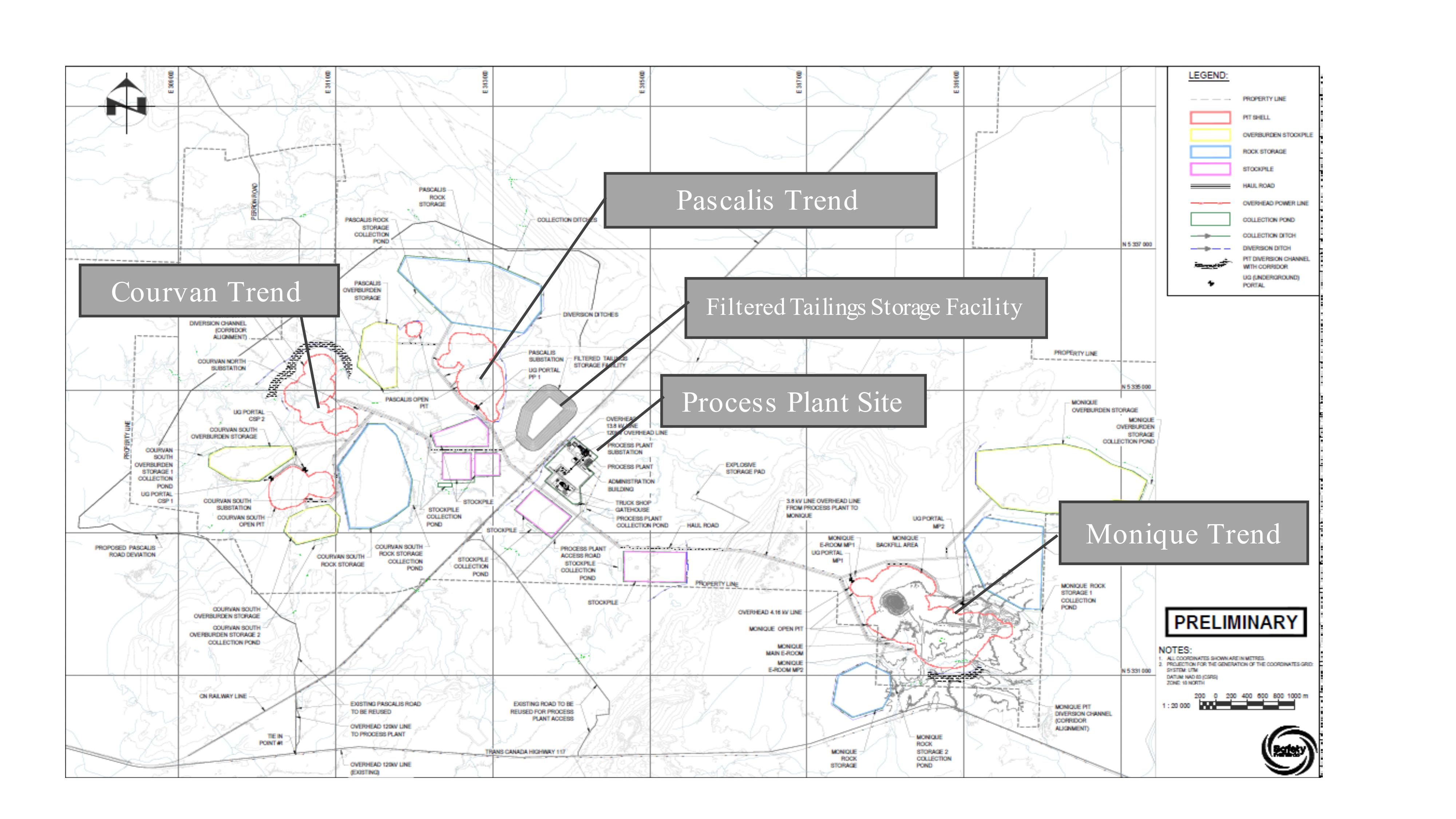

The Novador Project includes the properties on the Pascalis, Monique and Courvan gold trends, which are all 100%-owned by Probe. The Project benefits from world-class mining infrastructure, expertise for underground and open-pit operations and highly qualified personnel. It can be easily reached by roads that are well maintained in all seasons. Several large-scale mining operations and gold mills (some with excess capacity) are currently active in the area. Since 1930, more than 30 million ounces of gold have been produced in the Val-d’Or mining camp.

Since 2016, Probe Gold has been consolidating its land position in the highly prospective Val-d’Or East area in the province of Quebec with a district-scale land package of 600 square kilometres that represents one of the largest land holdings in the Val-d’Or mining camp. The Novador project is a sub-set of properties totaling 175 square kilometres hosting three past producing mines (Beliveau Mine, Bussière Mine and Monique Mine) and falls along three regional mine trends. The current total Novador resource stands at 3,793,900 ounces of gold in the Measured and Indicated category (M&I) and 1,179,400 ounces of gold in the Inferred category (see Table 9 and 11 for details on split between open pit and underground, and for grade and tonnage in each category).

Ausenco was appointed as lead consultant in August of 2023 to prepare the updated PEA in accordance with NI 43-101 and was assisted by Moose Mountain Technical Services for the mine design.

The independent PEA was prepared through the collaboration of the following firms: Ausenco Engineering Canada ULC (Ausenco), Moose Mountain Technical Services (MMTS), InnovExplo, Knight Piésold Ltd. (KP), Richelieu Hydrogéologie Inc., Lamont Inc. and Rock Engineering Consulting Services. These firms provided mineral resource estimates, design parameters and cost estimates for mine operations, process facilities, major equipment selection, rock and tailings storage, reclamation, permitting, as well as operating and capital expenditures.

Financial Analysis

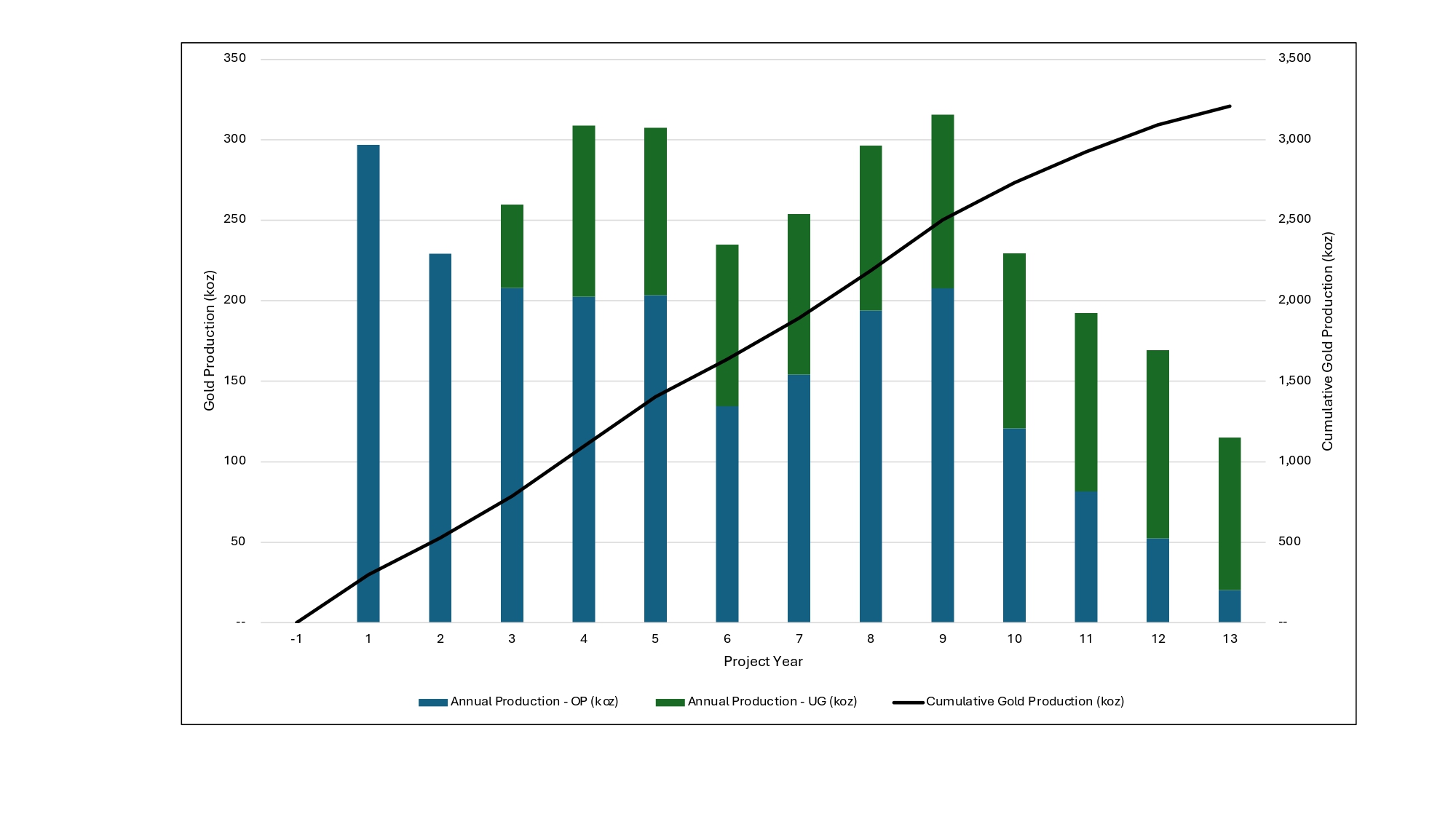

The economic analysis was performed assuming a 5% discount rate. On a pre-tax basis, the NPV5% is $1,530 million, the IRR is 34.4% and the payback period is 3.5 years. On an After-Tax basis, the NPV5% is $910 million, the IRR is 24.4% and the payback period is 4.4 years. A summary of the Novador Project economics, and the projected annual gold production is listed in Table 1 and Figure 1, respectively.

Table 1: Summary of Novador Project Economics

| General |

|

|

LOM Total/Avg |

|

| Gold Price (US$/oz) |

|

|

$1,750 |

|

| Exchange Rate (US$:C$) |

|

|

0.74 |

|

| Mine Life (years) |

|

|

12.6 |

|

| Total Overburden and Waste Tonnes Mined (kt) |

|

|

504,344 |

|

| Total Mill Feed Tonnes (kt) |

|

|

80,317 |

|

| Total Underground Mill Feed Tonnes (kt) |

|

|

12,418 |

|

| Total Open Pit Mill Feed Tonnes (kt) |

|

|

67,899 |

|

| Strip Ratio (tonnes of waste: tonnes of mineralized material) |

|

|

7.43 x |

|

| Production |

|

|

|

|

| Mill Head Grade (g/t) |

|

|

1.30 |

|

| Mill Recovery Rate (%) |

|

|

95.70% |

|

| Total Mill Ounces Recovered (koz) |

|

|

3,210 |

|

| Total Average Annual Production (koz) |

|

|

255 |

|

| Operating Costs |

|

|

|

|

| Open Pit Mining Cost (C$/t Mined) |

|

|

$2.88 |

|

| Underground Mining Cost (C$/t Mined) |

|

|

$88.07 |

|

| Processing Cost (C$/t Milled) |

|

|

$9.80 |

|

| G&A Cost (C$/t Milled) |

|

|

$1.69 |

|

| Refining & Transport Cost (C$/oz) |

|

|

$2.50 |

|

| Total Operating Costs (C$/t Milled) |

|

|

$44.52 |

|

| Net Equivalent Royalty after Buyback |

|

|

0.80% |

|

| Cash Costs (US$/oz Au) |

|

|

$841 |

|

| AISC (US$/oz Au) |

|

|

$1,038 |

|

| Capital Costs |

|

|

|

|

| Initial Capital (C$M) |

|

|

$602 |

|

| Sustaining Capital (C$M) |

|

|

$818 |

|

| Closure Costs (C$M) |

|

|

$64 |

|

| Salvage Costs (C$M) |

|

|

($26) |

|

| Financials |

Pre-Tax |

|

After-Tax |

|

| NPV (5%) (C$M) |

$1,530 |

|

$910 |

|

| IRR (%) |

34.4% |

|

24.4% |

|

| Payback (years) |

3.5 |

|

4.4 |

|

Notes:

* Cash costs consist of mining costs, processing costs, mine-level G&A, refining and transport charges and royalties

** AISC includes cash costs plus sustaining capital, closure costs, and salvage value

Cautionary Statement - The reader is advised that the updated PEA summarized in this news release is intended to provide only an initial, high-level review of the project potential and design options. The updated PEA mine plan and economic model include numerous assumptions and the use of Inferred Resources. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the results of the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Projected gold production averages 281,000 ounces per year over the first five years and 273,000 ounces per year over the first eight years. The LOM production totals 3,210 koz and averages 255,000 ounces per year. Production will come from open pit mining in the first two years before transitioning to a combined open pit and underground operations afterwards.

Figure 1: Annual Gold Production

Mine Design and Production Schedule

The updated PEA considers open-pit mining from Monique, Courvan, Pascalis gold trends. Underground mining is used to extract material outside of the Monique, Courvan and Pascalis open pits. Underground mining areas are accessed from surface portals and are mined concurrently with the open pits. The underground mining methods considered in this study are longhole retreat for the Monique gold trend and mechanized drift and fill for the Courvan and Pascalis gold trends.

Lerchs-Grossman (LG) pit shell optimizations are used to define the ultimate economic pit limit for each gold trend. Ultimate pit limits are then split into smaller, detailed mining phases which incorporate geotechnical feedback for berm width, bench face angles and overall angles and also include highwall ramps which are appropriately sized for the selected mining equipment. Haulage profiles are built for each destination from each phase, allowing the mining schedule program to include fleet size optimization, along with grade profile and mining rate optimizations.

Underground mining limits consider the expected processing and mining costs, with mining costs dependent upon the selected mining method. These costs are applied to the block model inside a stope optimizer program to develop mining stope areas. The stope areas are examined and small, isolated areas that would incur high development costs are removed. The remaining stopes are applied with appropriate mining loss and dilution factors. Stopes are scheduled with consideration of throughput capacities on the access ramps, ordered sequencing of stopes, timing of underground production relative to open pit production, and overall personnel requirements.

The scheduled mill feed Resources by type are as follows: 5% Measured, 72% Indicated and 23% Inferred.

The owner-operated mining fleet will utilize conventional truck and shovel methods with 16 cubic metre loaders and 135-tonne haul trucks on 12m benches. Non-mineralized material will be placed as near as possible to the pit rims to reduce haulage costs. Mineralized material will be directed to stockpiles or to the mill. Underground material is direct fed to the mill. The average mill feed head grade during the first five years is 1.67 g/t Au and is 1.30 g/t Au over the LOM.

The mining schedule considers one year of pre-production, followed by approximately 12.6 years of mill feed. The mill feed throughput is planned at 15,500 tonnes per day (tpd) for the first 5 years and then 19,200 tpd for the following 7.6 years. The mill feed is comprised of 67.9 million tonnes of open-pit material and 12.4 million tonnes of underground material. The open-pit strip ratio is 7.43 tonnes waste/tonnes mill feed. Over the mine life, total gold production is forecasted to be 2,106koz from open-pit operations and 1,104koz from underground operations.

Metallurgy and Mineral Processing

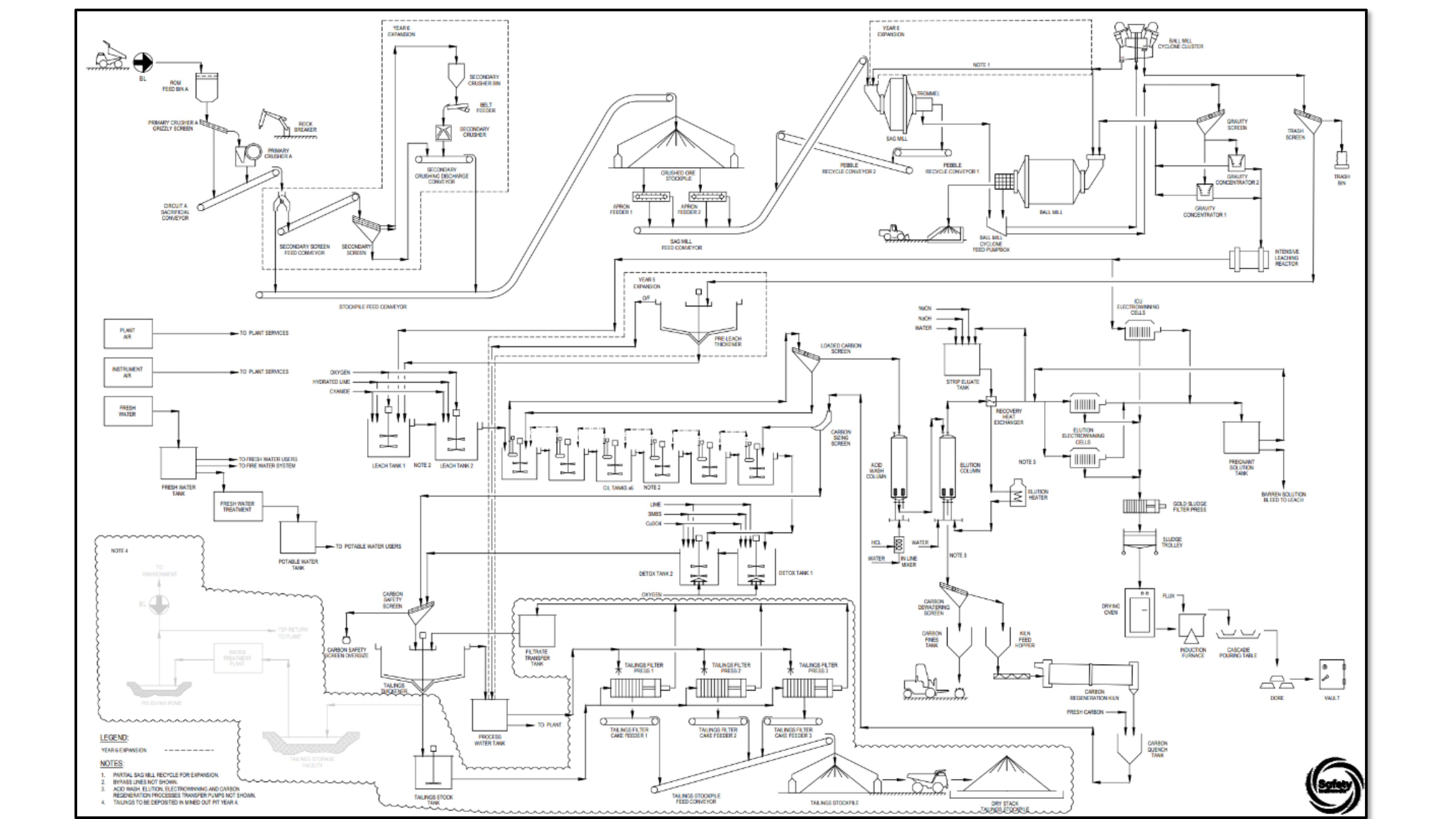

The process plant will employ gravity concentration, standard leaching with carbon-in-leach (CIL) technology for gold recovery. The process plant includes single stage crushing followed by semi-autogenous (SAG) and ball milling, classification, gravity concentration, leach and CIL, and cyanide detoxification before tailings filtration. The filtered tailings will be stored in the filtered tailing storage facility (FTSF) for the first three years. After the New Beliveau/North open pit is depleted in year 3, the tailings will bypass the filtration plant and will be then deposited as a slurry to backfill this open pit. The process plant will treat 5.66 Mt of mineralized material per year at an average throughput of 15,500 tpd until the expansion in year 6.

The process plant will be expanded in year 6 of production to increase the plant capacity to treat 7.00 Mt of material per year at an average throughput of 19,200 tpd. This will be done by adding secondary crushing, pre-leach thickening and increasing the primary grind size from 70 to 83 microns.

The mill design availability is 8,059 hours per year or 92%. The crushing design availability is 5,694 hours per year or 65%. The tailings filtration design availability is 7,183 hours per year or 84%. The process plant has been designed to realize an average recovery of 95.7% of the gold over the life of the Novador Project based on metallurgical test work completed at Base Metallurgical Laboratories Ltd. in Kamloops, British Columbia in 2022. Of this, 50% of the gold will be extracted by gravity and a further 45.7% by the leach/CIP process.

Figure 2: Novador Process Layout

Site Location and Infrastructure

The Novador Project is located approximately 25 kilometres east of the city of Val-d’Or in the province of Québec. The Project is in a rich mining area with easy access to power, labour, communities, highways, and a national railway adjacent to the proposed process plant. Figure 3 shows the site plan with pit locations, rock storage facilities, overburden stockpiles, water collection ponds, the process plant, buildings, and the filtered tailings storage facility (FTSF), among others.

The process plant site location selection considered various factors including social, environmental, topographic, accessibility, proximity to existing infrastructure, and overall flow of material to the FTSF. Centralized administration facilities, truck shop, wash bay, tire store, refueling station, warehousing and explosive magazine are optimized for efficient use of facilities.

Based on ongoing geochemical characterization and the geology of the various deposits, it can be considered that the waste rock, mineralized material and tailings should not be acid-generating nor leachable. These positive characteristics of the Novador Project (simplified operation, easier water management and reduced closure risks) were incorporated into its design.

Based on a technology, preliminary siting, ground condition and deposition study for the Novador Project, it was decided to filter the tailings and store them in a FTSF until the Beliveau/North open pit is depleted. Then, tailings will be deposited as slurry within the Beliveau/North open pit.

Filtered tailings are one of the most sustainable methods for storing tailings as there is no need for a dam to hold them in place or potential long-term storage issues. When dry stacking is applied, the filtered tailings (cake) will be handled using a combination of loaders, trucks and dozers to a stockpile immediately northwest of the filtering plant. The filtered tailings will be loaded into haul trucks for deposition on the FTSF, approximately 2.8 kilometres north of the process plant, by road.

When the deposition method changes to in-pit storage, the slurry will be pumped and transported by pipeline to the depleted New Beliveau/North open pit. This approach is also among the most sustainable methods for storing tailings and has the additional benefit of reducing energy consumption, lower operating cost and the backfilling of an open pit.

Runoff from the FTSF, as well as all storage facilities (rock, mineralized material and over burden stockpiles) will be collected in series of water management ponds and drainage ditches. A public road (, Chemin Perron and Chemin Pascalis) is diverted to the North and to the West and thus go around the site as indicated on the site layout.

Figure 3: Novador Project Site Layout

Operating Costs

Operating costs were derived using benchmark information in the Val-d’Or region and are estimated at $44.52 per tonne milled (Table 2).

Pricing for reagents and consumables was solicited from qualified suppliers and reflects the expected pricing for the project. Reagents and consumables are being delivered by rail.

Table 2: Total Life of Mine Operating Costs

| COST AREA |

LOM

(C$M) |

ANNUAL

AVG. COST

(C$M) |

AVG. LOM

(C$/T MINED) |

AVG.LOM

(C$/T

MILLED) |

AVG. LOM

(C$/OZ) |

OPEX

(%) |

| Mine Operating |

$2,653 |

$211 |

$4.78 |

$33.03 |

$827 |

74% |

|

| Mill Processing |

$787 |

$63 |

N/A |

$9.80 |

$245 |

22% |

|

| General &Administration |

$136 |

$11 |

N/A |

$1.69 |

$42 |

4% |

|

| Total |

$3,576 |

$284 |

N/A |

$44.52 |

$1,115 |

100% |

|

Capital Costs

The total initial capital costs for the Novador Project are estimated to be C$602M including allowances for indirect costs. Sustaining capital costs are estimated at C$818M, including plant expansion in Year 6

Quotations were solicited from suppliers for the grinding section of the process plant equipment supply cost, which constitutes 36% of the mechanical equipment cost of the project. The remaining mechanical equipment costs were benchmarked from recent Canadian mining studies.

Open pit mining equipment is assumed to be leased (15% down payment with a 10% lease rate over 5 years)

Table 3: Total Capital Costs

| DESCRIPTION |

INITIAL CAPITAL COST

(C$M) |

SUSTAINING

CAPITAL COST

(C$M) |

TOTAL INITIAL

AND SUSTAINING

CAPITAL COST

(C$M) |

| MINING |

$118.4 |

$709.5 |

$827.9 |

| ON SITE INFRASTRUCTURE |

$78.5 |

$27.3 |

$105.8 |

| PROCESS PLANT |

$259.7 |

$10.2 |

$269.9 |

| OFF SITE INFRASTRUCTURE |

$8.5 |

$2.9 |

$11.3 |

| TOTAL DIRECT COSTS |

$465.1 |

$749.9 |

$1,215.0 |

| PROJECT INDIRECTS |

$11.5 |

$3.3 |

$14.8 |

| PROJECT DELIVERY |

$32.4 |

$2.2 |

$34.6 |

| OWNER'S COSTS1 |

$23.2 |

|

- |

$23.2 |

| PROVISIONS |

$70.0 |

$62.1 |

$132.1 |

| TOTAL INDIRECT COSTS |

$137.1 |

$67.7 |

$204.8 |

| PROJECT TOTAL COSTS |

$602.2 |

$817.5 |

$1,419.7 |

1 Includes wetlands and bodies of water compensation.

The $709.5M in sustaining mining capital includes $262.6M for the open pit mining fleet, $160.8M for the underground (“UG”) mining fleet and $277.5M for the UG development and infrastructure, expected to be self-funded through operating cashflows. While the incremental UG production demands substantial capital injection, all UG mining enhances overall production profile and project value with the $1,750/oz gold price (base case for the updated PEA mine planning), while offering additional leverage to a potential increase in the gold price. Each UG operation will be evaluated in more detail in the next phase of the project to ensure that the sustaining and UG capital is providing incremental value and that it is timed to maximize IRR.

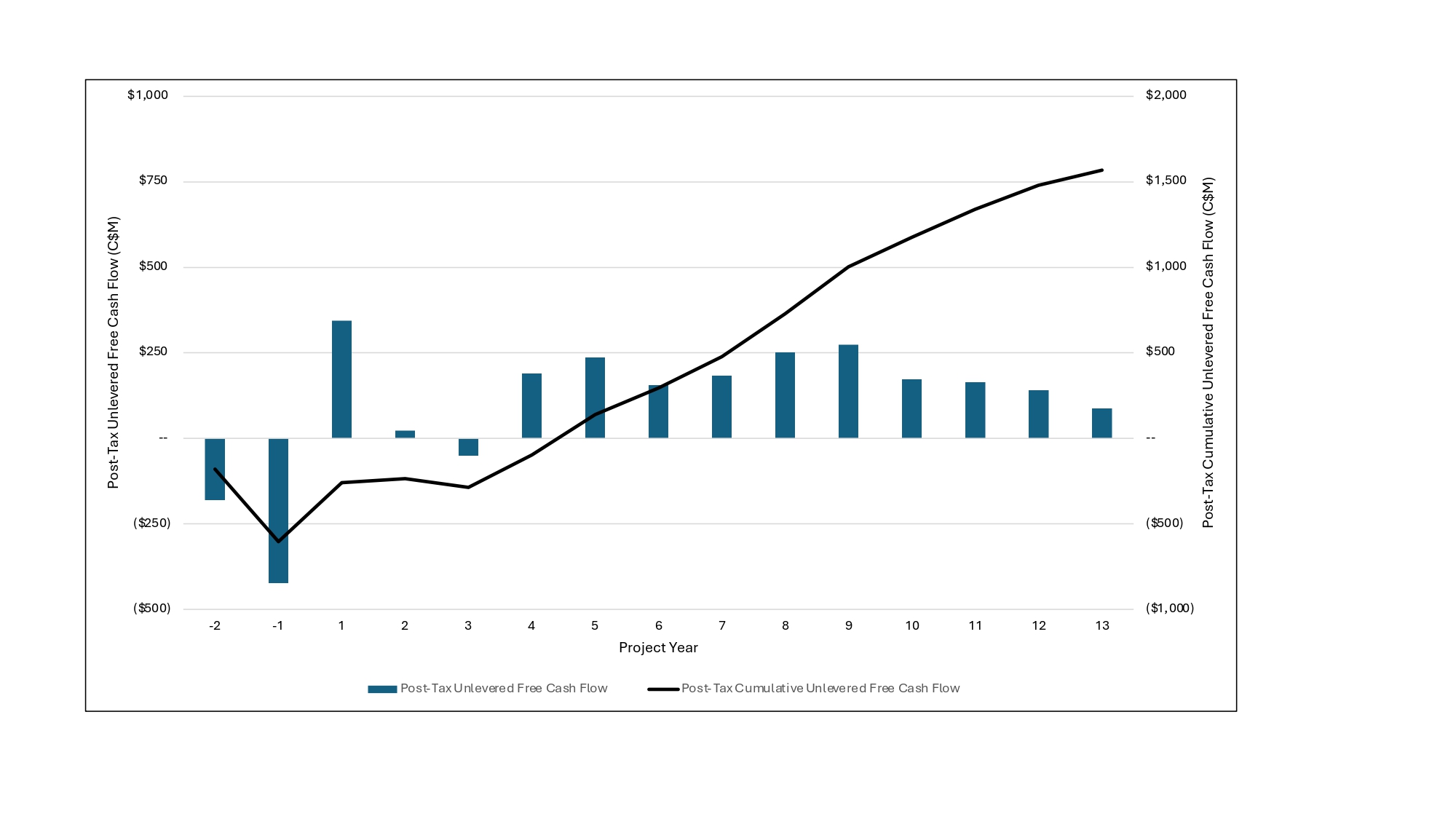

Cashflow Analysis

The projected cash flow and sensitivities are indicated below. The year 6 expansion and the UG development and infrastructure starting in year 2 will be self-funded.

Figure 4: Projected Annual and Cumulative LOM After-Tax Unlevered Free Cash Flow

Sensitivities

A sensitivity analysis was conducted on the base case pre-tax and after-Tax NPV and IRR of the Novador Project, using the following variables: metal price, initial capex, total operating costs, and foreign exchange. Table 4 summarises the after-tax sensitivity analysis results.

Table 4: After-Tax Sensitivity Summary

Gold Price

US$/oz |

$1,600 |

|

Base Case

$1,750

|

$1,900 |

|

$2,050 |

|

$2,200 |

|

| After-Tax NPV5% |

$626 |

|

$910 |

|

$1,188 |

|

$1,461 |

|

$1,730 |

|

| IRR |

|

18.5% |

|

|

24.4% |

|

|

30.1% |

|

|

35.4% |

|

|

40.5% |

|

| NPV5%/Capex |

1.0x |

1.5x |

2.0x |

2.4x |

2.9x |

| Payback (Years) |

|

5.5 |

|

|

4.4 |

|

|

3.8 |

|

|

3.3 |

|

|

2.7 |

|

As shown in Table 5 and Table 6, the sensitivity analysis revealed that the Novador Project is most sensitive to changes in gold prices, and foreign exchange and less sensitive to initial capex and operating costs.

Table 5: After-Tax NPV5% Sensitivity

Gold Price

US$/oz

|

After-Tax NPV5%

Base Case (C$M)

|

Initial Capital |

Total Operating Costs |

FX (CAD/USD) |

| (-20%) |

(+20%) |

(-20%) |

(+20%) |

(-20%) |

(+20%) |

| $1,600 |

$626 |

$742 |

$510 |

$937 |

$262 |

$1,371 |

$57 |

| $1,750 |

$910 |

$1,026 |

$794 |

$1,212 |

$583 |

$1,708 |

$327 |

| $1,900 |

$1,188 |

$1,304 |

$1,072 |

$1,482 |

$881 |

$2,041 |

$593 |

| $2,050 |

$1,461 |

$1,577 |

$1,345 |

$1,748 |

$1,162 |

$2,372 |

$832 |

| $2,200 |

$1,730 |

$1,846 |

$1,614 |

$2,014 |

$1,438 |

$2,698 |

$1,065 |

Table 6: After-Tax IRR Sensitivity

Gold Price

US$/oz

|

IRR

Base Case

|

Initial Capital |

Total Operating Costs |

FX (CAD/USD) |

| (-20%) |

(+20%) |

(-20%) |

(+20%) |

(-20%) |

(+20%) |

| $1,600 |

18.5% |

|

23.9% |

|

14.6% |

|

24.9% |

|

10.9% |

|

33.6% |

|

6.3% |

|

| $1,750 |

24.4% |

|

31.2% |

|

19.7% |

|

30.3% |

|

17.7% |

|

40.1% |

|

12.2% |

|

| $1,900 |

30.1% |

|

38.1% |

|

24.6% |

|

35.5% |

|

23.9% |

|

46.2% |

|

17.8% |

|

| $2,050 |

35.4% |

|

44.6% |

|

29.1% |

|

40.5% |

|

29.8% |

|

52.3% |

|

22.8% |

|

| $2,200 |

40.5% |

|

50.8% |

|

33.5% |

|

45.4% |

|

35.2% |

|

58.1% |

|

27.6% |

|

Opportunities for Project Enhancement

The Novador project still holds substantial exploration potential, which could extend the mine life beyond the 12.6 years outlined in the updated PEA. Probe did not consider any of the resources on the other Val-d’Or East properties. Those could potentially be considered for further exploration and growth.

There is the potential for the underground mine plan to be further optimized to reduce capital cost and improve project economics by deferring development costs later into the mine life.

Ore sorting was part of the 2021 PEA following promising commercial testwork results on the Pascalis trend mineralization. For this PEA, the process flowsheet was simplified by removing the ore sorting plant. There is the potential for re-integrating this technology in the project for some portion of the mill feed to reduce the amount of waste rock and to sell the ore sorting rejects as aggregate material in the construction industry.

The project is currently contemplated as a standalone operation with its own milling facilities. As part of its ongoing process, the Company is evaluating alternative mining and milling scenarios due to the excess milling capacity in the region.

Comparison of 2021 PEA and the Updated PEA

This updated PEA represents the conclusion of 3 years of work since the last PEA in 2021. The following table shows the information used to support the design bases and criteria for the Novador project.

Table 7: Comparing supporting data between 2021 PEA and the Updated PEA

| Information/type of data |

2021 PEA |

Updated PEA |

| Block model |

Resource based on 380,400m of drilling.

Basic geostatistics and technical parameters used for the Mineral Resource Estimate (MRE). |

Resource based on 581,000m of drilling.

Enhanced geostatistics and tighter technical parameters used for the MRE. |

| Geological model |

3D geological model from exploration and historical drill core supported by structural data. |

Enhanced and more constrained 3D geological model from exploration drill core and targeted mine scale drilling including improved structural analysis. |

| Ratio of M&I to Inferred Resources |

44% M&I; 56% Inferred |

77% M&I; 23% Inferred |

| Geotechnical Rock Mass Characterization |

Geotechnical assessment from advanced exploration data |

Assessment and compilation of initial mine scale geotechnical data from advanced exploration data and targeted mine scale drilling. |

| Open Pit Geomechanical Design Criteria |

Conceptual design criteria based on representative geotechnical characterization data, index testing for intact rock strength and limited structural orientation data from exploration drill core |

Updated design criteria from detailed geotechnical characterization data, laboratory strength testing for intact rock strength and structural orientation data from targeted mine scale drilling and exploration drill core. |

| Underground Geomechanical Design Criteria |

Assumed |

Design criteria established from detailed geotechnical characterization data, laboratory strength testing for intact rock strength and structural orientation data from targeted mine scale drilling and exploration drill core. |

| Geotechnical – Overburden Thickness |

Based on exploration database and limited historic site investigations at Monique |

Based on updated exploration database, and additional site investigations performed in 2022/2023 at Monique, Pascalis, and Courvan for site specific infrastructure (stockpiles and tailings storage facility). |

| Geotechnical – Ground Conditions |

Based on limited historic site investigations at Monique |

A geotechnical site investigation including a total of 65 test pits and 26 drillholes with 35 monitoring well installations and soil laboratory test work was completed during the period of September 2022 through February 2023 to characterize the general soil, bedrock, groundwater, and foundation conditions within the vicinity of select proposed locations for the open pits, stockpiles and tailings storage facility for the Pascalis, Courvan, and Monique sites. |

| Stockpiles Design Criteria |

Assumed and based on volumetrics and available footprint. |

Stockpile designs (including waste rock, overburden and mineralized) are based on slope stability analyses and slope recommendations that consider the proposed dump heights and foundation conditions (including the rate of construction) from recently completed site investigations. |

| Processing and Metallurgy |

Design criteria sourced from two preliminary testwork programs:

-Sensor based sorting on New Beliveau

-Metallurgical testing on drill core composites from the three trends (physical property characterization, mineralogy, gravity amenability, gravity recoverable gold, leach cyanidation and flotation testing) |

Design criteria from 2023 testwork program with a total of 57 composites from New Beliveau, Monique, Courvan, Creek and North zone. These were subjected to physical property characterization, mineralogy, gravity amenability, gravity recoverable gold, leach cyanidation and flotation testing. This program included oxygen uptake testing, cyanide detoxification and solids liquid separation testing. |

| Biological Environmental & Constraints |

Preliminary biological baseline studies in the Pascalis/Courvan area and historical baseline studies at Monique site. |

Detailed biological baseline studies in the three project sites (Courvan, Pascalis and Monique) for vegetation and wetlands, birds, water and fish. |

| Hydrogeology – Physical Environment & Groundwater Inflow |

Modeling based on limited testings and a historical study conducted at Monique site in 2011. |

Updated modeling to estimate the radius of influence of the activities on groundwater levels based on 2022-2023 site investigation including installation of 35 monitoring wells, hydraulic testing and groundwater sampling within the vicinity of select proposed locations for the project infrastructure. |

| Geochemical Characterization of Waste Rock, Ore and Tailings |

Assessment based on more than 250 samples for the Monique, Pascalis and Courvan sites. |

Additional 70 samples for the Monique site to confirm the homogeneity of the geochemical composition of waste rock and mineralized units. |

| Metal Leaching and Acid Rock Drainage Prediction |

Based on chemical assays and static tests. |

Launch of kinetic testing in 2023 using field columns. |

|

|

|

The Novador project has changed significantly since the first PEA in 2021. It has expanded and now boasts a larger production profile. Some of the scope changes include a 55% increase in initial plant capacity, a larger mining fleet with a reduced number of open pits, and a more substantial underground component that begins from the surface rather than the bottom of the open pits. The following table provides a comparison between the 2021 PEA and the current updated PEA (2024).

Table 8: Summary of Novador Project Economics (2021 PEA vs Updated PEA)

|

2021 PEA |

Updated PEA |

| General |

LOM Total / Avg. |

LOM Total / Avg. |

| Gold Price (US$/oz) |

$1,500 |

|

$1,750 |

|

| Exchange Rate (US$:C$) |

|

0.75 |

|

|

0.74 |

|

| Mine Life (years) |

|

12.5 |

|

|

12.6 |

|

| Total Overburden and Waste Tonnes Mined (kt) |

|

366,924 |

|

|

504,344 |

|

| Total Mill Feed Tonnes (kt) |

|

38,084 |

|

|

80,317 |

|

| Total Underground Mill Feed Tonnes (kt) |

|

7,115 |

|

|

12,418 |

|

| Total Open Pit Mill Feed Tonnes (kt) |

|

45,199 |

|

|

67,899 |

|

| Strip Ratio (tonnes of waste: tonnes of mineralized material) |

6.42 x |

7.43 x |

| Production |

|

|

|

| Mill Head Grade (g/t) |

|

1.88 |

|

|

1.30 |

|

| Mill Recovery Rate (%) |

|

94.70% |

|

|

95.70% |

|

| Total Mill Ounces Recovered (koz) |

|

2,584 |

|

|

3,210 |

|

| Total Average Annual Production (koz) |

|

207 |

|

|

255 |

|

| Operating Costs |

|

|

|

| Open Pit Mining Cost (C$/t Mined) |

$2.75 |

|

$2.88 |

|

| Underground Mining Cost (C$/t Mined) |

$83.72 |

|

$88.07 |

|

| Processing Cost (C$/t Milled) |

$13.26 |

|

$9.80 |

|

| G&A Cost (C$/t Milled) |

$2.72 |

|

$1.69 |

|

| Refining & Transport Cost (C$/oz) |

$2.50 |

|

$2.50 |

|

| Total Operating Costs (C$/t Milled) |

$58.81 |

|

$44.52 |

|

| Net Equivalent Royalty after Buyback |

|

0.80% |

|

|

0.80% |

|

| Cash Costs (US$/oz Au) |

$786 |

|

$841 |

|

| AISC (US$/oz Au) |

$965 |

|

$1,038 |

|

| Capital Costs |

|

|

|

| Initial Capital (C$M) |

$353 |

|

$602 |

|

| Sustaining Capital (C$M) |

$602 |

|

$818 |

|

| Closure Costs (C$M) |

$30 |

|

$64 |

|

| Salvage Costs (C$M) |

($13) |

|

($26) |

|

| Financials |

Pre-Tax |

After-Tax |

Pre-Tax |

After-Tax |

| NPV (5%) (C$M) |

$991 |

|

$598 |

|

$1,530 |

|

$910 |

|

| IRR (%) |

|

47.20% |

|

|

32.80% |

|

|

34.4% |

|

|

24.4% |

|

| Payback (years) |

|

1.8 |

|

|

2.7 |

|

|

3.5 |

|

|

4.4 |

|

Mineral Resource Estimate

The Novador Project includes the properties on the Pascalis Gold Trend, the Monique Gold Trend and the Courvan Gold Trend, which are 100% owned by Probe.

Table 9: Novador Project Mineral Resource Estimate

All Deposits / Category

|

Pit-Constrained Resources |

Underground Resources |

Total |

| Tonnes |

Grade

(Au1 g/t) |

Gold

(oz.) |

Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

| Measured |

3,356,300 |

2.34 |

252,100 |

126,400 |

1.87 |

7,600 |

3,482,800 |

2.32 |

259,700 |

| Indicated |

56,297,200 |

1.49 |

2,690,600 |

7,811,000 |

2.38 |

596,700 |

64,108,200 |

1.59 |

3,287,300 |

| M&I |

59,653,600 |

1.53 |

2,942,700 |

7,937,400 |

2.37 |

604,300 |

67,591,000 |

1.63 |

3,547,000 |

| Inferred |

9,915,600 |

1.48 |

472,800 |

6,802,400 |

2.82 |

616,500 |

16,717,900 |

2.03 |

1,089,300 |

1 Au is the symbol for Gold

Notes:

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The mineral resource estimate follows current CIM Definitions (2014) and CIM MRMR Best Practice Guidelines (2019).

- The independent and qualified persons (“QPs”) for the mineral resource estimate, as defined by NI 43-101, are Marina Iund, P.Geo. (Monique, Courvan SW, Courvan SE, Bussiere Mine, Bussiere and Creek deposits), Vincent Nadeau-Benoit, P.Geo. (New Beliveau and North deposits), Martin Perron, P.Eng. (all deposits) and Simon Boudreau, P.Eng. (all deposits) of InnovExplo Inc. The effective date is July 13, 2023.

- The presented MRE is taken from the 2023 mineral resource estimate (NI43-101 Technical Report and Updated Resource Estimate for the Novador Project, Quebec, September 1st, 2023)

- The results are presented undiluted and are considered to have reasonable prospects of economic viability.

- The mineral resource estimate is locally pit constrained. The out-pit mineral resource met the standard of reasonable prospects for eventual economic extraction by applying constraining volumes to all blocks (potential underground long-hole extraction scenario) using DSO.

- Monique, Courvan SW, Courvan SE, Bussiere Mine, Bussiere, Creek, New Beliveau and North deposits: The pit-constrained mineral resource estimate is reported at a 0.42 g/t Au cut-off grade for the Monique deposit and a 0.40 g/t Au cut-off grade for the other deposits, a value above the base case cut-off grade. A base case cut-off grade of 0.26 g/t Au was calculated using the following parameters: mining cost = CA$2.97/t; mining overburden cost = CA$2.70; processing cost = CA$17.82; selling costs = CA$ 5.00; royalty = CA$ 8.59/oz to CA$ 45.22/oz; gold price = US$ 1,700/oz; USD:CAD exchange rate = 1.33; bedrock slope angle of 43° to 54°; and mill recovery = 95%. The use of a higher cut-off could allow in-pit mineralized waste (0.20 – 0.40 g/t Au; 0.20 – 0.42 g/t Au) to be selected for potential upgrade through an industrial sorter process. The underground mineral resource estimate is reported at a cut-off grade of 1.43 to 1.71 g/t Au. The underground mineral resources estimate was based on two mining methods depending on the orientation of the mineralization. The cut-off grade was calculated using the following parameters: mining cost = CA$ 81.00 (Long-hole) to CA$ 97.50 (Cut&fill); processing cost = CA$ 17.82; selling costs = CA$ 5.00; royalty = CA$ 8.59/oz to CA$ 45.22/oz; gold price = US$ 1,700/oz; USD:CAD exchange rate = 1.33; and mill recovery = 95%.

- Bordure, Highway and Senore deposits: The pit-constrained mineral resource estimate is reported at a 0.40 g/t Au cut-off grade. The cut-off was calculated using the following parameters: gold price = US$ 1,600/oz; USD:CAD exchange rate = 1.33; mining cost = CA$3.00/t or CA$3.50/t; processing + G&A costs = CA$21.50/t; transport cost = $0.15/t.km; ; bedrock slope angle of 48° to 59°; and mill recovery = 95%. The underground mineral resource estimate is reported at a cut-off grade of 1.65 to 2.05 g/t Au. The underground mineral resources estimate was based on two mining methods depending on the orientation of the mineralization, long-hole retreat at a mining cost of CA$82/t and mechanized cut and fill at a mining cost of CA$110/t and using the same ground unit cost as for the pit-constrained scenario.

- The cut-off grades should be re-evaluated considering future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101. Any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348).

- The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues or any other relevant issue not reported in the Technical Report that could materially affect the Mineral Resource Estimate.

As part of its land consolidation strategy in the Val-d’Or East camp, Probe earned a 60% interest in the Cadillac Break East Property in joint venture with O3 Mining Inc., which includes the Sleepy deposit. The Company also owns a 100%-interest in the Val-d’Or East Lapaska and Croinor properties.

Table 10: Val-d’Or East Other Properties

Deposit / Category

|

Pit-Constrained Resources |

Underground Resources |

Total |

| Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

Lapaska1

Total Inferred |

512,000 |

1.47 |

24,200 |

460,000 |

3.19 |

47,200 |

972,000 |

2.28 |

71,300 |

Sleepy2

Total Inferred |

-- |

-- |

-- |

1,113,000 |

4.70 |

167,900 |

1,113,000 |

4.70 |

167,900 |

1 NI 43-101 Technical Report Val-d’Or East Project – July 14th, 2021, Lapaska property 100% interest

2 NI 43-101 Technical Report Val-d’Or East Project – July 14th, 2021, Option to earn 60%, 60% presented

3 The Croinor deposit is excluded from Table 10 for the sake of consistency.

Furthermore, by applying industrial sorting to mineralized waste, additional mineral material may be extracted from the mineralized waste and thus become additional mineral resource on the Project.

Table 11: Novador Project – Additional Pit Constrained Resource from Industrial Sorting

All Deposits / Category

|

Pit-Constrained Mineral Resources |

Underground Mineral Resources |

Total |

| Tonnes |

Grade

(Au1 g/t) |

Gold

(oz.) |

Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

Tonnes |

Grade

(Au g/t) |

Gold

(oz.) |

| Measured |

642,100 |

0.29 |

6,000 |

-- |

-- |

-- |

642,100 |

0.29 |

6,000 |

| Indicated |

24,355,000 |

0.31 |

240,800 |

-- |

-- |

-- |

24,355,000 |

0.31 |

240,800 |

| M&I |

24,997,100 |

0.31 |

246,900 |

-- |

-- |

-- |

24,997,100 |

0.31 |

246,900 |

| Inferred |

10,021,200 |

0.28 |

90,100 |

-- |

-- |

-- |

10,021,200 |

0.28 |

90,100 |

1 This additional pit-constrained Mineral Resource represents mineralized waste between cut-off grades of 0.20 g/t Au and 0.42 g/t Au for the Monique deposit and between cut-off grades of 0.20 g/t Au and 0.40 g/t Au for the other deposits, exclusive of pit-constrained Mineral Resource from Table 9. This lower cut-off was based on the following parameters: industrial sorting cost CA$1.73/t, gold recovery in the industrial sorting process at 82% with an overall gold recovery with gravity and leaching at 68%, mass recovery in the industrial sorting process at 42%. Potentially, the industrial sorting results on this material allow obtaining a product above 0.42 g/t Au. For more details on industrial sorting technique and parameters, see the "Val-d’Or East Project, NI 43-101 Technical Report & Preliminary Economic Analysis” (the "Val-d’Or East PEA"), dated October 20, 2021, and available on SEDAR (www.sedar.com) under Company's issuer profile.

Qualified Person:

Technical information in this release was supervised and approved by Yves Dessureault, Probe's Chief Operating Officer and a Qualified Person under NI 43-101.

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures in this news release, such as initial capital cost, sustaining capital cost, total capital cost, AISC, and capital intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Total Cash Costs and Total Cash Costs per Ounce

Total cash costs are reflective of the cost of production. Total cash costs reported in the PEA include mining costs, processing and water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total cash costs per ounce is calculated as total cash costs divided by payable gold ounces.

AISC and AISC per Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital, closure costs and salvage, but excludes corporate general and administrative costs. AISC per ounce is calculated as AISC divided by payable gold ounces.

About Ausenco:

Ausenco is a global company based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining deep technical expertise with a 30-year track record, Ausenco delivers innovative, value-add consulting studies, project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas and industrial sectors.

About Probe Gold:

Probe Gold Inc. is a leading Canadian gold exploration company focused on the acquisition, exploration, and development of highly prospective gold properties. The Company is well-funded and dedicated to exploring and developing high-quality gold projects. Notably, it owns 100% of its flagship asset, the multimillion-ounce Novador Gold Project in Québec, as well as an early-stage Detour Gold Quebec project. Probe controls a large land package of approximately 1,600-square-kilometres of exploration ground within some of the most prolific gold belts in Québec.

On behalf of Probe Gold Inc.,

Dr. David Palmer,

President & Chief Executive Officer

For further information:

Please visit our website at www.probegold.com or contact:

Seema Sindwani

Vice-President of Investor Relations

info@probegold.com

+1.416.777.9467

Forward Looking Statements

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release. This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/61b67a6e-9069-491c-aa80-1d8ce4e9fb27

https://www.globenewswire.com/NewsRoom/AttachmentNg/bf9941c4-4c52-4d8f-b581-3a849d48fce8

https://www.globenewswire.com/NewsRoom/AttachmentNg/927af198-a9c0-45ef-be61-300c7dad94c0

https://www.globenewswire.com/NewsRoom/AttachmentNg/c9aede2e-a1f6-43f7-b34c-5168f974eaf0