NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES OF AMERICA

TORONTO, ON / ACCESSWIRE / March 1, 2024 / E2Gold Inc. (the "Company") (TSXV:ETU)(OTCQB:ETUGF) is pleased to announce its plans to raise up to $1,000,000 in an equity private placement to fund its next stage drilling plans on its district-scale Hawkins gold project in north Central Ontario. Shareholders can learn more about these plans at the upcoming Prospectors and Developers Conference in Toronto, March 3 to March 5, at Booth 2130.

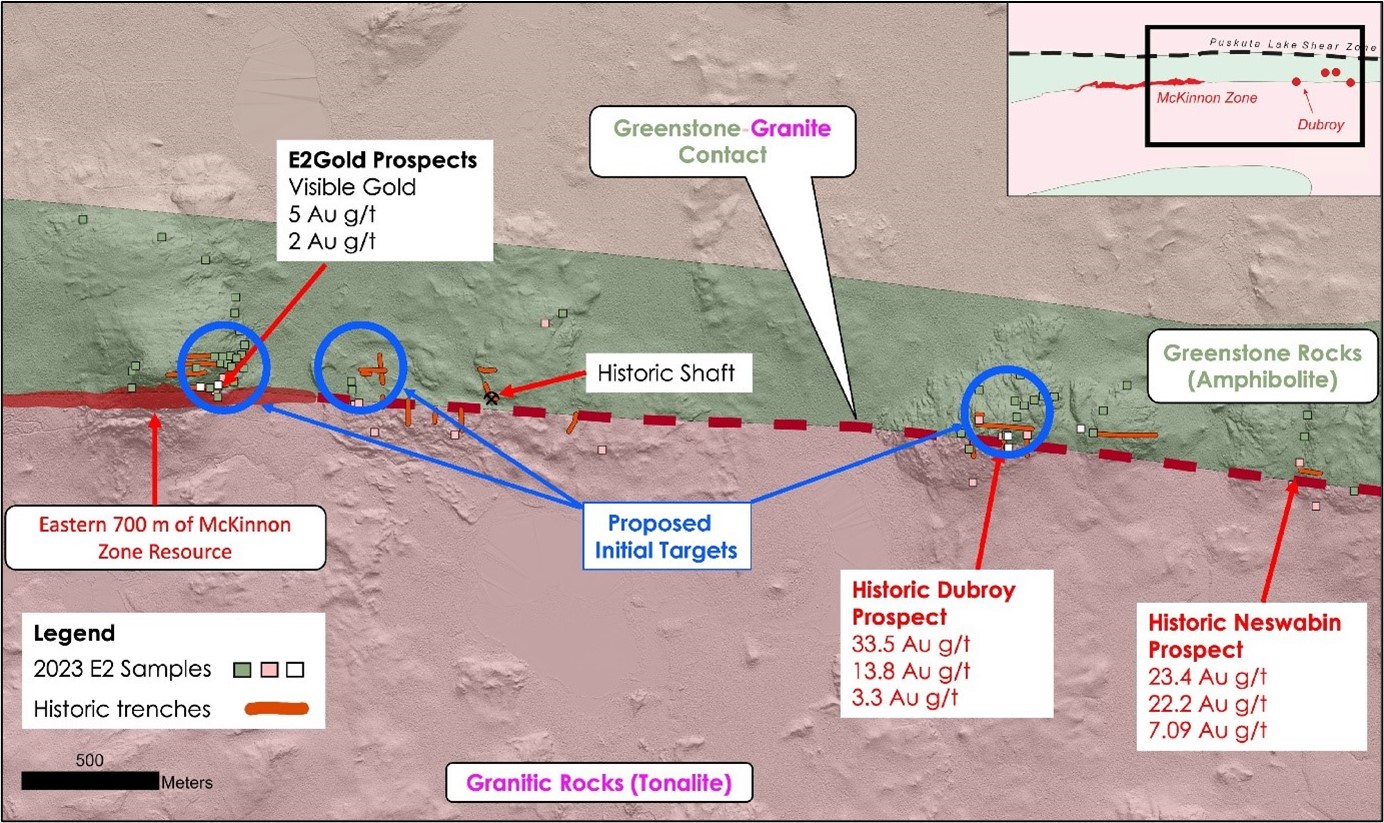

Eric Owens, CEO, states, "Our 2023 field crews were able to confirm high grade gold and base metals in surface occurrences up to 200 m north and 3.5 km east along trend with the existing McKinnon Zone Inferred Resource." Dr. Owens added, "A shallow-level program is planned to test this never-before-drilled area."

Figure 1. Map of McKinnon Zone Eastern Extension with proposed initial drill targets

The private placement will consist of a combination of units ("HD Units"), priced at C$0.025, and Flow Through Units ("FT Units"), priced at C$0.030, in any combination to raise a maximum aggregate gross proceeds of up to $1,000,000.

Each HD Unit will consist one common share of the Company plus one common share purchase warrant to acquire one additional common share at a price of C$0.05 for a period of 24 months from the date of issuance. Each FT Unit will be comprised of one "flow-through" common share of the Company (a "FT Share") and one common share purchase warrant (a "Warrant"), with each whole Warrant exercisable to acquire one additional common share at a price of $0.06 for a period of 24 months from the date of issuance thereof. Up to 50% of the offering may be purchased by insiders. The offering remains subject to the approval of the TSX Venture Exchange.

In other matters, the Company notes that it has entered into a general security agreement dated February 26th, 2024 (the "GSA") in connection with an existing promissory note of the Company dated March 15, 2023 (the "Promissory Note"), held by certain insiders (non-arm's length parties). The Promissory Note is in the principal amount of US$153,000, is due on demand, and bears interest at a rate of 12.5% per annum until repayment. Pursuant to the GSA, security has been granted against the Promissory Note in respect of all or substantially all of the assets of the Company. The GSA remains subject to the final approval of the TSX Venture Exchange.

The Company has also negotiated an extension of property option payments to the underlying claim holder of the Hawkins optioned claims. Under the terms of the agreement, the Company has been granted an extension of the annual cash payment, which is normally due on January 28, 2024, to April 28, 2024, in exchange for non-cash remuneration relating to the transfer of assessment credits and other housekeeping matters.

Further to the Company's press release dated December 20, 2023, the private placement (the "Offering") that closed on December 20, 2023, is exempt from minority shareholder approval and valuation requirements pursuant to subsections 5.5(b) and 5.7(1)(a) of Multilateral Instrument 61-101.

The Company paid a finder's fee of $16,800 to eligible registrants assisting in the Offering and issued an aggregate of 560,000 broker warrants ("Broker Warrants") to such registrants, with each Broker Warrant entitling the holder to acquire one Share at $0.05 for a period of two years following the date of issuance.

ABOUT E2GOLD INC.

E2Gold Inc. is a Canadian gold exploration company with a large flagship property, the 80 km long Hawkins Gold Project in north-central Ontario, about 140 km east of the Hemlo Gold Mine, and 75 km north of the Magino and Island Gold Mines. The property is anchored by the McKinnon Zone Inferred Resource of 6.2 Mt grading 1.65 Au g/t, for 328,800 ounces of gold.1 E2Gold is committed to increasing shareholder value through discoveries at Hawkins.

Note 1: NI 43-101 Technical Report and Updated Mineral Resource Estimate on Hawkins Gold Project, Ontario, by P&E Mining Consultants, effective date September 10, 2020.

For further information please contact:

Jeff Pritchard

Investor Relations

info@e2gold.ca

+1 647 699 3340

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements - Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, certain of which are beyond the control of E2Gold, including with respect to the receipt of all regulatory approvals. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.

SOURCE: E2Gold Inc.

View the original

press release on accesswire.com