Highlights include:

- Hole D-375 intersecting 60.4 m @ 1.50 g/t Au, including 6.0 m @ 7.06 g/t

- Hole D-381 intersecting 44.9 m @ 2.28 g/t Au, including 18.3 m @ 4.38 g/t Au

- Hole D-389 intersecting 21.6 m @4.00 g/t Au, including 4.0m @ 17.67 g/t Au

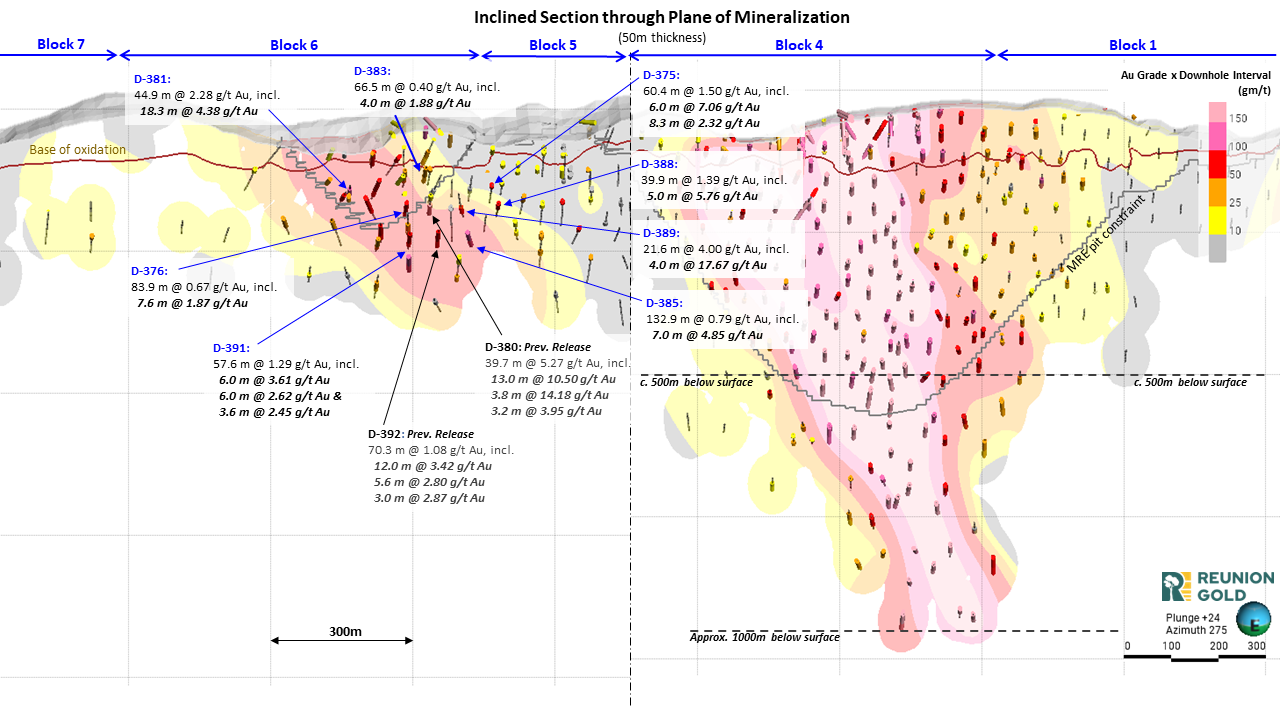

LONGUEUIL, Québec, April 15, 2024 (GLOBE NEWSWIRE) -- Reunion Gold Corporation (TSXV: RGD; OTCQX: RGDFF) (the “Company”) is pleased to announce additional drill results from its infill drill program on Block 6 at its 100%-owned Oko West Project in Guyana. These results, reported in Table 1 and illustrated in Figure 1, continue to expand the core of high-grade mineralization that has been identified at Block 6 and are consistent with the results of the previously released hole D-380, which intersected 39.7 meters (“m”) at 5.27 grams per tonne of gold (“g/t Au”) including 3.8 m @ 14.18 g/t Au and 13.0 m @ 10.50 g/t Au. Rick Howes, CEO of Reunion Gold, stated, “We are pleased to see the identification of further high-grade mineralized shoots at Oko West, resulting from the exploration team’s growing understanding of structural controls and the factors that are localizing mineralization along the Kartuni shear zone. These latest results continue to indicate the potential for additional high-grade gold mineralization to be defined even within areas of existing wider drill spacing as our current infill program continues.”

Highlights of drill results reported today include Hole D-375, which intersecting 60.4 m grading 1.50 g/t Au (using a 0.3 g/t cutoff), including 6.0 m grading 7.06 g/t (using a 1.5 g/t cutoff) starting at 31.5 m downhole, Hole D-381 intersecting 44.9 m grading 2.28 g/t Au (using a 0.3 g/t cutoff) starting at 85.2 m downhole, including 18.3 m grading 4.38 g/t Au (using a 1.5 g/t cutoff), as well as Hole D-389, intersecting 21.6 m grading 4.00 g/t Au (using a 0.3 g.t Au cutoff) starting at 150.0 m downhole, including 4.0 m grading 17.67 g/t Au (using a 1.5 g/t cutoff).

The Company continues to conduct its drill program designed to both expand and infill the Oko West resource, as well as to advance its exploration programs to identify additional areas of mineralization outside of the resource area at Oko West. In parallel with this, the Company continues to move its development studies forward, with the near-term goal of releasing a Preliminary Economic Assessment by the end of Q2 2024.

Table 1 - Significant intersects

Hole ID

|

Block

|

From |

To |

Downhole

Interval |

Au Grade |

Grade x

Downhole

Interval |

Cutoff ** |

| (m) |

(m) |

(m) |

(g/t) |

(gm/t) |

(Au g/t) |

| OKWD24-375 |

6 |

31.5 |

91.9 |

60.4 |

1.50 |

91 |

0.3 |

| inc. |

|

58.3 |

64.3 |

6.0 |

7.06 |

42 |

1.5 |

| inc. |

|

68.3 |

76.6 |

8.3 |

2.32 |

19 |

1.5 |

| OKWD24-376 |

6 |

124.2 |

208.1 |

83.9 |

0.67 |

56 |

0.3 |

| inc. |

|

181.7 |

189.3 |

7.6 |

1.87 |

14 |

1.5 |

| OKWD24-381 |

6 |

85.2 |

130.0 |

44.9 |

2.28 |

102 |

0.3 |

| inc. |

|

106.9 |

125.1 |

18.3 |

4.38 |

80 |

1.5 |

| OKWD24-383 |

6 |

16.1 |

27.0 |

10.9 |

0.96 |

11 |

0.3 |

| OKWD24-383 |

|

67.0 |

133.5 |

66.5 |

0.40 |

26 |

0.3 |

| inc. |

|

67.0 |

71.0 |

4.0 |

1.88 |

8 |

1.5 |

| OKWD24-385 |

6 |

137.0 |

149.0 |

12.0 |

0.80 |

10 |

0.3 |

| OKWD24-385 |

|

174.0 |

306.9 |

132.9 |

0.79 |

104 |

0.3 |

| inc. |

|

224.0 |

231.0 |

7.0 |

4.85 |

34 |

1.5 |

| OKWD24-388 |

6 |

124.2 |

164.1 |

39.9 |

1.39 |

55 |

0.3 |

| inc. |

|

132.4 |

137.4 |

5.0 |

5.76 |

29 |

1.5 |

| OKWD24-389 |

6 |

61.0 |

73.8 |

12.8 |

0.38 |

5 |

0.3 |

| OKWD24-389 |

|

150.0 |

171.6 |

21.6 |

4.00 |

86 |

0.3 |

| inc. |

|

156.5 |

160.5 |

4.0 |

17.67 |

71 |

1.5 |

| OKWD24-391 |

6 |

107.0 |

121.2 |

14.2 |

0.46 |

6 |

0.3 |

| OKWD24-391 |

|

199.4 |

257.0 |

57.6 |

1.29 |

74 |

0.3 |

| inc. |

|

207.7 |

211.3 |

3.6 |

2.45 |

9 |

1.5 |

| inc. |

|

227.0 |

233.0 |

6.0 |

2.62 |

16 |

1.5 |

| inc. |

|

248.9 |

254.8 |

6.0 |

3.61 |

21 |

1.5 |

Qualified Persons

Justin van der Toorn, CGeol FGS, EurGeol, the Company’s Vice President Exploration and a “qualified person” under NI 43-101, has also reviewed and approved the scientific and technical information contained in this news release.

About Reunion Gold Corporation

Reunion Gold Corporation is a leading gold explorer in the Guiana Shield, South America. In 2020, the Company announced an exciting new greenfield gold discovery at its Oko West project in Guyana and announced its maiden mineral resource estimate in June 2023 after just 22 months of resource definition drilling. In February 2024, the Company announced an updated Mineral Resource Estimate (the “2024 MRE”) containing a total of 4.3 Moz of gold in Indicated Resources grading 2.05 g/t and 1.6 Moz of gold in Inferred Resources grading 2.59 g/t. This 2024 MRE includes an underground Resource containing 1.1 Moz of gold at a grade of 3.12 g/t Au in the Inferred category. See the Company’s NI 43-101 Technical Report Oko West Gold Project, Cuyuni-Mazaruni Mining Districts, Guyana dated April 11, 2024, with an effective date of February 26, 2024 for additional information about the Oko West Project and the 2024 MRE. The Company is moving forward on development studies and expects to deliver a Preliminary Economic Assessment by the end of Q2 2024. The Company continues to explore several additional priority targets at Oko West that lie outside of the area of the MRE, as well as leverage its considerable experience in uncovering new discoveries in the Guiana Shield to acquire and explore additional new projects in the region.

The Company's common shares are listed on the TSX Venture Exchange under the symbol 'RGD' and trade on the OTCQX under the symbol 'RGDFF'. Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company's website (www.reuniongold.com).

For further information, please contact:

REUNION GOLD CORPORATION

Rick Howes, President and CEO, or Doug Flegg, Business Development Advisor

E: doug_flegg@reuniongold.com

E: info@reuniongold.com

Telephone: +1 450.677.2585

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information within the meaning of Canadian securities laws (collectively, "forward-looking statements"). Statements and information that are not historical facts are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible" and similar expressions, or statements that events, conditions, or results "will", "may", "could" or "should" occur or be achieved. Forward-looking statements in this press release include statements regarding the potential to define additional high-grade gold mineralization plans to complete a preliminary economic assessment by Q2 2024 and expectations regarding the results of such assessment and study and forward looking assumptions used relating to the mineral resources estimates, as well as statements regarding beliefs, plans, expectations or intentions of the Company.

Forward-looking statements and the assumptions made in respect thereof involve known and unknown risks, uncertainties and other factors beyond the Company's control including risks and uncertainties related to timing, cost and results of exploration programs, updated resource estimates, economic assessment and development studies; uncertainties inherent with conducting business in foreign jurisdictions including corruption, civil unrest, political instability; geopolitical risks including risks related to recent actions taken by the government of Venezuela over the border dispute; unanticipated title disputes; gold price volatility; currency fluctuations; risks associated with the recurrence of COVID-19 or future pandemics; delays in obtaining governmental approvals or financing; risks regarding potential litigation proceedings; regulatory risks and liabilities including, regulatory environment and restrictions; metallurgical testing and recoveries and other risks of the mining industry; speculative nature of gold exploration; dilution; share price volatility; competition; and loss of key employees. Additional information on these risks and other factors is included in documents and reports filed by the Company with Canadian securities regulators and available at SEDAR+ (www.sedarplus.ca) including, but not limited to, the cautionary statements made in the relevant sections of the Company’s Annual Information Form and Management Discussion & Analysis.

Forward-looking statements in this press release are made as of the date herein. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this press release are reasonable, undue reliance should not be placed on such statements. New factors emerge from time to time, and it is not possible for management of the Company to predict all such factors and to assess in advance the impact of each such factor on the business of the Company or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information or future events or otherwise, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

Figure 1 - Inclined long section through the planes of mineralization for Blocks 1 & 4 and Blocks 5 & 6 showing drill hole locations and results reported in this press release. Significant intersects are calculated using a 0.3 g/t Au cutoff, 10 m minimum down hole length and 10 m maximum consecutive internal dilution. Included intersects are calculated using a 1.5 g/t Au cutoff, 3 m minimum down hole length and 2 m maximum consecutive internal dilution.

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/42c222f5-8778-4639-a75a-c32f16896c59