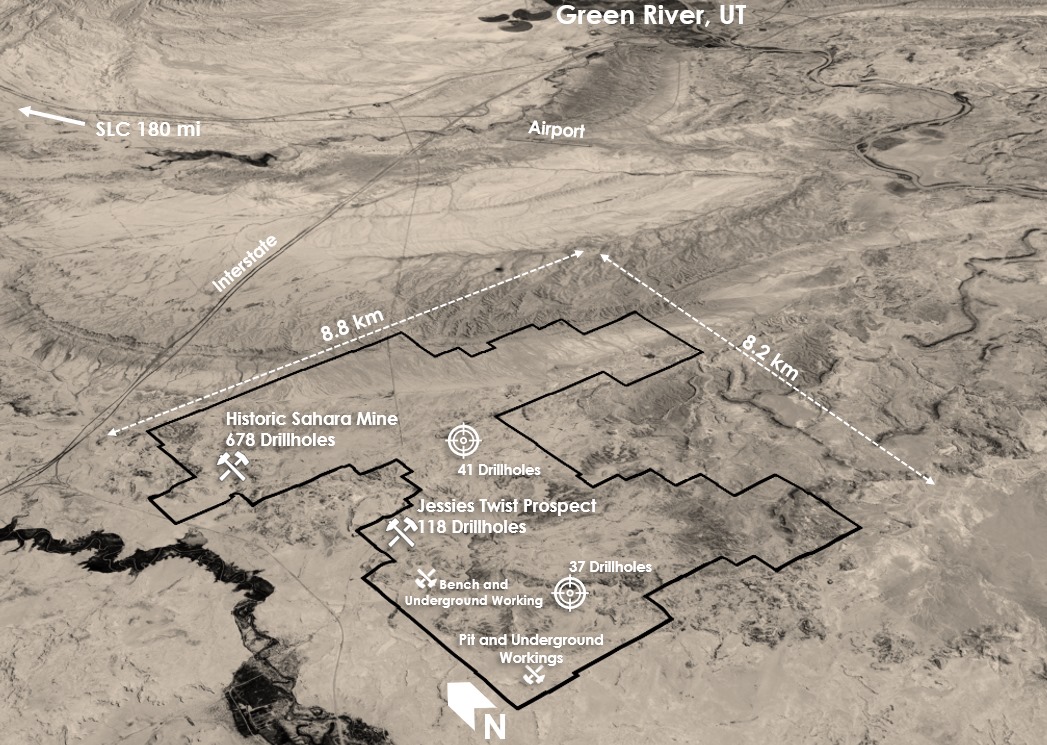

CALGARY, AB / ACCESSWIRE / April 25, 2024 / Ashley Gold Corp. (CSE:ASHL) ("Ashley" or the "Company") has compiled historical drilling information at the Sahara Uranium-Vanadium historical reserve as part of it's due diligence process. Results are exceeding expectations with over one-third of the historical drilling intersecting mineralization. The advanced and accessible Sahara property is located in east-central Utah, 180 miles southeast of Salt Lake City just off of interstate I-70.

Darcy Christian, CEO of Ashley comments "It is amazing to see the amount of capital and effort that has gone into the delineation of the Sahara Historical reserve. The amount of drilling completed on property would cost at least $15-20 million if done today. Historical drilling has identified a large body of sandstone hosted Uranium-Vanadium with the 1979 decline terminating against some of the higher uranium grades and thickness' in the system found to date. This will allow for a quick payout on capital costs to reopen the mine with ore processing at the future Western Uranium facility down the road."

For a video discussion on the Sahara Acquisition with Darcy Christian click here:

Highlights

eU3O8 grades up to 3.92%*

Thickness of up to 16 feet*

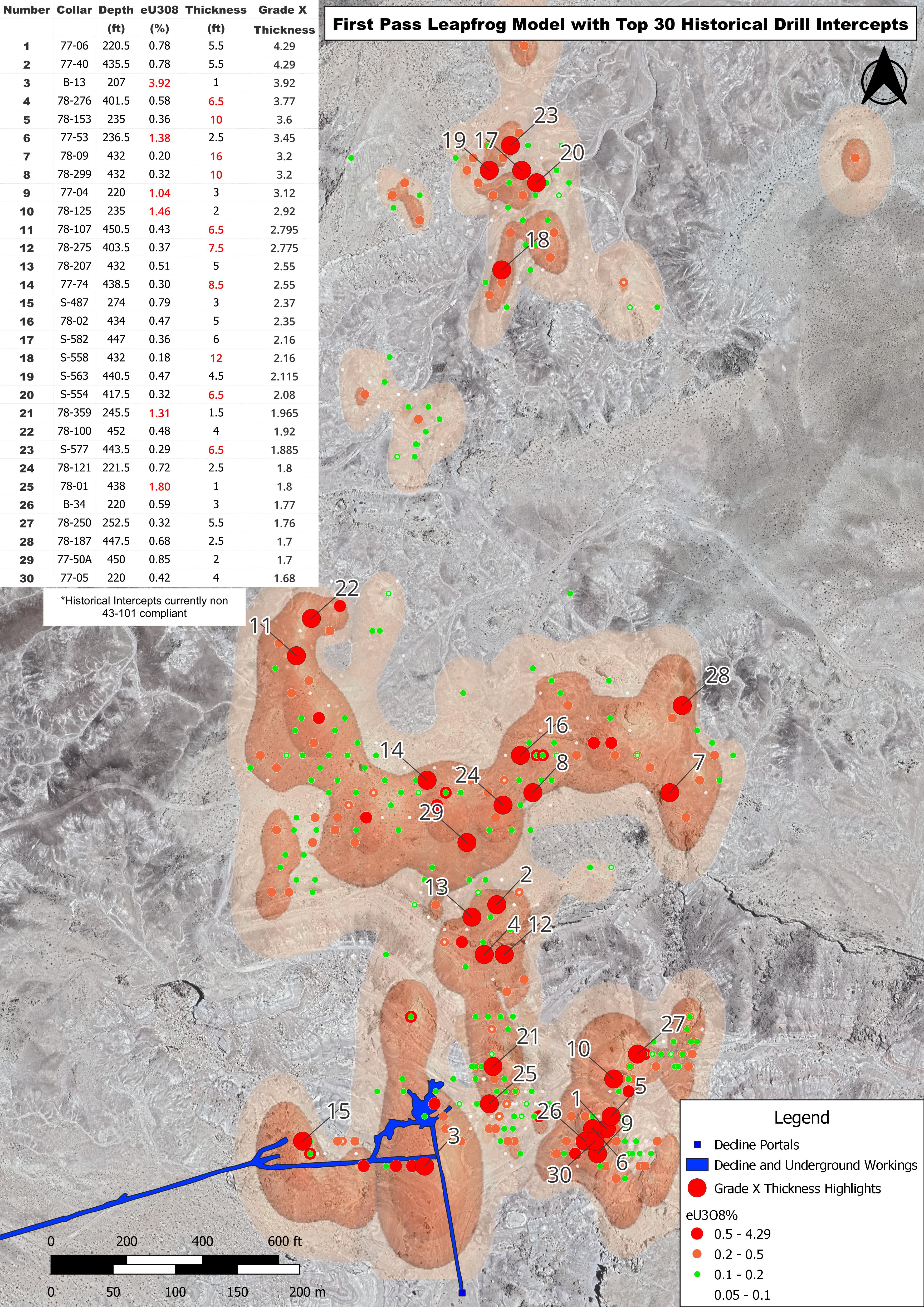

Top Holes Highlighted By (See Figure 1):

5.5 ft @ 0.78% eU3O8*

1.0 ft @ 3.92% eU3O8*

6.5 ft @ 0.58% eU3O8*

Includes:

9 holes over 1% eU3O8*

38 holes over 0.5% eU3O8*

162 holes over 0.2% eU3O8*

392 holes over 0.1% eU3O8*

Drill density down to 10m, ~100,000m of historical drilling

Historical ore reserve of ~500,000 lbs of eU3O8* with modern models reporting non-compliant resource of over 2,240,000 lbs of eU3O8* and almost 4,000,000 lbs of V2O5*

Infill and step-out drilling locations defined for upcoming drill program

*Historical drill data currently non-43-101 compliant

Declines and Workings

Figure 1 shows the declines to the ore bodies and underground workings in blue. The original decline running roughly south to north was used to produce ore out of the mine until 1977. Energy Fuels drove an 800m (2,600ft) low angle decline into the deposit in 1979 for higher haulage rates (west-east). The older decline was used for a secondary exit and air circulation. The production operation was put on standby due to the Three Mile Island incident in 1979. Focus was put on expansion of the Sahara reserve in anticpation of Uranium price rebound however this did not occur with prices falling below 20 US dollars a pound for two decades. It is Ashley's intent to reopen the modern decline in the near future to evaluate the decline and workings.

Historical Drilling

Energy Fuels conducted multiple drill programs over the greater Sahara property 1990 with a total of 776 holes comprising of 325,988 ft (~99,000m). In today's dollars this represents and expenditure of $15-20 million in exploration drilling. Drill density was as tight as 10m over the reserve area with almost 400 holes exceeding 0.1% eU3O8*. Highlights of the top 30 holes ordered by Grade X Thickness (ft) are outlined in Figure 1. Grade as high as 3.92% eU3O8* were documented as well as several intercepts over 10ft (3m). Additional programs in 2006 and 2009 were also documented and will be outlined in a future release.

*Historical drill data currently non-43-101 compliant

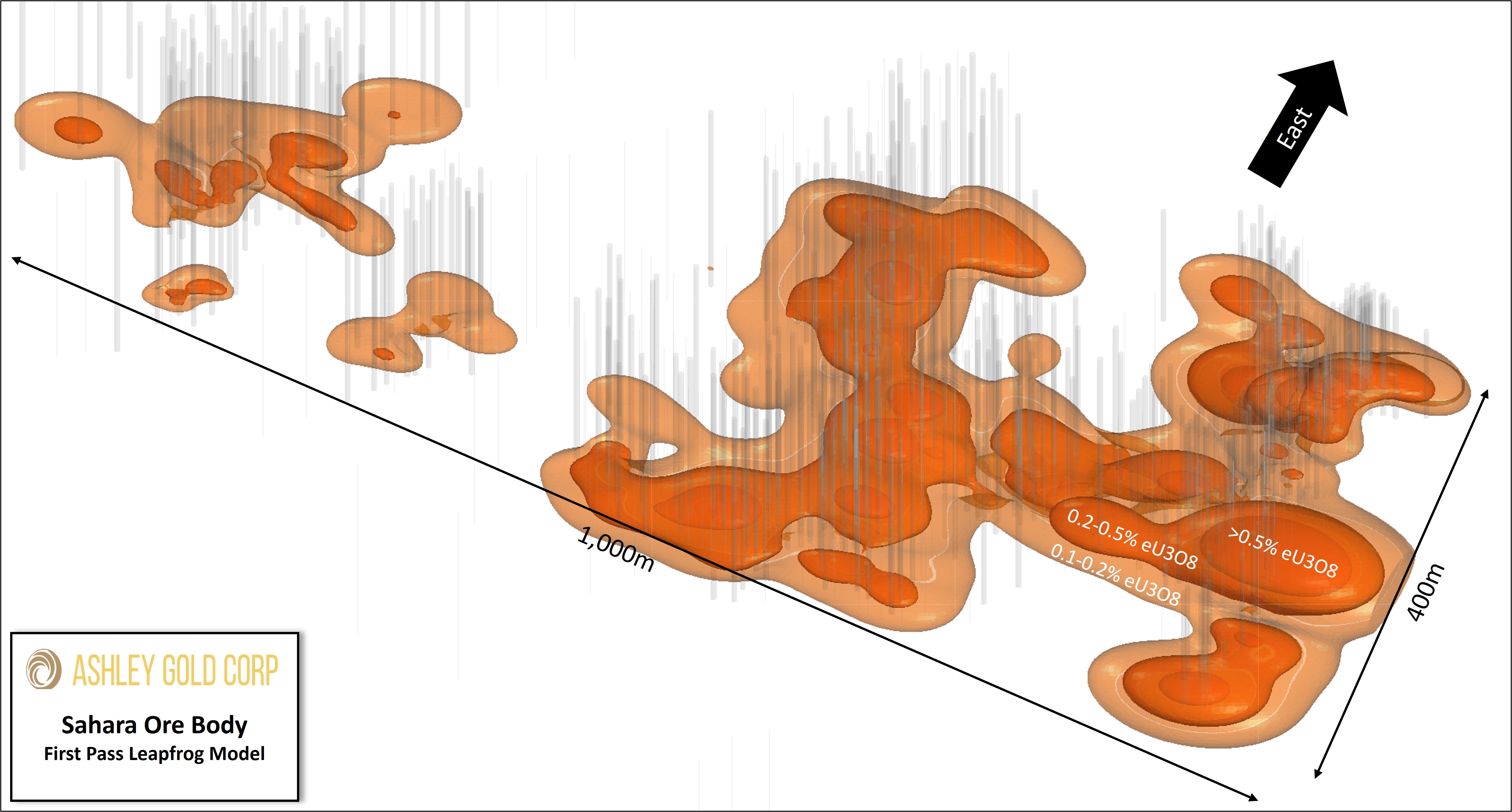

Historical Reserve and First Pass Modelling

By 1987 Energy Fuels outlined a historical ore reserve of almost 500,000 lb of eU3O8* at the Sahara mine. An ore reserve is defined as economically minable ore and represents a high level of confidence. Subsequent modelling in Vulcan as part of a Master's Thesis reports a non-compliant resource of over 2,240,000 lbs of eU3O8* and nearly 4,000,000 lbs of Vanadium*. As part of Ashley's due diligence the drill data from the Vulcan model was loaded and modelled in Leapfrog. The modelled bodies look to match the thesis model in size and shape. Infill and step out opportunities for the upcoming drill program are identified and will be used to confirm. Additional historic resources outside of the Sahara Ore-body have been documented within the Property and data for these are currently being digitized to be summarized in future releases.

*Historical drill data currently non-43-101 compliant

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Darcy Christian, P.Geo., President of Ashley, who is a Qualified Person as defined by NI 43-101.

ABOUT ASHLEY GOLD CORP.

Ashley Gold is focused on creating substantive, long-term value for its shareholders through the discovery and development of world class gold deposits. Ashley has acquired, 100% of the Tabor Lake Lease subject to a 1.5% royalty, 100% of the Santa Maria Project subject to a 1.75% royalty, 100% interest in the Howie Lake Project subject to a 0.5% royalty, 100% interest in the Alto-Gardnar Project subject to a 0.5% royalty, 100% interest in the Burnthut Property subject to a 1.5% NSR, and an option to earn 100% of the Sakoose claims subject to a 1.5% NSR. In addition, Ashley has entered into an option agreement to earn 100% of the Sahara Uranium-Vanadium property in Emery County, Utah subject to a 2% NSR.

Ashley Gold Corp. is an early-stage natural resource company engaged primarily in the acquisition, exploration and development of mineral projects. The Corporation's objective is to conduct efficient and economical exploration on its growing portfolio of high-quality gold projects as well as moving the Sahara Uranium-Vanadium project towards near-term production.

The responsibility of this release lies with Mr. Darcy Christian, President and CEO • +1 (587) 777-9072 • dchristian@ashleygoldcorp.com, may be contacted for further information. www.ashleygoldcorp.com

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

DISCLAIMER & FORWARD-LOOKING STATEMENTS

This news release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management's expectations. Factors which cause results to differ materially are set out in the Company's documents filed on SEDAR. Undue reliance should not be placed on "forward looking statements".

SOURCE: Ashley Gold Corp

View the original

press release on accesswire.com