- Q1 Gold equivalent production of 11,204 GEO while transitioning to new Calandrias Norte deposit

- Production levels at MDN stabilized beginning in March at both the CIL and Heap leach

- MDN production for March, April and May exceeded 17,000 ounces, supporting the ongoing turnaround of operations at MDN

- Application to remove Cease Trade Order Underway

TORONTO, ON / ACCESSWIRE / June 26, 2024 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces its operational and financial results for the first quarter ("Q1/24") at its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and for its ongoing activities at the Monte Do Carmo gold project in Brazil and Mont Sorcier Iron Project in Quebec.

Production results for MDN were previously released on April 30, 2024. The Company's financial results are reported and available on SEDAR as well as on the Company's website (www.cerradogold.com). As previously disclosed, the filing of the company's financial results were delayed as a result of delays in filing the annual statements. The Company has now applied to the Ontario Securities Commission for removal of the cease trade order and is expecting a response shortly.

Q1/24 MDN Highlights:

- Q1/24 production of 11,204 Gold Equivalent Ounces ("GEO") and Q1 AISC of $2,045 per ounce.

- Q1 Adjusted EBITDA of $3.0 million loss due to lower production and higher operating costs per ounce in the first two months before accessing higher grades in the new Calandrias Norte pit during March.

- Total production in April of 6,641 GEO and 5,486 GEO in May

- Calandrias Norte produced 6,150 GEO in April, 4,500 GEO in May and is expected to hold at these levels until around year end.

- Ramp-up of production from the Las Calandrias Heap Leach on track, delivering approximately 1,000 GEO per month from May.

- Cashflow and proceeds of asset sales are now starting to improve the balance sheet, with the working capital position expected to improve during Q2 2024.

The Company produced 11,204 gold equivalent ounces and sold 10,331 gold equivalent ounces during Q1 2024.

Production was lower than planned during January and February as the company transitioned to full operation in the new Calandrias Norte pit. Production levels have stabilized since March 2024, when 5,747 GEO were produced, a further 6,641 GEO in April and 5,486 GEO in May from both Calandrias Norte and Calandrias Sur. Future production at Calandrias Norte is expected to stabilize at ~4,000 -4,500 GEO per month, with additional production delivered from the heap leach operation.

At the Calandrias Sur heap leach project, the crushing plant is now operating as expected, which has resulted in a more consistent feed to the heap leach pad, improving overall performance and resulting in 1,132 GEO produced during the quarter. Production is currently running at ~1,000 GEO per month and is expected to reach approximately 2,000 GEO per month for the month of July.

Cerrado's MDN operations are now starting to benefit from the completion of its recent expansionary capital expenditure programs and are positioned to generate significant cash flows during the remainder of the year. Combined with additional funds from the Monte Do Carmo ("MDC") transaction, the Company is focused on strengthening the balance sheet by paying down payables and reducing our short-term notes at MDN as well as reducing liabilities at the Corporate level.

As outlined previously, the focus of the Company in the medium term continues to be securing existing cashflows and generating sufficient cash to enhance the overall financial position of the Company. As part of this process, the Company is reviewing the merits of repositioning the mine to solely a heap leach operation for the short to medium term. This would entail a proposed doubling of the current heap leach capacity to sustain a robust production profile for the next several years. During this period, exploration programs will be targeted to continue to grow the existing high-grade ore resources through both open pit and underground targets that are currently being delineated. The Company is on track to release an NI 43-101 Resource Update and a Preliminary Economic Assessment for the revised near term mine plan at MDN in early Q3 of 2024.

At the Mont Sorcier iron and vanadium project, owned by Cerrado's wholly owned subsidiary Voyager Metals Inc., a successful metallurgical testing program completed during Q1 has resulted in a high grade/purity DRI product being produced (See PR March 1, 2024). While further optimization is ongoing, the results to date suggest the project can produce a High Purity +67% DRI concentrate with low impurities. The company continues to progress discussions with various parties to support accelerating project development, however, at this time, the timeline to deliver the Feasibility study is under review.

As previously announced, the Company has now filed proxy related materials in relation to the annual and special meeting of shareholders set for June 27th, 2024. Amongst other items, the principal purpose of the meeting is to approve the sale of an option over the MDC project to a wholly owned subsidiary of Hochschild Mining PLC.

Mark Brennan, CEO and Chairman commented, "Despite a slow start to the quarter before entering the higher grades at Calandrias Norte, both the CIL and Heap Leach operations are now performing well, while the winter months typically produce challenges in Santa Cruz, we expect production to remain stable allowing the company to significantly reduce debt levels over the remainder of 2024 and into 2025".

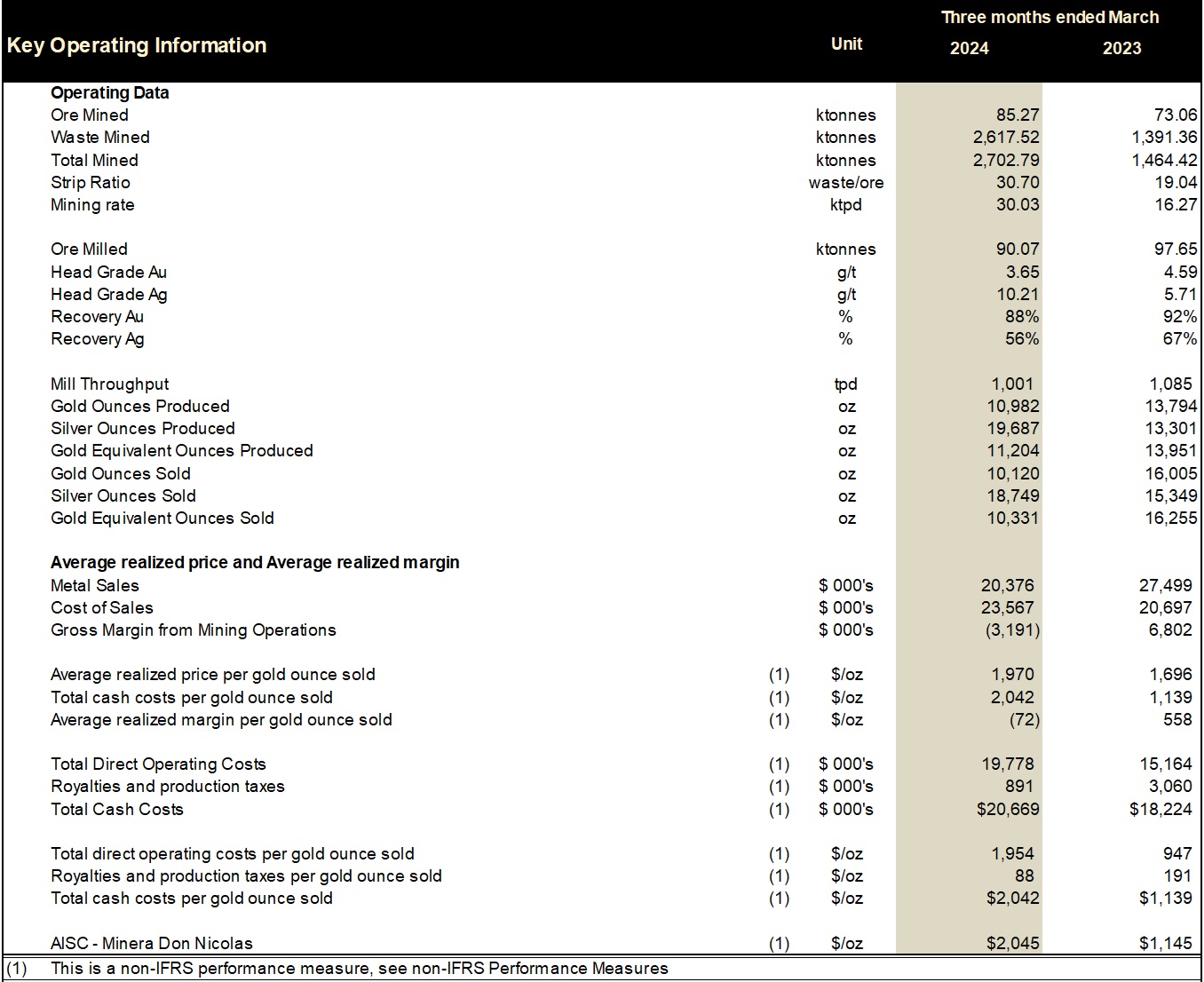

Table 1. Q1 2024 Operational and Financial Performance

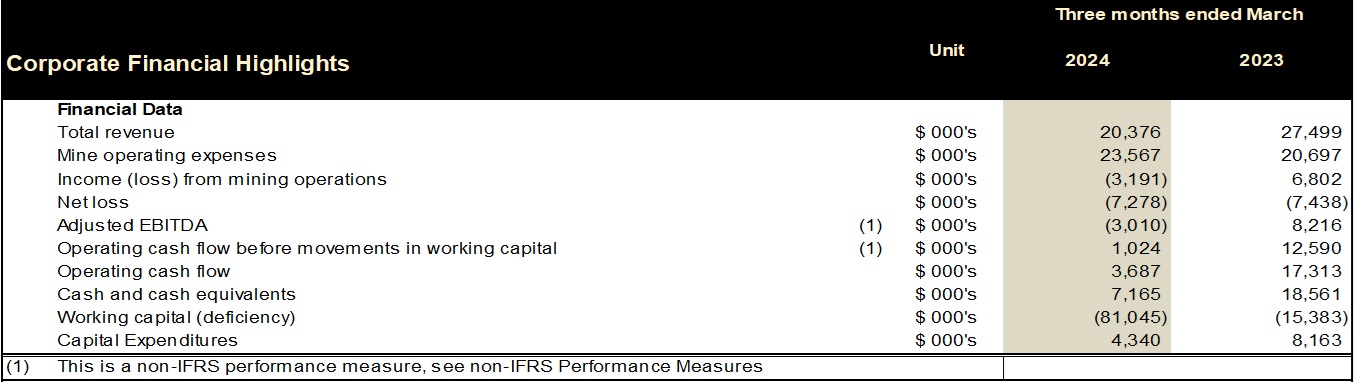

The Company generated revenue of $20.4 million for the first quarter ended March 31, 2024, from the sale of 10,120 ounces of gold and 18,749 ounces of silver at an average realized price per gold ounce sold of $1,970. For the first quarter ended March 31, 2023, the Company generated revenue of $27.5 million from the sale of 16,005 ounces of gold and 15,349 ounces of silver at an average realized price per gold ounce sold of $1,696.

Cost of sales for the first quarter ended March 31, 2024, was $23.6 million as compared to $20.7 million for the quarter ended March 31, 2023. The Company incurred $4.7 million higher production costs for the first quarter ended March 31, 2024, due primarily to higher labour costs.

All in Sustaining Costs (including royalties) per ounce sold were $2,045 per ounce in the first quarter ended March 31, 2024, as compared to $1,145 per ounce for the first quarter ended March 31, 2023 a $900 per ounce increase (refer to reconciliation of Non-IFRS performance metrics). The increase is a result of lower production rates and thus higher production costs per ounce incurred in 2024 as compared to 2023.

Net loss for the first quarter ended March 31, 2024, was $7.3 million as compared to a $7.4 million net loss for the first quarter ended March 31 2023. The decrease in net loss is primarily a result of lower other expenses and income and mining taxes, offset by lower revenues and higher production costs.

The Company incurred general and administrative expenses of $2.4 million for the first quarter ended March 31, 2024, as compared to $3.4 million of general and administrative expenses incurred during the first quarter ended March 31, 2023. For the three months ended March 31, 2024, there was a decrease in salaries and wages of $1.3 million.

Other expense of $1.2 million during the first quarter ended March 31, 2024, includes finance expense of $1.4 million, loss on fair value remeasurement of MDN stream obligation of $1.9 million, and loss on fair value remeasurement of MDC secured note and stream obligation of $1.9 million offset by a foreign exchange gain of $3.7 million.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado and the completion and filing of the Quarterly filings, the Interim Filings and the CTO. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original

press release on accesswire.com