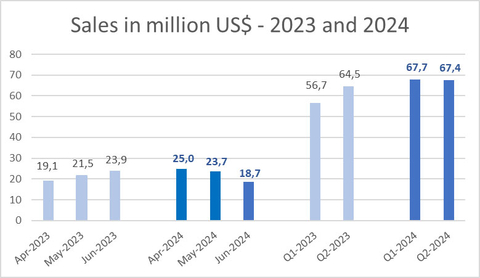

Dynacor Group Inc. (TSX-DNG) (Dynacor or the "Corporation"), an international gold ore industrial corporation servicing ASMs (artisanal and small-scale miners), today announced that it had recorded unaudited gold sales of US$18.7 million (C$25.6 million) (1) for June 2024, compared to US$23.9 million (C$31.8 million) in June 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240717192328/en/

(Graphic: Business Wire)

Second quarter sales amounted to US$67.4 million (C$92.2 million) in 2024, compared to US$64.5 million (C$86.7 million) in Q2-2023, a 4.5% increase.

Sales decrease versus June last year of US$5.2 million is due to decreases in sales volumes (-US$8.3 million) partially offset by increases in sales prices (+US$3.1 million). Volumes were impacted by lower grades of ore supplied.

In June, the average selling price of gold was US$2,313 per ounce, compared to US$1,933 per ounce in June 2023 as gold price continued to remain high.

During June 2024, the Veta Dorada plant continued working at full pace processing 14,000 tonnes. Compared with May 2024, our June production decreased by approximately 950 ounces mainly due to lower grades of ore processed and sales decreased by approximately 2,000 ounces due to the timing of exports.

The 2024 cumulative sales at the end of June amounted to US$135.1 million, compared to US$121.2 million for the same period of 2023, a 11.5% increase. The average selling price of gold at the end of June 2024 was US$2,196 per ounce compared to US$1,923 per ounce in 2023.

The Corporation announced sales guidance for 2024 ranging between US$265-285 million using a market gold price ranging between US$2,000 and US$2,050 per ounce.

(1) Sales are converted using the monthly average exchange rate

ABOUT DYNACOR

Dynacor is a dividend-paying industrial gold ore processor headquartered in Montreal, Canada. The corporation is engaged in gold production through the processing of ore purchased from the ASM (artisanal and small-scale mining) industry. At present, Dynacor operates in Peru, where its management and processing teams have decades of experience working with ASM miners. It also owns a gold exploration property (Tumipampa) in the Apurimac department.

The corporation intends to expand its processing operations in other jurisdictions as well.

Dynacor produces environmental and socially responsible gold through its PX IMPACT® gold program. A growing number of supportive firms from the fine luxury jewelry, watchmakers and investment sectors pay a small premium to our customer and strategic partner for this PX IMPACT® gold. The premium provides direct investment to develop health and education projects for our artisanal and small-scale miner’s communities.

Dynacor is listed on the Toronto Stock Exchange (DNG).

FORWARD-LOOKING INFORMATION

Certain statements in the preceding may constitute forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of Dynacor, or industry results, to be materially different from any future result, performance or achievement expressed or implied by such forward-looking statements. These statements reflect management’s current expectations regarding future events and operating performance as of the date of this news release.

Shares Outstanding: 36,475,656

Website: http://www.dynacor.com

Twitter: http://twitter.com/DynacorGold

View source version on businesswire.com: https://www.businesswire.com/news/home/20240717192328/en/