-

Gold equivalent production of 16,255 GEO for Q2; On track for Full year guidance of 50,000-60,0000 GEO

-

Adjusted EBITDA of $14.7 million for Q2

-

Operating results for Q2 highlight stable operating performance which is expected for the remainder of the year

-

Recent 43-101 Mineral Resource Update and Preliminary Economic Assessment Completed for MDN showing an NPV5% of $111MM at $2,100 oz gold price over a 5 year mine life

TORONTO, ON / ACCESSWIRE / August 29, 2024 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) announces its operational and financial results for the second quarter ("Q2/24") at its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and at its Mont Sorcier Iron Project in Quebec.

Production results for MDN were previously released on July 17, 2024. The Company's financial results are reported and available on SEDAR as well as on the Company's website (www.cerradogold.com).

Q2/24 Operating Highlights

-

Q2/24 production of 16,255 Gold Equivalent Ounces ("GEO").

-

Q2/24 Adjusted EBITDA of $14.7 million

-

AISC of $1,233 during Q2; Focus on cost reduction initiatives underway

-

Focus remains on delivering cashflow and strengthening the balance sheet with significant progress made towards debt reduction during the quarter.

Operational results presented for Q2/24 show a marked improvement over the previous quarter as the full exploitation of the Calandrias Norte high-grade open pit was achieved in addition to the continued ramp up of the heap leach operations. Production results for June included a modest decline due to harsh weather conditions where heavy snow impacted the transportation of high-grade ore to the mill and reduced mill throughput. The performance of the Heap leach during the quarter continued to improve despite the harsh weather and bodes well for the ramp-up to full commercial production. Performance of the crushing circuit at the Calandrias Sur Heap Leach continues to improve, allowing the placement of more ore on the heap leach pad during the quarter, which is key to delivering higher sustained production rates. Additional crushing capacity is being added via the addition of a secondary mobile crushing unit that has recently been delivered to the site and is set to double crushing capacity at Calandrias Sur to around 10,000 tpd to support an increase in production in the latter part of the year, doubling capacity to around 4,500 ozs per month.

The Company has also made significant progress in improving its working capital position during the quarter, partly due to cashflow generated by higher gold prices and strong production but also from the remaining proceeds received under the sale of an option on the Monte Do Carmo project in Brazil, to a subsidiary of Hochschild, which was approved by shareholders on 27th June 2024. Further improvement in the balance sheet is expected in the coming quarter due to sustained production rates.

Mark Brennan, CEO and Chairman commented, "With production levels stabilized, the outlook for the remainder of the year appears robust combined with the added expectation of higher gold prices. This should have a strong impact on our balance sheet. The recently completed PEA at MDN, underscores the value of the MDN operations. We are now positioned to ramp up exploration efforts to extend the mine life to further enhance the value of the project. In addition, if the option to purchase our Monte do Carmo project in Brazil is exercised, it would place Cerrado in a very strong financial position to resume an aggressive growth orientated strategy. "

Updated Mineral Resource Estimate and Preliminary Economic Assessment at Minera Don Nicolas

Subsequent to quarter end, on August 6th, 2024 the Company released results of a NI 43-101 Preliminary Economic Assessment ("PEA") and an updated Mineral Resource Estimate ("MRE") for its Minera Don Nicolas mine located in Santa Cruz Province, Argentina. The work was completed by GeoEstima SpA (Chile). The final report is to be completed and available on SEDAR+ by 20th September 2024. The results show a robust cash generating operation producing approximately 56,000 GEO per annum over an initial five year mine life.

Key highlights are presented below:

-

After Tax NPV5% of US$111 Million at US$2,100/oz Au price

-

Average annual production targeted at approx. 56,000 Gold Equivalent Ounces ("GEO")2

-

Life of Mine Average annual EBITDA of US$49 Million and FCF of US$25 Million

-

Mine life of 5 years, from April 2024 based on existing Resources

-

Average Cash Costs of US$863/oz; Avg AISC US$1,144/oz

-

No Material Upfront Capital Expenditures required

-

Updated Mineral Resource Estimate contains 490,000ozs of Measured and Indicated Resources and 121,150 ozs of Inferred Resources with potential upside from continued drilling & resource expansion

Notes

1. Spot prices; Au: US$2,400/oz and Ag:US$29/oz

2. GEO calculated by multiplying recovered silver ounces by (25/2100)

The PEA is primarily designed to exploit the Calandrias Norte high grade deposit and the Calandrias Sur low grade, heap leach, deposit. In addition, a modest underground mine based solely on currently known resources in the Paloma Trend and the smaller Zorro open pit near Martinetas are planned to add additional material for the CIL processing plant. The mine design is based on using standard open pit mining techniques of drill, blast and haul using a fleet of its own and rented mining equipment mining fleet to reduce capital needs. Mineralized material from Calandrias Norte is trucked to the CIL plant near the historical Martinetas mining operations, while material from the Calandrias Sur pit is crushed and placed on the leach pad in close proximity to the mining operations. The gold loaded carbon from the heap leach operations will be transported to the gold recovery circuit at the Martinetas site. Once processing of Calandrias Norte and additional high-grade material is completed, the CIL plant is to be placed on Care and Maintenance until mineralized material from the proposed underground mine becomes available in 2026, after underground development has been completed. Once this material is processed the CIL plant will once again be placed on Care and Maintenance until sufficient new sources of mineralized material have been upgraded to support ongoing mining operations which are expected from future exploration activities. Future mineralized material potential from exploration is currently excluded from the PEA mine plan.

Q2 Financial Performance

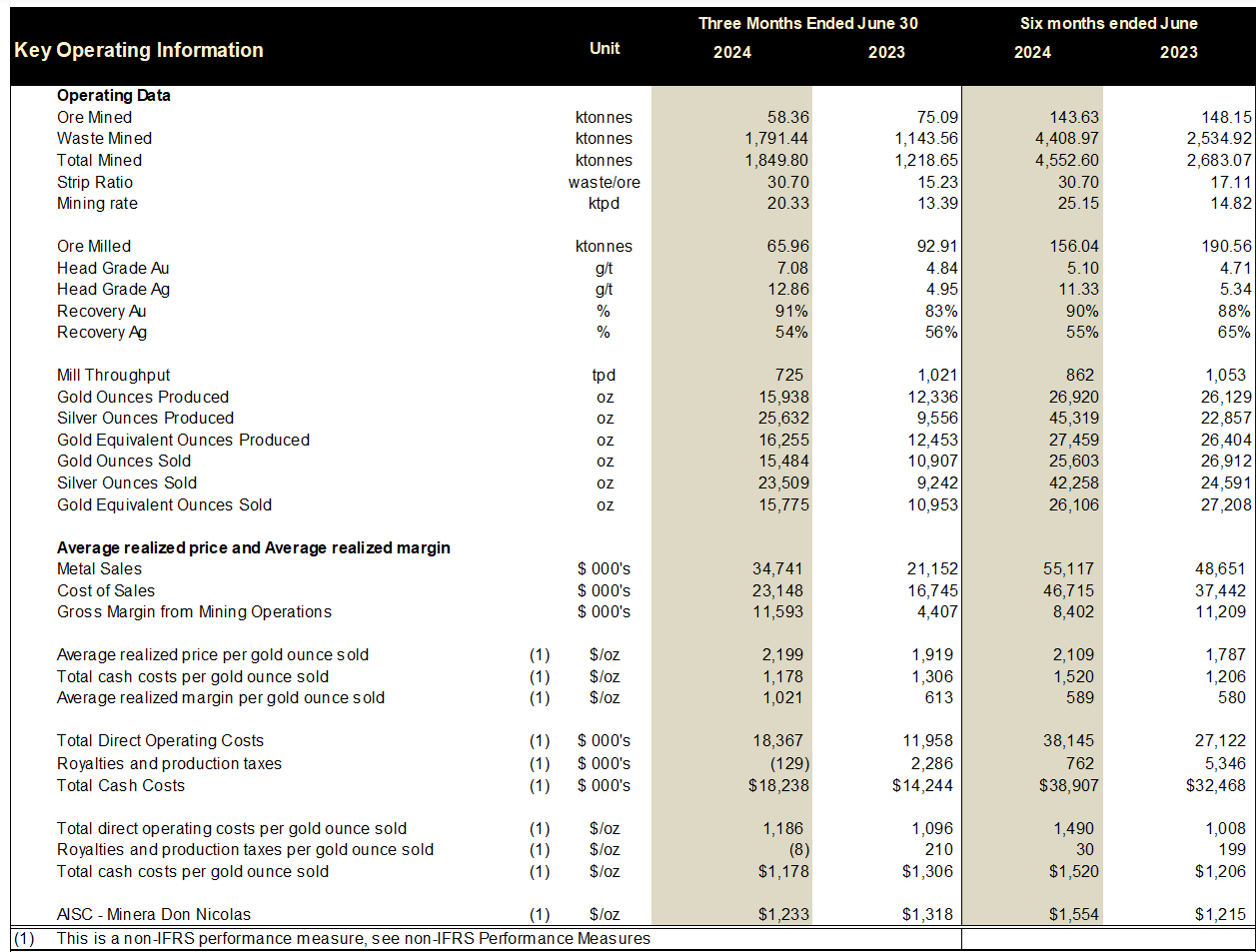

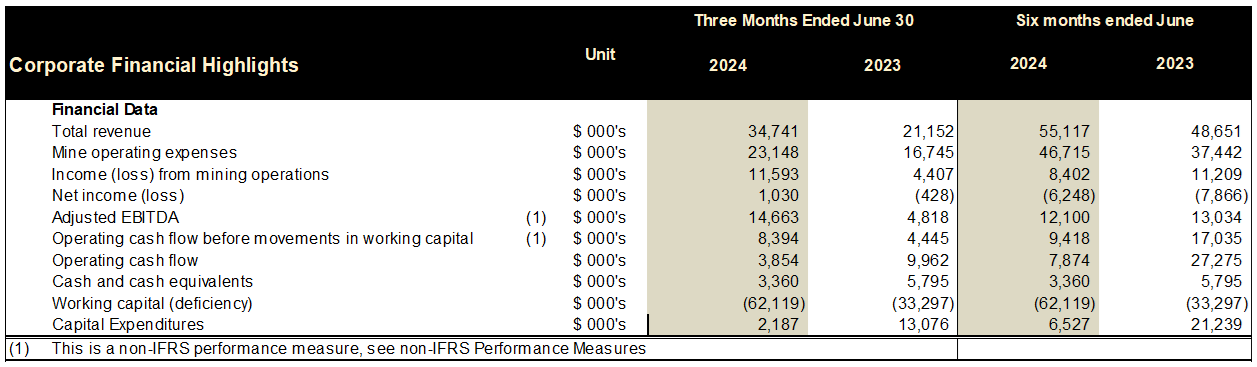

Table 1. Q2 2024 Operational and Financial Performance

The Company produced 16,255 GEO during the second quarter ended June 30, 2024, as compared to 12,453 GEO for the second quarter ended June 30, 2023. Production is higher in the three months ended June 30, 2024, due to 46% higher gold head grade and 9% higher recovery, offset by 29% lower throughput.

The Company generated revenue of $34.7 million for the second quarter ended June 30, 2024, from the sale of 15,484 ounces of gold and 23,509 ounces of silver at an average realized price per gold ounce sold of $2,199. For the second quarter ended June 30, 2023, the Company generated revenue of $21.2 million from the sale of 10.907 ounces of gold and 9,242 ounces of silver at an average realized price per gold ounce sold of $1,919. Revenue and sales of gold for the current period are higher than the quarter ended June 30, 2023, due to higher ounces sold and higher average realized gold price.

Cost of sales for the second quarter ended June 30, 2024, were $23.1 million as compared to $16.7 million for the quarter ended June 30, 2023. The Company incurred $6.9 million higher production costs for the second quarter ended June 30, 2024 due primarily to due to higher labor costs.

All in Sustaining Costs (including royalties) per ounce sold were $1,233 per ounce in the second quarter ended June 30, 2024, as compared to $1,318 per ounce for the second quarter ended June 30, 2023, an $85 per ounce decrease (refer to reconciliation of Non-IFRS performance metrics). The decrease is a result of higher production rates in the quarter, offset slightly by higher production costs in 2024 as compared to 2023.

Net income for the second quarter ended June 30, 2024, was $1.0 million as compared to a $0.4 million net loss for the second quarter ended June 30, 2023. The decrease in net loss is primarily a result of higher revenues, offset by higher other expenses and income and mining taxes.

The Company incurred general and administrative expenses of $2.5 million for the second quarter ended June 30, 2024, as compared to $2.3 million of general and administrative expenses incurred during the second quarter ended June 30, 2023. For the three months ended June 30, 2024 there was an increase in office expense of $0.4 million offset by a decrease in professional fees of $0.3 million.

Other expense of $7.3 million during the second quarter ended June 30, 2024, included finance expense of $2.6 million, foreign exchange loss of $5.0 million, loss on fair value remeasurement of MDN stream obligation of $0.2 million and loss on fair value remeasurement of MDC secured note and stream obligation of $0.4 million.

Cancellation of Stock Options

The Company and certain directors and employees of the Company have mutually agreed to cancel certain stock options (the "Cancelled Options") exercisable to acquire an aggregate of 7,521,663 common shares of the Company. These Cancelled Options consist of an aggregate of 1,720,000stock options that were granted on August 9, 2021 (expiring August 9, 2026) at an exercise price of CA$1.41, 150,000 stock options that were granted on October 28, 2021 (expiring October 28, 2026) at an exercise price of CA$1.53, 1,675,000stock options that were granted on September 19, 2022 (expiring September 19, 2027) at an exercise price of CA$1.10, 583,330 stock options that were granted on September 26, 2022 (expiring September 26, 2027) at an exercise price of CA$0.72, 8,333 stock options that were granted on November 25, 2022 (expiring November 25, 2027) at an exercise price of CA$0.72, and 3,385,000 stock options that were granted on August 23, 2023 (expiring August 23, 2028) at an exercise price of CA$0.75.

No consideration was paid for the surrender of the Cancelled Options. Following this cancellation of stock options, the Company has a total of 1,190,829 stock options outstanding.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil under option to Amarillo Mineração Do Brasil Ltda., a subsidiary of Hochschild Mining PLC. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, the likelihood of the option to sell the Monte do Carmo project being exercised and assumptions set out in the PEA.. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original

press release on accesswire.com