TORONTO, Sept. 05, 2024 (GLOBE NEWSWIRE) -- Hemlo Explorers Inc. (the “Company” or “Hemlo”) (CSE: HMLO) is pleased to announce completion of the purchase of Rocky Shore Metals Ltd. (“Rocky Shore”) on September 4, 2024 pursuant to which the Company has acquired all of the issued and outstanding common shares of Rocky Shore (“Rocky Shore Shares”) in exchange for the issuance of an aggregate of 49,999,704 common shares (“Hemlo Shares”) in the capital of the Company (the “Transaction”). Under the terms of the Transaction, each Rocky Shore Share received 2.832 Hemlo Shares. Hemlo now has 100,724,624 Hemlo Shares outstanding. Prior to the closing, the Company obtained the written consents of disinterested shareholders owning more than 50% of the outstanding Hemlo Shares authorizing the Transaction to proceed.

Transaction Highlights:

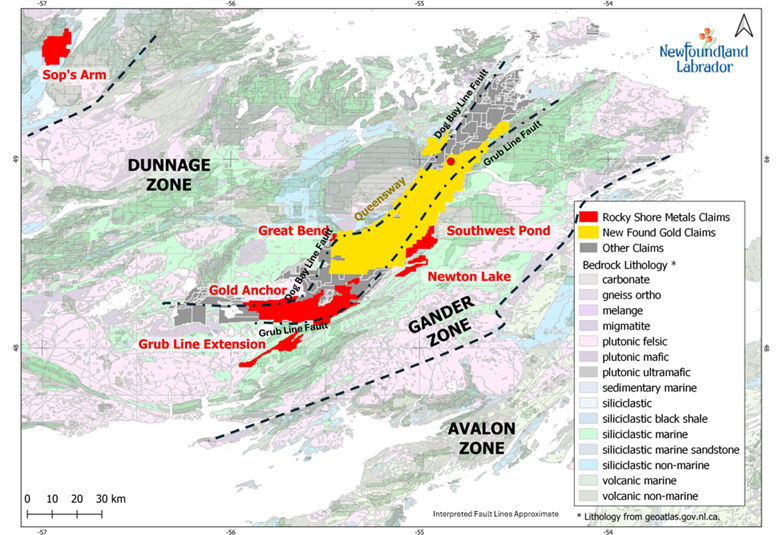

- Acquisition of 100% ownership of six (6) grass roots gold projects in a Tier 1 jurisdiction (Newfoundland and Labrador, Canada) with no underlying royalties. (see map 1 below);

- All properties were staked for their potential to host widespread, high grade gold mineralization in structurally complex geological environments;

- Rocky Shore’s flagship Gold Anchor Project, is a district scale asset in a significantly underexplored area that totals over 2,100 claims and 533 square kilometres. No systematic exploration or drilling has ever been completed for gold over the entire property; and

- The Gold Anchor Project features approximately 50 kilometres of strike length of favorable metasediments bounded by two crustal faults (Dog Bay Line and Grub Line faults) hosting an interpreted “Major Fault and Splay Structural Corridor” on trend to New Found Gold Corp’s significant gold discoveries at its Queensway Project in Central Newfoundland.

Map 1 – Rocky Shore Metals Property Portfolio (in red)

Brian Howlett, the President and Chief Executive Officer of Hemlo said, “We are extremely pleased to have acquired this exciting claim package in Newfoundland, particularly the Gold Anchor Project. We believe the combination of the Hemlo gold projects and Rocky Shore’s early-stage gold properties in central Newfoundland will generate significant value for all stakeholders as we advance these projects forward toward discovery.”

Concurrent with closing the Transaction, Ken Lapierre was appointed Vice President, Exploration of Hemlo. Mr. Lapierre brings forty plus years of experience to the management team at Hemlo. He is an exploration, mine geologist and financier with experience in the precious and base metals sectors.

“This is an excellent opportunity that allows us to advance our district scale Gold Anchor Project; an underexplored and strategically located property on trend to significant high grade gold discoveries in a potential emerging gold district. I am delighted to be able to work with the Hemlo team and look forward to completing our summer field program presently in full swing at Gold Anchor,” said Ken Lapierre, V.P. Exploration of the Company.

The Company is preparing a technical report for the Gold Anchor Project which will be filed on the Company’s SEDAR+ profile at www.sedarplus.com when finalized.

Early Warning Disclosure

In connection with the closing of the Transaction, Ken Lapierre, of Brockville, Ontario, acquired an aggregate of 10,195,200 Hemlo Shares at a deemed value of $0.053 per Hemlo Share in exchange for 3,600,000 Rocky Shore Shares having a deemed value of $0.15 per Rocky Shore Share or $540,000 in the aggregate, pursuant to the exemption contained in Section 2.16 of National Instrument 45-106 – Prospectus Exemptions (the “take-over bid and issuer bid” transaction exemption). The purchase agreement for the Hemlo Shares contains customary representations, warranties and agreements, conditions to closing and other obligations of the parties.

Prior to the closing of the Transaction, Mr. Lapierre did not own any securities of Hemlo. Following closing, Mr. Lapierre owns and controls 10,195,200 Hemlo Shares and nil convertible securities representing approximately 10.12% of the issued and outstanding Hemlo Shares.

The acquisition of the Hemlo Shares by Mr. Lapierre did not take place through the facilities of any market for Hemlo’s securities. Mr. Lapierre may increase or decrease his investment in Hemlo at any time, or continue to maintain his current investment position, depending on market conditions or any other relevant factor.

This portion of this new release is issued pursuant to National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues, which also requires an early warning report to be filed on SEDAR+ (www.sedarplus.com) containing additional information with respect to the foregoing matters. A copy of the related early warning report may be obtained on Hemlo’s SEDAR+ profile or by contacting Brian Howlett at the details below.

Qualified Person

Ken Lapierre, P.Geo., V.P. Exploration for the Company, a Qualified Person in accordance with Canadian regulatory requirements as set out in National Instrument 43-101, has reviewed and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

About Hemlo Explorers Inc.

Hemlo is a Canadian-based mineral exploration company with a portfolio of properties in Ontario, Newfoundland and Nunavut. Hemlo is focused on generating shareholder value through the advancement of its main Hemlo area projects, including Project Idaho, the Pic Project (under option to Barrick Gold Inc.), and North Limb Project, as well as advancing its Newfoundland claims and newly acquired Gold Anchor project.

For more information please contact:

Brian Howlett, President & CEO

Hemlo Explorers Inc.

brian@hemloexplorers.ca

1-647-227-3035

http://www.hemloexplorers.ca

Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian and United States securities exchange and interest rates, actual results of current production, development and exploration activities, government legislation.Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Certain information set forth in this news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties, including, but not limited to: the anticipated benefits of the Transaction to Hemlo and its shareholders, the future growth potential of the Company on a post-Transaction basis, the financial outlook of the Company on a post-Transaction basis, the possible impact of any potential transactions referenced herein on the Company’s shareholders, and any potential future arrangements and engagements in regards to any such potential transactions. The forward-looking information is based on reasonable assumptions and estimates of the management of the Company at the time such statements were made and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Hemlo to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration; future commodity prices; changes in foreign or domestic regulation; political or economic developments; environmental risks; permitting timelines; capital expenditures; operating or technical difficulties in connection with development activities; employee relations; the speculative nature of mineral exploration and development including the risks of diminishing quantities of grades of resources, contests over title to properties, the Company’s limited operating history, future capital needs and uncertainty of additional financing, and the competitive nature of the mining industry; the need for the Company to manage its future strategic plans; global economic and financial market conditions; uninsurable risks; and changes in project parameters as plans continue to be evaluated. Although Hemlo has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Although the forward-looking information contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, Hemlo cannot assure shareholders that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. Hemlo does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking information, except as required by applicable securities law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e2e6ef59-97f1-4f00-bdd4-af8f9ff901f6