Not for distribution to United States newswire services or dissemination in the United States.

ST. JOHN'S, Newfoundland and Labrador, Oct. 22, 2024 (GLOBE NEWSWIRE) -- Kraken Robotics Inc. (“Kraken” or the “Company”) (TSXV: PNG, OTCQB: KRKNF) is pleased to announce today that it has closed its previously announced “bought deal” short form prospectus offering (the “Offering”) of common shares of the Company (“Common Shares”). A total of 32,343,750 Common Shares were sold at a price of $1.60 per Common Share for gross proceeds of $51,750,000, inclusive of the full exercise of the over-allotment option by the Underwriters (as defined below).

The Offering was led by Cormark Securities Inc. as lead underwriter, on behalf of a syndicate of underwriters including Canaccord Genuity Corp., Beacon Securities Limited, Raymond James Ltd., and Scotia Capital Inc. (the “Underwriters”). The Underwriters received a cash commission equal to 5.0% of the gross proceeds of the Offering, which is $2,587,500.

The net proceeds of the Offering are expected to be used to advance the Company’s long-term strategy, including: (1) investing in expanded facilities and increased manufacturing capacity; (2) providing flexibility to take advantage of opportunities for accretive acquisitions of complementary technologies and businesses; (3) increasing the Company’s attractiveness as a stable and reliable long-term supplier; (4) strengthening the Company’s balance sheet to provide additional working capital to meet customer requirements in connection with potential additional large orders, as well as new program and contract opportunities; and (5) for general corporate purposes.

The Offering is subject to TSX Venture Exchange’s (“TSXV”) final acceptance of requisite regulatory filings.

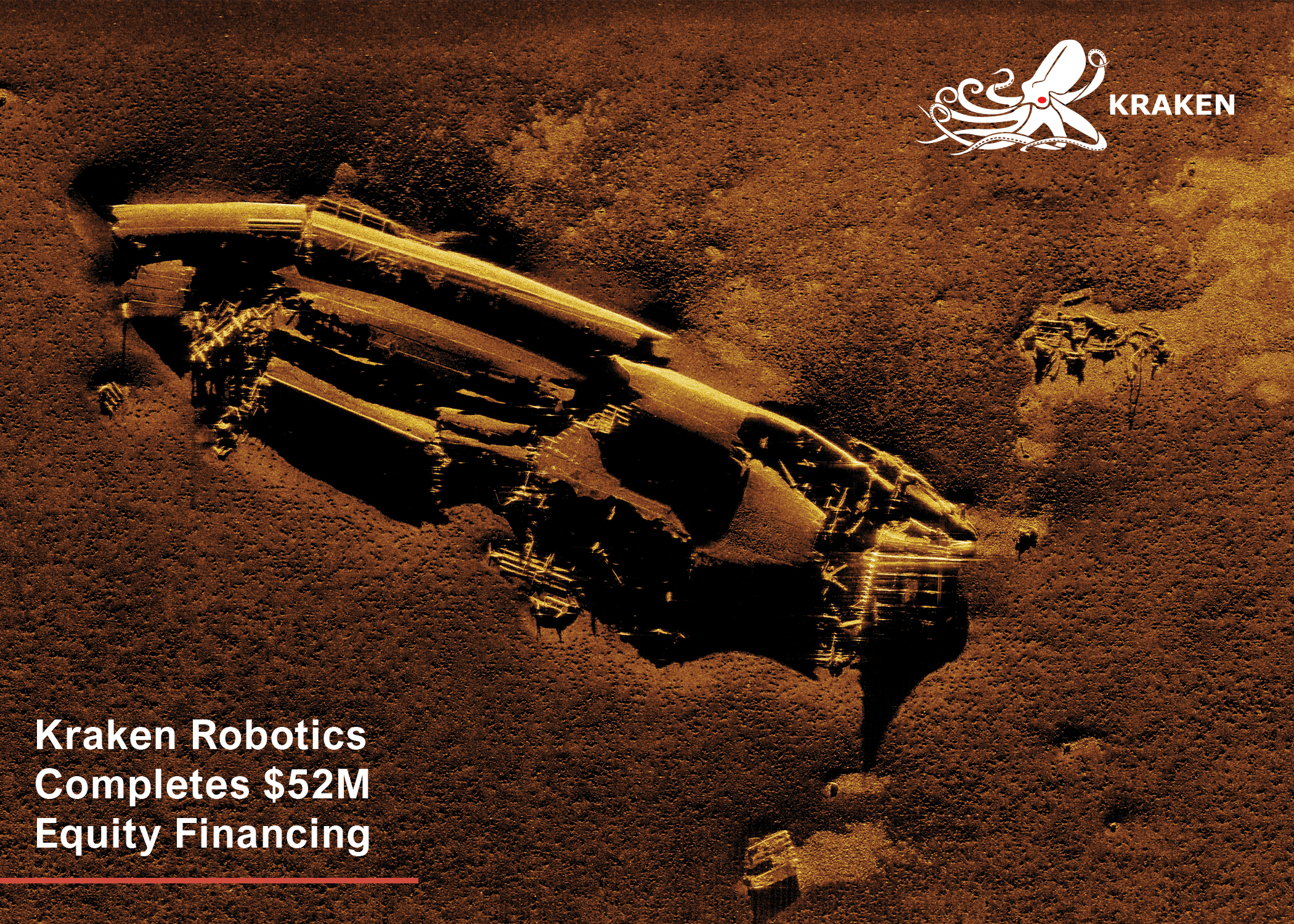

Figure 1: Kraken Robotics Miniature Interferometric Synthetic Aperture Sonar (MINSAS)

imagery of a shipwreck.

ABOUT KRAKEN ROBOTICS INC.

Kraken Robotics Inc. (TSX.V:PNG) (OTCQB: KRKNF) is a marine technology company providing complex subsea sensors, batteries, and robotic systems. Our high-resolution 3D acoustic imaging solutions and services enable clients to overcome the challenges in our oceans - safely, efficiently, and sustainably. Kraken is headquartered in Canada and has offices in North and South America and Europe. Kraken is ranked as a Top 100 marine technology company by Marine Technology Reporter.

LINKS:

www.krakenrobotics.com

SOCIAL MEDIA:

LinkedIn www.linkedin.com/company/krakenrobotics

Twitter www.twitter.com/krakenrobotics

Facebook www.facebook.com/krakenroboticsinc

YouTube www.youtube.com/channel/UCEMyaMQnneTeIr71HYgrT2A

Instagram www.instagram.com/krakenrobotics

For further information please contact:

Joe MacKay, Chief Financial Officer

(416) 303-0605

jmackay@krakenrobotics.com

Sean Peasgood

Investor Relations

(647) 955-1274

sean@sophiccapital.com

Forward-Looking Information

Certain information in this news release constitutes “forward-looking information”. All information contained herein that is not historical in nature may constitute forward-looking information. In particular, this news release contains forward-looking information with respect to, among other things, statements regarding the final acceptance of the TSXV and the expected use of the net Offering proceeds. These statements reflect the Company's current views with respect to future events based on certain material factors and assumptions and are subject to certain risks and uncertainties, including without limitation, changes in market, competition, governmental or regulatory developments, general economic conditions and other factors set out in the Company's public disclosure documents. Many factors could cause the Company's actual results, performance or achievements to vary from those described in this news release, including without limitation those listed above. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking information prove incorrect, actual results may vary differ, and may differ materially, from those described in this news release, and such forward-looking information should not be unduly relied upon. Forward-looking information speaks only as of the date of this news release. Except as required by law, the Company does not intend, and does not assume any obligation, to update or revise any forward-looking information. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release, and the OTCQB has neither approved nor disapproved the contents of this press release.

The securities offered pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any U.S. state securities laws, and may not be offered or sold in the United States unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to exemptions from the registration requirements of the U.S. Securities Act and applicable state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9394fd2c-d263-4b9e-8ca5-fdb6c2356e47.