(TheNewswire)

HIGHLIGHTS

-

Mithril confirms firm commitments for a heavily over-subscribed capital raising of A$12.5M at $0.50 with cornerstone investments by new and existing shareholders

-

Jupiter Gold and Silver Fund has confirmed its recently increased Mithril shareholding at 16% and 1832 Fund (Bank of Nova Scotia) maintains its shareholding at 8% post placement

-

The Directors of the Company have committed to subscribe for $200,000 following earlier 2024 commitments for $672,500

-

Proceeds of the placement will boost the Mithril’s post settlement cash balance to ~$18m and be used to more than quadruple drill metres in 2025 to a new target of 40,000 metres, equivalent to the total metres drilled in Copalquin in the modern history of the project

-

Mithril is on track to significantly expand the current 529,000 ounce gold equivalent resource at the Target 1 area Q1 2025 from 9,000 metres drilled in 2024

-

Mithril confirms the recent commencement of Copalquin District access road upgrade works with completion expected by end of Q1 2025 facilitating the company’s significantly expanded exploration activities

October 27,2024 – TheNewswire - The Board of Mithril Silver and Gold Limited (ASX:MTH, TSXV:MSG) (Mithril or the Company) is pleased to announce that is has undertaken a capital raising with new and existing institutional, professional and sophisticated clients of PAC Partners Securities Pty Ltd and Arlington Group Asset Management (the Joint Lead Managers) for an investment in the Company of $12.5 million (before costs)through a Placement Offer.

Mithril Managing Director/CEO John Skeet said,

“We are very pleased with Jupiter Gold and Silver and the 1832 Funds’ continued support and welcome several new high-quality Australian and global funds to the register. The funding allows Mithril to considerably expand drilling at Copalquin with additional drill capacity and open up the district for more rapid advancement of exploration work. We remain on track for the high-grade resource update at the Target 1 area in Q1 2025, where we aim to greatly expand the current resource and establish at least two further resource target areas by the end of 2025 with ~40,000 metres of drilling. In addition to the resource expansion work, we continue to advance the district geologic model to determine the source of the widespread gold and silver mineralisation across the 70km2 mining district with its 298 historic mines and workings and to establish Copalquin as another world class gold-silver district in the prolific Sierra Madre Gold-Silver Trend of Mexico.”

Use of Funds

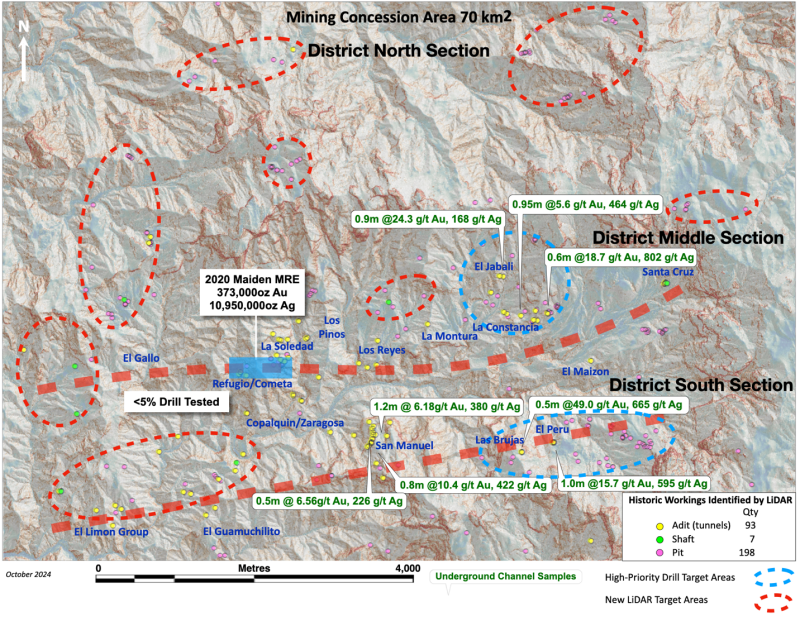

The Company will use the proceeds from the Placements to complete the current 9,000m drill program to expand the high-grade maiden JORC resource1 at the Target 1 area and the upgrade of the access road, for District target advancement and prepare Targets 2 (Las Brujas-El Peru) and 3 (Constancia-El Jabali) for drilling in 2025. It is projected the Company will double its total metres drilled in the District by the end of 2025 with an additional, fully funded ~40,000 metres of drilling.

Capital Raising Details

Mithril has received binding commitments for the Placement from professional and sophisticated investors, comprising of 25,000,000 new fully paid ordinary shares in the Company (Placement Securities) at an issue price of $0.50 to raise approximately $12.5M (before costs) (Capital Raising). An applicable Appendix 3B pertaining to this Placement follows this announcement. The Placement was well supported by Australian, North American and European investors.

Participants in Placement will receive one free attaching option for every two shares subscribed for under the Placement. The options will be unlisted, have an exercise price of $0.75 and an exercise period of 2 years from date of issue (Attaching Options).

The Directors of the Company have committed to subscribe for $200,000 in the Placement.

The issue of the shares will be completed under the Company’s 7.1 (9,542,378) and 7.1A (8,457,622) placement capacity and 400,000 are to be issued under LR 10.11 for director participation. The Attaching Options, including shares and options to Directors, are subject to shareholder approval at an upcoming EGM and the Placement is subject to acceptance by the TSX Venture Exchange. Placement Securities issued to Canadian participants, the Directors and 10% shareholders will be subject to a four month hold period.

The Capital Raising price of $0.50 per share represents:

11.5% discount to the last traded price of $0.565

4.7% discount to 5-day VWAP of $0.525

0.2% discount to the 15-day VWAP price $0.501

The Placement was conducted by PAC Partners Securities Pty Ltd and Arlington Group Asset Management as joint lead managers with fees consisting of 6% cash and 6% in Options equal to 1,500,000 options, unlisted, with an exercise price of $0.75 and an exercise period of 2 years from date of issue (Broker Options).

The Company will announce a Notice of Extraordinary General Meeting to approve the issue of the Attaching Options, Broker Options and Placement Securities to Directors.

-ENDS-

Released with the authority of the Board.

For further information contact:

|

John Skeet

Managing Director and CEO

jskeet@mithrilresources.com.au

+61 435 766 809

|

Mark Flynn

Investor Relations

mflynn@mithrilresources.com.au

+61 416 068 733

|

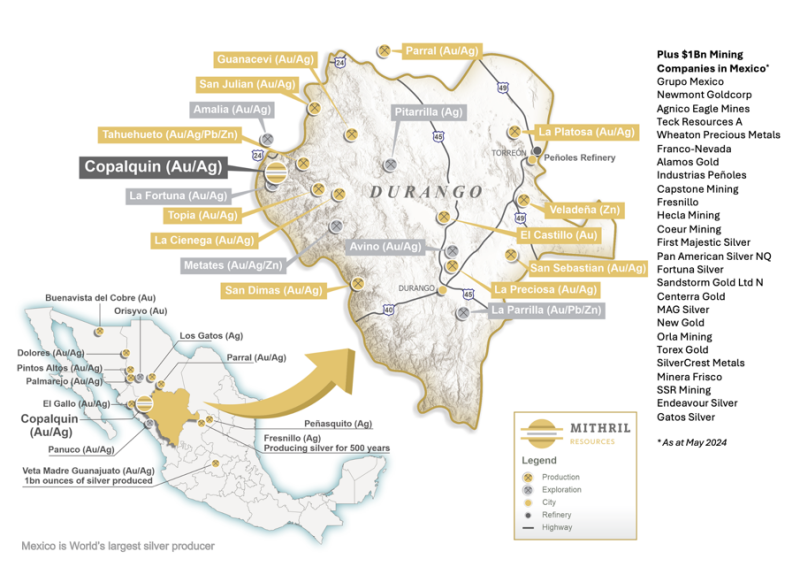

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021)^ and a NI43-101 Technical Report, “Copalquin Property Mineral Resource Estimate”, filed on SEDAR+, July 2024.

-

2,416,000 tonnes4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

-

28.6% of the resource tonnage is classified as indicated

|

Tonnes

(kt)

|

Tonnes

(kt)

|

Gold

(g/t)

|

Silver

(g/t)

|

Gold Eq.* (g/t)

|

Gold

(koz)

|

Silver

(koz)

|

Gold Eq.* (koz)

|

|

El Refugio

|

Indicated

|

691

|

5.43

|

114.2

|

7.06

|

121

|

2,538

|

157

|

|

Inferred

|

1,447

|

4.63

|

137.1

|

6.59

|

215

|

6,377

|

307

|

|

La Soledad

|

Indicated

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Inferred

|

278

|

4.12

|

228.2

|

7.38

|

37

|

2,037

|

66

|

|

Total

|

Indicated

|

691

|

5.43

|

114.2

|

7.06

|

121

|

2,538

|

157

|

|

Inferred

|

1,725

|

4.55

|

151.7

|

6.72

|

252

|

8,414

|

372

|

|

TOTAL

|

2,416

|

4.80

|

141

|

6.81

|

373

|

10,953

|

529

|

Table 1 - Mineral resource estimate El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

* The gold equivalent (AuEq.) values are determined from gold and silver values and assume the following: AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. Metallurgical recoveries are assumed to be approximately equal for both gold and silver at this early stage. Actual metallurgical recoveries from test work to date are 96% and 91% for gold and silver, respectively. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold. Actual metal prices have not been used in resource estimate, only the price ratio for the AuEq reporting.

^ The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021 - MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Silver and Gold Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional underground mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi-million-ounce gold and silver potential.

Mithrilhasanexclusiveoptiontopurchase100%interestintheCopalquinminingconcessionsbypayingUS$10M onoranytimebefore7August2026(optionhasbeenextendedby3years).Mithrilhasreachedanagreementwith thevendorforanextensionofthepaymentdatebyafurther2years(bringingthepaymentdateto7August2028).

Click Image To View Full Size

Figure 1 – Copalquin District location map with locations of mining and exploration activity within the state of Durango

Click Image To View Full Size

Figure 2 LiDAR hill shade image with the historic workings identified across the district and 2020-2022 highlight drill and channel sample results. Several new areas highlighted across the district for follow-up work.

1See JORC resource details at end of Announcement

Copyright (c) 2024 TheNewswire - All rights reserved.