(TheNewswire)

31 October 2024 (Australia) - TheNewswire

|

Jervois Global Limited

ACN: 007 626 575

ASX/TSXV: JRV

OTCQB: JRVMF

Corporate Information

2,703M Ordinary Shares

53.4M Options

209.2M Performance Rights

Non-Executive Chairman

Peter Johnston

CEO and Executive Director

Bryce Crocker

Non-Executive Directors

Brian Kennedy

Michael Callahan

David Issroff

Daniela Chimisso dos Santos

Company Secretary

Alwyn Davey

Contact Details

Suite 2.03,

1-11 Gordon Street

Cremorne

Victoria 3121

Australia

P: +61 (3) 9583 0498

E: admin@jervoisglobal.com

W: www.jervoisglobal.com

|

Highlights

Jervois Finland:

-

US$2.9 million adjusted EBITDA0F1 in Q3 2024; resilient performance in context of cyclically weak market conditions, including low cobalt prices.

-

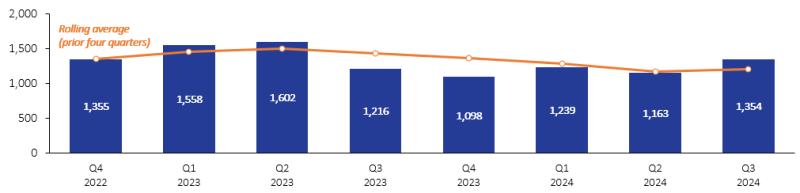

1,354 metric tonnes (“mt”) of cobalt sold in Q3 2024; expected full year guidance of 5,100 to 5,400 mt is unchanged.

Jervois USA:

-

Strong results from resource extensional drilling at Idaho Cobalt Operations (“ICO”), funded by U.S. Department of Defense (“DoD”) Defense Production Act (“DPA”) Title III funding, illustrates growth potential.

-

Advancing U.S. cobalt refinery bankable feasibility study (“BFS”) funded by DoD, still expected to be completed in Q4 2024.

Corporate:

-

Fully drawn US$7.5 million additional secured term loan as part of amended Jervois Finland working capital facility.

-

Waiver of covenants under Jervois’ debt facilities and deferral of ICO bond interest extended until 14 December 2024.

-

US$15.4 million cash balance, US$33.0 million physical cobalt inventories and US$147.9 million1F2 drawn senior debt at September 2024 quarter-end.

-

Jervois continues to pursue a balance sheet restructuring transaction, including relying on its secured lender to extend covenant waivers and interest deferral, and to provide additional debt funding.

|

Financing update

Jervois Global Limited (“Jervois” or the “Company” and, together with its subsidiaries, “Jervois GlobalGroup”) ended the September 2024 quarter with US$15.4 million in cash, US$33.0 million in physical cobalt inventories, and total drawn senior debt of US$147.9 million.

End of September 2024 cash of US$15.4 million was lower than the previous quarter-end balance of US$21.3 million, with cash flow impacted by a rebuild of inventories in the quarter at Jervois Finland and holding costs at Jervois’ 100%-owned ICO mine site in the U.S. and the São Miguel Paulista (“SMP”) nickel-cobalt refinery in São Paulo, Brazil. The Company also incurred US$2.3 million in costs in the quarter, pursuing a balance sheet restructuring transaction.

At 27 October 2024, Jervois Global Group’s current cash balance is US$9.8 million.

During the quarter, Jervois and its “Lender”, being the majority holder of the US$100.0 million 12.5% ICO Senior Secured Bonds (the “ICO Bonds”) and lender under Jervois Finland’s working capital facility (the “JFO Facility”), amended the JFO Facility including adding a US$7.5 million term loan facility (the “Term Loan”) for general corporate and working capital purposes. The Term Loan is fully drawn, with US$3.75 million drawn in the quarter and, subsequent to the quarter end in October 2024, the remaining US$3.75 million drawn.

As part of the Term Loan, the Lender received additional security for the JFO Facility, including an agreement to provide a pledge over the shares of Jervois Brasil, which owns the SMP nickel-cobalt refinery, and a second lien on the assets which currently pledged to secure the repayment of the ICO Bonds.

The Lender, as majority holder of the ICO Bonds, agreed on 15 October 2024 to (a) extend to 14 December 2024 the waiver of all financial covenants and certain potential cross-defaults under the ICO Bonds (collectively the “Waiver”), (b) defer the semi-annual interest payments under the ICO Bonds (the “Deferral”)2F3 and (c) to forbear remedies associated with ICO Bonds financial covenant compliance. In exchange, the Company granted a second lien on the Jervois Finland assets pledged to secure the repayment of the JFO Facility security package, in favour of the ICO Bonds.

At 31 October 2024, neither the ICO Bonds nor the JFO Facility are in default.

Jervois Finland

-

Revenue: US$38.2 million (Q2 2024: US$36.9 million)

-

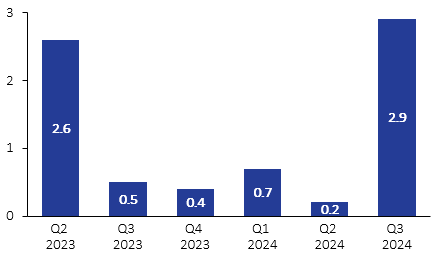

Adjusted EBITDA US$2.9 million (Q2 2024: US$0.2 million)

-

Cash flow from operations: -US$1.0 million (Q2 2024: US$4.3 million)

-

Sales volume: 1,354 mt (Q2 2024: 1,163 mt)

-

Production volume: 1,389 mt (Q2 2024: 1,041mt)

Sales and marketing

Jervois Finland produced 1,389 mt and sold 1,354 mt of cobalt in the quarter.

Figure 1: Jervois Finland sales volume by quarter (mt)

Click Image To View Full Size

Sales volumes of 1,163 mt during the quarter ending 30 September 2024 were 16% higher than the previous quarter volumes. The increase in sales volumes on the prior quarter reflected an uptick in demand from cobalt battery customers due to U.S. Foreign Entity of Concern (“FEOC”) regulations. Production volumes and product mix remains subject to continuous review and adjustment based on Jervois assessing end-use demand and considering target inventory levels. Production levels in the quarter were higher than the previous quarter to achieve alignment with the increase in sales and current market demand.

Jervois Finland’s sales performance and outlook for key market segments are summarised below.

Batteries:

-

Jervois is commencing negotiations for 2025 supply agreements and expects U.S. requirements to source non-FEOC cobalt sulphate to result in new customers in 2025.

-

The U.S. Inflation Reduction Act, including FEOC sourcing restrictions, continues to drive interest in the U.S. and other Western supply of battery raw materials, providing a key advantage to Kokkola as the leading global cobalt refinery outside of China.

-

European and U.S. based electric vehicle (EV”) OEMs (automakers) continue to enquire about multi-year cobalt supply contracts. However, medium-term timelines remain uncertain and committed volume requests commence later than previously forecast due a moderation in current EV roll out rates.

Chemicals, Catalysts, and Ceramics:

-

Chemicals: Demand in general continues to show stability across key chemical applications, with coatings and rubber adhesion being particularly robust.

-

Catalysts: Cobalt demand continues to track steadily in the refinery catalyst segment, albeit at somewhat lower levels against 2023.

-

Ceramics: This segment continues to be impacted by reduced demand and increased competition. Cobalt producers in China are aggressively targeting export markets, resulting in continued low prices. These prices look to remain under pressure throughout the balance of the year as pigment producers are benefiting from increased competition by suppliers, together with less focus on supplier ESG characteristics than other customer segments.

Powder Metallurgy:

-

Competition in downstream markets (especially from China) continues to weaken demand for Jervois product across all powder metallurgy applications.

-

There has been no improvement in automotive, oil and gas production (drilling), general engineering, and construction markets. These markets are forecast to remain weak through to the beginning of 2025.

-

Continued positive outlook in aerospace, which remains supported by expansion in both civilian and military sectors.

Financial performance

Jervois Finland achieved revenue of US$38.2 million in the quarter, a 4% increase on the prior quarter. The increase was principally due to higher sales volumes, offset by lower realised pricing due to historically low cobalt prices during the quarter. The business improvement programme, introduced in Q4 2023, continues to deliver a positive impact, with operating costs trending lower in the quarter, partially offsetting lower cobalt prices.

Adjusted EBITDA

Jervois Finland achieved Adjusted EBITDA in the third quarter of US$2.9 million, continuing a turnaround that commenced in the second quarter of 2023. Q3 2024 was the sixth consecutive quarter of positive Adjusted EBITDA, and the result is consistent with Jervois Finland’s historical performance of its business model supporting a positive margin in an environment of cyclically weak, but stable, cobalt prices.

Figure 2: Jervois Finland Adjusted EBITDA by quarter (US$M, unaudited)

Cash flow performance

Cash flow from operations (before interest payments) was -US$1.0 million in the quarter. Higher sales volumes and the financial benefits of sustained delivery of the business improvement programme at Jervois Finland continued to deliver a positive impact, with operating costs trending lower during the quarter. Higher working capital inventory offset the positive underlying financial result in the quarter. Physical cobalt inventories increased by US$1.1 million from US$31.9 million at 30 June 2024 to US$33.0 million at 30 September 2024. This represented an increase from 1,158 mt and ~69 days at 30 June 2024 to 1,305 mt and ~78 days at 30 September 2024, based on a normalised 6,000 mt annual production rate. Jervois is continuing to execute an inventory management strategy aligned to a near-term target range of 90 days or less, in a manner that balances commercial, liquidity, and risk management objectives.

Jervois USA

Idaho Cobalt Operations, U.S.

During the quarter, Jervois reported results from extensional drillholes as part of its U.S. DoD DPATitle III fully refundable (“DoD Agreement Funding”) programme at ICO.

Results from the initial four drillholes of Jervois’ RAM extensional drilling campaign under its DoD Agreement Funding yielded positive indication of resource extension both along strike and at depth. Drillhole JU24-097 provides an especially positive indication of the potential for extension of the RAM deposit, with its significant mineralisation and width representing the deepest intersection of the main mineralised horizon (“MMH”) to date at ICO. Additionally, the development of significant hangingwall (“HW”) intercepts across 2024 extensional drilling provides further strategic opportunity for cobalt resource growth.

Extensional drilling was conducted from a single underground drilling platform positioned within existing underground mine workings at ICO, with collar coordinates found in Table 1 included in the ASX announcement dated 31 July 20243F4.

Underground drilling at RAM highlighted appreciable grades, widths, and mineralisation continuity. The deepest intercept to date indicated strong upside potential of further resource extension at depth, which Jervois anticipates will be tested with future drilling.

Importantly, drilling demonstrated down-dip grade continuity along an interpreted orientation favourable to continued exploration by Jervois within its contiguous claim boundaries. This updated interpretation of the MMH in the southern extents of the RAM provides additional pathways to resource growth, previously believed to be limited to deep exploratory drilling, with additional moderate-depth extensional drilling at ICO. Greater continuity of HW mineralisation is also observed along this mineralised orientation based upon the 2024 drilling programme, indicating further resource growth opportunity.

Table 1: RAM DoD Agreement Funding extensional drilling results

|

Hole ID

|

From

(m)

|

To

(m)

|

Zone

|

True width*

(m)

|

Co grade

(%)

|

Cu grade

(%)

|

Au grade (g/t)

|

|

JU24-093

|

155.3

|

159.3

|

HW

|

3.8

|

0.48

|

1.74

|

1.131

|

|

JU24-093

|

174.4

|

176.5

|

MMH

|

1.8

|

1.10

|

1.18

|

0.686

|

|

JU24-093

|

200.6

|

203.7

|

FW

|

2.6

|

0.15

|

1.57

|

0.309

|

|

JU24-095

|

194.7

|

198.1

|

HW

|

2.7

|

0.38

|

0.22

|

0.274

|

|

JU24-095

|

207.1

|

212.8

|

MMH

|

4.8

|

0.18

|

0.34

|

0.103

|

|

JU24-095

|

264.0

|

266.3

|

FW

|

1.5

|

0.43

|

0.99

|

0.617

|

|

JU24-096

|

221.9

|

229.2

|

HW

|

5.2

|

1.40

|

1.38

|

2.229

|

|

JU24-096

|

241.4

|

244.3

|

MMH

|

2.1

|

0.48

|

0.60

|

0.857

|

|

JU24-097

|

393.6

|

405.0

|

MMH

|

5.5

|

0.61

|

1.35

|

1.509

|

* Calculated true widths determined for the composited intercept mid-point, perpendicular to the down-dip projection of the RAM deposit.

Jervois completed 2,500 metres of targeted resource expansion drilling across both its RAM and Sunshine deposits under the DoD Agreement Funding, as well as more than 350 metres of underground mine development in support of DoD Agreement Funding extensional drilling.

Amendments to the DoD Agreement Funding during the quarter allow about half of the ~US$1.0 million monthly ICO site holding costs to be reimbursed under the DoD Agreement Funding, utilising residual unallocated funds from the US$15.0 million budget for an expected six-month period, commencing 1 October 2024. Jervois is engaged with the DoD seeking an extension and expansion of DPA Title III support of ICO.

U.S. cobalt refinery study

During the quarter, work continued on the U.S. cobalt refinery BFS being conducted with AFRY USA LLC, with a design capacity of 6,000 mt per annum of cobalt in sulphate form, suitable for EVs. The facility design would be able to supply sufficient cobalt for approximately 1.2 million EVs per annum. The cobalt refinery BFS is fully refundable through the existing DoD Agreement Funding. The BFS continues to be expected to be completed in the fourth quarter 2024.

São MiguelPaulista (“SMP”) nickel and cobalt refinery, Brazil

SMP continues to deliver a cost-effective care and maintenance programme, and advance work focussed on maximising optionality for a restart of the refinery.

Corporate activities

In October 2024, the Company’s Chief Executive Officer, Mr. Bryce Crocker, attended the Minerals Security Partnership Finance Network forum in New York.

Exploration and development expenditure

No material cash expenditure on exploration and development was spent during the quarter.

Insider compensation reporting

During the quarter, US$0.1 million was paid to Non-Executive Directors and US$0.1 million was paid to the CEO (Executive Director).

By order of the Board

Bryce Crocker

Chief Executive Officer

For further information, please contact:

Forward-Looking Statements

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to restructure of the balance sheet, operations at Jervois Finland, future resource potential at ICO, U.S. refinery studies, reimbursement of funds to Jervois Mining USA Limited by the DoD, possible restart of the SMP refinery, and the reliability of third-party information, and certain other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules, and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Basis of preparation of financial information

Historical and forecast financial information

Financial information is prepared under Jervois Global Group accounting policies, which conform with Australian Accounting Standards and International Financial Reporting Standards (“IFRS”). The Jervois Finland financial results for the period post-acquisition are consolidated into the Jervois Global Group consolidated financial statements. All information presented is unaudited.

EBITDA for historical periods is presented as net income after adding back tax, interest, depreciation, and extraordinary items and is a non-IFRS/non-GAAP measure.

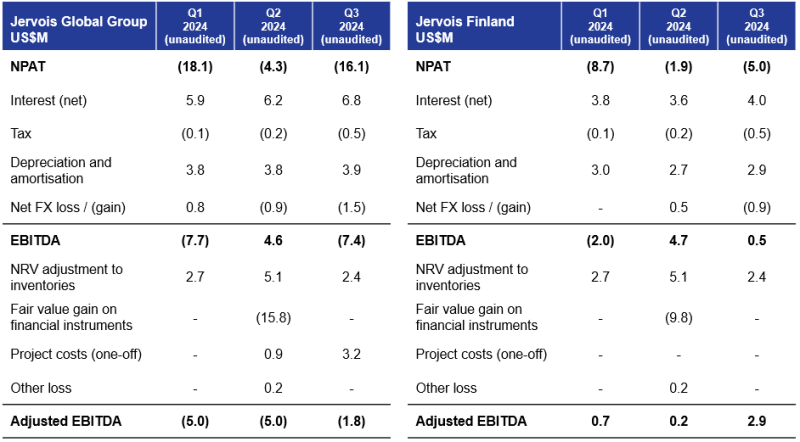

Reconciliation of net profit after tax (“NPAT”) to EBITDA and Adjusted EBITDA

EBITDA is a non-IFRS financial measure. EBITDA is presented as net income after adding back interest, tax, depreciation and amortisation, and extraordinary items. Adjusted EBITDA represents EBITDA adjusted to exclude items which do not reflect the underlying performance of the Company’s operations. Exclusions from adjusted EBITDA are items that require exclusion in order to maximise insight and consistency on the financial performance of the Company’s operations.

Exclusions include gains/losses on disposals, impairment charges (or reversals), certain derivative items, NRV adjustments to inventories, fair value adjustments on financial instruments, and one-off project-related costs.

Refer to the table below for a reconciliation of NPAT to EBITDA and Adjusted EBITDA.

Click Image To View Full Size

Tenements

Australian Tenements

|

0BDescription

|

|

1BTenement number

|

2BInterest owned %

|

|

Ardnaree (NSW)

|

|

EL 5527

|

100.0

|

|

Thuddungra (NSW)

|

|

EL 5571

|

100.0

|

|

Nico Young (NSW)

|

|

EL 8698

|

100.0

|

|

West Arunta (WA)

|

|

E80 4820

|

17.9

|

|

West Arunta (WA)

|

|

E80 4986

|

17.9

|

|

West Arunta (WA)

|

|

E80 4987

|

17.9

|

|

Idaho Cobalt Operations – 100% Interest owned

|

|

Claim Name

|

County #

|

IMC #

|

|

SUN 1

|

222991

|

174156

|

|

SUN 2

|

222992

|

174157

|

|

SUN 3 Amended

|

245690

|

174158

|

|

SUN 4

|

222994

|

174159

|

|

SUN 5

|

222995

|

174160

|

|

SUN 6

|

222996

|

174161

|

|

SUN 7

|

224162

|

174628

|

|

SUN 8

|

224163

|

174629

|

|

SUN 9

|

224164

|

174630

|

|

SUN 16 Amended

|

245691

|

177247

|

|

SUN 18 Amended

|

245692

|

177249

|

|

Sun 19

|

277457

|

196394

|

|

SUN FRAC 1

|

228059

|

176755

|

|

SUN FRAC 2

|

228060

|

176756

|

|

TOGO 1

|

228049

|

176769

|

|

TOGO 2

|

228050

|

176770

|

|

TOGO 3

|

228051

|

176771

|

|

DEWEY FRAC Amended

|

248739

|

177253

|

|

Powder 1

|

269506

|

190491

|

|

Powder 2

|

269505

|

190492

|

|

LDC-1

|

224140

|

174579

|

|

LDC-2

|

224141

|

174580

|

|

LDC-3

|

224142

|

174581

|

|

LDC-5

|

224144

|

174583

|

|

LDC-6

|

224145

|

174584

|

|

LDC-7

|

224146

|

174585

|

|

LDC-8

|

224147

|

174586

|

|

LDC-9

|

224148

|

174587

|

|

LDC-10

|

224149

|

174588

|

|

LDC-11

|

224150

|

174589

|

|

LDC-12

|

224151

|

174590

|

|

LDC-13 Amended

|

248718

|

174591

|

|

LDC-14 Amended

|

248719

|

174592

|

|

LDC-16

|

224155

|

174594

|

|

LDC-18

|

224157

|

174596

|

|

LDC-20

|

224159

|

174598

|

|

LDC-22

|

224161

|

174600

|

|

LDC FRAC 1 Amended

|

248720

|

175880

|

|

LDC FRAC 2 Amended

|

248721

|

175881

|

|

LDC FRAC 3 Amended

|

248722

|

175882

|

|

LDC FRAC 4 Amended

|

248723

|

175883

|

|

LDC FRAC 5 Amended

|

248724

|

175884

|

|

RAM 1

|

228501

|

176757

|

|

RAM 2

|

228502

|

176758

|

|

RAM 3

|

228503

|

176759

|

|

RAM 4

|

228504

|

176760

|

|

RAM 5

|

228505

|

176761

|

|

RAM 6

|

228506

|

176762

|

|

RAM 7

|

228507

|

176763

|

|

RAM 8

|

228508

|

176764

|

|

RAM 9

|

228509

|

176765

|

|

RAM 10

|

228510

|

176766

|

|

RAM 11

|

228511

|

176767

|

|

RAM 12

|

228512

|

176768

|

|

RAM 13 Amended

|

245700

|

181276

|

|

RAM 14 Amended

|

245699

|

181277

|

|

RAM 15 Amended

|

245698

|

181278

|

|

RAM 16 Amended

|

245697

|

181279

|

|

Ram Frac 1 Amended

|

245696

|

178081

|

|

Ram Frac 2 Amended

|

245695

|

178082

|

|

Ram Frac 3 Amended

|

245694

|

178083

|

|

Ram Frac 4 Amended

|

245693

|

178084

|

|

HZ 1

|

224173

|

174639

|

|

HZ 2

|

224174

|

174640

|

|

HZ 3

|

224175

|

174641

|

|

HZ 4

|

224176

|

174642

|

|

HZ 5

|

224413

|

174643

|

|

HZ 6

|

224414

|

174644

|

|

HZ 7

|

224415

|

174645

|

|

HZ 8

|

224416

|

174646

|

|

HZ 9

|

224417

|

174647

|

|

HZ 10

|

224418

|

174648

|

|

HZ 11

|

224419

|

174649

|

|

HZ 12

|

224420

|

174650

|

|

HZ 13

|

224421

|

174651

|

|

HZ 14

|

224422

|

174652

|

|

HZ 15

|

231338

|

178085

|

|

HZ 16

|

231339

|

178086

|

|

HZ 18

|

231340

|

178087

|

|

HZ 19

|

224427

|

174657

|

|

Z 20

|

224428

|

174658

|

|

HZ 21

|

224193

|

174659

|

|

HZ 22

|

224194

|

174660

|

|

HZ 23

|

224195

|

174661

|

|

HZ 24

|

224196

|

174662

|

|

HZ 25

|

224197

|

174663

|

|

HZ 26

|

224198

|

174664

|

|

HZ 27

|

224199

|

174665

|

|

HZ 28

|

224200

|

174666

|

|

HZ 29

|

224201

|

174667

|

|

HZ 30

|

224202

|

174668

|

|

HZ 31

|

224203

|

174669

|

|

HZ 32

|

224204

|

174670

|

|

HZ FRAC

|

228967

|

177254

|

|

JC 1

|

224165

|

174631

|

|

JC 2

|

224166

|

174632

|

|

JC 3

|

224167

|

174633

|

|

JC 4

|

224168

|

174634

|

|

JC 5 Amended

|

245689

|

174635

|

|

JC 6

|

224170

|

174636

|

|

JC FR 7

|

224171

|

174637

|

|

JC FR 8

|

224172

|

174638

|

|

JC 9

|

228054

|

176750

|

|

JC 10

|

228055

|

176751

|

|

JC 11

|

228056

|

176752

|

|

JC-12

|

228057

|

176753

|

|

JC-13

|

228058

|

176754

|

|

JC 14

|

228971

|

177250

|

|

JC 15

|

228970

|

177251

|

|

JC 16

|

228969

|

177252

|

|

JC 17

|

259006

|

187091

|

|

JC 18

|

259007

|

187092

|

|

JC 19

|

259008

|

187093

|

|

JC 20

|

259009

|

187094

|

|

JC 21

|

259010

|

187095

|

|

JC 22

|

259011

|

187096

|

|

CHELAN NO. 1 Amended

|

248345

|

175861

|

|

GOOSE 2 Amended

|

259554

|

175863

|

|

GOOSE 3

|

227285

|

175864

|

|

GOOSE 4 Amended

|

259553

|

175865

|

|

GOOSE 6

|

227282

|

175867

|

|

GOOSE 7 Amended

|

259552

|

175868

|

|

GOOSE 8 Amended

|

259551

|

175869

|

|

GOOSE 10 Amended

|

259550

|

175871

|

|

GOOSE 11 Amended

|

259549

|

175872

|

|

GOOSE 12 Amended

|

259548

|

175873

|

|

GOOSE 13

|

228028

|

176729

|

|

GOOSE 14 Amended

|

259547

|

176730

|

|

GOOSE 15

|

228030

|

176731

|

|

GOOSE 16

|

228031

|

176732

|

|

GOOSE 17

|

228032

|

176733

|

|

GOOSE 18 Amended

|

259546

|

176734

|

|

GOOSE 19 Amended

|

259545

|

176735

|

|

GOOSE 20

|

228035

|

176736

|

|

GOOSE 21

|

228036

|

176737

|

|

GOOSE 22

|

228037

|

176738

|

|

GOOSE 23

|

228038

|

176739

|

|

GOOSE 24

|

228039

|

176740

|

|

GOOSE 25

|

228040

|

176741

|

|

SOUTH ID 1 Amended

|

248725

|

175874

|

|

SOUTH ID 2 Amended

|

248726

|

175875

|

|

SOUTH ID 3 Amended

|

248727

|

175876

|

|

SOUTH ID 4 Amended

|

248717

|

175877

|

|

SOUTH ID 5 Amended

|

248715

|

176743

|

|

SOUTH ID 6 Amended

|

248716

|

176744

|

|

South ID 7

|

306433

|

218216

|

|

South ID 8

|

306434

|

218217

|

|

South ID 9

|

306435

|

218218

|

|

South ID 10

|

306436

|

218219

|

|

South ID 11

|

306437

|

218220

|

|

South ID 12

|

306438

|

218221

|

|

South ID 13

|

306439

|

218222

|

|

South ID 14

|

306440

|

218223

|

|

OMS-1

|

307477

|

218904

|

|

Chip 1

|

248956

|

184883

|

|

Chip 2

|

248957

|

184884

|

|

Chip 3 Amended

|

277465

|

196402

|

|

Chip 4 Amended

|

277466

|

196403

|

|

Chip 5 Amended

|

277467

|

196404

|

|

Chip 6 Amended

|

277468

|

196405

|

|

Chip 7 Amended

|

277469

|

196406

|

|

Chip 8 Amended

|

277470

|

196407

|

|

Chip 9 Amended

|

277471

|

196408

|

|

Chip 10 Amended

|

277472

|

196409

|

|

Chip 11 Amended

|

277473

|

196410

|

|

Chip 12 Amended

|

277474

|

196411

|

|

Chip 13 Amended

|

277475

|

196412

|

|

Chip 14 Amended

|

277476

|

196413

|

|

Chip 15 Amended

|

277477

|

196414

|

|

Chip 16 Amended

|

277478

|

196415

|

|

Chip 17 Amended

|

277479

|

196416

|

|

Chip 18 Amended

|

277480

|

196417

|

|

Sun 20

|

306042

|

218133

|

|

Sun 21

|

306043

|

218134

|

|

Sun 22

|

306044

|

218135

|

|

Sun 23

|

306045

|

218136

|

|

Sun 24

|

306046

|

218137

|

|

Sun 25

|

306047

|

218138

|

|

Sun 26

|

306048

|

218139

|

|

Sun 27

|

306049

|

218140

|

|

Sun 28

|

306050

|

218141

|

|

Sun 29

|

306051

|

218142

|

|

Sun 30

|

306052

|

218143

|

|

Sun 31

|

306053

|

218144

|

|

Sun 32

|

306054

|

218145

|

|

Sun 33

|

306055

|

218146

|

|

Sun 34

|

306056

|

218147

|

|

Sun 35

|

306057

|

218148

|

|

Sun 36

|

306058

|

218149

|

|

Chip 21 Fraction

|

306059

|

218113

|

|

Chip 22 Fraction

|

306060

|

218114

|

|

Chip 23

|

306025

|

218115

|

|

Chip 24

|

306026

|

218116

|

|

Chip 25

|

306027

|

218117

|

|

Chip 26

|

306028

|

218118

|

|

Chip 27

|

306029

|

218119

|

|

Chip 28

|

306030

|

218120

|

|

Chip 29

|

306031

|

218121

|

|

Chip 30

|

306032

|

218122

|

|

Chip 31

|

306033

|

218123

|

|

Chip 32

|

306034

|

218124

|

|

Chip 33

|

306035

|

218125

|

|

Chip 34

|

306036

|

218126

|

|

Chip 35

|

306037

|

218127

|

|

Chip 36

|

306038

|

218128

|

|

Chip 37

|

306039

|

218129

|

|

Chip 38

|

306040

|

218130

|

|

Chip 39

|

306041

|

218131

|

|

Chip 40

|

307491

|

218895

|

|

DRC NW 1

|

307492

|

218847

|

|

DRC NW 2

|

307493

|

218848

|

|

DRC NW 3

|

307494

|

218849

|

|

DRC NW 4

|

307495

|

218850

|

|

DRC NW 5

|

307496

|

218851

|

|

DRC NW 6

|

307497

|

218852

|

|

DRC NW 7

|

307498

|

218853

|

|

DRC NW 8

|

307499

|

218854

|

|

DRC NW 9

|

307500

|

218855

|

|

DRC NW 10

|

307501

|

218856

|

|

DRC NW 11

|

307502

|

218857

|

|

DRC NW 12

|

307503

|

218858

|

|

DRC NW 13

|

307504

|

218859

|

|

DRC NW 14

|

307505

|

218860

|

|

DRC NW 15

|

307506

|

218861

|

|

DRC NW 16

|

307507

|

218862

|

|

DRC NW 17

|

307508

|

218863

|

|

DRC NW 18

|

307509

|

218864

|

|

DRC NW 19

|

307510

|

218865

|

|

DRC NW 20

|

307511

|

218866

|

|

DRC NW 21

|

307512

|

218867

|

|

DRC NW 22

|

307513

|

218868

|

|

DRC NW 23

|

307514

|

218869

|

|

DRC NW 24

|

307515

|

218870

|

|

DRC NW 25

|

307516

|

218871

|

|

DRC NW 26

|

307517

|

218872

|

|

DRC NW 27

|

307518

|

218873

|

|

DRC NW 28

|

307519

|

218874

|

|

DRC NW 29

|

307520

|

218875

|

|

DRC NW 30

|

307521

|

218876

|

|

DRC NW 31

|

307522

|

218877

|

|

DRC NW 32

|

307523

|

218878

|

|

DRC NW 33

|

307524

|

218879

|

|

DRC NW 34

|

307525

|

218880

|

|

DRC NW 35

|

307526

|

218881

|

|

DRC NW 36

|

307527

|

218882

|

|

DRC NW 37

|

307528

|

218883

|

|

DRC NW 38

|

307529

|

218884

|

|

DRC NW 39

|

307530

|

218885

|

|

DRC NW 40

|

307531

|

218886

|

|

DRC NW 41

|

307532

|

218887

|

|

DRC NW 42

|

307533

|

218888

|

|

DRC NW 43

|

307534

|

218889

|

|

DRC NW 44

|

307535

|

218890

|

|

DRC NW 45

|

307536

|

218891

|

|

DRC NW 46

|

307537

|

218892

|

|

DRC NW 47

|

307538

|

218893

|

|

DRC NW 48

|

307539

|

218894

|

|

EBatt 1

|

307483

|

218896

|

|

EBatt 2

|

307484

|

218897

|

|

EBatt 3

|

307485

|

218898

|

|

EBatt 4

|

307486

|

218899

|

|

EBatt 5

|

307487

|

218900

|

|

EBatt 6

|

307488

|

218901

|

|

EBatt 7

|

307489

|

218902

|

|

EBatt 8

|

307490

|

218903

|

|

OMM-1

|

307478

|

218905

|

|

OMM-2

|

307479

|

218906

|

|

OMN-2

|

307481

|

218908

|

|

OMN-3

|

307482

|

218909

|

|

BTG-1

|

307471

|

218910

|

|

BTG-2

|

307472

|

218911

|

|

BTG-3

|

307473

|

218912

|

|

BTG-4

|

307474

|

218913

|

|

BTG-5

|

307475

|

218914

|

|

BTG-6

|

307476

|

218915

|

|

NFX 17

|

307230

|

218685

|

|

NFX 18

|

307231

|

218686

|

|

NFX 19

|

307232

|

218687

|

|

NFX 20

|

307233

|

218688

|

|

NFX 21

|

307234

|

218689

|

|

NFX 22

|

307235

|

218690

|

|

NFX 23

|

307236

|

218691

|

|

NFX 24

|

307237

|

218692

|

|

NFX 25

|

307238

|

218693

|

|

NFX 30

|

307243

|

218698

|

|

NFX 31

|

307244

|

218699

|

|

NFX 32

|

307245

|

218700

|

|

NFX 33

|

307246

|

218701

|

|

NFX 34

|

307247

|

218702

|

|

NFX 35

|

307248

|

218703

|

|

NFX 36

|

307249

|

218704

|

|

NFX 37

|

307250

|

218705

|

|

NFX 38

|

307251

|

218706

|

|

NFX 42

|

307255

|

218710

|

|

NFX 43

|

307256

|

218711

|

|

NFX 44

|

307257

|

218712

|

|

NFX 45

|

307258

|

218713

|

|

NFX 46

|

307259

|

218714

|

|

NFX 47

|

307260

|

218715

|

|

NFX 48

|

307261

|

218716

|

|

NFX 49

|

307262

|

218717

|

|

NFX 50

|

307263

|

218718

|

|

NFX 56

|

307269

|

218724

|

|

NFX 57

|

307270

|

218725

|

|

NFX 58

|

307271

|

218726

|

|

NFX 59

|

307272

|

218727

|

|

NFX 60 Amended

|

307558

|

218728

|

|

NFX 61

|

307274

|

218729

|

|

NFX 62

|

307275

|

218730

|

|

NFX 63

|

307276

|

218731

|

|

NFX 64

|

307277

|

218732

|

|

|

|

|

OMN-1 revised

|

315879

|

228322

|

1 EBITDA is a non-IFRS financial measure. EBITDA is presented as net income after adding back interest, tax, depreciation and amortisation, and extraordinary items. Adjusted EBITDA represents EBITDA adjusted to exclude items which do not reflect the underlying performance of the Company’s operations. Exclusions from Adjusted EBITDA are items that require exclusion in order to maximise insight and consistency on the financial performance of the Company’s operations. Exclusions include gains/losses on disposals, impairment charges (or reversals), certain derivative items, NRV adjustments to inventories (or reversals), fair value adjustments on financial instruments, and one-off project-related costs. Refer to the “Basis of preparation of financial information” section for a reconciliation of NPAT to EBITDA and Adjusted EBITDA.

2 Drawn senior debt represents the aggregate of amounts drawn under Jervois’ senior debt facilities (excludes Unsecured Convertible Notes that mature in July/August 2028). Amounts represent the nominal loan amounts; balances recorded in Jervois’ financial statements under International Financial Reporting Standards will differ.

3 See JRV ASX Announcements dated 9 May 2024, 22 July 2024, 21 August 2024, 2 September 2024, 16 October 2024.

4 In accordance with ASX listing rule 5.23.2, Jervois confirms it is not aware of any new information or data that materially affects the information included in the relevant market announcements referred to above and that the assumptions contained therein continue to apply and have not materially changed.

Copyright (c) 2024 TheNewswire - All rights reserved.