(TheNewswire)

Vancouver, British Columbia – TheNewswire – December 4, 2024: GSP Resource Corp. (TSX-V: GSPR / FSE: 0YD / OTC: GSRCF) (the “Company” or “GSP”) announces the completion of its initial mineral resource estimate (“2024 Alwin MRE” or “MRE”) with respect to the Alwin Copper-Silver-Gold Project (the “Alwin Project”) in southwestern British Columbia, Canada. The 2024 Alwin MRE provides the first comprehensive analysis of the Alwin Project’s potential as an open pit resource which is a significant advancement of the project which had previously only been considered for underground mining. The Alwin Project is situated in the Highland Valley Copper (“HVC”) camp, surrounded by mineral title controlled by Teck Resources’ HVC operations, which is comprised of several presently and past producing open pit mining operations.

Highlights:

-

Inferred Mineral Resource comprising 1.46 million tonnes (Mt) tonnes, average grading of 1.08% copper (Cu), yielding 34.6 million pounds of Cu;

-

Multiple high-grade zones; with 66% of the contained Cu amenable to open pit and 34% by underground mining;

-

Significant Potential for resource expansion of underexplored surface zones within pit, along strike, and at depth below the pit; and

-

Potential for significant gold-silver contribution with additional drilling as highlighted by historic and recent gold-silver intercepts (see GSP news release dated August 19, 2024).

The 2024 Alwin MRE comprises an inferred mineral resource of 34.6 million pounds of Cu at an average grade of 1.08 % Cu within 1.46 Mt. Tables 1 and 2 present the complete 2024 Alwin MRE statement and cut-off sensitivities, respectively. The effective date of the 2024 Alwin MRE is September 16, 2024, and a technical report relating to the MRE will be filed on SEDAR+ within 45 days of this news release. The 2024 Alwin MRE was prepared by APEX Geoscience Ltd.

Significant Exploration Potential at Alwin Project:

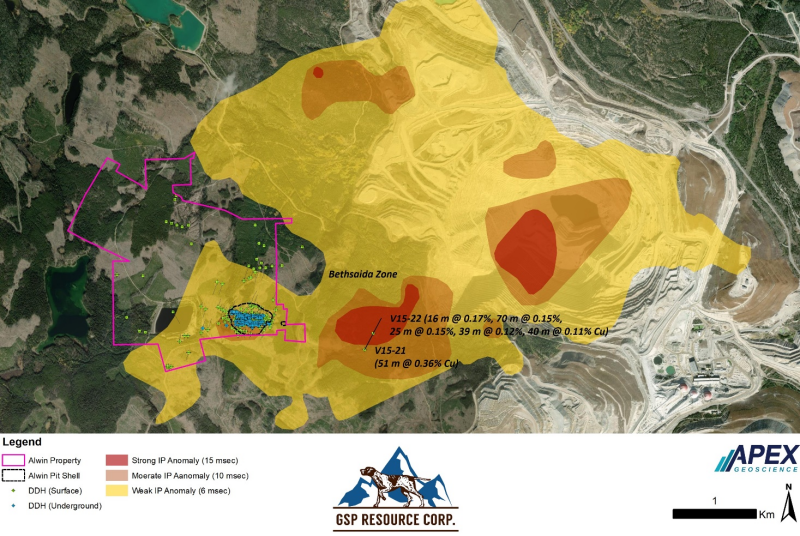

The Alwin Project has significant exploration upside with the potential to grow open pit mineralization along strike and at depth as well as several underexplored porphyry style copper targets hosted both on GSP’s Alwin claims, as well as the Company’s 100% owned Mer Claims, approximately 2 km NW of the Alwin Project. Publicly available exploration data from HVC’s adjacent claims shows that historic IP anomalies coincident with HVC operations and exploration drill targets extend westward onto the Alwin claims. Notably, 2015 diamond drilling of these IP anomalies by Teck Resources at the Bethsaida Zone located 700 metres east of Alwin yielded significant intercepts of porphyry style copper mineralization1 (see Figure 1 below).

Figure 1: Plan Map of Alwin Project and HVC IP anomalies / Drilling

Click Image To View Full Size

Simon Dyakowski, CEO of GSP commented, “We are excited to provide this initial resource estimate for the Alwin Project, which is a significant mineral endowment of copper, a critical mineral located 1.5 kilometers west of Teck Resources’ Highland Valley Copper operations. While Alwin was well known as a high-grade copper underground past producer, we have now established the significant open pit potential of the Project. This resource estimate provides an excellent foundation for continued resource expansion.”

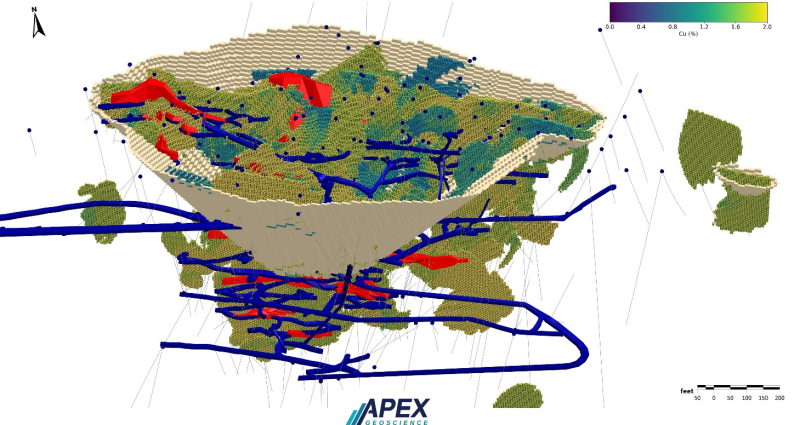

Figure 2: Oblique View of Alwin Mine MRE Pit Shell (beige) and Copper Block Model (gradational colour bar), historic underground development (blue), and backfilled stopes (red)

Click Image To View Full Size

Table 1 Summary of Inferred Mineral Resources on the Alwin Project. (1-9)

|

Cut-off

|

Classification

|

Tonnes

|

Cu

|

Cu

|

|

Cu (%)

|

(t)

|

(%)

|

(Mlbs)

|

|

Pit-Constrained Mineral Resource Estimate

|

|

0.2

|

Inferred

|

918,326

|

1.13

|

22.9

|

|

Underground Mineral Resource Estimate

|

|

0.8

|

Inferred

|

536,730

|

0.98

|

11.7

|

|

Total Mineral Resource Estimate

|

|

0.2/0.8

|

Inferred

|

1,455,056

|

1.08

|

34.6

|

Notes:

1. Warren Black, M.Sc., P.Geol., P.Geo., Senior Consultant, Mineral Resources of APEX Geoscience Ltd., who is deemed a qualified person as defined by NI 43-101 is responsible for the completion of the mineral resource estimation, with an effective date of September 16, 2024.

2. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

4. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

5. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

6. Historical mined areas were removed from the block-modelled Mineral Resources.

7. Economic assumptions used include US$4.30/lbs Cu, process recoveries of 95% for Cu, a US$15/t processing cost, and a G&A cost of US$2/t.

8. The constraining pit optimization parameters were US$2.0/t mineralized and waste material mining cost and 45° pit slopes. Pit-constrained Mineral Resources are reported at a Cu cutoff of 0.2%.

9. The Underground Mineral Resources include blocks below the constraining pit shell that form continuous and potentially minable shapes. A mining cost of US$58/t and the economic assumptions above result in the out-of-pit Cu cutoff of 0.8%. Mining shapes encapsulate material within domains with a minimum horizontal width of 4 feet, perpendicular to strike, and target vertical and horizontal dimensions of approximately 50 feet. A “take all” approach was used where all material within the mining shapes is reported, regardless of whether the estimated grades are above the optimized cutoff grade.

Table 2 Sensitivities of the Pit-Constrained 2024 Alwin MRE.

|

Cut-off

|

Classification

|

Tonnes

|

Cu

|

Cu

|

|

Cu (%)

|

(t)

|

(%)

|

(Mlbs)

|

|

0.1

|

Inferred

|

1,102,961

|

0.967

|

23.5

|

|

0.2

|

Inferred

|

918,326

|

1.132

|

22.9

|

|

0.3

|

Inferred

|

791,865

|

1.273

|

22.2

|

|

0.4

|

Inferred

|

695,777

|

1.400

|

21.5

|

|

0.5

|

Inferred

|

616,910

|

1.522

|

20.7

|

|

0.6

|

Inferred

|

548,999

|

1.642

|

19.9

|

|

0.8

|

Inferred

|

440,117

|

1.877

|

18.2

|

|

1

|

Inferred

|

360,509

|

2.094

|

16.6

|

|

2

|

Inferred

|

150,032

|

3.052

|

10.1

|

2024 Mineral Resource Estimation Methodology

Modelling was conducted in the historical mine grid (MG) feet system. The MRE utilized a block model with a size of 10.0 feet (X) by 10.0 feet (Y) by 10.0 feet (Z) to honour the mineralization wireframes for estimation. Copper (Cu) grades were estimated for each block using Ordinary Kriging (OK) with locally varying anisotropy (LVA) to ensure grade continuity in various directions are reproduced in the block model. For the purposes of the pit shell optimization, blocks along the estimation domain boundaries that partially contain waste were diluted by estimating a waste value using composites within a transition zone along the outer boundary of the estimation domains. The final diluted copper grade for the partially diluted model assigned to each block is a volume-weighted average of the estimated copper and waste copper values. The MRE is reported within that pit shell and using the diluted gold grades.

The 2024 Alwin MRE drillhole database consists of a total of 387 drillholes that intersect the mineralization domains. There is 8730.08 feet (ft) of drilling within the estimation domains. Any sample intervals with explicit documentation that drilling did not return enough material to allow for analysis are classified as insufficient recovery (IR) and left blank. Portions of the drillholes not sampled, samples with unknown detection limits and/or assay methodologies and in the database as zero are assumed to be unmineralized. These intervals are assigned a nominal waste value, set at half the detection limit of modern assay methods.

The Alwin Project features steep vertical zones of brecciation and sheared quartz monzonite due to faulting. Copper mineralization, primarily bornite and chalcopyrite with minor chalcocite, occurs as bled and clots of the copper sulphide minerals within altered quartz monzonite. The Alwin Project comprises 22 estimation domains, averaging 6 ft in thickness, with some up to 44 ft thick. The domains strike roughly 85-degree azimuth and dipping 75 degrees south.

Wireframes of historical workings and stopes were used to extract the volume of material previously mined for depletion purposes. APEX also created a topographic surface that honors the historical surface drilling. All mineralization wireframes were clipped above the top of the topographic surfaces.

Copper estimation was completed using Ordinary Kriging. The search ellipsoid size used to estimate the Cu grades was defined by the modelled variograms. Block grade estimation employed locally varying anisotropy, which uses different rotation angles to define the principal directions of the variogram model and search ellipsoid on a per-block basis. Blocks within estimation domains are assigned rotation angles using a modelled 3D mineralization trend surface wireframe, which allows structural complexities to be reproduced in the estimated block model. The number of variogram structures, contributions of each structure, and their ranges are set per estimation domain and do not vary within the estimation domain.

The 2024 Alwin MRE was assigned a single bulk density value of 2.65 g/cm3. This value was applied to mineralization and host rock blocks in the 2024 Alwin MRE block model. The density value was determined from the literature and is based on the mineralization type and host rock. An overburden surface was modeled using information from the Alwin drillhole geologic logs. A density of 1.8 g/cm3 was assigned to any block above the overburden surface in the 2024 Alwin MRE block model.

The reported open-pit resources utilize a cutoff of 0.2 % Cu. The resource block model underwent several pit optimization scenarios using Deswik’s Pseudoflow pit optimization. The resulting pit shell is used to constrain the reported open-pit resources. The reported Out-of-Pit MRE is constrained within mining shapes, assuming a long-hole open stope mining method and a grade cutoff of 0.8% Cu. The mining shapes were manually constructed, constraining contiguous material above the copper cutoff that met the minimum thickness and volume requirements.

There are no other known factors or issues known by the Qualified Person that materially affect the MRE other than normal risks faced by mining projects. The Alwin Project is subject to the same types of risks that large base metal projects experience at an early stage of development in Canada. The nature of the risks relating to the Project will change as the Project evolves and more information becomes available. The Company has engaged experienced management and specialized consultants to identify, manage and mitigate those risks.

About the Alwin Mine Project

The Alwin Mine Copper-Silver-Gold property is approximately 344 hectares and is located on the semi-arid, interior plateau in south-central British Columbia. The historic underground mine was developed over 500 m long by 200 m wide by 300 m deep. Production took place between 1916 to 1981 from five major subvertical high-grade copper mineralization zones totaling 233,100 tonnes that milled 3,786 tonnes of copper, 2,729 kilograms of silver and 46.2 kilograms of gold. The average diluted head grade was 1.5% copper.

The Alwin Project is adjacent with the western boundary of Teck Resources’ Highland Valley Mine, the largest open-pit porphyry copper-molybdenum mine in western Canada. Alteration and mineralization of the Highland Valley hydrothermal system extends westward from the Highland Valley mine onto the Alwin Project (see GSP’s news release dated January 30, 2020).

Qualified Person: The scientific and technical information contained in this news release has been reviewed and approved by Kristopher J. Raffle, P.Geo. (B.C.), principal and consultant of APEX Geoscience Ltd. of Edmonton, AB, a consultant to the Company and a “qualified person” as defined in National Instrument 43-101 — Standards of Disclosure for Mineral Projects. Mr. Raffle has verified the data disclosed, which includes a review of the sampling, analytical and test data underlying the information and opinions contained herein.Mineralization hosted on nearby properties is not necessarily indicative of mineralization that may be hosted on the Alwin Project.

National Instrument 43-101 Technical Report

An independent technical report prepared and authored by APEX Geoscience Ltd.,for the Alwin Project will be prepared in accordance with National Instrument 43-101 and will be filed on SEDAR+ at www.sedarplus.ca and on the GSP Resource Corp. website within 45 days of this news release. Readers are encouraged to read the technical report in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

About GSP Resource Corp.

GSP Resource Corp. is a mineral exploration & development company focused on projects located in Southwestern British Columbia. The Company has an option to acquire a 100% interest and title to the Alwin Mine Copper-Gold-Silver Property in the Kamloops Mining Division, as well as an option to acquire 100% interest and title to the Olivine Mountain Property in the Similkameen Mining Division, of which it has granted an option to earn a 60% interest to a third party.

For more information, please contact:

Simon Dyakowski, Chief Executive Officer & Director

Tel: +1 (604) 619-7469

Email: simon@gspresource.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains “forward‐looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, completing ongoing and planned work, advancing the Alwin Project, completing and filing a technical report relating to the MRE, other statements relating to the technical, financial and business prospects of the Company, its projects and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses, and those filed under the Company’s profile on SEDAR+ at www.sedarplus.ca. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather or climate conditions, failure to maintain all necessary government permits, approvals and authorizations, failure to obtain or maintain community acceptance (including First Nations), decrease in the price of copper, gold, silver and other metals, increase in costs, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

1Mineralization hosted on nearby properties is not necessarily indicative of mineralization that may be hosted on the Alwin Project.

Copyright (c) 2024 TheNewswire - All rights reserved.