New version of market-leading solution further simplifies time-consuming process and supports more payment types

Pegasystems Inc. (NASDAQ: PEGA), the Enterprise Transformation Company™, today introduced the next generation version of its market-leading Pega Smart Dispute™ offering, including new generative AI and automation features that helps banks accelerate resolution of disputes and fraud claims for any type of payment. With the new Pega Smart Dispute Enterprise Edition, banks can now resolve complex disputes and claims even faster across a wider range of payment types, all through a single, powerful, and time-tested Pega solution.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241211846627/en/

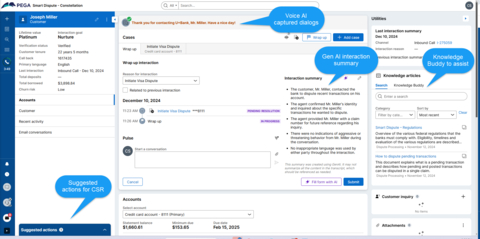

This screenshot of Pega Smart Dispute Enterprise Edition highlights how new Pega GenAI capabilities help the service representative accelerate a credit card transaction dispute. (Photo: Business Wire)

Banks worldwide are facing a massive surge in chargeback requests, which are costly and time-consuming to process. Research firm Datos Insights found customers disputed $11 billion worth of charges in the U.S. last year alone, with this figure expected to rise 40% by 2026. The adoption of alternative payment methods beyond Visa and Mastercard has surged in recent years with significant growth in mobile wallet payments, peer-to-peer payments, buy now pay later (BNPL), and real/near-real time payment systems. Banks must navigate this ever-growing array of global and regional payment types while working across a complex web of evolving chargeback policies, often across siloed systems.

Any payment type, unified under one solution

Trusted for decades by dozens of the top global banks to handle card payment disputes, Pega Smart Dispute Enterprise Edition can now process any possible payment type more efficiently and effectively with gen AI and expanded automation capabilities.

By tapping into Pega GenAI Blueprint™ – the workflow design platform launched earlier this year – users can extend Pega Smart Dispute Enterprise Edition to support new payment types in just seconds using natural language prompts. This means banks can easily support emerging, regional, or niche payment types as quickly as they come to market. Pega leverages its 20 years of extensive chargeback experience and the power of gen AI to automate new payment workflow creation. This complements existing out-of-the-box support for more established payment types, such as Visa, Mastercard, American Express, Zelle, and others, all under one centralized disputes platform.

Even more automation & guidance

In addition, Pega has added a suite of AI agents that infuse even more automation and guidance through every step, including:

- Intelligent guidance:Pega GenAI Coach™ gives employees an always-on mentor within Pega Smart Dispute Enterprise Edition to help optimize their work and overcome roadblocks.

- Fast and accurate data retrieval: Pega Knowledge Buddy™ gives employees quick and accurate answers to dispute processing questions using Retrieval Augmented Generation-based gen AI.

- Other gen-AI agent assistance: Additional gen AI agents help employees process disputes smarter and faster, including instant summaries of customer calls via Pega Voice AI™ or instant summaries of client claims and dispute histories with Pega GenAI™.

Additional enhancements

- Pega has enhanced the underlying architecture of Pega Smart Dispute in the new Enterprise Edition to accelerate new deployments, provide greater flexibility, streamline design of new payment types, and enable increased use of AI and automations.

- A new user interface provides a more responsive, accessible, and modern look and feel as well as a streamlined user experience for faster processing of customer disputes and fraud.

- Enhanced integrations with Pega’s DX API capabilities make it easier to extend chargeback request functionality to any channel, including self-service over mobile or web, as well as phone and chat agents.

- Pega Smart Dispute Enterprise Edition now comes integrated with market-leadingPega Customer Service™, enabling agents to leverage Pega’s customer service capabilities to seamlessly provide additional service actions tied to disputes and fraud.

- Pega will continue to make timely updates to the solution with the latest compliance rules for Visa, American Express, and Mastercard.

Longtime market leader Pega Smart Dispute manages all aspects of the payment dispute and exception processes in a unified solution. It both guides employees and automates processes to increase efficiency, customer satisfaction, and compliance. Built on Pega’s leading low-code platform, Pega Smart Dispute enables clients to rapidly adapt to changing conditions and handle new payment types.

Pega Smart Dispute Enterprise Edition is available today. Some AI features may require additional licensing. For more information, visit: www.pega.com/industries/financial-services/smart-dispute.

Quotes & Commentary:

“With the rapid growth in chargeback disputes, banks must be increasingly quick and nimble to keep up with customer demands,” said Steve Morgan, global banking industry lead, Pega. “By infusing new powerful gen AI and automation capabilities across our market-leading payment dispute solution, Pega is helping banks increase efficiency and bring faster resolutions to customers.”

Supporting Resources:

About Pegasystems

Pega is The Enterprise Transformation Company that helps organizations Build for Change® with enterprise AI decisioning and workflow automation. Many of the world’s most influential businesses rely on our platform to solve their most pressing challenges, from personalizing engagement to automating service to streamlining operations. Since 1983, we’ve built our scalable and flexible architecture to help enterprises meet today’s customer demands while continuously transforming for tomorrow. For more information on Pega (NASDAQ: PEGA), visit www.pega.com

All trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241211846627/en/