Getting in on the stock market has never been easier, but understanding the barriers to entry can help investments pay off.

Either you’ve seen a company’s performance, or you want to know how to get into a promising market, you just want in on the stock investing action.

There’s no such thing as a sure bet, but knowing where to look makes it easier and the first step is knowing how to get started. From all the different blogs, forums, and web pages out there, it can be a challenge to find meaningful answers.

An online investment account can be one of the best ways for beginner investors to learn how to manage stocks or mutual funds. You can even invest money for the price of just one stock share through many brokerage accounts, and brokers can even give you access to stock market simulators (or paper trading) that let you learn how to buy and sell shares without the commitment.

The costs to invest in stocks

Brokers charge a fee for their services, like purchases, stock trades or options, account maintenance, data costs, etc. These fees can be incorporated as an annual expense ratio into your funds, added on as a stock trading commission when you buy or sell, charged as a brokerage fee on your investment account, or levied by an advisor.

There are other types of investment fees, such as mutual fund transaction fees, sales loads, management fees and TFSA/RRSP/401(k) fees.

Step 1: Selecting a broker

Being an investor doesn’t necessarily mean following a stock day-to-day. You can be as casual or hands-on as suits your comfort.

Your first step is to find a broker that aligns with your investing goals. From long-term buy-and-hold newbies to active and sophisticated day traders, different brokers are optimized for different types of investors. Once you determine your level of engagement with investments, it’s time to pick a broker.

Wealthsimple Inc. has more than 1.5 million clients in Canada and offers a number of services including an automated investing service, a peer-to-peer cash transfer platform, as well as cryptocurrency and tax services.

InteractiveBrokers has clients in more than 200 countries and territories trade stocks, options, futures, currencies, bonds, funds and more on 150 global markets from a single unified platform.

TD Direct Investing is much like the other two and offers a range of products and account types to suit the needs and goals of its clients, as well as an educational tool to help novices understand the investing game.

After opening an account, you’ll need to plan an investment strategy. That means setting a budget and picturing the long-term desire, then managing the portfolio.

Many experts in the field will advise you to have a diverse set of different investments in a single portfolio. You can even put several funds together to build a diversified portfolio. For example, tech, mining, retail, oil and gas, etc. Also, stay engaged with your investment regardless of how the market is doing, be they good times or bad.

If you want to choose stocks and stock funds on your own, you will need to choose the right account for your needs and compare your stock investments.

If you want some help and have an expert to manage the process for you, a robo-advisor service offers low-cost investment management.

Guided by your risk tolerance and financial goals, robo-advisors use algorithms based on your risk tolerance to create and manage your investment portfolio. Most major brokerage firms and many independent advisors offer these services.

“Never leave free money on the table” is an age-old adage for a reason and when it comes to employers matching TFSA/RRSP/401(k) accounts, many beginners use this as their entry to investing. Essentially, making regular contributions with a long-term view is one of the essential themes of investing. Many of these accounts offer a limited selection of stock mutual funds, but not access to individual stocks.

The two avenues to investment you’ll want to keep your eye on is through mutual funds and individual stocks.

Stock mutual funds or exchange-traded funds:

You can purchase small pieces of many different stocks in a single transaction with a stock mutual fund (also called equity mutual funds). Index funds and ETFs are types of mutual funds that can track an index; for example, an S&P 500 fund replicates that index by buying the stock of the companies in it. When you invest in a fund, you also own small pieces of each of its companies.

Top ETFs to consider:

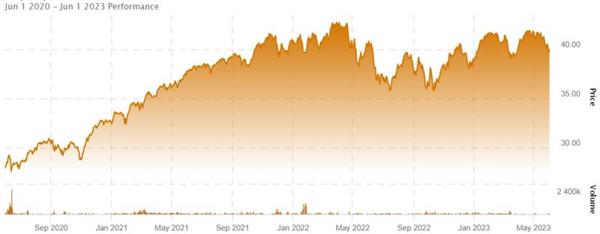

Vanguard Investments Canada Inc Vanguard FTSE Canada All Cap Index ETF stock chart – June 2020 to June 2023.

Vanguard Investments Canada Inc Vanguard FTSE Canada All Cap Index ETF stock chart – June 2020 to June 2023.

Vanguard FTSE Canada All Cap Index ETF (TSX:VCN): Tracks the performance of FTSE Canada All Cap Domestic Index or the Benchmark. The Index is a market capitalization-weighted index representing the performance of Canadian large, mid, and small capitalization companies.

iShares Core S&P/TSX Capped Composite Index ETF (TSX:XIC): Provides long-term capital growth by replicating the performance of the S&P/TSX Capped Composite Index net of expenses.

BMO S&P/TSX Capped Composite Index ETF (TSX:ZCN): Replicates the performance of the SPTSX Capped Composite Index net of expenses.

Stock mutual funds are inherently diversified, which lessens risk, though on the other hand, they aren’t likely to skyrocket like a specific company could.

Individual stocks:

Buying single shares, or a few shares of a company can be a way to test the waters. However, individual stocks have ups and downs as the company and the market it does business in fluctuates. Building a portfolio of specific stocks is usually left to the more seasoned investor. Buying into one company on the hopes of serious dividends is not much different than getting rich from the lottery.

Step 2: Understand your stock investing risk tolerance

Ever heard of no risk, no reward? The risk tolerance is a degree of which an investor is willing to endure market volatility and its impact on the value of an investment.

Risk tolerance is an important facet to investing and no beginner should fear a low tolerance, as it can determine the type and number of investments that you choose. Know the risks, every stock has its share and investing takes patience.

You can gauge your own level of risk with an online calculator or by speaking with a financial planner.

Step 3: Define your investment goals

The amount of money you need to buy an individual stock depends on how expensive the shares are. (Share prices can range from just a few cents to a few thousand dollars.)

If you want mutual funds on a small budget, an exchange-traded fund (ETF) may work for you. Mutual funds often have minimums of $1,000 or more, but ETFs trade like a stock, which means you purchase them for a share price.

Where to invest right now:

Here are a couple of stocks that are popular among our audience, the most expensive one is still under C$20:

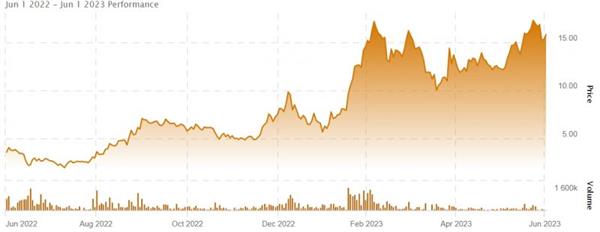

Patriot Battery Metals Inc. (TSXV:PMET) stock chart June 2022 to June 2023.

Patriot Battery Metals Inc. (TSXV:PMET) stock chart June 2022 to June 2023.

Patriot Battery Metals Inc. (TSXV: PMET) is a mineral exploration company focused on the acquisition and development of battery, base, and precious metal properties. It holds interests in multiple projects across Canada and the United States.

RevoluGROUP Canada Inc. (TSXV:REVO) is a multinational financial technology company active in banking, remittances, forex payments, esports, travel and blockchain, among others.

New Found Gold Corp. (TSXV:NFG) is a mineral exploration company engaged in the acquisition, exploration and evaluation of resource properties with a focus on gold properties located in the provinces of Newfoundland and Labrador and Ontario.

Conclusion

It can appear daunting for novice investors to take stock of how to manage everything, but once the approach is set, everything else, from the kind of account that makes sense, to how much money you should invest, and what to expect in return, can all fall into place.

For the latest in what’s trending across North American markets, visit the Stockhouse trending news page here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.