Blue Sky Uranium Stocks (TSXV:BSK) launched a $1.5 million non-brokered private placement to help secure its leading position in Argentina.

The company will issue up to 20 million units at $0.075 per unit. Each unit consists of one common share and one transferrable common share purchase warrant. Each warrant will entitle the holder to purchase one common share at an exercise price of $0.12 for three years from the date of issue. All securities issued will be subject to a statutory four-month hold period and directors, officers and employees of the company may join a portion of the financing.

The proceeds will be used to fund exploration programs on the company’s projects in Argentina, such as its flagship Amarillo Grande Project in central Rio Negro Province.

Amarillo Grande was an in-house discovery of a new district that has the potential to be a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier.

From the mid-1950s until 1999, Argentina produced uranium and active exploration/evaluation of deposits has picked up again under a renewed national nuclear agenda.

Defined mineralisation at Amarillo Grande was found in three target areas (Ivana, Anit, and Santa Barbara) at, or very near the surface along a 145 kilometre-long trend.

Surface exploration, ground geophysics, pit sampling and more than 9,000 metres of reverse circulation drilling were completed at the project since the beginning of the revitalized work program in 2016.

The National Atomic Energy Commission (CNEA) launched Uranium exploration activities and the industry is owned by the State. Under the mining code, the government has the first option to purchase all uranium produced in Argentina and that export of uranium is dependent upon first guaranteeing domestic supply. Development activities are also under the government’s purview, in an effort to maintain international standards for environmental practices.

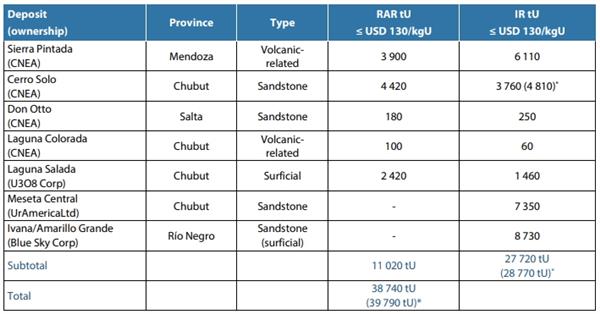

While governmental studies have found no material change among conventional resources, new inferred resources of 8,730 tU from the Ivana deposit (Amarillo Grande project) have been reported.

Identified uranium resources in Argentina (as of Jan. 1, 2019):

* tU for production cost category of <260 USD/kgU. Source: International Atomic Energy Agency / Nuclear Energy Agency.

* tU for production cost category of <260 USD/kgU. Source: International Atomic Energy Agency / Nuclear Energy Agency.

In December 2018, Blue Sky completed its first set of process design tests for the Ivana uranium-vanadium mill.

Source: Blue Sky Uranium Corp.

Source: Blue Sky Uranium Corp.

The company reported 85 per cent uranium from overall process plant recovery (derived from 89 per cent leach feed preparation recovery and 95 per cent subsequent alkaline leach circuit recovery); and 53 per cent for vanadium (derived from 89 per cent leach feed preparation recovery and 60 per cent subsequent alkaline leach circuit recovery).

In its most recent update for investors, Blue Sky announced that the process design test work program was advancing for Ivana, with uranium / vanadium leach tests underway for a second 294 kilogram bulk sample averaging 530ppm U3O8 , prepared from reverse circulation chips from the deposit.

The optimized leach conditions were 60 g/L Na2CO3 and 10 g/L NaHCO3, at 95°C for eight hours. For these new tests, uranium recovery for the alkaline leach stage was 96 per cent, vanadium recovery was 35 per cent. The team is preparing for testing membrane filtration media, the next step in the milling process. Four litres of leach solution have been prepared for the small-scale membrane filtration tests. Also, scout drilling results from Ivana Central were reported for a program launched in 2020, suspended because of the pandemic, then completed in 2022. The program drilled 2,607 metres across 43 scout holes.

A leader in uranium discovery in Argentina, Blue Sky Uranium Corp. is well on its way to advancing Amarillo Grande toward being a potential future leading domestic supplier of uranium to the growing Argentine market and a new international market supplier.

Blue Sky Uranium Corp. (BSK) opened trading at $0.075 per share.

To view or participate in the Blue Sky Uranium Corp. Deal Room offering, click here.

The Deal Room: your destination to participate in exclusive financings, featuring some of the best companies – and deals – currently available on the market.

FULL DISCLOSURE: The Market Herald is not registered as a broker, dealer, exempt market dealer, or any other registrant in any securities regulatory jurisdiction and will not be performing any registerable activity as defined by the applicable regulatory bodies. This deal room is for informational purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. Offers to sell, or the solicitations of offers to buy, any security can only be made through official offering documents that contain important information about risks, fees, and expenses. The information contained in this deal room is selective and does not purport to contain all the information relating to Blue Sky Uranium Corp. in all cases, parties should conduct their own investigation and due diligence, not rely solely on the data provided herein and are encouraged to consult with a financial adviser, lawyer, accountant, and any other professional that can help to understand and assess the risks associated with any investment opportunity.