- Alamos Gold announced it will acquire all of the issued and outstanding shares of Argonaut Gold in a friendly takeover

- This is expected create one of Canada’s largest, lowest cost and most profitable gold mines, expected to produce around 280,000 ounces this year

- Using shared infrastructure, Alamos expects to unlock immediate and long-term synergies expected to total US$515 million

- Alamos Gold stock opened at C$18.60 per share and Argonaut Gold stock opened at $0.37 per share

Alamos Gold (TSX:AGI) announced it will acquire all of the issued and outstanding shares of Argonaut Gold (TSX:AR) in a friendly takeover.

Based on the midpoint of Alamos’ and Argonaut’s 2024 production guidance, the two stated that this is expected to create one of Canada’s largest, lowest cost and most profitable gold mines. The combined Magino and Island Gold mines are expected to produce around 280,000 ounces this year and increase to more than 400,000 ounces per year at first quartile costs, once the third phase of its expansion is finished in 2026.

Combined near-term gold production is expected to increase approximately 25 percent to more than 600,000 ounces per year, with longer term growth potential to more than 900,000 ounces per year, at declining costs.

Using shared infrastructure, Alamos expects to unlock immediate and long-term synergies expected to total US$515 million.

Argonaut’s assets in the United States and Mexico will be spun out to its existing shareholders as a new junior gold producer that will own the Florida Canyon mine in the U.S., as well as the El Castillo Complex, the La Colorada operation and the Cerro del Gallo project in Mexico.

Under the terms of the agreement, each Argonaut share outstanding will be exchanged for 0.0185 Alamos share and one share of the spinout company. Alamos has also agreed to provide Argonaut with a private placement equity financing in the amount of C$50 million.

“This is a logical and attractive transaction for both companies. The combination of the adjacent Island Gold and Magino mines will immediately unlock tremendous value, with significant longer-term upside through further optimizations of the combined operation, and ongoing exploration success,” Alamos Gold’s president and CEO, John McCluskey said in a news release. “Both assets complement each other well with large mineral reserve and resource bases, long mine lives, and existing infrastructure that can support the bright future for the larger combined operation. Together, Island Gold and Magino will create one of the largest and most profitable mines in Canada, further enhancing our leading position as a Canadian focused intermediate gold producer.”

“After considering a broad range of alternatives, we believe this transaction provides a unique opportunity to place Magino in the hands of a well-capitalized and well-run company, who will be able to realize significant synergies given the proximity of the adjacent Island Gold Mine,” Richard Young, Argonaut Gold’s president and CEO, said. “We believe with adequate capital and an optimal expansion at Magino, the mine will deliver significant value to all stakeholders. We are grateful to our team at Magino for their significant contribution and hard work during mine and mill ramp-up. Similarly, we thank our exceptional teams in Mexico and Nevada for their continued hard work throughout the years.”

Alamos Gold Inc. is an intermediate gold producer with diversified production from three operating mines in North America.

Argonaut Gold Inc. is a gold producer with a portfolio of operations in North America.

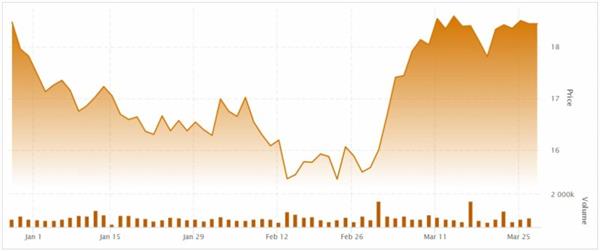

Alamos Gold stock chart – January. 2024 to March 2024.

Alamos Gold stock chart – January. 2024 to March 2024.

Alamos Gold stock opened more than 4 per cent higher at C$18.60 per share and is up 20.48 per cent in the past month, having also risen 20.78 per cent in the past year.

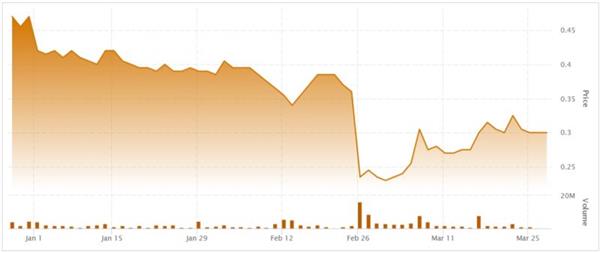

Argonaut Gold stock chart – January. 2024 to March 2024.

Argonaut Gold stock chart – January. 2024 to March 2024.

Argonaut Gold stock opened 25 per cent higher at $0.37 per share and though it is up 63.64 per cent on the month, it has also lost 34.48 per cent in the past year.

Join the discussion: Find out what everybody’s saying about these mining stocks on Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.