- Fairfax Financial Holdings (TSX:FFH) intends to offer C$450 million in senior notes due 2034 and C$250 million in senior notes due 2054

- The former will be priced at C$99.929 per C$100 principal amount and the company plans to issue the latter priced at C$100 per C$100 principal amount

- The company has not yet determined which specific series of preferred shares will be redeemed, nor the amount, timing, or method of repayment

- Fairfax Financial stock (TSX:FFH) closed trading at C$1,950.40

Fairfax Financial Holdings (TSX:FFH) intends to offer C$450 million in senior notes due 2034 and C$250 million in senior notes due 2054.

The former will be priced at C$99.929 per C$100 principal amount and the company plans to issue the latter priced at C$100 per C$100 principal amount.

The offering will be facilitated through a syndicate of dealers led by BMO Nesbitt Burns Inc., CIBC World Markets Inc., RBC Dominion Securities Inc., and Scotia Capital Inc. as joint bookrunners. Other participating agents include Merrill Lynch Canada Inc., National Bank Financial Inc., TD Securities Inc., Citigroup Global Markets Canada Inc., Desjardins Securities Inc., J.P. Morgan Securities Canada Inc., and Mizuho Securities Canada Inc.

The 2034 notes will carry a fixed interest rate of 4.73 per cent per annum, while the 2054 notes will offer a fixed rate of 5.23 per cent per annum. These senior notes will be unsecured obligations of Fairfax.

The net proceeds from this offering are intended to be used to redeem, in whole or in part, one or more series of Fairfax’s outstanding cumulative five-year rate reset preferred shares or cumulative floating rate preferred shares. However, the company has not yet determined which specific series of preferred shares will be redeemed, nor the amount, timing, or method of repayment.

The offering is expected to close on or about November 22, 2024, pending the satisfaction of customary conditions. The senior notes will be available for purchase in all provinces and territories of Canada.

What are senior notes?

Senior notes are a type of bond that have priority over other debts in case a company declares bankruptcy. While they have a lower degree of risk compared with stocks, senior notes often also pay lower rates of interest.

Senior notes are a common way for companies to borrow money with lower interest than other kinds of debt. When notes are redeemed for company shares, they reduce the businesses’ debt obligations.

About Fairfax Financial Holdings

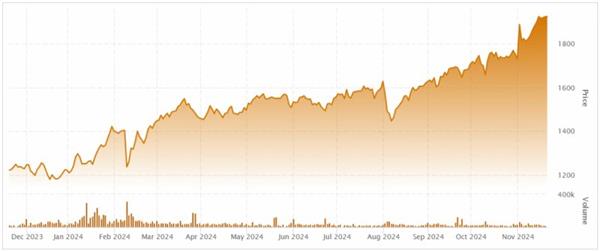

(Fairfax Financial Holdings Ltd. stock chart – Nov. 2023 to Nov. 2024.)

(Fairfax Financial Holdings Ltd. stock chart – Nov. 2023 to Nov. 2024.)

Fairfax Financial Holdings Ltd. is a holding company which, through its subsidiaries, is primarily engaged in property and casualty insurance and reinsurance and the associated investment management.

Fairfax Financial stock (TSX:FFH) closed trading up 1.44 per cent at C$1,950.40 and has risen 59.54 per cent since the year began and 57.58 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this stock on the Fairfax Financial Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image generated with AI)