Global markets have been erratic in recent days and weeks, as volatility has returned with a vengeance. Today, in the span of about five minutes, the Dow went from being up roughly 1% to

down by nearly 0.5%. But investors continue to congregate at Stockhouse. What is a selling window for one investor is a “buying opportunity” for another.

On the Stockhouse Bullboards, the cannabis sector remains the largest hub of investor activity. However, the Stockhouse Community also discusses and invests in companies representing the full spectrum of the economy. Here is a sample of recent Bullboard posts, from the leaders of each of the seven different industry groups we cover on Stockhouse’s

Trending News page. [Editor’s note: the following posts were selected at random and are not intended to reflect general investor sentiment for the following companies.]

Top Viewed Blockchain Stocks

(3,618 views)

Leonovus Inc. (

TSX: V.LTV,

OTCQB: LVNSF,

Forum)

Blockchain has been a tough sell to investors in recent months. The following post for the most popular blockchain stock at Stockhouse provides one indication of why investor sentiment has faded.

Thanks Nukey. It would be nice to get even a crumb of news today......I am still holding and still BELEIVING!!!

Pucci1989

Top Viewed Energy Stocks

(46,533 views)

AltaGas Ltd. (

TSX: ALA,

OTCQB: ATGFF,

Forum)

Energy is another tough sell, despite relatively strong crude oil prices. Unfortunately, investor activity here is motivated by bad news. Yesterday's views alone were 30,000+, with ALA’s stock dropping $3.95 in one day. With the recent

IPO and sale of 16,500,000 common shares, it appears that there are some changes about to happen at Alta Gas. A 1-month chart tells the story.

(click to enlarge)

(click to enlarge)

Ratios Debt covenant requirements As at September 30, 2018 Bank debt-to-capitalization(1) not greater than 65 percent 59.8% Bank...

YodaLayhehoo

Top Viewed Healthcare Stocks

(22,086 views)

ProMetic Life Sciences Inc. (

TSX: PLI,

OTCQB: PFSCF,

Forum)

Another industry group leader that has been struggling. While PLI’s research has continued to advance, once again it is financial issues which are currently weighing on investors. A look at a 1-year chart paints a distressing picture.

.jpg?width=450&height=282) (click to enlarge)

(click to enlarge)

News of

extension of debt maturities to 2024 didn't instill a lot of confidence in investors this week with the stock price bouncing up and down between 0.45¢ to 0.40¢.

If its additional financing, I will wait until after the new financing and dilution happens. gibbonsj wrote: This is one of those...

GunnerG

Top Viewed Industrial Stocks

(29,597 views)

Bombardier Inc. (

TSX: BBD.A,

OTCQB: BDRAF,

Forum)

Bombardier has been flying high in 2018…until recently. After peaking in the summer, Bombardier has since given back nearly all of its gains for 2018. This is despite recent news (

New President,

Orders for best-seling Challengers 350 Aircraft) that would seem to have been supportive of the share price. Investor sentiment reflects this apparent disconnect.

The TSX ws down 6% in October. Bombardier was down 57%. There's something fishy in Denmark!

flyman1

Top Viewed Resource Stocks

(79,140 views)

Royal Nickel Corp. (

TSX: RNX,

OTCQB: RNKLF,

Forum)

We see a similar disconnect with Stockhouse’s most popular resource stock. Royal Nickel has been one of the big winners in 2018 – on the strength of an exciting

gold discovery. The price of gold has been rising recently, and the company reported

“record” gold production in its recent Q3 quarterly report. Yet a 1-year chart shows a share price that has been consolidating in recent weeks.

.jpg?width=450&height=283) (click to enlarge)

(click to enlarge)

At least one investor is anticipating the

financial news for Q3.

now. Quarterly results out soon! Interest picking up today. Very exciting as RNX drills and drifts for gold!

Johnnycake59

Top Viewed Cannabis Stocks

(241,365 views)

Aurora Cannabis Inc. (

TSX: ACB,

OTCQB: ACBFF,

Forum)

Perhaps the biggest disconnect of all is in the cannabis sector. The Canadian cannabis industry became much

bigger on October 17

th. The run-up in share price experienced many of the leading stocks over the summer wasn’t “pricing in” a legal recreational cannabis market, it was reflecting

major news and operational progress from many of these companies.

But the Big Money has been pounding cannabis stocks with shorting since October 17

th, and the “sell-off” predicted by a number of semi-informed pundits has become a self-fulfilling prophecy. Stockhouse’s most popular cannabis stock, Aurora Cannabis is emblematic of recent trends in the sector, with the share price currently more than 40% off of its 52-week high. Cannabis investors remain undaunted, as indicated in the following post.

Agreed... we could see the roller coaster ride continue for quite some time... SP climbs up, shorts tear it down, SP climbs back up again...

40hourweak

Top Viewed Technology Stocks

(16,619 views)

Patriot One Technologies Inc. (

TSX: V.PAT,

OTCQB: PTOTF,

Forum)

Last but not least, we get to a good-news story at Stockhouse: a company making operational progress and being rewarded for it. A week ago Patriot One announced a

Partnership with Cisco Systems, and this week they

Announce $40.0 Million Bought Deal! It appears that investors likes the news because their stock price is rising.

A long term chart for PAT shows a small-cap company that has been making steady progress in advancing operations and building value for investors.

(click to enlarge)

(click to enlarge)

True believers for this company are very optimistic about the long-term potential…

That's a tough question. I've heard different numbers from different analysts, anything from $30 to $150/share. Who's to say...

BullshitBoard

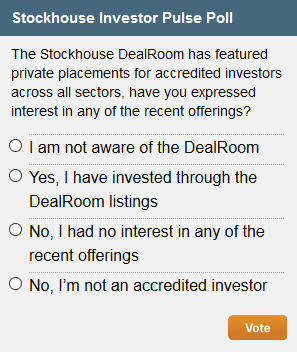

Wrapping up this edition of Buzz on the Bullboards, we have the results from our previous Investor Pulse Poll, as well as a new poll for the Stockhouse Community.

.png)

Somewhat surprisingly, the greatest response (nearly 1/3rd) was “I don’t invest in cannabis stocks”. What this says to cannabis investors is that there is still a long ways to go in educating people on cannabis – replacing decades of now-discredited propaganda with cannabis facts. Put another way, there are still enormous numbers of investors who have yet to discover the enormous investment potential of this now-legal industry.

Here is the new poll for investors:

It’s another crazy day in (in particular) U.S. markets, where the automated trading algorithms that now dominate global trading are once again running wild. In this new reality for 21st century markets, the extended run of record-low volatility that was experienced for several years wasn’t merely anomalous, it was radically improbable. Going forward “volatility” will remain the operative for markets.

With small-cap stocks inherently more volatile than large caps, this will test the resolve of small-cap investors like never before. Disconnects between value and price will continue to become more extreme. The “momentum” that many investors/traders have relied upon to fuel gains in recent years will become increasingly capricious. In short, for many investors, “value investing” is back.

Look for undervalued stocks, and then strap yourselves in for what will be (in many cases) a long and wild ride. And as these stocks rise and fall, Stockhouse remains your best destination to exchange information and ideas with other investors.