After 100 years of cannabis Prohibition, perhaps we shouldn’t be surprised that the normalization of cannabis laws in North America (and around the world) has been a slow, uneven process. Even so, cannabis investors will likely be surprised to learn how clumsy and inefficient North American governments have been in executing this transition.

A recent Stockhouse article attached some numbers to this administrative and political failure. In Canada, it is

estimated that as much as 72% of recreational cannabis sales in 2019 will continue to come from the black market. This is despite the fact that the recreational consumption of cannabis was legalized nationally in 2018.

In the U.S., conditions vary considerably state-to-state because of the opposition at the federal level to the normalization of cannabis (marijuana) that remains in that nation. Even in a state like Massachusetts, with both the medicinal and recreational consumption of cannabis legalized, a

Forbes article projects that 75% of cannabis sales in 2019 will be black market transactions.

Due to this failure, in Canada a forecast for total (legal) recreational cannabis sales in 2019 has been slashed by 30%. Obviously, this has been negatively impacting valuations for cannabis stocks on both sides of the border as government ineptitude and intransigence has seriously impeded the growth of cannabis retail commerce.

Yet even with these roadblocks, the revenues that are starting to materialize are already substantial in some jurisdictions. For Quebec-based

HEXO Corp (

TSX: HEXO, NYSE American: HEXO,

Forum) the largest single distributor of legalized cannabis in the province, the Company just reported $16.2 million in total gross revenues for Q2 of its fiscal 2019. That represents

revenue growth of 1,269%.

The message here is simple. Significant cannabis revenues

are starting to materialize in the cannabis industry across Canada and the U.S., in spite of, not because of government efforts to phase out cannabis Prohibition. But the numbers today are a drop in the bucket compared to the revenue dollars that will be on the table once these governments (more or less)

get out of the way of the cannabis industry.

With this backdrop, this week’s edition of Buzz on the Bullboards is swinging back to the cannabis sector after several weeks of primarily focusing on mining. First a look at the Stockhouse Bullboard leaders for cannabis for the most recent period (March 7 – 13).

Top Viewed Cannabis Stocks

The names at the top will be very familiar to Stockhouse’s cannabis investors, and often top our cannabis Bullboards as the most popular cannabis stocks. The two names at the bottom will likely be of greater interest to cannabis investors at present.

Newstrike Brands Ltd (

TSX: V.HIP,

OTCQB: NWKRF,

Forum) is a name in the news in cannabis for a very good reason. It’s just been acquired by previously mentioned HEXO Corp. Newstrike will already be familiar to many Stockhouse cannabis investors because of its strategic relationship and sponsorship agreement with Canada’s iconic

The Tragically Hip. So on the retailing/branding front, this HEXO-Newstrike combination may be a name to watch.

Right beneath Newstrike is a newcomer among cannabis Bullboard leaders and perhaps not familiar to most investors:

Village Farms International Inc. (

TSX: VFF,

OTCQB: VFFIF,

Forum). This TSX-listed agricultural producer is becoming a cannabis producer.

With vast greenhouse cultivation operations, VFF has already retrofitted 1 million square feet of greenhouse space for cannabis cultivation operations. Through a joint venture with

Emerald Health Therapeutics (

TSX: V.EMH,

OTCQB: EMHTF,

Forum), Village Farms may ultimately elect to convert nearly

5 million square feet of greenhouse space to cannabis cultivation.

(click to enlarge)

(click to enlarge)

All it takes is a quick glance at Village Farms’ 1-year chart to see what is getting cannabis investors excited at Stockhouse. Clearly the market sees VFF’s (partial) transition into the cannabis industry to be strongly positive for operations.

By the time that a publicly listed company nears the top of our Bullboard leaders for any particular sector, it’s sometimes already too late for newer investors to climb onboard and take advantage of whatever is driving interest in that company. So what we want to start doing more of on “Buzz” is to pick out companies that are just starting to rise up the ranks of our Bullboard leaders.

In cannabis, one rising star is

48North Cannabis Corp. (

TSX: V.NRTH,

Forum). Here is another cannabis company with a very impressive 1-year chart.

(click to enlarge)

(click to enlarge)

The big difference between 48North Cannabis and Village Farms is that Village Farms is a company that already has a market cap of over $800 million, and its share price has quadrupled over the past year. In contrast, 48North has a relatively compact market cap of approximately $160 million, and at current levels its rise is less than three-fold over the past year.

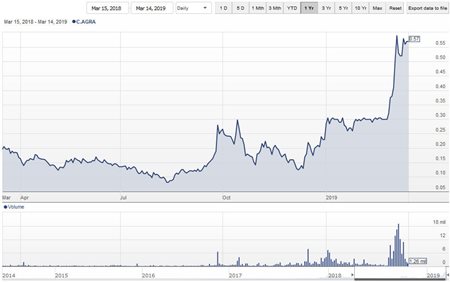

Similarly,

AgraFlora Organics International Inc. (

CSE: AGRA,

OTCQB: PUFXF,

Forum) is another cannabis company that is rapidly building a following at Stockhouse due to strong share price performance.

(click to enlarge)

(click to enlarge)

AgraFlora is similar in size to 48North, with maybe a slightly stronger 1-year performance for the stock. For both 48North and AgraFlora, investors need to do their own due diligence to ascertain whether the “move” for these companies is largely finished (for now), or whether performance to date is only a partial indication of things to come.

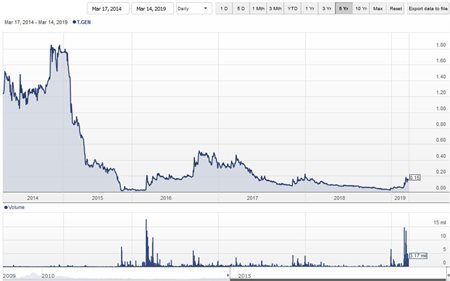

Outside of cannabis, we also wanted to provide honourable mention for the new leader atop Stockhouse’s Healthcare Bullboards:

GeneNews Ltd. (

TSX: GEN,

OTCQB: GNWSF,

Forum). The most popular healthcare stock at Stockhouse at the moment is a “molecular diagnostics” specialist with a particular focus on cancer research.

(click to enlarge)

(click to enlarge)

Its

January 28, 2019 news release on the Company’s latest development in its colorectal cancer research has been very well-received by the market. Perhaps of more interest to investors here is a much longer-term look at GeneNews.

(click to enlarge)

(click to enlarge)

A 5-year chart for GeneNews shows a company that has fallen a long way from much loftier levels of a few years earlier. This presents an interesting question to potential investors: is the recent rebound in share price a mere “dead-cat bounce” or this the early stages of a much more substantial recovery? This is what investor due diligence is all about.

Whether your favorite investing sector is cannabis, healthcare, mining, tech, or some other niche prospering in investing is all about identifying prospective companies before they have translated operational success into share price performance.

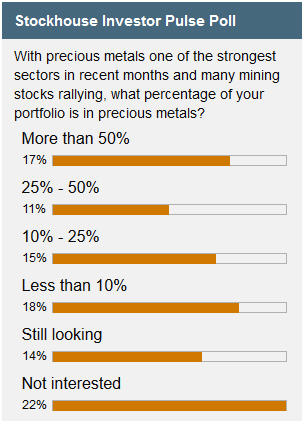

Last but not least in this edition of Buzz is reporting on our Stockhouse Investor Pulse polls. Here are the results for our just-concluded poll on precious metals:

With precious metals prices having see-sawed over the two weeks that we posted this poll, it was interesting to see these numbers swinging back and forth day-to-day. While many (most?) financial investment professionals recommend at least a 10% component of portfolios in precious metals, clearly many Stockhouse investors haven't (yet) heeded this advice.

This leads to our new investment poll, hosted (as always) on the Stockhouse

homepage. Watch for this new poll to appear on the site shortly:

HEXO Corp’s acquisition of Newstrike Brands is the big cannabis news of the week. How much M&A activity are you expecting in Cannabis in 2019?

- “Lets Make A Deal.” 2019 is going to be the biggest year yet for cannabis acquisitions and consolidations.

- Shopping spree. There will be lots of M&A activity in 2019.

- Ho-hum. M&A activity and consolidations will be unchanged from 2018.

- “All’s Quiet On The Western Front.” There will be considerably less M&A activity in 2019.

Come to Stockhouse to network with Canada’s largest Community of small-cap investors as Stockhouse’s stock hounds look to identify the next winner. And tune into Buzz on the Bullboards for additional tips and information on what’s hot and what’s not.

Readers wanting to reference older editions of Buzz on the Bullboards can find those

here.

FULL DISCLOSURE: HEXO Corp and Newstrike Brands are paid clients of Stockhouse Publishing.