With the big weeks for energy companies behind us and the cannabis sector ongoing, the last week of trading has felt like the eye of the storm. When you add political tensions ramping up in Washington and uncertain global markets, it makes sense that investors had a tough time relaxing over a holiday weekend for many parts of Canada and the US.

Over on Stockhouse, investors and analysts come to break down some of the largest and smallest public companies and how their shares are moving in response to (or against) the market. As a community with a lot of money and experience sunk into small-cap investments, the Stockhouse Bullboards are a great place to take the pulse of retail investors on the biggest value propositions on the market today.

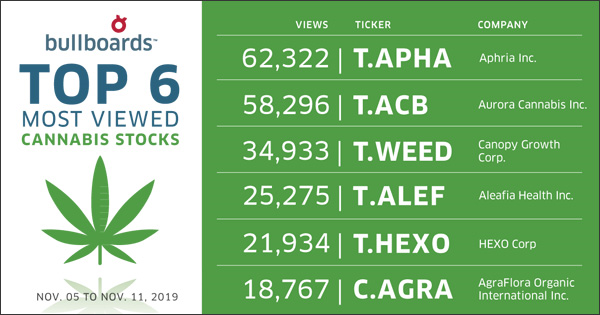

This week, our weekly Buzz review of the Bullboards looks at the most popular companies dominating three of the hottest investment sectors for big value swings: cannabis, technology, and healthcare.

This week is a massive report card for the cannabis industry as

major LPs release their latest earnings reports, yet in the lead-up, the cannabis Bullboards turned once again to one of the few companies not reporting any earnings,

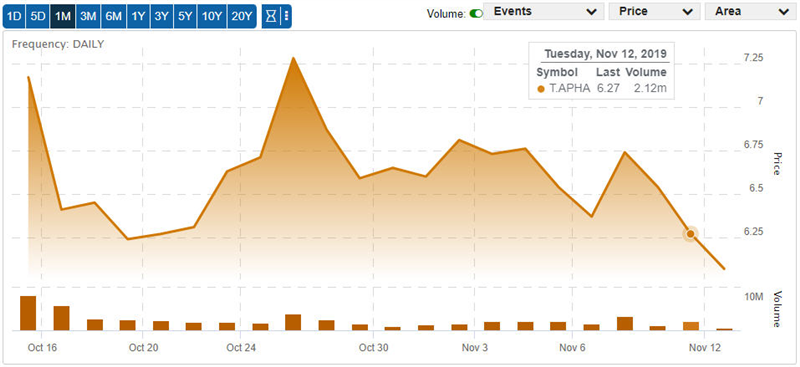

Aphria Inc. (

TSX:APHA,

Forum). The LP had posted a profitable quarter in October

that temporarily rallied the sector, and investors in turn have made APHA a reflection of cannabis as a whole.

Early in the week, that saw APHA shares slide as the first few results missed expectations, from $6.76 on Nov. 5 to $6.27 on Nov 12. Yet the company is continuing its march forward, announcing on Nov. 4 that it had

doubled production capacity after receiving a cultivation license for a new greenhouse. Aphria also managed to capitalize on strong customer support by

winning seven major awards at the recent Canadian Cannabis Awards.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Despite the good news from Aphria, investors on the APHA Bullboard recognize that its performance is being directly tied to the other LPs contending in the market (even if it outperforms them). In the long run, a focus on profitability and diversified revenues makes it a strong hold, but in the short term, Stockhouse Member

N00bInvesT0R pointed out that the market is still nervous and reacting quickly.

“Title says it all, the last thing we need is Aurora, Tilray and Canopy to confirm Hexo's struggle and indicate that we in a oversupply market. The only good news is Aphria already has a plan B in motion: CC pharma reliable sales and soon Eu GMP for Aphria One that can be sold through CC pharma distribution channel.

Lately the MJ space has been unfair with individual performances like the incredible Q4 2019 and Q1 2020 of Aphria, two quarters back to back profitable but look where we trading…

This week we find out if bears are in full control or if we bottomed and they are getting greedy…”

(Po?st: Most important week in the cannabis space history)

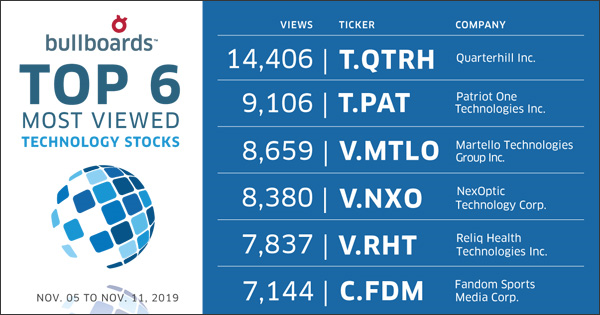

On the technology Bullboards, a clear and very interesting leader emerged on the Top 6 most-viewed companies in the form of

Quarterhill Inc. (

TSX:QTRH,

Forum). The tech developer and provider didn’t see much action in terms of share price or trading volume, but dedicated QTRH investors have ramped up discussions over the last week.

On the news front, the company has been focused largely on solidifying management.

Earlier in October we pointed out that Quarterhill’s drop in October coincided with the resignation of its President and CEO, and on Oct. 22 the company also announced the

appointment of a new interim CFO. QTRH shares climbed slightly to start November before the Nov. 7 release of

the latest quarterly earnings slightly missed revenue expectations.

But where were all the wild price swings and high trade volumes? As the invested users on the QTRH Bullboard were aware, the current focus for Quarterhill is larger than day-to-day operations, with ongoing litigation against some of the world’s largest tech giants and hundreds of millions of dollars on the line. For users like Stockhouse Member

wilander, the fact that analysts were nonplussed by the company’s recent earnings solidified a hold position.

“All I know is the question was asked. Analyst seemed happy with the answer. No questions or concerns or any negative commentary by CIBC or anyone else either in the days following. They no numbers better than me. So, If they aren’t worried neither am I...”

(Po?st: RE:Cash on hand drop from 2nd qtr)

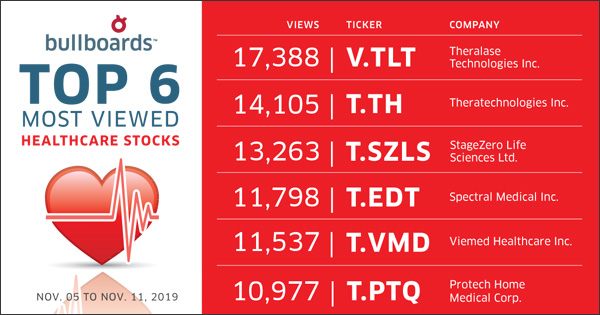

Finally we look at a sector where big news can make or break a company’s fortune, the healthcare Bullboards.

Spectral Medical Inc. (

TSX:EDT,

Forum) is all too familiar with how one piece of news can affect a company, as

a failed trial for the company’s septic shock treatment in October 2016 sent shares of EDT plummeting, but recently it has climbed in share price and on the most-viewed Bullboards chart.

November has been a good month for Spectral investors. Shares of EDT started the month of November at $0.50 before rocketing up to $0.69 on Nov 6, though it has come back down closer to $0.60 since then. The reason isn’t the company’s PR department, as the latest news release comes from back on Sept. 24 as Spectral announced

the launch of a new clinical trial. Instead, it comes from

positive initial coverage from an analyst at Paradigm Capital that sees EDT as a buy.

Given positive momentum for the first time in a while, users on the EDT Bullboard were vocally hoping that the company would work to keep the flow going. One potential idea was to get American investors back on board by listing on a higher tier exchange, with Stockhouse Member

inspecthrgadget highlighting that Spectral is facing an opportunity to open its doors and continue to climb upwards.

“…The addition of a thorough report from Paradigm is wonderful validation to accompany the message from the company. Looked at Renmark and they have sites all over America to tell the Spectral story. EDT needs to provide a real exchange opportunity for American interest. It was Renmark that moved EDT up a couple tiers on the OTC exchange years back. It was Spectral’s choice to list down on the OTC which prevents news to flow to the US. Hopefully EDT will see the fiduciary light soon...”

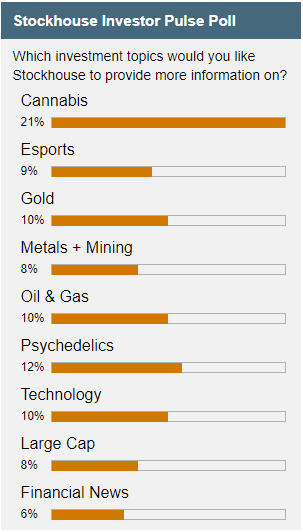

Before we turn our attention to cannabis results, we want to highlight an ongoing poll on our homepage that will help you get the investment coverage you need. Last week we kicked off a new Investor Pulse Poll asking Stockhouse readers which topics they would like to see more coverage on, and so far the results are even with one leading exception.

However, we all know that early poll results don’t tell the whole story, so you still have a chance to let your voice be heard.

Head to the homepage or click the image below to tell us which investment topics you would like Stockhouse to offer info, analysis, and insight on!

(Click image to go to the poll)

(Click image to go to the poll)

Next week, we’ll be able to see how the dust has started to settle in the cannabis sector following the release of major earnings results, and where investors on Stockhouse stand. As the top current sector for discussion and investment on the Bullboards, you can bet that things will get heated. For previous editions of Buzz on the Bullboards:

click here.