The energy sector was already battered by the COVID-19 coronavirus when the

oil price war began in earnest on Monday. Russia and OPEC couldn’t agree on production caps, Saudi Arabia decided to flood the market with oil and increase production, and the crash began.

For many Canadian investors, Monday played out as a horrible case of déjà vu. Crude prices dropped more than $10 to US $31.13 a barrel, a decline of more than 20%. Major oil producers, a cornerstone of the Canadian economy, saw shares drop anywhere from 20% on the

low side to above 60% for some of the big names.

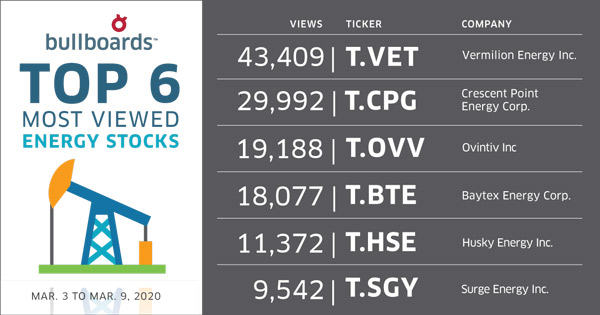

As Canada’s largest investor hub, the focus for a large portion of Stockhouse Bullboard investors has understandably been on energy over the past week. The most-viewed companies in the sector include some of the hardest hit, and discussions on the Bullboards have been trying to make sense of what comes next; hope, or despair?

Though many producers suffered worse drops, top place on the most-viewed energy Bullboard went to

Vermilion Energy Inc. (

TSX:VET,

Forum). Shares of VET closed on Friday, Mar. 6 at $10.36 before dropping to $6.11 on Monday, Mar. 9, a drop of 41%.

Again, the drop over the last few weeks has affected almost the entire energy sector, as the coronavirus outbreak has significantly reduced demand for oil. But the bigger question for investors is which companies will rebound or be able to withstand a downturn, and which are heading further downwards. Unfortunately for Vermilion Energy, the short-term market prognosis for VET seems to be the latter.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

One of the major reasons is that Vermilion recently decided not to reduce capital expenditures in light of the market downturn, though that was

before the price collapse, and though it cut its dividend, it still seemed too high. Like most producers, a majority of the company’s upcoming production was already hedged, and

if Vermilion announces some cuts, many on the VET Bullboard including Stockhouse Member

farmboy75 feel they can weather the storm (but that’s a big

if for investors and analysts that have lost faith in management).

“While it is highly likely many producers will have to restructure their financing, be taken over, or go bankrupt, I really don't see VET in that category. With our hedges in place, our ability to further cut the divvy and slash capex, I firmly believe we can and will weather this storm.”

(Post: RE: Recapitalization)

Second and third place respectively on the most-viewed energy Bullboards chart were

Crescent Point Energy Corp. (

TSX:CPG,

Forum) and

Ovintiv Inc. (

TSX:OVV,

Forum). Both give us examples of a share price drop on Mar. 9 followed by a recovery on Mar. 10, but the magnitudes are exponentially different. CPG dropped 43% from $2.91 to $1.65, then climbed 5% to $1.73. Meanwhile,

OVV dropped 72% from $7.94 to $2.22,

then climbed 34% to $2.98.

The larger bounce back of Ovintiv (formerly known as Encana) is tied to the company releasing a statement outlining

reduced near-term capital spending, in addition to touting its capital structure and flexibility. A similar climb at a lower scale was seen by

Cenovus Energy Inc. (

TSX:CVE) when it too announced

reduced capital spending for 2020.

We can see a recurring theme of companies being frank with investors about the consequences being rewarded, and understandably, the CPG and OVV Bullboards want to see more action. Capital expenditure reduction is good, and there are many theories as to how long the war between Saudi Arabia and Russia will last before prices start to climb back, but Stockhouse Member

lufkin1961 pointed out what many experts are worried about: unnecessary dividends and ballooning debt in the oil sector.

“1. Glad to get ‘free cash’ neutrality goal, see the willingness to cut capex, and see that bank credit not dependent on market cap ratios.

2. Yet, with the ‘net 3.5 billion’ credit, it means that the total secured 4 billion credit minus the commercial paper liability leaves us at ‘already free cash neutral’ on the first of March 2020, before the Saudi cuts and $30 dollar oil…

3. So, when do we cancel dividend? Sooner rather than later? The debt is the problem, and cash is king.

4. When might we ever begin to pay down debt? Even if 80% of debt is due after 2024, can we pay off 6 billion in debt from 2025 to 2030+?”

(Post: After Yesterday’s OVV Financial Update:)

And yet, the irony of sixth-place

Surge Energy Inc. (

TSX:SGY,

Forum) shows that you can’t win them all. The Canadian producer dropped from $0.75 on Mar. 6 to $0.45 on Mar. 9, a 40% decrease. That was just in time for the release of its 2019

year-end financial results, in which SGY also announced it was reducing its dividend by 90%, and shares fell the next day an additional 9% to $0.41.

In addition to the dividend cut, Surge also said it shifted capital from Q1 2020 to the second half of the year. Still, the stock declined on a day when most of the energy sector was up. With most dividends being priced in to shares, it was largely expected, and experts are expecting more companies to follow.

In a reflection of the posts above, a vocal part of the SGY Bullboard was happy to see the dividend reduction. Though many investors had bought into Surge on the strength of the dividend in the first place, others like Stockhouse Member

exprohibition18 saw the move for what it was, a hopefully temporary move to combat difficulties down the road. Now, it’s the time to hunker down and have faith.

'“…The response to this if one is holding oil stocks - in my humble opinion - is to stay with management teams that one subscribes to. Yes, I miss my dividend. But the way this thing trades, it could be back at some point sooner versus the today sentiment that it’s gone for good and we are bankrupt on less than 2X debt to cash. We have hedges and we will see…”

(Post: RE:How did sgy lose 2/3 of its value in 2 mths?)

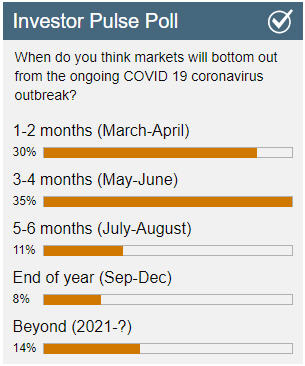

What’s next for the COVID-19 coronavirus, the markets, and your investments? Stockhouse has been active in assessing the impact and getting feedback from experts and companies on what’s going on, and we’ve also been polling users on the

Stockhouse homepage on when the outbreak will be put in the rearview mirror. Initially the response was optimistic, but as the outbreak has worsened, we expect the timeline to shift accordingly.

Of course, we’ll be keeping our Investor Pulse Poll open for the forseeable future, so head over to the homepage and cast your vote as well!

(Click image to go to the poll)

(Click image to go to the poll)

Next week the focus will shift back to the other sectors, as we’ll be able to get a clearer picture of where the markets are headed and which companies will do well in the times to come. For previous editions of Buzz on the Bullboards:

click here.