Last week we highlighted the rise of healthcare to the top of investor’s minds in today’s climate, and the receding of interest in metals and mining. This week, we eat some of our words and highlight significant gains in both.

As the COVID-19 pandemic has continued to grip the world, the markets have started to become less volatile and more positive in its wake. Whether or not this will last long (or is artificially boosted), the effects it’s having on a few companies are bound to stick around, and have made some plays more beneficial than others.

Investors on the Stockhouse Bullboards are starting to figure out how each sector is being affected differently by the coronavirus pandemic, and where to put their focus. This week, the spotlight isn’t just on coronavirus-specific moves, but on what to expect in the developing market to come.

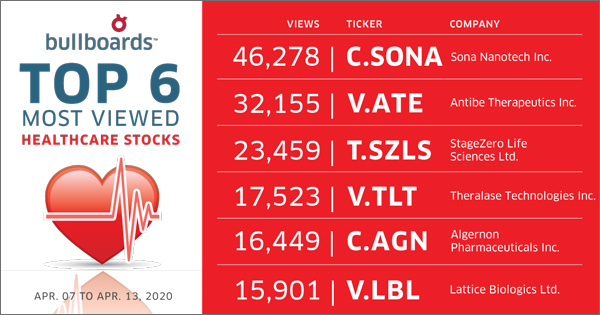

The healthcare sector is seeing winners all around, but the coronavirus-related gains are the ones capturing new attention. That’s how

Algernon Pharmaceuticals Inc. (

CSE:AGN,

Forum) cracked the most-viewed healthcare Bullboards chart

once again, and looking at the clinical drug developer’s price chart it’s easy to see why. Last week saw AGN climb from $0.235 on Apr. 7 to a peak of $0.50 on Apr. 13 before slightly retreating.

Algernon’s climb comes from the re-purposing of the drug NP-120, or Ifenprodil, for treatment of COVID-19 infected patients with pneumonia. After announcing the focus on Ifenprodil in early March, the company has been rapidly developing the drug’s rollout. Last week in the leadup to phase 2 trials, Algernon announced

positive feedback from Health Canada, regulatory submission for

human trials in South Korea, and most impressively,

positive feedback from the US FDA.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Early in March, the question on the AGN Bullboard was whether the company would be able to deliver on its promise. In the wake of the increased developments, however, the tone has shifted to comparing the company to others in the space. There’s still work cut out for them, but Stockhouse Members like

DigitalSpurs are impressed with how active Algernon and its CEO is, not just in developments, but in being upfront.

“I love the fact that the CEO is very active; going out, doing interviews, representing the company and shareholders, while the scientists do their job to get things to the next level.

…Well spoken, brief and lots of evidence. Never goes overboard with promises to be number one, but states that they did outperform some leaders in the pharma space with their drug.”

(Post: RE:New video (Streamed an hour ago))

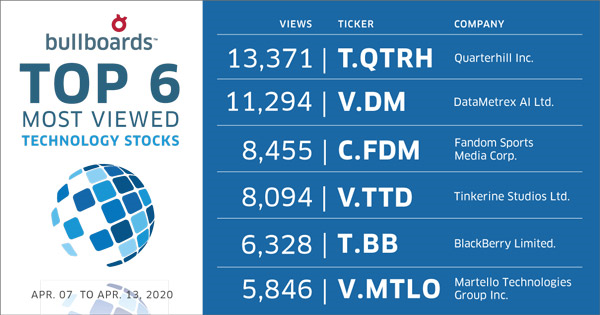

While companies directly involved in the coronavirus fight are obvious investments, there’s just as much profit to be made if you know how other sectors are impacted. A clear example is on the technology Bullboards, where the app-based entertainment company

Fandom Sports Media Corp. (

CSE:FDM,

Forum) climbed back towards the top of the most-viewed chart. Two strong back-to-back weeks propelled the FDM climb, from $0.065 on Apr. 2 to a high of $0.275 on Apr. 13.

So how does Fandom benefit from the ongoing situation? Similarly to how other tech companies are stepping up to fill gaps left by forced lockdowns, the shutting down of almost all sports and betting has renewed the focus on esports platforms. On Apr. 3, FDM announced it

would focus on esports and fantasy gaming, and followed up on Apr. 9 with an

outline of its non-betting and betting platform.

In a market starved for entertainment, FDM has done well, and the company’s Bullboard has taken notice. But without concrete releases that correlate directly to the increased share price, many investors are rightly skeptical and trying to figure out if they’re seeing a to-be-announced private placement closing, app launch, or empty air. For many like Stockhouse Member

Sextant, however, the increase is still nothing compared to what they’re expecting in the current market.

“Despite an upward trend in the share price movement, we have yet to see a full-on breakout. I have seen a number of powerpoints of late on eSports themed companies going public at valuations North of $10 million with not much more than an assembly of human equity with good intentions. We have more here, quite a bit more, and the market cap is just above $4 million. A platform built for betting. A platform built for eSports. Some investors know fully well what It means when you hear: The trend is your friend.”

(Post: Whence comes the breakout?)

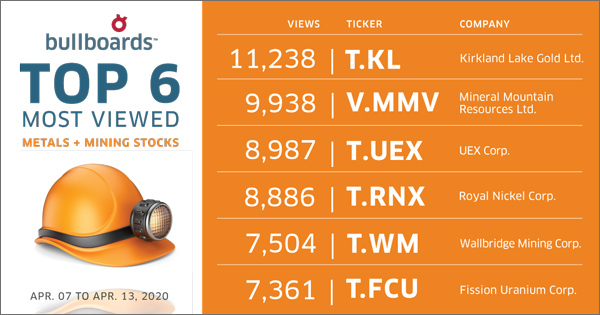

And finally we come full-circle to metals + mining once again, which last week we highlighted for falling investor interest. If you’ve looked away from the metals market, however, you should heavily consider checking again, because the once-negative coronavirus impact has turned positive for some very quickly. One clear example is the rise of

UEX Corp. (

TSX:UEX,

Forum),

Fission Uranium Corp. (

TSX:FCU,

Forum), and other uranium plays. Looking at UEX’s chart, we can see a surge from $0.07 on Mar. 23 to $0.165 on Apr. 14.

What’s happening? Uranium prices have climbed significantly over the past few weeks and keep climbing (alongside many other metals) because of heavy pressure on supply. Some of the major producers around the world have been forced to temporarily close operations in the wake of the coronavirus pandemic, constraining a supply that had been notoriously glutted. All of a sudden, many projects aren’t just profitable, they’re needed.

Does that mean the carpet has been rolled out for the full-on uranium recovery? The Bullboards have been debating exactly that, and the traction on the UEX board indicates that the bull run is set to continue. Stockhouse Member

mangoe pointed out that the uranium market’s situation should continue the snowball for some time to come.

“Barchart Uranium Futures up $1.50 lb today. Lots of green.

And this is how the coiled spring Uranium Markets work. Lots of green numbers all of a sudden. Uranium plants being started up and others being restarted and more fuel keeps getting consumed while production keeps getting halted…”

(Post: Barchart Uranium Futures up $1.50 lb today.)

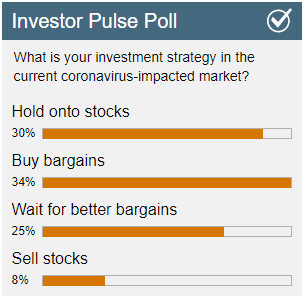

At this point, it seems like the uncertainty and volatility of March trading has given way to a betting market in April. It’s anyone’s guess how long the current positive market traction will continue, but the overall investor sentiment seems to indicate that now is a time to make plays. Our recent poll homepage poll on the current investment strategy of Stockhouse Readers confirmed this notion.

But as indicated by the Bullboards above, the current market isn’t a one-sector pony. There are many rising and falling tides to try and catch, so what are you focusing on? Head over to the

Stockhouse homepage or click the image below to cast your vote!

(Click image to go to the poll)

(Click image to go to the poll)

The most important thing for investors is to stay informed, alert, and ready for action. The lingering market uncertainty and developments of the pandemic only strengthen this need, so make sure to catch up on the latest plays on the Stockhouse Bullboards. For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: Algernon Pharmaceuticals Inc. and Fission Uranium Corp. are clients of Stockhouse Publishing