(Screenshots via CNN video.)

(Screenshots via CNN video.)

It has been a tumultuous time for the markets, from abrupt deep dips to relief rallies that saw effects to indexes on both sides of the border. US stock futures have been northing short of volatile in the last few days with the presidential election still unsettled and vote-counting in crucial swing states, as of this writing.

Last week was a big week for many sectors, including oil, and the Stockhouse Bullboards took notice. First came a wave of fiscal quarter results being released, which sent shares of major companies every which way.

But the bigger story was a jump in the Canadian energy sector (and the TSX up with it). The oil industry has been mentioned frequently in the speeches of both major US candidates and many remain uncertain what its future holds, depending who wins.

In turn, the Stockhouse Bullboards have been heated with the most popular sectors seeing investors debate short-term swings, long-term swings, and whether some small cap offerings were gold mines or pitfalls.

The story was not the same across the board, as some companies did not ride the wave, while most operators are still staying passive as they wait for the dust to settle on the election. This week, we dive into discussions of investors on the Stockhouse Bullboards trying to figure which companies will make it (and make for valuable investments in the process).

In this week’s review of the action, we dive into the most-viewed companies and, much like those who have cast their votes in the US, we see three very different communities: one uncertain, one thoughtful, and one extremely divided.

Hemmingway shot himself when he ran out of stories to tell, but the mind-crushing narrative of 2020 keeps on going, so let’s get into some Bullboard highlights and see how the Stockhouse community is disseminating the investing world today.

Crescent Point Energy Corp. (TSX: CPG, Forum)

Crescent Point Energy Corp. (TSX: CPG, Forum) caught positive attention of investors this week upon the release of its

Q3 2020 operating and financial results. CPG highlighted approximately $120 million (CAD) of excess cash flow during the quarter and an average production of 113,383 barrels of oil equivalent per day (boe/d), of more than 90% oil and liquids over that time.

Meanwhile,

Suncor Energy Inc. (TSX: SU, Forum) shares took a slide recently after the Calgary-based energy giant reported

a significant decline in its Q3 financial performance - a net loss of $12 million (CAD), compared to net earning of more than $1 billion in the same period last year. Total upstream production fell from 762,300 boe/d in Q3 2019 to just 616,200 barrels this year.

Then we have

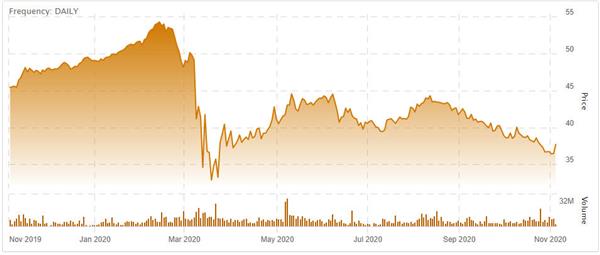

Enbridge Inc. (TSX: ENB, Forum), who just declared a quarterly dividend of

$0.81 (CAD) per common share, payable on December 1, 2020 to shareholders of record on November 13 (the numbers are expected to be consistent to the dividend from September 1st.). This oil corporation has struggled to regain its share values since the infamous cratering of March 2020 and its shareholders are among those tracking the latest on election results the most thoroughly, based on what we know about how both main parties feel about where this sector should be headed.

(Enbridge Inc. stock chart – November 2019 – 2020. Click to enlarge.)

(Enbridge Inc. stock chart – November 2019 – 2020. Click to enlarge.)

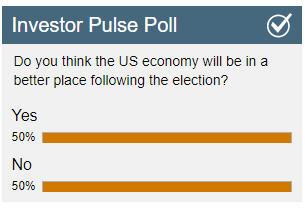

The oil sector has been a divisive issue among people in the US and Canada and short of asking flat-out who you intended to vote for, last week’s Investor Pulse Poll indicates just how split people are.

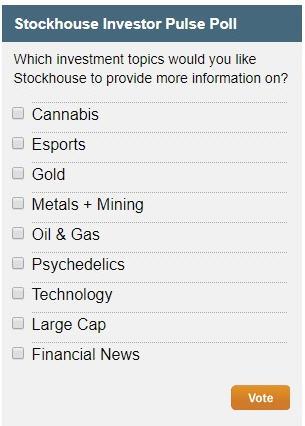

It is clear from Bullboard discussions which sectors matter to Stockhouse users, but we want to make sure that we are covering the right tracks.

(Click on the image to vote.)

(Click on the image to vote.)

Our new Investor Pulse Poll asks you which investment topics you need more information on. You can head

over to the Stockhouse homepage or click the image above to let us know what you’d like to see more coverage on.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Looking at Healthcare, one of the most popular stocks on the Bullboards,

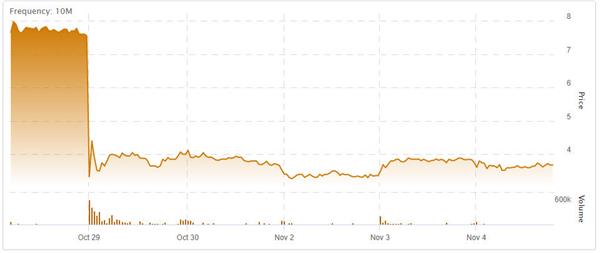

Sona Nanotech Inc. (CSE: SONA, Forum) saw its shares plunge after its COVID-19 antigen test application was

downgraded by the US Food and Drug Administration (FDA).

(Sona Nanotech Inc. stock chart – October - November 2020. Click to enlarge.)

(Sona Nanotech Inc. stock chart – October - November 2020. Click to enlarge.)

It should be stressed that this ruling does not mean the test failed, just that the FDA does not consider the product a top priority. The Health Canada evaluation is still underway.

Protech Home Medical Corp. (TSX-V: PTQ, Forum), a medical company that provides in-home monitoring and disease management services including end-to-end respiratory solutions for US patients, released a statement supporting the Centers for Medicare and Medicaid Services (CMS) to not award contracts for any of the product categories that would have affected Protech’s revenue because the expected payment amounts did not achieve expected savings for the Competitive Bidding Program (CBP) that was expected to begin on January 1, 2021.

From

the news release:

“Protech believes that in light of the COVID-19 pandemic, the decision made by the CMS was appropriate and proper given these unprecedented times. The decision will help to ensure that there are no unnecessary barriers to the quality of care for patients, such as access to home respiratory products, other needed supplies, and durable medical equipment.”

A unique company that has been rising rapidly up the Healthcare Bullboard ranks is

Reliq Health Technologies Inc. (TSX-V:RHT, Forum), which was previously listed on the Stockhouse Technology Bullboards.

The software as a service (SaaS) healthcare tech provider is focused on developing innovative mobile health and telemedicine solutions for community-based healthcare released its audited annual consolidated financial statements, as well as management’s discussion and analysis for the year ended June 30th, 2020. You can read this update from the company

here.

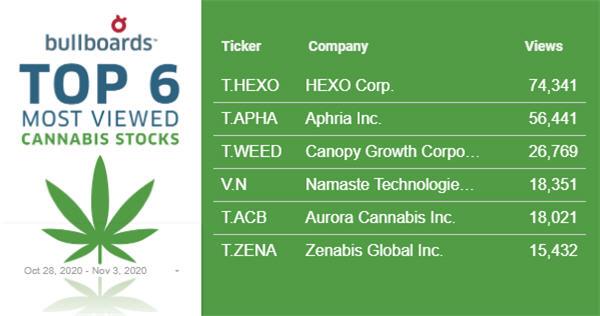

Ottawa, Ontario-based licensed cannabis producer (LP)

HEXO Corp. (TSX.HEXO, NYSE:HEXO, Forum) has been on a bit of a success streak as of late, having recently

reported Q4 2020 results touting revenue up 22.6% over the prior quarter.

HEXO also booked $89 million (CAD) in asset write-downs and inventory write-downs. Its adjusted EBITDA came in at a $3.3 million loss, a better-than-expected result from $4.8-million loss analysts were forecasting. The company said it expects to report positive adjusted EBITDA in its next two fiscal quarters.

The good news keeps on coming from Canadian cannabis LPs as

Aphria Inc. (TSX: APHA, Forum) announced this week that, despite COVID 19 delays, it has streamlined its supply chain and executed a supply agreement with

ODI Pharma. The Supply Agreement grants ODI the exclusive right to sell a defined set of co-branded products in Poland. These products will be co-branded and sold under the ODI and Aphria brand names.

Aphria Inc.’s Chief Executive Officer and Chairman, Irwin D. Simon

commented on the news that the partnership with ODI Pharma, which expands the international presence of the Aphria medical brand into Poland.

“This partnership is further evidence of our global commitment to provide patients with access to high-quality medical cannabis products as well as a testament to the strength and quality of our medical brand, Aphria. We look forward to working with ODI Pharma in bringing our high-quality medical cannabis products to patients in Poland.”

Finally, we look at

Canopy Growth Corp. (TSX: WEED, Forum), a heavy-hitting juggernaut in its own right in the Canadian cannabis business, its

shares are set to transfer from the New York Stock Exchange listing to the Nasdaq Global Select Market next week.

The company’s Chief Executive Officer, David Klein noted that this move will position WEED among the world’s leading companies.

“Making the transition to Nasdaq also provides us with greater cost-effectiveness and access to a suite of tools and services that will help us connect more efficiently with our current and future investors.”

This comes just after the release of Canopy Growth’s

fiscal Q2 2021 financial results on November 9th.

As we continue into November with fresh minds, an extra hour of sleep courtesy of Daylight Savings Time, and a fresh batch of market activity to dissect, it feels as if every week has been a rollercoaster of news and findings. The next should prove to be no different, so expect the Bullboards to be as lively as ever.

Once the uncertainty around the US election gets out of the way, the coming weeks of trading activity should be tame … right? The next big issue or news is always right around the corner, and the Stockhouse Bullboards are one of the best places to make sense of it all.

For previous editions of Buzz on the Bullboards:

click here.