(Image via Therma Bright Inc.)

(Image via Therma Bright Inc.)

This is another time of renewed uncertainty in the markets and investors are once again focusing on most consistent plays.

Increases in COVID-19 cases and worries over the state of the economy caused this recent wave of uncertainty, much like what followed the earlier wave. However, even with restrictions in place, many businesses are seeing progress in their return to something resembling a “pre-COVID society”.

While small-cap investors focused on COVID-19 testing plays during the vaccine rollout and a potential energy comeback in the face of volatile prices with a pipeline shutdown, last week some unexpected names managed to rattle discussions on the Stockhouse Bullboards.

This week, we dive into some of the newer names claiming their stake on the most-viewed company charts.

Sponsored by

Therma Bright Inc. (TSX-V: THRM, Forum) entered into an agreement to white label and distribute a

15 minute COVID-19 antibody test. The new product will be branded Therma Bright's AcuVid COVID-19 Rapid Antibody Test and will detect IgG and IgM antibodies against SARS-CoV-2.

The test uses a small amount of blood and has a 96.6 per cent sensitivity to individuals currently infected or who have previously been infected but went undiagnosed. The test will also aid in determining antibodies generated by those who have received a COVID-19 vaccine.

Clinical stage medical company

Antibe Therapeutics Inc. (TSX-V: ATE, Forum) is combining with Antibe Holdings in an amalgamation transaction pursuant to which shareholders of Holdings will receive common shares of the Company in exchange for their shares of Holdings.

In

a news release explaining this combination, Antibe’s Chief Executive Officer Dan Legault said the

move was desirable for all parties.

“With this agreement, we’ve unlocked value by providing potential partners and institutional investors with a straightforward, unified IP base for our drugs and platform. We’ve also extinguished a significant royalty commitment, amounting to 15% of licensing revenues from our pipeline drugs. As we accelerate our partnering efforts for the large markets, we expect this agreement to strengthen our position and expand our options for monetization.”

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

After unveiling it’s

$10 million bought deal public offering, biopharmaceutical leader in cannabinoid-based drugs,

Tetra Bio-Pharma Inc. (TSX-V: TBP, Forum) announced this week that it is accelerating a revolutionary Phase 2 clinical trial,

PLENITUDE, to evaluate the safety and efficacy of the investigational cannabis medicine, QIXLEEF, for use in managing uncontrolled pain in patients with advanced cancer.

TBP’s inhaled proprietary drug formulation, QIXLEEF has a fixed ratio of THC and CBD. The medication is inhaled through a Class II medical vaporizer. When pharmaceutical grade cannabis is vaporized rather than smoked, the beneficial components can be inhaled without the generation of smoke and combusted by-products.

Up next we have a slew of earnings reports that came down the wire from several energy companies, notable standouts for Q1 2021 were:

Crescent Point Energy Corp. (TSX: CPG, Forum) reported adjusted funds flow totalled

$262.7 million during Q1 2021, ($0.49 per share diluted) driven by an operating netback of $35.06 per barrel of oil equivalent (boe). For the quarter ended March 31, 2021, the company's development capital expenditures, which included drilling and development, facilities, and seismic costs, totaled $119.2 million.

Following the successful close of its strategic Montney combination with

Seven Generations Energy Ltd.,

ARC Resources Ltd. (TSX: ARX, Forum) reported that it had generated funds from operations of

$273.9 million ($0.77 per share) and recognized net income of $178.0 million ($0.50 per share). ARC's average realized natural gas price of $4.60 per one thousand cubic feet (Mcf) was a 57% premium to the average AECO 7A Monthly Index price.

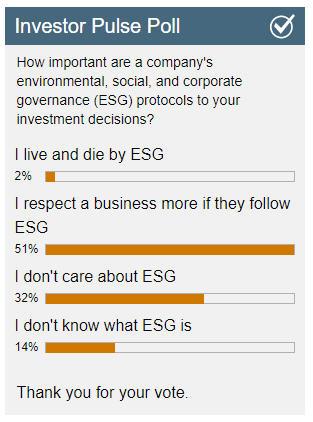

Many energy companies are promoting their environmental, social and governance (ESG) priorities, which measures the sustainability and societal impact of an investment in a company or business. Some see it as a buzzword to appease a certain segment of investors, while others look to it as a part of the future of business. Either way, at least half of you follow a business more if they manage to follow ESG protocols.

This week, we want your thoughts on the current energy situation and if you believe the oil glut is here to stay. Let us know your thoughts by clicking the image below.

(Click image to vote.)

Crew Energy Inc. (TSX: CR, Forum)

(Click image to vote.)

Crew Energy Inc. (TSX: CR, Forum) noted

$34.0 million of adjusted funds flow (AFF) ($0.22 per fully diluted share) generated in Q1 2021, a 174% increase over Q1 2020 and 118% higher than the preceding quarter, due largely to increased production, lower costs and stronger commodity pricing, particularly for natural gas.

CR added that 26,258 boe were produced per day (157.5 mmcfe per day) average production in Q1 2021, a 10% increase over Q12020 and a 21% increase from the preceding quarter. The company said that this reflects the operational success of the team’s drilling and completions program.

Q1 financial results were also coming in from companies in the industrial sector as well. Canadian clean tech company

Exro Technologies Inc. (TSX-V: EXRO, Forum) declared a comprehensive loss of

$6,676,520 (compared to $1,525,182 in Q1 2020). Although, research and development increased by $1,525,270 to $1,701,152.

Commenting on this, Chief Executive Officer of Exro, Sue Ozdemi explained that research and development expenses increased by 71% due to testing and validation of several projects to achieve its goals for commercialization.

“Our current focus is attracting top engineering talent and building a robust pipeline of versatile partners across different segments to validate our technology. We are also ramping up the design and construction of the new 36,966 square foot facility in south Calgary that will be capable of producing automotive compliant Coil Driver units in late 2022.”

Meanwhile, Canada’s top airline,

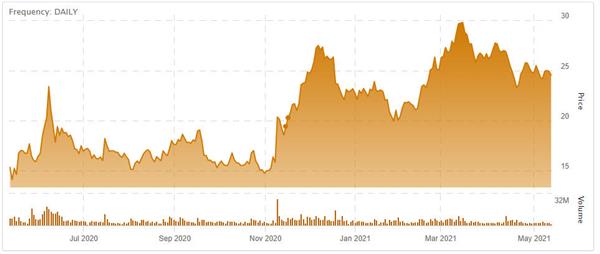

Air Canada Inc. (TSX: AC, Forum) also checked in with its Q1 2021 financial results this past week with harsh news many were expecting - operating revenues of

$729 million, a decline of $2.993 billion (80%) from Q1 2020.

While the stock isn’t trading at $50 a share like it was back at the beginning of last year, its value has weathered the storm better than many in the travel industry has during the COVID-19 pandemic.

(Air Canada Inc. stock chart – May 2020 to May 2021. Click to enlarge.)

(Air Canada Inc. stock chart – May 2020 to May 2021. Click to enlarge.)

Air Canada is seeing more demand for its services and announced this week that it will launch

more non-stop options from Canada to Hawaii starting in December 2021, including the first Montreal to Honolulu and Toronto to Maui services.

This brings us to another aviation heavyweight -

Bombardier Inc. (TSX: BBD, Forum) who just welcomed Airshare as its newest fleet operator for its best-selling Challenger 350 business jets. Airshare has ordered three super midsize Challenger 350 aircraft, with options for 17 more, which will enable the Kansas City-based private aviation company to double the size of its fractional ownership fleet in the near future.

This stock’s story over the past year is a little more dramatic than Air Canada, but the result has been the same – sitting in a better position now than versus 12 months ago.

(Bombardier Inc. stock chart – May 2020 to May 2021. Click to enlarge.)

(Bombardier Inc. stock chart – May 2020 to May 2021. Click to enlarge.)

By next week, the story for each sector is likely to change and sometimes even more quickly. Now it is more important than ever for small-cap investors to stay up to date on the current conversations and company movements. There is no better place than the Stockhouse Bullboards. For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: Therma Bright Inc. is a client of Stockhouse Publishing.