(Image via Inter Pipeline Ltd.)

(Image via Inter Pipeline Ltd.)

After a few tumultuous weeks of see-sawing market performances on Bay Street and Wall Street, it would appear as if companies were working to get on track to get back to the seasonably busy fall months and shake off these COVID restrictions … but given the rise of the Delta variant and lingering market uncertainty, we may not be nearing an epilogue to this story after all.

Inter Pipeline Ltd. (TSX: IPL, Forum) continues to weigh the pros and cons of a proposed buy out from global infrastructure company

Brookfield Infrastructure Partners LP (NYSE: BIP; TSX: BIP.UN, Forum), who recently sweetened the deal and made an offer that they say represents a 49% premium to IPL’s unaffected share price.

The Calgary-based petroleum transportation and natural gas liquids processing business just released its financial and operating results for the three and six-month periods ended June 30th, 2021, highlighting an adjusted EBITDA of

$235 million, up from $230 million in the same period of 2020. Net income was $146 million, approximately 130% higher than the $63 million generated in Q2 2020.

Meanwhile, another oil and gas exploration and production company based in Canada’s prairies is

Crew Energy Inc. (TSX: CR, Forum), who also reported its operating and financial results for the three and six month periods ended June 30th, 2021. In its financial and operating highlights, CR noted Petroleum and natural gas sales of $154,067 for the six-month period prior to the end of June, compared to $62,983 for the same period a year before.

In

a media release detailing this news for investors, Crew’s President and Chief Executive Officer, Dale Shwed explained that in Q2 2021, the team continued steadfast in the advancement of a two-year plan, designed to increase the pace of development of the Montney resource, situated in northeast British Columbia, with a goal to optimize throughput of our 40,000 barrels of oil equivalent (boe) per day infrastructure capacity and improve debt metrics.

“We are excited to continue with our plan to increase production, reduce unit costs to expand margins and to create sustainable value for all stakeholders, while playing an important role in the production of responsible energy. Today we are proud to unveil Crew’s inaugural ESG Report, presented in digital format as a reflection of our commitment to adopt new technologies while adapting to the evolving needs of our stakeholders.”

The leadership team heading Calgary-based oil and gas company

Baytex Energy Corp. (TSX:BTE, Forum) will be getting to know their investors a bit better when they take the stage to present at EnerCom’s Oil and Gas Conference on Monday August 16th, 2021. To find out more about the conference and how to participate, click

here.

This has always been a hot time for investor conferences and a big one on right now is Canaccord Genuity’s 41st Annual Growth Conference, which has a lot of investors talking. No less than three companies who take the lions share of health care and cannabis Bullboard chatter are taking part:

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Medical technology company

Therma Bright Inc. (TSX-V: THRM, Forum) signed a definitive partnership agreement with

Afero Inc., an Internet of Things (IoT) platform developer.

Under the agreement, Therma Bright will embed Afero’s Intelligent Edge smart platform into its AcuVid saliva test cartridge.

AcuVid is a rapid antigen saliva test used to detect COVID-19 and its variants. With Afero’s platform, the smart-enabled test will allow users to display a negative test result on their health passports, allowing access to public areas.

Afero CEO Joe Britt said, “The AcuVid COVID-19 Rapid Antigen Saliva Test, powered by Afero, has always had the main goal of helping communities safely and securely stay open or re-open during this COVID-19 pandemic.”

Rob Fia, CEO of Therma Bright, also commented on the partnership and the new product offering.

“Initially we see our smart-enabled testing solution ideal for facilities who have their own healthcare practitioners onsite.”

The company envisions that AcuVid will initially be used in airports, hospitals, medical facilities, schools, businesses, stadiums, and event venues.

“These are the places where the public come to connect for work, play or education, and are also places where people are most susceptible to catching and spreading this horrible virus and its growing list of variants,” Fia said.

Therma Bright has submitted the product to the FDA-EUA for point-of-care approval. Once that is granted, the smart-enabled test will be submitted for at-home use approval.

“That's when the true power of the Afero solution will come into play by integrating with a person's health passport for test verification,” Britt said.

When

PyroGenesis Canada Inc. (TSX-V.PYR, Forum) makes its own presentation at the

SNN Network Summer Virtual Event 2021 on Wednesday, August 18th , the team is likely to talk about the latest news with the company – how it successfully produced the

first batch of nano silicon materials with

HPQ Silicon Resources Inc. (TSX-V: HPQ, Forum).

The two companies have partnered to develop a method of producing nano silicon materials that reduces cost, energy input, and carbon footprint.

Together, they have created the PUREVAP Nano Silicon Reactor, a proprietary technology that will allow HPQ and PyroGenesis to commercialize silicon for battery anode materials.

This first batch is the last of HPQ’s three objectives for the testing program, which also included validating the reactor’s capabilities and production parameters.

Bernard Tourillon, President and CEO of HPQ Silicon, commented on the milestone.

“The HPQ NANO team is now more confident than ever that the PUREVAP NSiR will be able to deliver, at scale, and on-demand, a nano silicon for anode production that will be cost competitive,” he said.

The next samples of nano silicon powders will be sent to the

Institut National de Recherche Scientifique (INRS) for third-party evaluation.

“Words cannot adequately describe the excitement at PyroGenesis at potentially being able to address and solve challenges in developing lithium-ion batteries,” said PyroGenesis CEO and chair P. Peter Pascali.

Work will now begin on the next phase of development, creating the Gen2 PUREVAP Nano Silicon Reactor.

A global leader in aviation,

Bombardier Inc. (TSX: BBD, Forum) has raised full-year guidance with the release of its Q2 2021 financial results:

- Business jet revenues climbed to $1.5 billion (USD), up 50% year over year, fueled by increases in both aircraft deliveries and services

- Aircraft deliveries totalled 29, up 45% year over year, reflecting strong demand for large-category jets

- Worldwide business jet utilization continued to rise, nearly reaching pre-pandemic levels in North America and Europe, buoying revenue contribution from services activities to US$295 million, up 29% year over year

- Aircraft sales equally accelerated, reaching a unit book-to-bill ratio of 1.8

- Adjusted EBITDA was up $112 million (USD) year over year to $143 million (USD)

- Reported EBIT from continuing operations was US$36 million

The $91 million (USD) from continuing operations free cash flow represents an improvement of $841 million (USD) year over year, including a negative impact of $60 million (USD) in non-recurring cash items.

Pro-forma liquidity was roughly $2.1 billion (USD) and Pro-forma net debt was around $5.3 billion (USD) with $1 billion (USD) maturing in the next three years.

Bombardier remains focused on expanding its service network and diversifying top-line revenue streams. This includes the company's certified pre-owned aircraft program, which offers like-new planes backed by a one-year warranty and manufacturer-recommended modifications and updates.

Raised 2021 full-year guidance

| 2021 |

Previous |

Revised |

| Business jet deliveries (in units) |

110 – 120 |

~120 |

| Revenues |

>US$5.6 billion |

>US$5.8 billion |

| Adjusted EBIT |

>US$100 million |

>US$175 million |

| Adjusted EBITDA |

>US$500 million |

>US$575 million |

| Free cash flow usage |

Usage better than US$500 million

(including ~US$200 million of non-recurring outflows) |

Usage better than US$300 million

(including ~US$200 million of non-recurring outflows) |

Éric Martel, President and CEO of Bombardier, commented,

"Bombardier’s raised guidance stems from all-around solid execution in the first half of 2021, greater confidence in market momentum and our ability to accelerate initiatives supporting our recurring savings objective. Our team’s concerted efforts have already supported stronger full-year margins and have allowed us to focus diligently on our priorities of maturing the Global 7500 aircraft program, executing our aftermarket growth strategy and deleveraging our balance sheet."

Finally, it would seem that the industrial side of

Canopy Growth Corp.’s (TSX: WEED, Forum) business is going well, with the famed cannabis company raking in

23% revenue growth in Q1 2022 versus Q1 2021 driven by strong double-digit growth in both cannabis and other consumer products businesses. This means the company managed to hold on its #1 market share spot in tracked Canadian recreational cannabis market amid a highly competitive landscape.

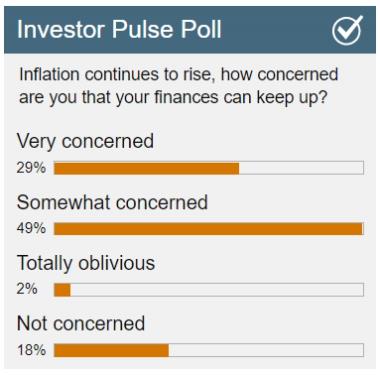

We end things off with a look at last week’s investor pulse poll and it appears that a majority of you who responded are feeling at least a little anxious about rising inflation and whether you have enough money to stay afloat. Hey, if you’re concerned, at least it means you’re probably aware and not spending your paycheque on retro video game cartridges or other stuff that you don’t want your spouse to know about. Click the image below to cast your vote.

(Click image to vote.)

(Click image to vote.)

Looking ahead, we want to know what you think about the future. It’s a tricky subject, given how erratic the markets in Canada and the US have been – record highs one day, deep in the red the next, who knows where we will be tomorrow? I know where I will be next week at least, right here, with the latest on what’s hot on the Stockhouse Bullboards!

For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: Therma Bright Inc. and PyroGenesis Canada Inc. are clients of Stockhouse Publishing.