There is nothing scarier on Hallowe’en than an uncertain stock market.

Lately, this is exactly what investors have been dealing with and part of what we try to demystify at Stockhouse.

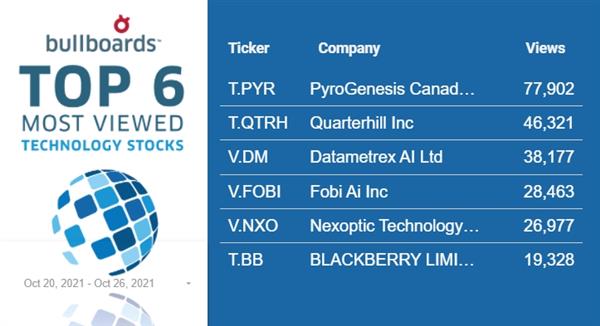

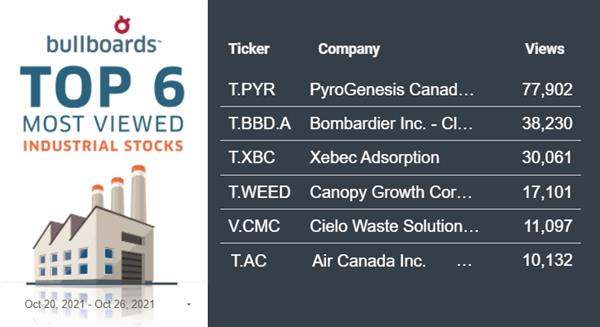

There have been many companies moving independent of the market, and quite often, against the market. We track many of the big movers on the Bullboards regularly gather on the top companies of the moment. Some of them have strong followings and a healthy investment base. Others swung so widely that hungry investors picked up their scent. In either case, the sectors highlighted today are normally hotly contested, but saw clear frontrunners dominate discussions.

One such operation is biopharmaceutical company

Theratechnologies Inc. (TSX: TH, Forum) reported this week that its

investigational peptide-drug conjugates (PDCs) are effective in inhibiting vasculogenic mimicry (VM) in ovarian and breast cancer models.

VM is believed to be associated with tumour growth, resistance, and poor prognosis in many types of aggressive cancers including ovarian and TNBC. The PDCs, TH1902 and TH1904, are derived from the company’s SORT1+ Technology. SORT1 is a receptor that plays a significant role in protein internalization, sorting and trafficking. It is highly expressed in cancer cells compared to healthy tissue making it an attractive target for cancer drug development.

According to Dr. Christian Marsolais, Senior Vice President and Chief Medical Officer, the results showcase for the first time the sortilin receptor plays a role in the formation of VM which is associated with cancer progression and resistance.

By targeting SORT1 the PDC’s have the potential to inhibit VM and cancer growth.

“This recognition by our scientific peers highlights the great potential of our PDCs as a unique and effective vehicle for the potential treatment of many types of cancers in which SORT1 receptors are overexpressed and provides additional evidence that SORT1 plays a major role in the generation of VM, particularly in TNBC and ovarian cancer,” said Dr. Marsolais.

These results further support the expectation that TH1902 and TH1904 may alter the VM process by bringing anticancer drugs, like docetaxel and doxorubicin, into SORT1-positive cancer cells.

Reliq Health Technologies Inc. (TSX-V:RHT, Forum)

Reliq Health Technologies Inc. (TSX-V:RHT, Forum) has signed contracts with

four primary care physician practices in the US. Reliq will provide its iUGO Care platform to the physician’s chronic disease patients.

“We are excited to be adding these four new physician practices and their Medicare and Medicaid patients,” said Dr. Lisa Crossley, CEO of Reliq Health.

As both Medicaid and Medicare expand the scope of their virtual care programs to include additional conditions such as high-risk pregnancy, solid organ disease, musculoskeletal conditions and others, the eligible patient population for Reliq’s products and services continue to increase. Demand for the iUGO Care platform is steadily increasing as clinicians recognize the significant revenue potential associated with offering virtual care programs to their at-risk patients.

We expect to onboard over 2,000 patients with these clients at an average revenue of $50 (USD) per patient per month for Reliq. Onboarding will begin this month and is expected to be completed in early 2022,” concluded Dr. Crossley.

Reliq Health Technologies is a rapidly growing global telemedicine company that specializes in developing innovative Virtual Care solutions for the multi-billion-dollar Healthcare market.

Reliq’s powerful iUGO Care platform supports care coordination and community-based virtual healthcare. iUGO Care allows complex patients to receive high-quality care at home, improving health outcomes, enhancing the quality of life for patients and families and reducing the cost of care delivery.

Following a management shakeup at the top,

HEXO Corp. (TSX: HEXO, Forum) will release its financial results for the fiscal quarter and fiscal year ended July 31, 2021, before market hours on Friday, October 29, 2021, as well as host a webcast for investors beginning at 8:30 a.m. EST.

For details on how to listen in, click

here.

PyroGenesis Canada Inc. (TSX-V.PYR, Forum)

PyroGenesis Canada Inc. (TSX-V.PYR, Forum) a high-tech company that designs, develops, manufactures and commercializes plasma - based processes is commissioning

HPQ Silicon Resources Inc. (TSX-V: HPQ, Forum) GEN3 PUREVAP quartz reduction reactor pilot plant.

After COVID-19 related delays, the last missing component – the power supply – has arrived at PyroGenesis’ Montreal facility to bring the pilot plant online. The plant seeks to validate the reactor’s one-step transformation of quartz into high-purity silicon metal at reduced costs, energy input and carbon footprint. The central advantage of the process is the continuously operating carbothermic process, resulting in the early removal of impurities without the need for extremely pure feedstock.

The process requires 4.5 MT of raw material to make 1 MT of silicon, versus 6 MT for conventional methods, which potentially allows for a 20% cost advantage.

Silicon is a strategic energy metal needed to meet global economic decarbonization goals in the coming decades. It’s in high demand as feedstock for polysilicon for electronics and solar power, the batteries sector and other industrial applications at a time of increasingly short supply. The shortage resulted from energy-intensive plants which found it economically unviable to return online due to the COVID-19 pandemic. The scenario creates a need for new greenfield projects to meet demand, positioning PUREVAP technology to capture market share.

Bernard Tourillon, President and CEO of HPQ-Silicon, stated,

“HPQ has been at the forefront of low-cost green silicon innovation developments since 2015, and with the commissioning of the GEN3 PUREVAP QRR pilot plant, our timing couldn’t be better.

With ESG principles playing an active role in materials sourcing, the world is waking up to the difficulty of securing the ESG compliant silicon needed to meet its renewable energy goals.

The reality of chronic underinvestment in new technologies, combined with the offshoring of silicon production capacity, has created a massive opportunity for HPQ and its PUREVAP QRR process, as we are the only company to bring to market a new process to make silicon that is perfectly suited to the new demands and realities of the silicon market.”

Tech developer and provider

Quarterhill Inc. (TSX: QTRH, Forum) completed its previously announced offering of

6% convertible unsecured subordinated debentures due October 30, 2026, at a price of $1,000 per debenture for total gross proceeds of $57,500,000, which included the full exercise of the over-allotment option by the underwriters.

The offering was completed on a bought deal basis by a syndicate of underwriters led by

Raymond James Ltd., and including

Canaccord Genuity Corp.,

CIBC World Markets Inc.,

Cormark Securities Inc.,

ATB Capital Markets Inc.,

M Partners Inc., and

Stifel Nicolaus Canada Inc. The debentures are listed on the TSX under the symbol

QTRH.DB.

Datametrex AI Ltd. (TSX-V: DM, Forum) announced this week that it had received purchase orders from

Lotte Data Communication Co., Samsung Electronics Co., and the Shinhan Financial Group.

The purchase order from SAMSUNG and Shinhan is for an A.I.-powered task automation system designed to streamline and optimize banking system operations. The project is named JobMind. JobMind is being designed to decrease human error through automation, flagging banking transaction errors and notifying the impacted parties.

Marshall Gunter, CEO of Datametrex commented on the purchase orders.

“As we continue to grow the core AI and tech business, the Korean market remains robust with the adoption of next-generation technologies backed by Datametrex’s artificial intelligence systems.”

Datametrex AI Limited is a technology-focused company with exposure to Artificial Intelligence and Machine Learning through its wholly owned subsidiary, Nexalogy. The company’s mission is to provide tools that support companies in fulfilling their operational goals, including health and safety, with predictive and preventive technologies.

Investors in the tech space have been celebrating a recent bump across this segment of the market following a brief downturn in its stock. It appears to be one of those instances where “buying in a dip” really paid off. Though it can be hard to predict, have you ever made money off buying in a dip? Let us know your thoughts by voting in the poll below.

(Click image to vote.)

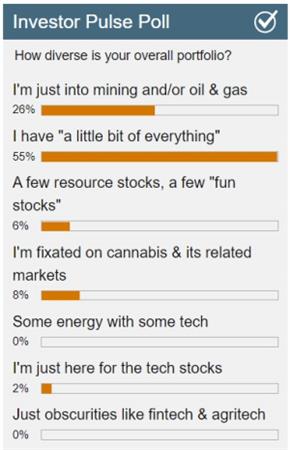

(Click image to vote.)

Looking at last week’s investor survey results, more than half of you have a smorgasbord of a portfolio. While diverse, there are of course plenty of you who stick to what works – the resource sector.

To the industrial world,

Xebec Adsorption Inc. (TSX-V: XBC, Forum) announced this week that it had received a research grant to create a

1 MW electrolyzer system to produce sustainable liquid fuels.

Under the ECO2Fuel Consortium, the total approved budget of C$28.9 million will be shared among partners to execute the project, which aims to convert captured CO2 and water with renewable electricity into a sustainable fuel source. The company has been tasked with designing and building the industrial-size 1 MW system, which will integrate technologies from other consortium partners, including De Nora, RWE Power, DLR, VITO and Ariema.

Marinus van Driel, President of Xebec Europe, stated,

“As we continue the energy transition, new technologies and solutions will need to be developed to decarbonize energy, mobility and industry. We are ecstatic to be participating in this large E.U. project as the designer and manufacturer of the world’s first low-temperature industrial 1 MW system that will create renewable alcohol fuels such as methanol and ethanol.

Our selection ultimately showcases the unique and breadth of expertise we have in hydrogen, electrolysis and CO2 capture, and we look forward to getting this unit into production and testing it with our partners.”

Xebec is a global provider of clean energy solutions for renewable and low-carbon gases used in energy, mobility, and industrial applications.

Air Canada Inc. (TSX: AC, Forum)

Air Canada Inc. (TSX: AC, Forum) introduced new testing products, including portable self-administered COVID-19 molecular and antigen test kits, through a partnership with

Switch Health, a Canadian-based healthcare company. Using the Switch Health COVID-19 RT-LAMP Kit, customers can test themselves while travelling abroad prior to their flight to Canada to meet Government of Canada testing entry requirements without the need to visit a foreign COVID-19 testing clinic. These tests are conducted under the remote supervision of a Telehealth professional from Switch Health and include an electronic report suitable for travel.

Mark Nasr, Senior Vice President, Products Marketing & eCommerce at Air Canada said that the company is adopting and implementing science-based safety measures to simplify the customers' journey.

“Together with Switch Health, we are pleased to offer our customers the most comprehensive range of travel testing options that will make travelling abroad easier and more predictable. Switch Health also seamlessly integrates into Air Canada's digital tool allowing customers to securely submit their COVID-19 test results and records of vaccination, further simplifying the travel experience.”

We head into November next week with fresh minds, an extra hour of sleep courtesy of Daylight Savings Time (how is that still a thing?), and a fresh batch of market activity to dissect. Lately it feels like every week has been a rollercoaster of news and findings, and the next should prove no different, so expect the Stockhouse Bullboards to be as lively as ever. For previous editions of Buzz on the Bullboards:

click here.