Once the American Thanksgiving passes, the mood in North American markets seems to shift dramatically as investors contend with holidays, gifts, and vacations on one hand, with the end of their fiscal years on the other.

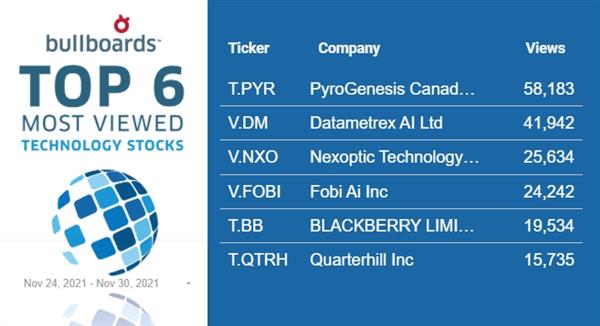

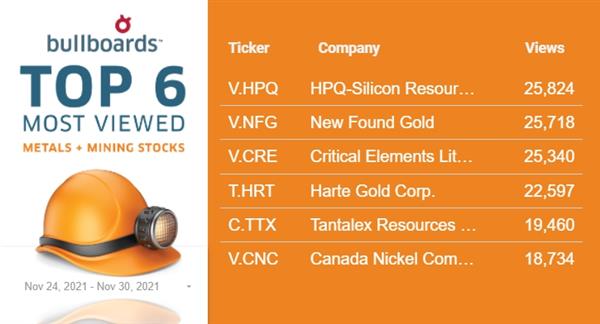

Companies also look to end the calendar year on a positive note, and any stocks making last-second rallies become attractive investments. The Stockhouse Bullboards fill up with discussions surrounding plays that look to be on the rebound, and investors and analysts debate whether to invest in what is part of a long-term recovery or short-term spike.

We highlight three companies in three sectors this week that have experienced some dips heading into the Winter but might be on the way back up and break down what’s happening. Are they worthwhile investment bargains or potential money pits?

First, a rapidly growing global medtech company that specializes in developing innovative Virtual Care solutions for the multi-billion dollar Healthcare market -

Reliq Health Technologies Inc. (TSX-V:RHT, Forum) released its consolidated financial statements and Management’s Discussion and Analysis for Q1 FY2022, highlighting increased sales quarter-over-quarter by

192% relative to the previous quarter, to $1,608,168 (Q4 FY2021: $549,825).

RHT also saw Increased gross profits quarter-over-quarter to $1,159,024 (Q4 FY2021: $324,429) for a gross margin of 72%. After adjusting for non-cash expenses including share-based compensation and accretion, as well as one-time non-reoccurring expenses (severance paid to the Company’s former CFO and CIO), the Company’s adjusted EBITDA (gain) for Q1 FY2022 was $74,126 (Q1 FY2021 adjusted EBITDA (loss): $1,518,925).

Clinical stage pharmaceutical company

Theralase Technologies Inc. (TSX-V: TLT, Forum) reported its unaudited Q3 2021 condensed interim consolidated financial statements, which provides

financial information on the previous fiscal quarter along with a quarterly newsletter which provides an interim clinical data analysis on the Phase II Non-Muscle Invasive Bladder Cancer clinical study.

Total revenue increased 7%, year over year and is primarily attributed to a recovery in the Canadian and United States economies from the COVID-19 pandemic, as most healthcare practitioners in 2020 elected to temporarily close their practices and place any purchasing decisions on temporary or permanent hold. Net loss decreased 34%, year over year.

On the subject of COVID, which has been a transformative catalyst in the health care sector in 2021, much like the year before,

Therma Bright Inc. (TSX-V: THRM, Forum) developer of its smart-enabled AcuVid COVID-19 Rapid Antigen Saliva Test and other progressive diagnostic and medical device technologies, signed an agreement with a

contract manufacturer to produce a weekly minimum of 500,000 AcuVid COVID-19 Rapid Antigen Saliva Tests in order to meet the new US Food and Drug Administration's Emergency Use Authorization Guidance on production of diagnostic tests (molecular and antigen) for point-of-care and at-home use. The contract manufacturer is a European ISO 13845 certified company with deep expertise in diagnostic tests manufacturing and worldwide distribution.

NexOptic Technology Corp.’s (TSX-V: NXO, Forum)

NexOptic Technology Corp.’s (TSX-V: NXO, Forum) announced that it had entered into a letter of intent with

Selten Metal Corp., where Selten Metal could earn a 100% interest in NexOptic’s wholly owned, THOR Heavy & Light Rare Earth Element Project.

The project consists of approximately 2184 hectares in southern Nevada, including roughly 1280 hectares that have been recently staked by NexOptic, the THOR Project was historically explored for heavy and light rare earth elements. Of the 17 rare earth elements, 14 have been discovered at the THOR Project on surface and in historic drilling.

Fobi AI Inc. (TSX-V: FOBI, Forum), a cutting-edge data intelligence company that helps clients turn real-time data into actionable insights and personalized customer engagement to generate increased profits, deployed its

Q1 2022 financial results this week.

Q1 highlights:

- Revenue of $580,317, a 293% increase from Q4, 2021

- Net loss of $4,468,214, which includes a $2,619,361 charge for stock based compensation

- Accounts receivable of $1.2 million

- Accrued liabilities increased by $78,122

- Assets increased to $12,315,379

Fobi CEO Rob Anson commented that with the launch of many new products and partnerships this year, the team has successfully achieved more operational milestones than any previous quarter and see a strong continuation of this momentum into 2022.

“The exponential growth we are starting to see in the past two quarters is a testament to the entire team’s dedication and focus on executing our business plan and validation from our customers. We remain focused on becoming a global leader in Artificial Intelligence Applications and Digital Wallet Passes.”

Meanwhile,

Datametrex AI Ltd. (TSX-V: DM, Forum) reported

record results for the three and nine-month periods ending September 30, 2021.

The company’s improved Q3 financial performance was attributed to growth across its COVID-19 sales and its related services with the film and production industry and uptake in its health technology business.

Financial highlights:

- Q3 gross revenue of $10,821,697 – 123% increase from Q3 2020

- Q3 gross profit of $3,021,838 – 160% increase from Q3 2020

- Q3 EBITDA of $1,420,179 – 404% increase from Q3 2020

- Q3 net earnings of $170,294 – 124% increase from Q3 2020

Andrew Ryu, Chairman of Datametrex added that the company continues to experience growth as a result of its growing and diversified portfolio.

“The future prospects of Datametrex continue to build along with our growing customer base and we look forward to continue executing our business plan for the growth of the company.”

Q3 business highlights:

- Revenue increased by 122.6% in Q3 2021 compared to Q3 2020 bringing in over $10.82 million in revenue

- Cash and marketable securities of $12,915,840

- Datametrex AI has entered into a $250,000 contract with a Canadian tech company on an Artificial Intelligence contract and received the first 50% payment on August 23, 2021

- On August 4, 2021, Datametrex announced passed the second round of scrutiny in a Canadian AI bid. The anticipated value of the contract is approximately $40 million

- The company completed the sale of the issued and outstanding share capital of Concierge Medical Consultants to ScreenPro Securities Inc. for 36,000,000 ScreenPro shares

Datametrex anticipates continued growth in business and improvement of its balance sheet. The company will continue expanding and improving its AI businesses, to generate continued growth in both its existing cybersecurity AI verticals and new health technology verticals that the company is building on.

There is clear and mounting evidence that people are coming down with breakthrough COVID-19 infections. Testing and contact tracing is a COVID-19 preventative action that will continue for years to come. Only 29.6% of the world population have received at least one dose of a COVID-19 vaccine, and 15.2% are fully vaccinated.

HPQ Silicon Resources Inc. (TSX-V: HPQ, Forum)

HPQ Silicon Resources Inc. (TSX-V: HPQ, Forum) has issued a

notice of allowance regarding a patent application. The company also confirmed that the HPQ patent agent has paid the required fees. The US patent covers the PUREVAP QRR innovative process, which permits the one-step transformation of quartz into high purity silicon metal at reduced costs, energy input, and carbon footprint.

This advantage means that the PUREVAP QRR process produces a higher purity silicon material than traditional processes, and it does not require the extremely pure feedstock needed by conventional processes. This means a 25 % reduction which potentially allows a 20 % cash cost advantage versus the lowest cost traditional silicon producer. As a part of HPQ’s ongoing strategy of protecting and strengthening the PUREVAP Intellectual Property Portfolio, a second patent application process was filed in 2019 and is currently advancing through the process.

High purity silicon is in high demand due to the underlying needs for silicon as feedstock solar and electronics, the emerging Batteries sectors. New and efficient greenfield projects will be needed to meet demand, and the PUREVAP QRR technology is positioned to eventually become the industry’s option of choice. Additionally, the HPQ board of directors approved the modification of the total number of shares that may be issued pursuant to its stock option plan.

The total number of shares has been increased by 17,500,000 shares from 4,500,000 shares to 22,000,000 shares and as a result the consolidation of its current stock option plan into the new 2021 stock option plan.

The maximum number of common shares that may be issued under the plan shall be equivalent to less than 10 % of the issued and outstanding common shares of HPQ.

New Found Gold (TSX-V: NFG, Forum) gave investors an update on the closing of its acquisition

of three royalty interests with arm’s length royalty holders, whereby New Found purchased 100% of each Vendor’s royalty interests, each equal to 0.2% of net returns for an aggregate of 0.6% of net returns from the company’s Linear and JBP Linear properties. These properties cover key target areas on the company’s Queensway Project and include the Company’s Keats, Golden Joint, and Lotto discoveries.

Pursuant to the Acquisition, New Found paid $1,300,000 cash consideration and issued 152,941 common shares in the capital of the company to each Vendor, for an aggregate cash consideration of $3,900,000 and aggregate share consideration of 458,823 common shares.

Finally in the news,

Critical Elements Lithium Corporation (TSX-V: CRE, Forum) announced that it had obtained a receipt for the

final short-form prospectus dated November 29th, 2021 in respect of its recently announced bought deal underwritten offering. The company anticipates that the closing of the offering will occur tomorrow, December 3rd, 2021.

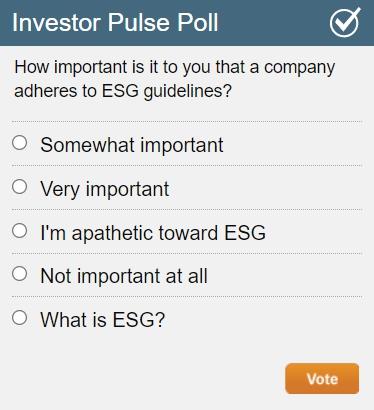

Now we want your thoughts on a movement that has been gaining momentum among corporations regarding environmental, social, and corporate guidelines (ESG) … how important is it to you that a company adheres to ESG?

(Click image to go to the poll)

(Click image to go to the poll)

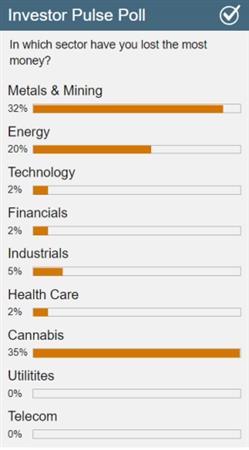

Taking a look at last week’s survey … it seems a solid majority of you saw most of your money go up in smoke in the cannabis sector …. Surprise, surprise.

One thing is for sure: the season, and the year, are quickly wrapping up. We might only be at the start of December right now, but that means we only have a few more editions of Buzz on the Bullboards to see how the hottest stocks and sectors are faring heading into 2022. For previous editions of Buzz on the Bullboards:

click here.